Matchless Tips About Gross Trial Balance Big 4 Audit

Balance method or net trial balance;

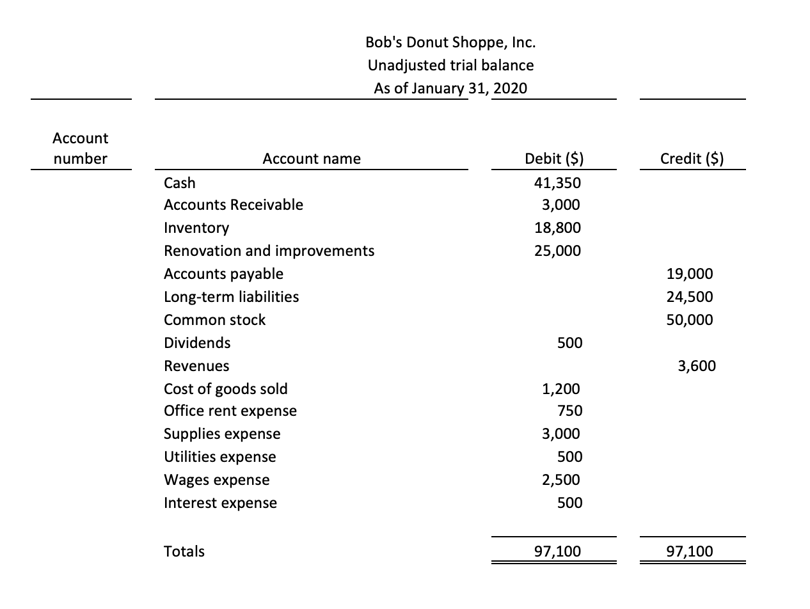

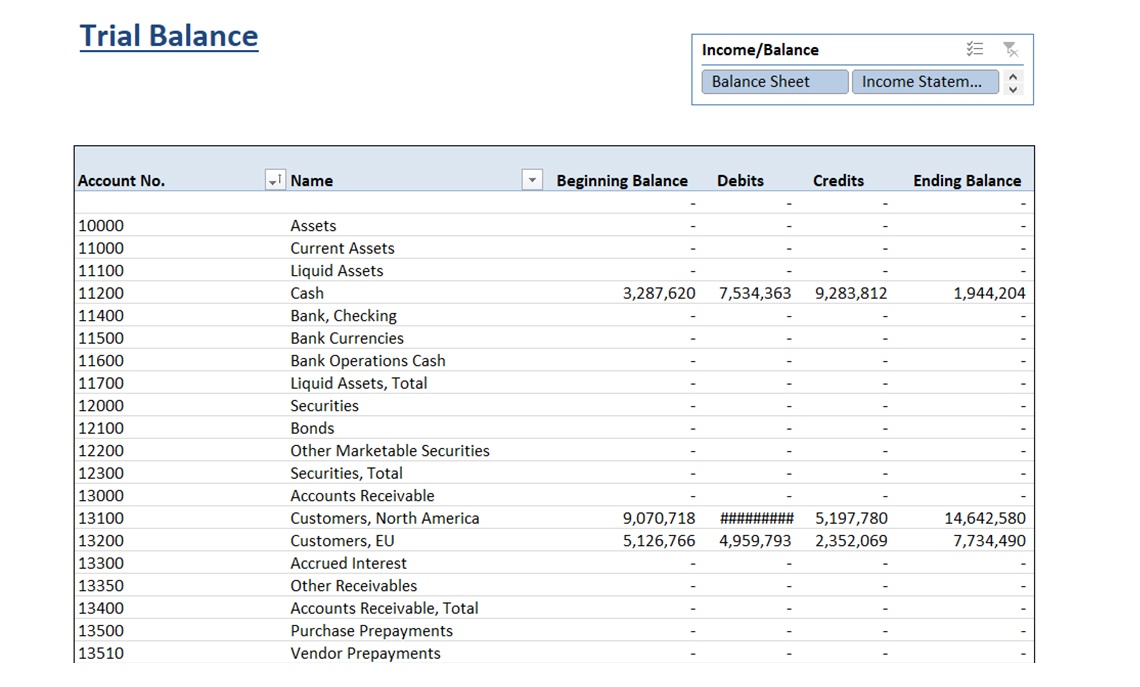

Gross trial balance. The trial balance will list out all of the accounts in the chart of accounts with the associated debit or credit balance. Trial balance utilities and interpretation; Copy the revenue balances from the general ledger to the unadjusted trial balance.

