Inspirating Tips About Income And Expense Statement For Child Support Rent Payable In Balance Sheet

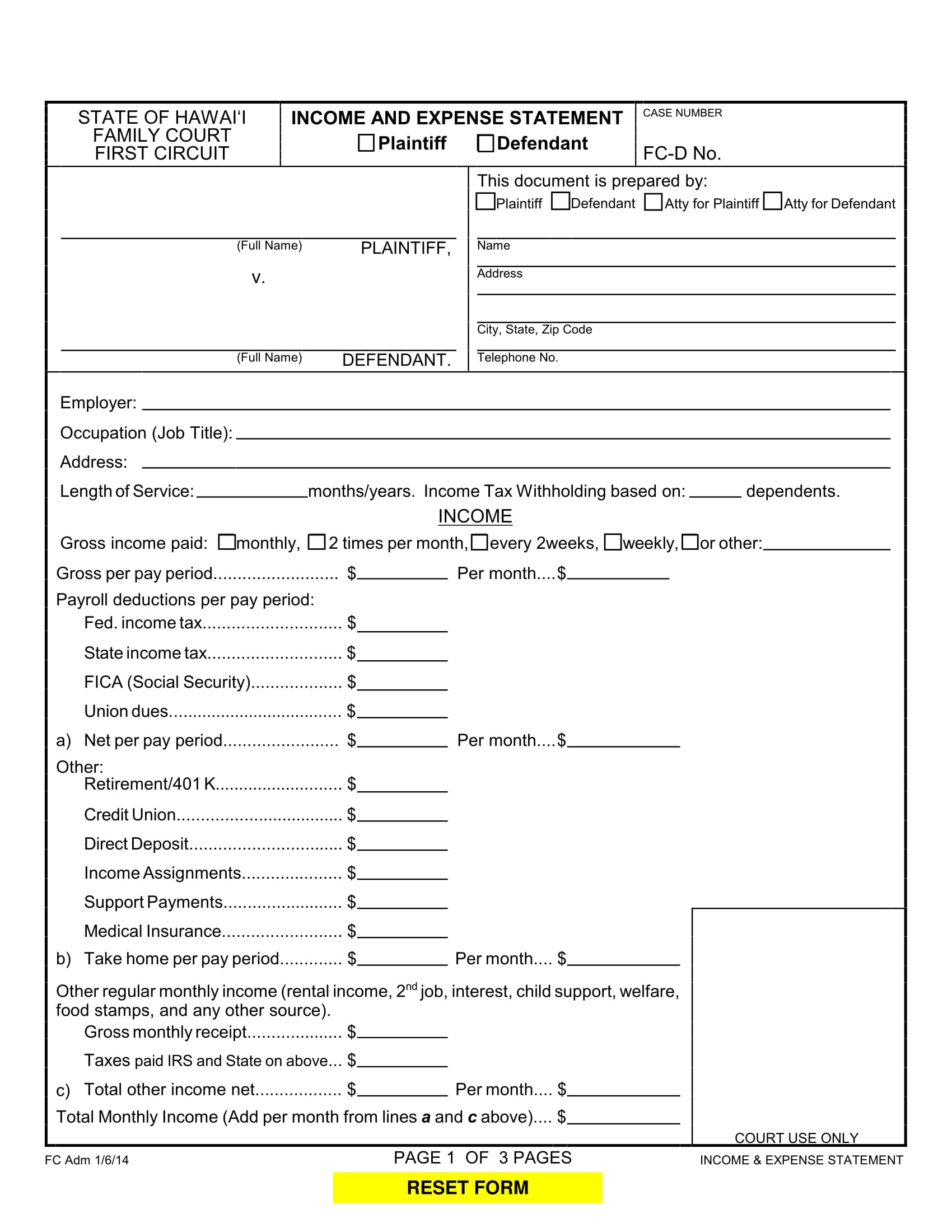

