Who Else Wants Info About Accounting For Income Tax Problems And Solutions Net Profit

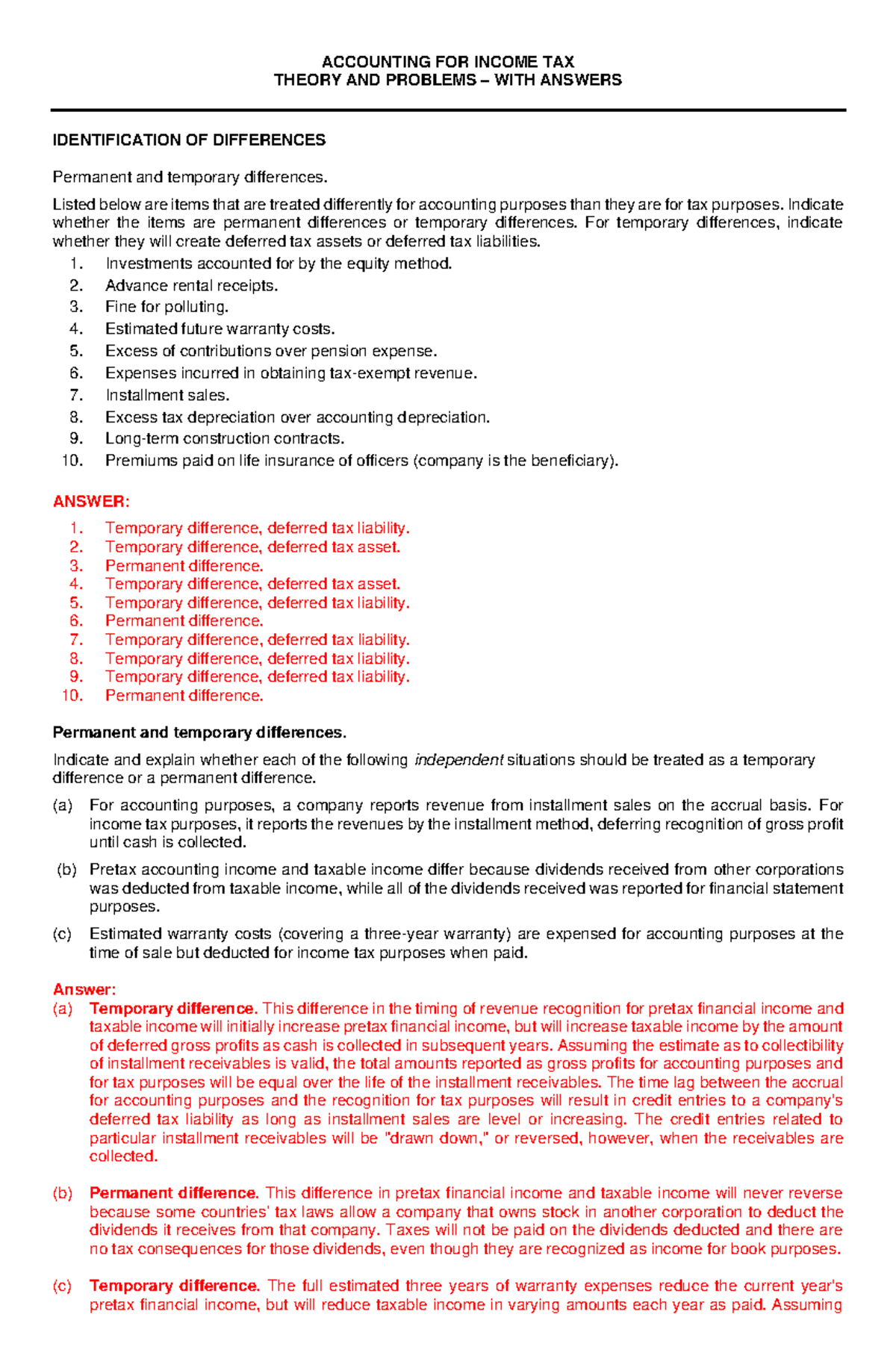

In accounting when calculating income tax can arise differences caused by mismatch of updated national accounting regulations (standards) and tax code of.