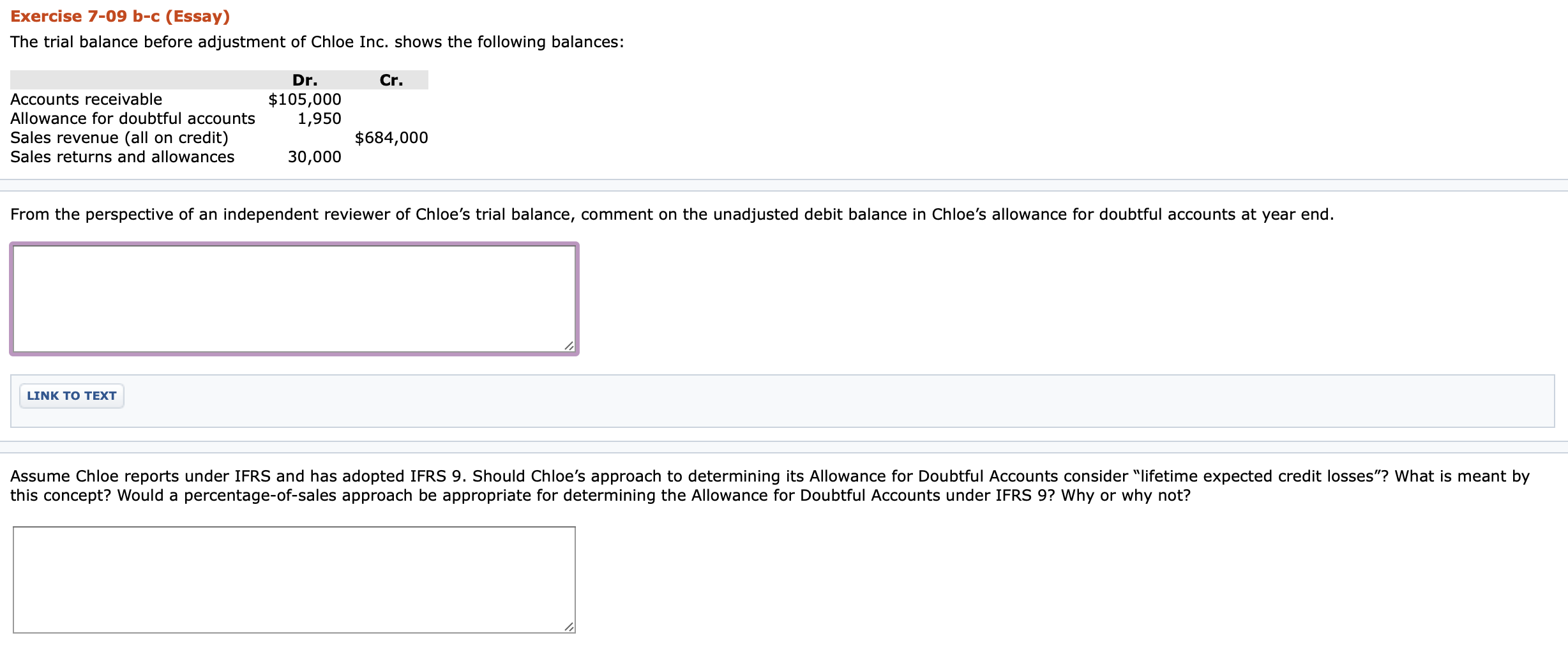

How do you find the gross profit on a trial balance? The gross profit equation is as follows. Balance or net trial balance;