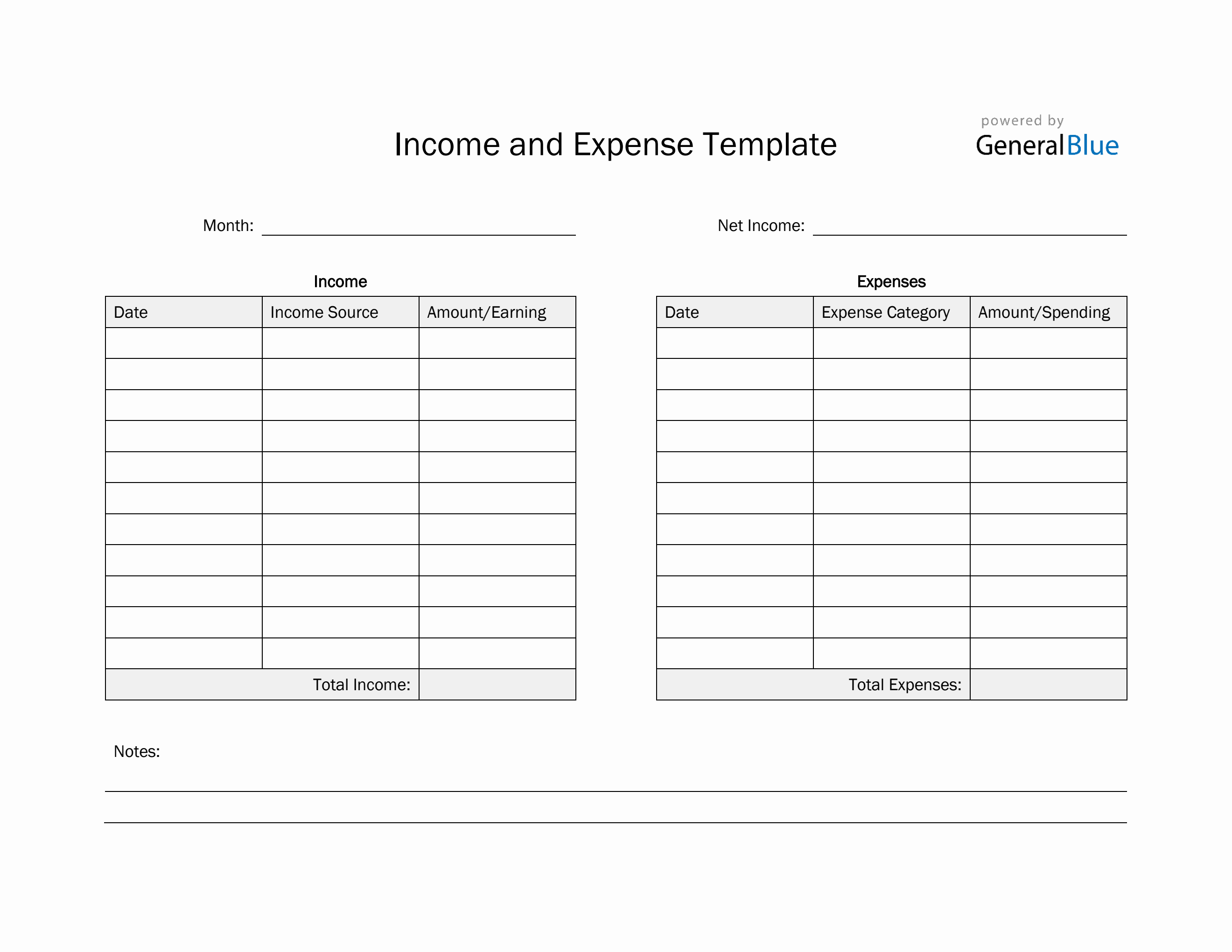

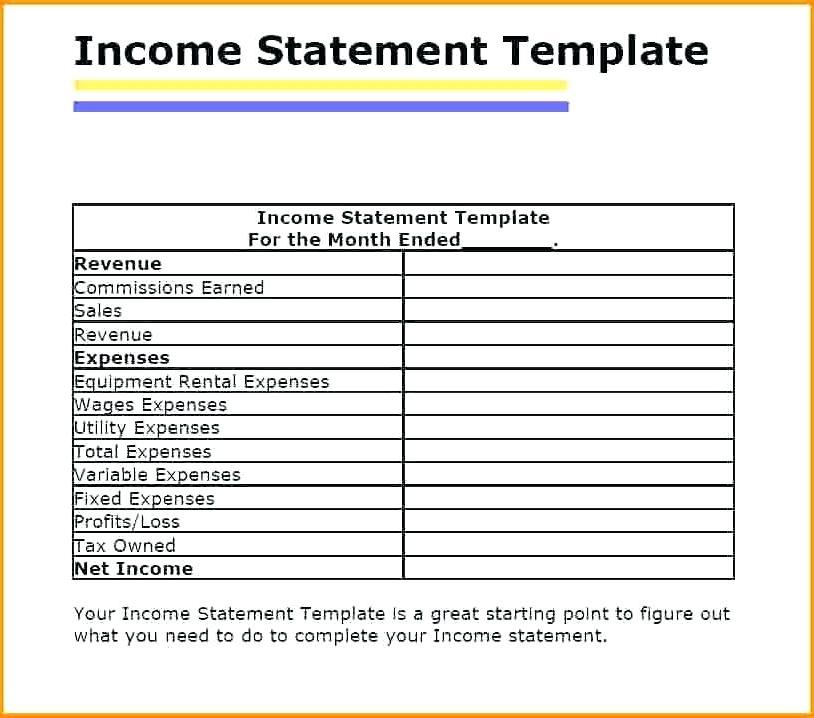

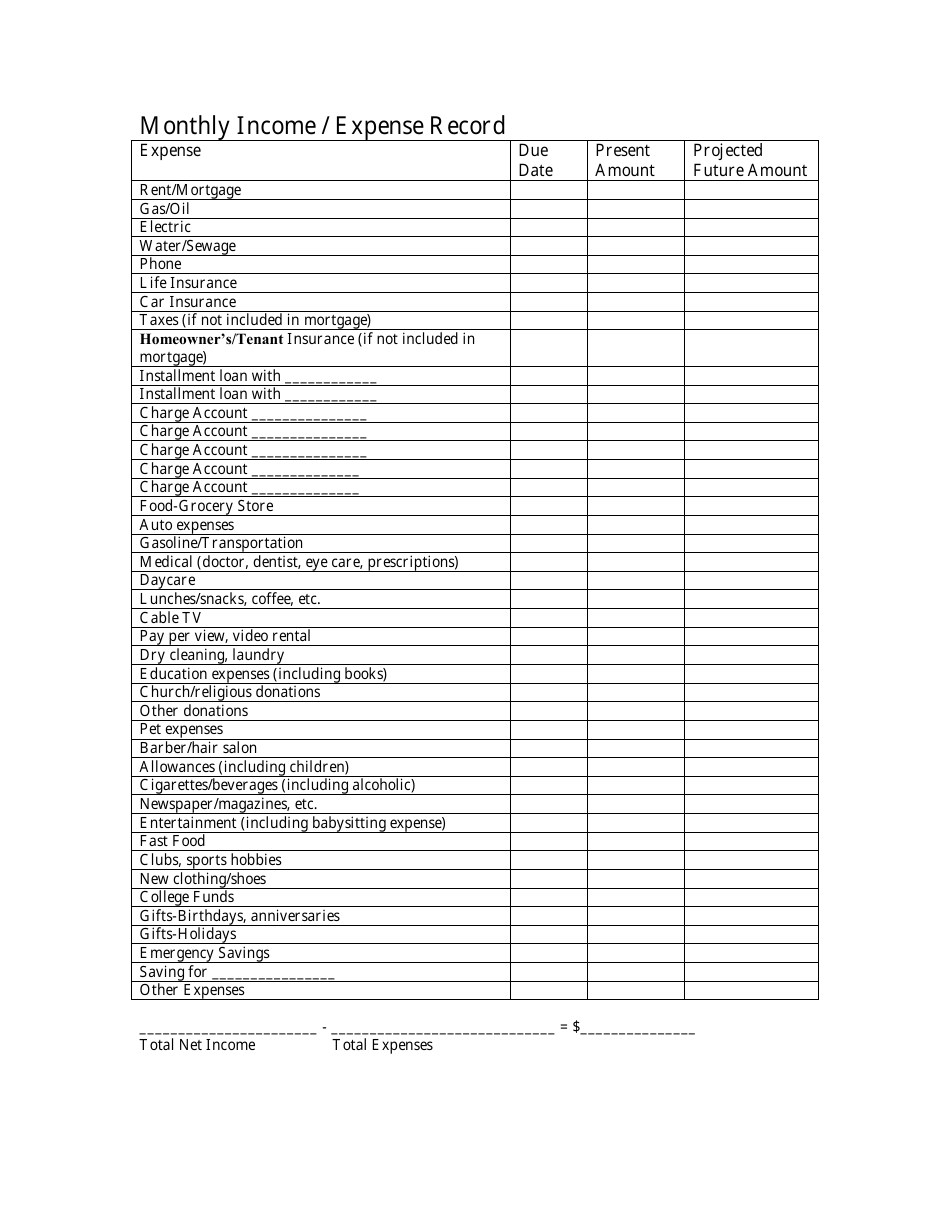