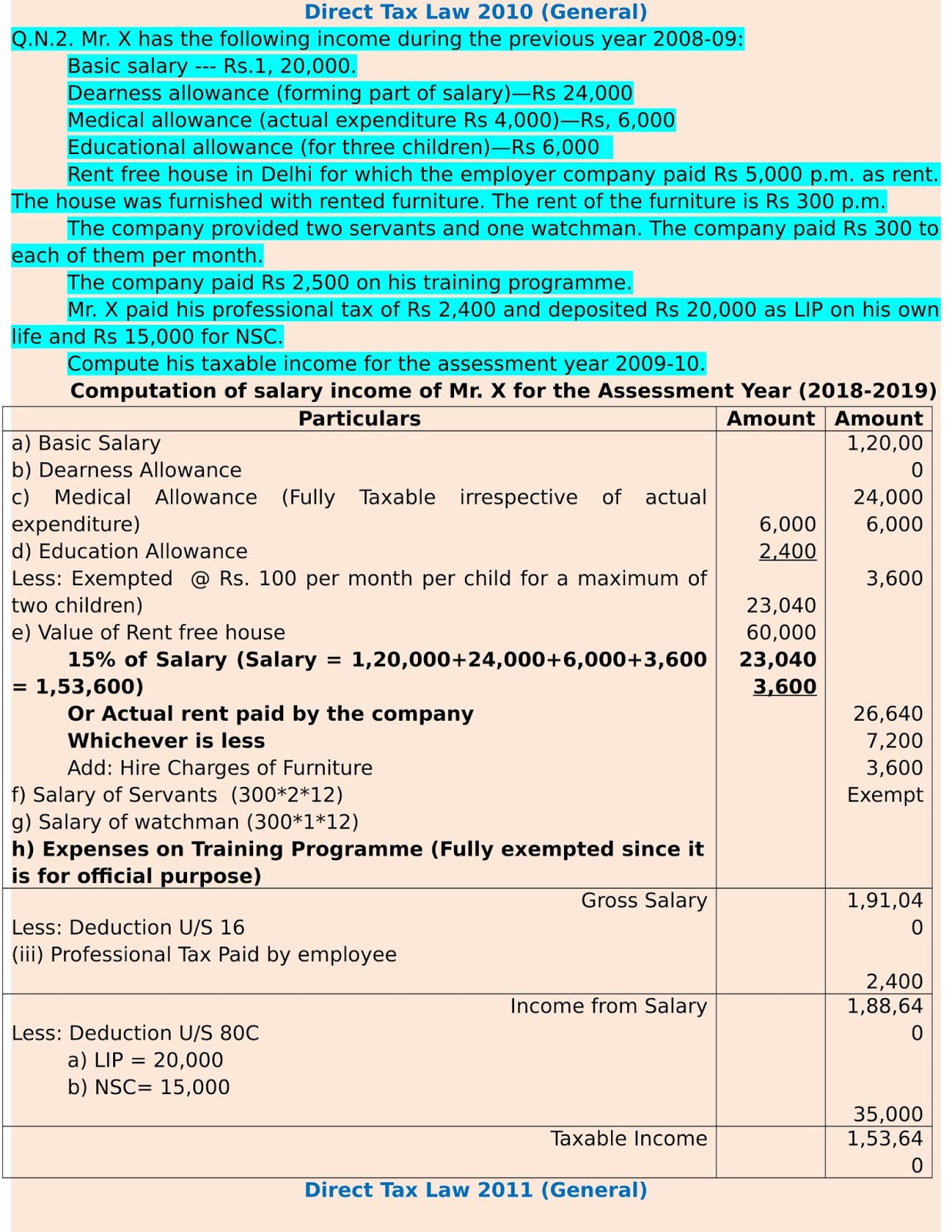

Accounting for income tax problems and solutions. Assessment on agricultural income, 3. We go over the top tax problems americans face today to help you prepare for whatever may come your way. All the problems and solutions have been thoroughly.