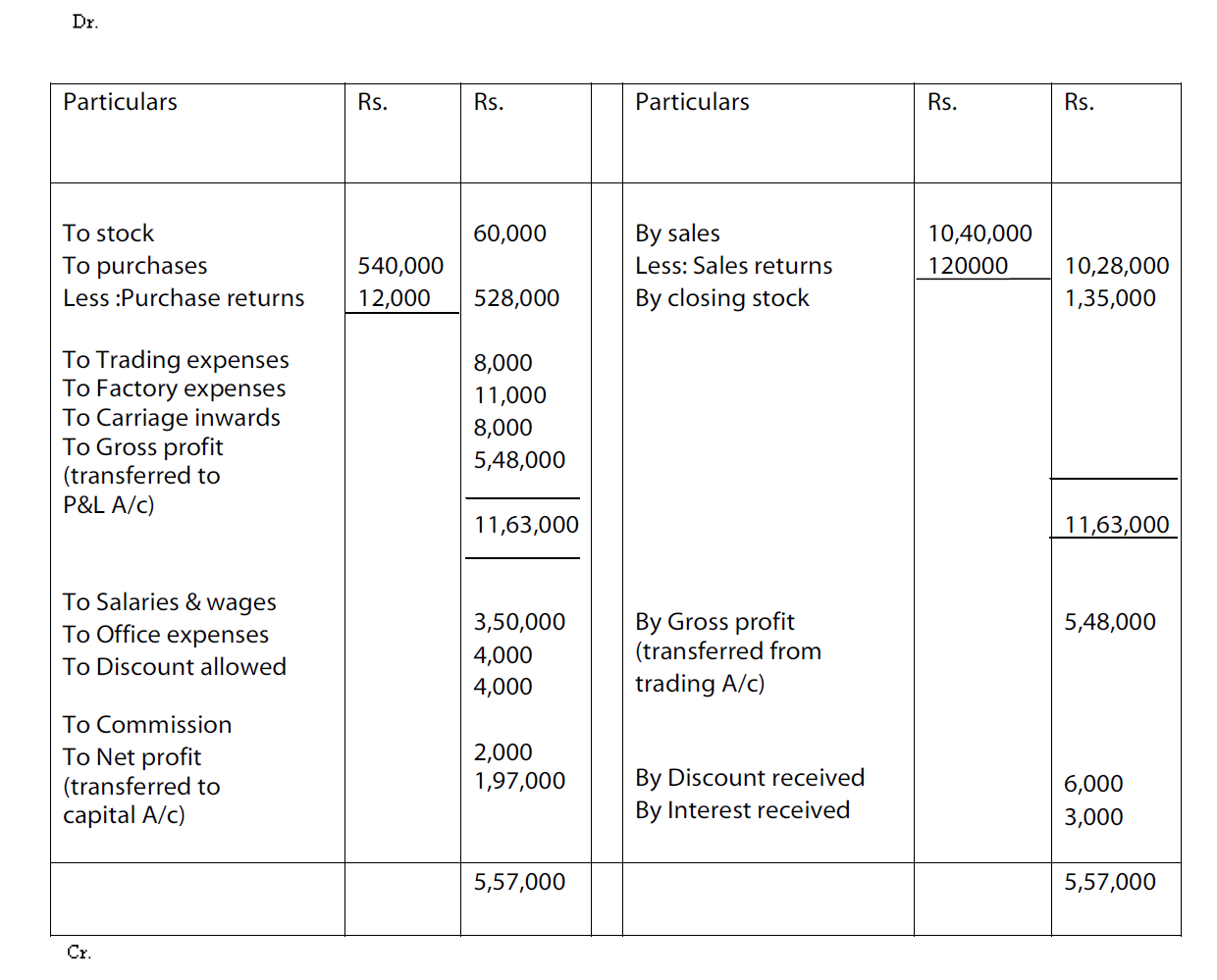

This will sum the income, expenditure and payroll sections (g,h & i) once loaded and any changes will dynamically update the total. Total method or the gross trial balance method with template in this method, the total value at the end of the debit and credit columns of a company’s ledger is recorded in the trial balance sheet. The methods of preparing a trial balance are as follows:

Methods to prepare trial balance. Total or gross trial balance: We enter the ‘debit totals’ on the debit side of the trial balance and the ‘credit totals’ on the credit side of the trial balance.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. But before you prepare the financial statements, you need to first get the trial balance. 4 years ago updated for new trial balances a line will be automatically added to the v (equity) section of the trial balance:

A trial balance is a list of all accounts in the general ledger that have nonzero balances. A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. It is helpful to check if these credit and debit balances balance each other.

Under this method, we total both the sides of the ledger accounts. There are three methods in which a trial balance can be prepared. The cost of goods sold is a very important record in a company’s financial statements.

It thus verifies the arithmetical accuracy of the postings in the ledger accounts. This is a standard report in your accounting software, and will provide you with a summary listing of the ending balances in every general ledger account. Otherwise called gross trial balance method, under this method all the ledger accounts are totalled and the total of both debit and credit side is carried forward to the trial balance.this method saves time, as the time taken to balance the account is saved and the trial balance can be prepared as and when the accounts are.

A trial balance allows you to check for mathematical errors (is the sum of the debits equal to the sum of the credits), and check account balances versus expectations (if you usually have a. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

Which are as follows : A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. Balance method or net trial balance;.