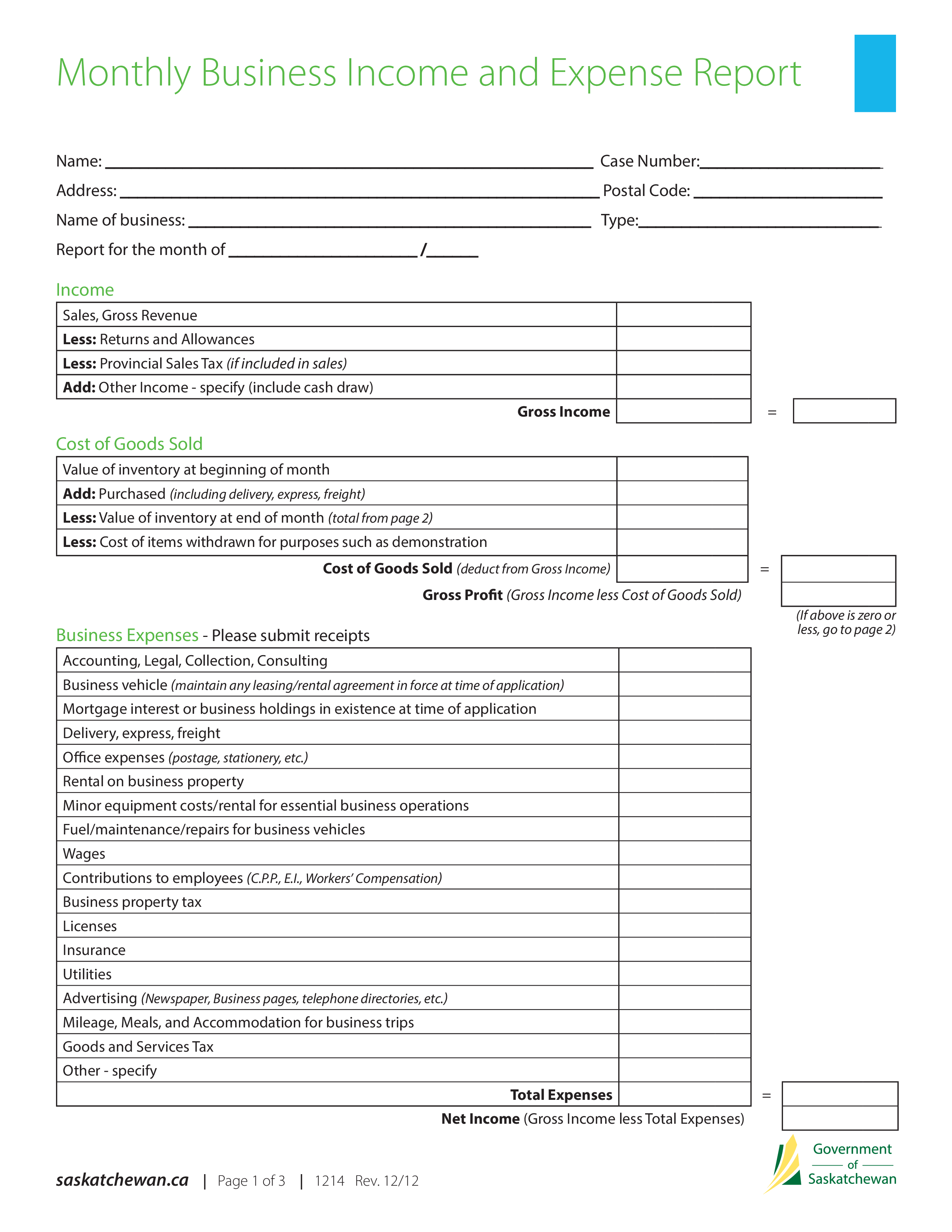

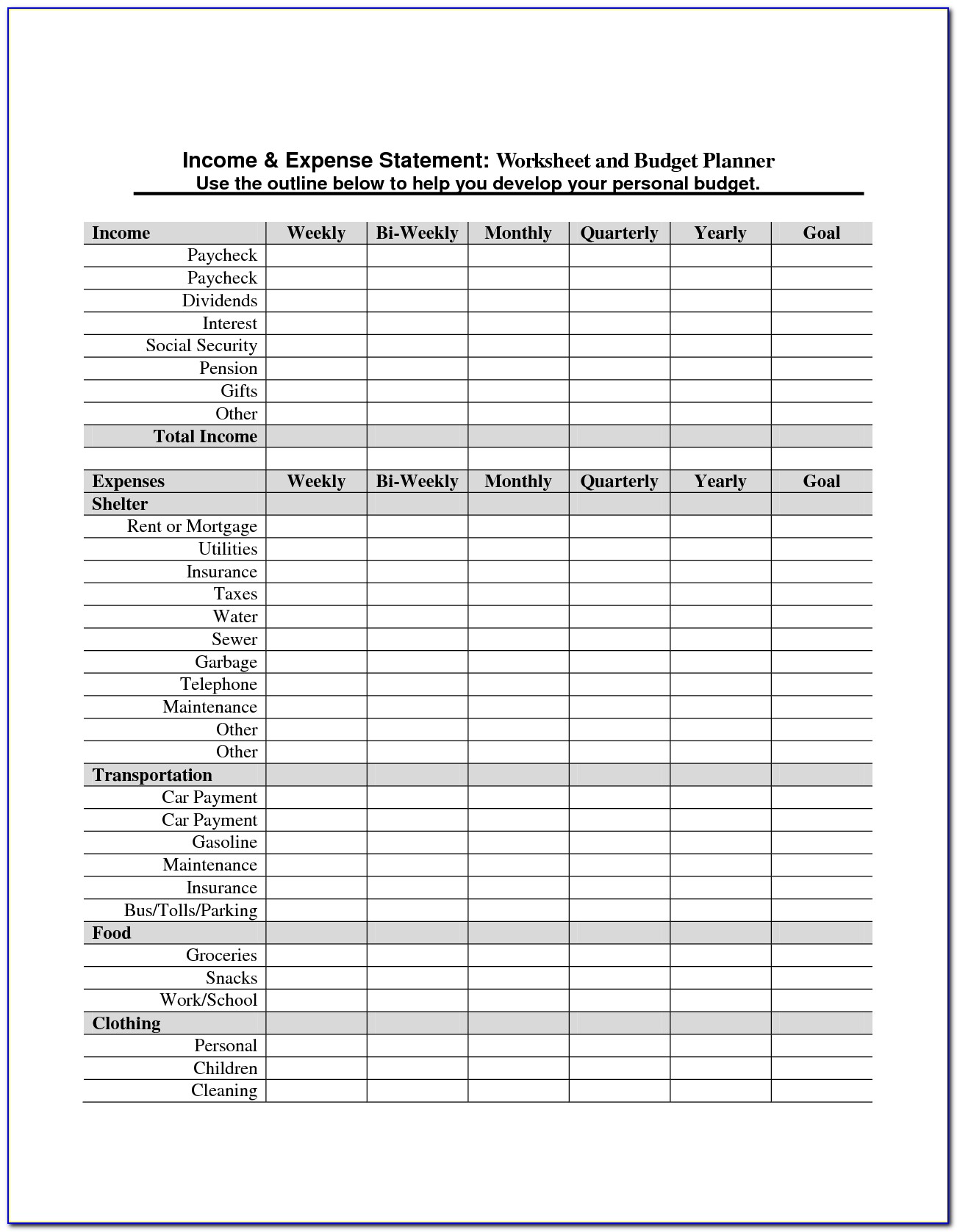

It also requires information about current income and expenses.

Income and expense statement for child support. The expenses included in the monthly child support calculation when figuring out child support needs include: (do not include the amount your employer pays.). Being prepared with the right documents can save you time, money, and stress.

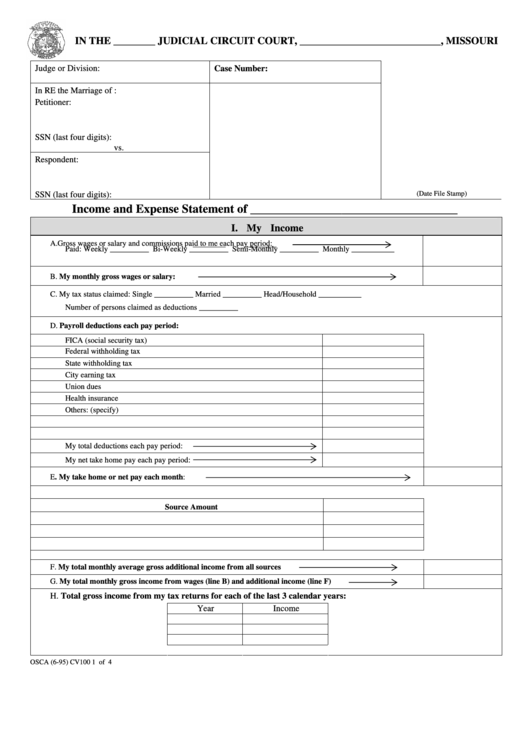

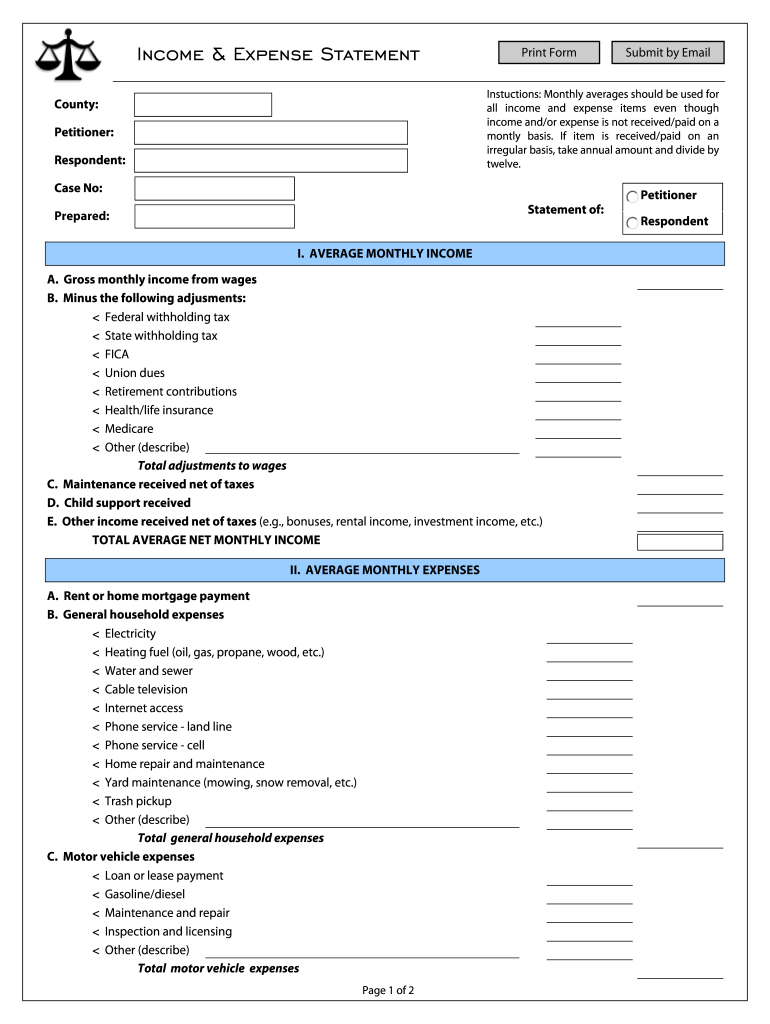

Income and expense declaration. You must provide documents to support all amounts provided in this expense statement And most important, how does it influence what i receive as child and/or spousal support, or what i might have to pay in child/spousal support?” the income and expense declaration is one of the most misunderstood forms required by the court when setting child and/or spousal support.

Subject of this proceeding that primarily reside with. Uniform income and expense statement: You might use a child support calculator to estimate the guideline amount.

Child support information (note: If you are dealing with support issues and property claims, you will need to complete a form 13.1 financial statement. If you are only dealing with child support and/or spousal support, you will need to fill out a form 13 financial statement.

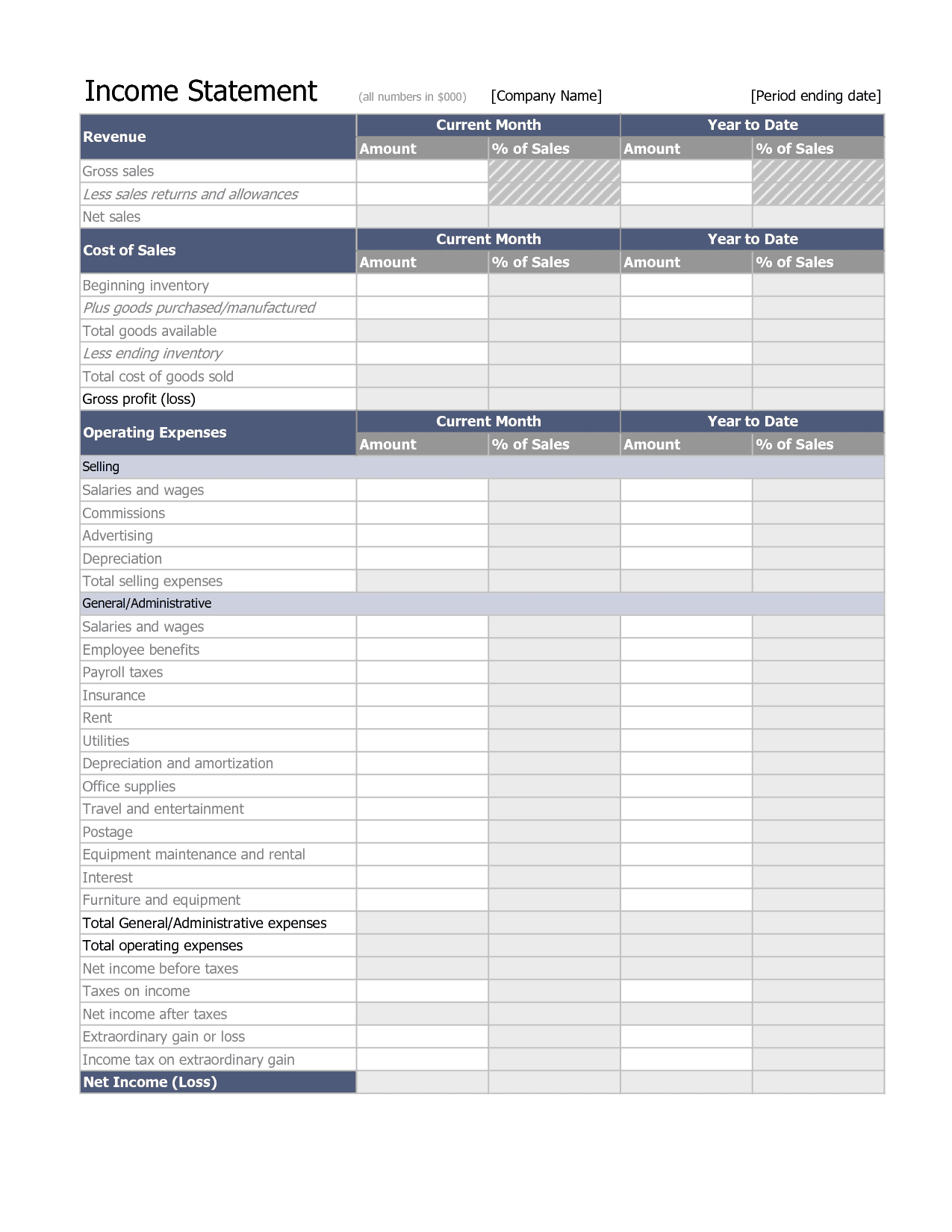

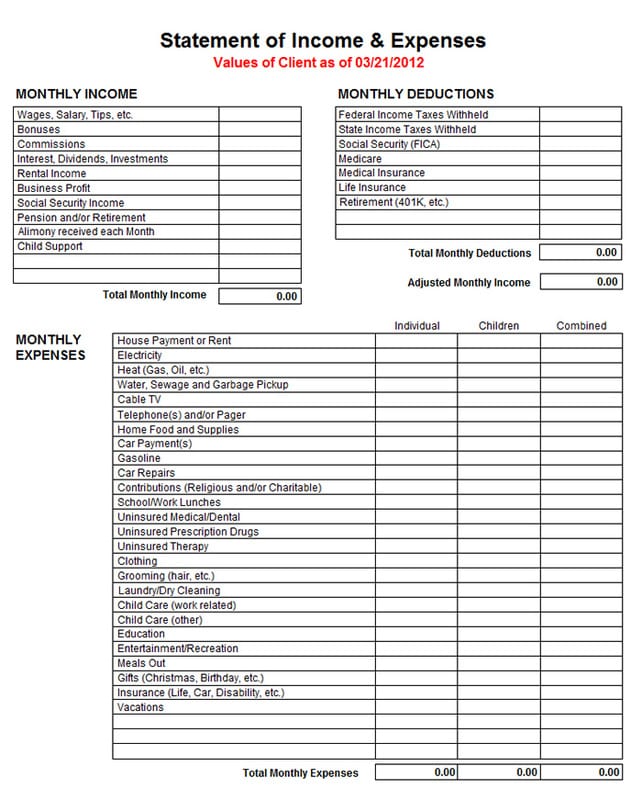

Number of unemancipated children who are not the. If your case does not involve a request for spousal support or attorneys fees, there are 15 items that you must fill out on an income and expense declaration. Income information annual gross income $ married ☐ yes ☐ no if yes, please list your spouse’s annual gross income $ family expense information for any expenses that are paid each week, multiply by 4.3 to obtain a monthly payment.

Statement of financial condition for individuals: Complete this form to provide the domestic relations section with information for yourself, your children, and the other party to the support action. Information on child custody, child support, and any fees to be paid.

Only a portion is refundable this year, up to $1,600 per child. Before you start to fill this form out you should gather the following documents: A blank answer form is served on the person paying support with the summons and complaint/proposed judgment.

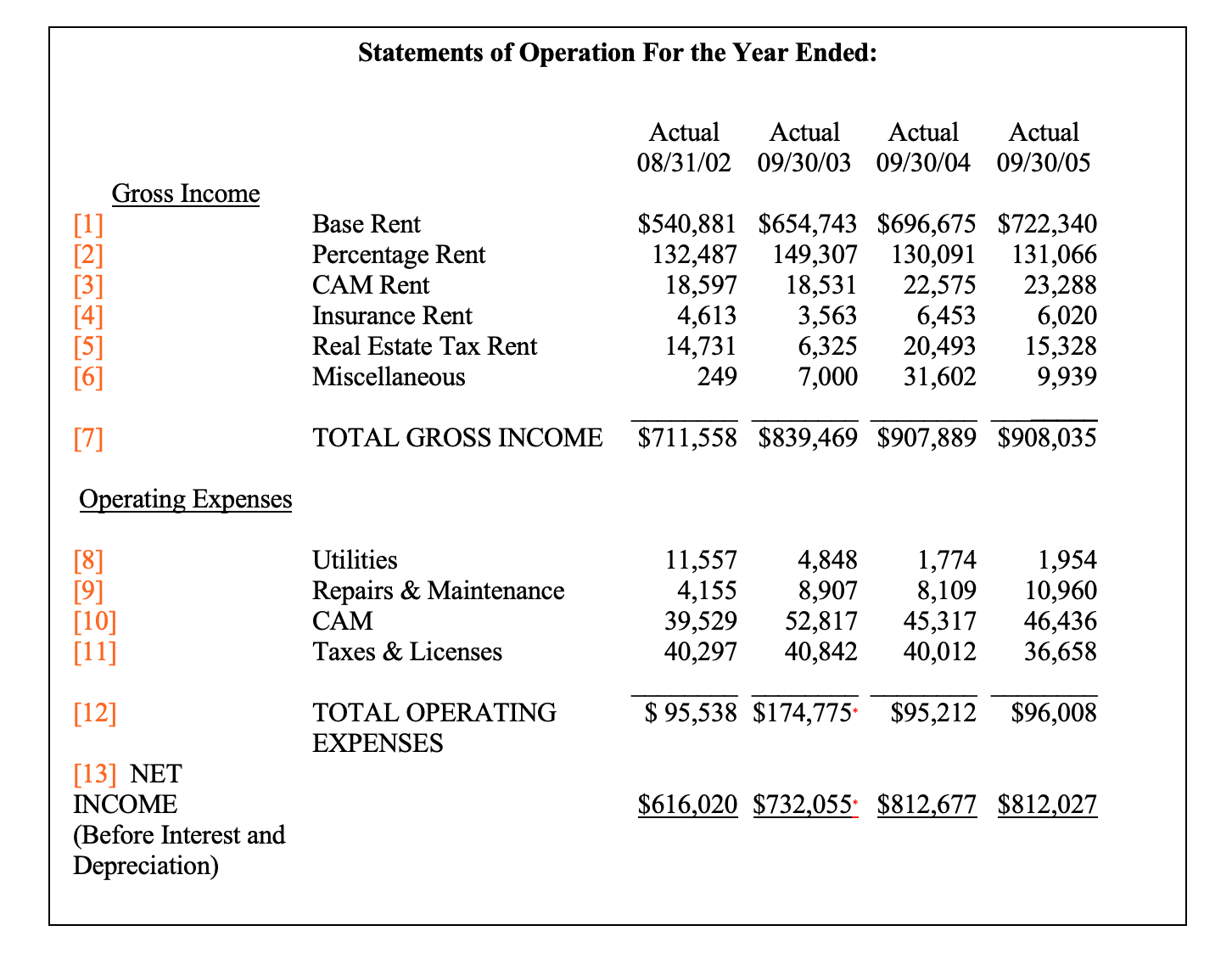

The parties' guideline incomes can be used to determine child support according to the federal child support guidelines. Your state has a formula for calculating child support. Child support is the right of the child, thus a parent’s legal obligation to pay child support that fairly reflects the parent’s income is not to be limited by income tax statutes that may confer entitlements in relation to deductibility of business expenses (cunningham at para.

Worksheet to calculate child support. Expenses included under other should be listed separately with separate dollar amounts. How is it used by the court?

The financial statement helps the court determine the proper incomes of both parties (their guideline incomes). Determining income for purposes of child support. Take a copy of your latest federal tax return to the court hearing.