Explain the accounting for loss carrybacks and loss carryforwards. The negative income tax: How to account for income taxes.

The essential accounting for income taxes is to recognize tax liabilities for estimated income taxes payable, and determine. The fasb believes that the deferred tax method is the most. All the problems and solutions.

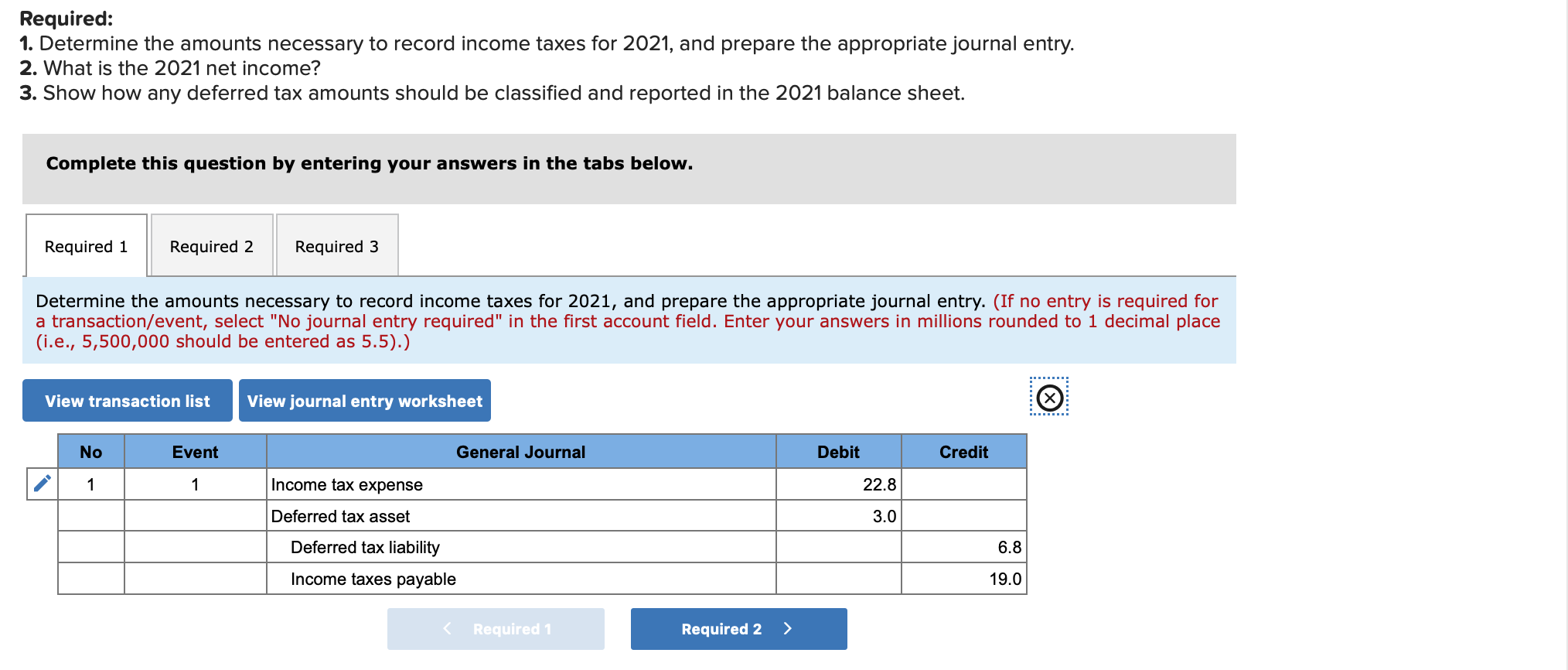

What amount should be reported as. Companies should classify the balances in the deferred tax accounts on the balance sheet as noncurrent assets and noncurrent liabilities. 17 accounting challenges and their solutions.

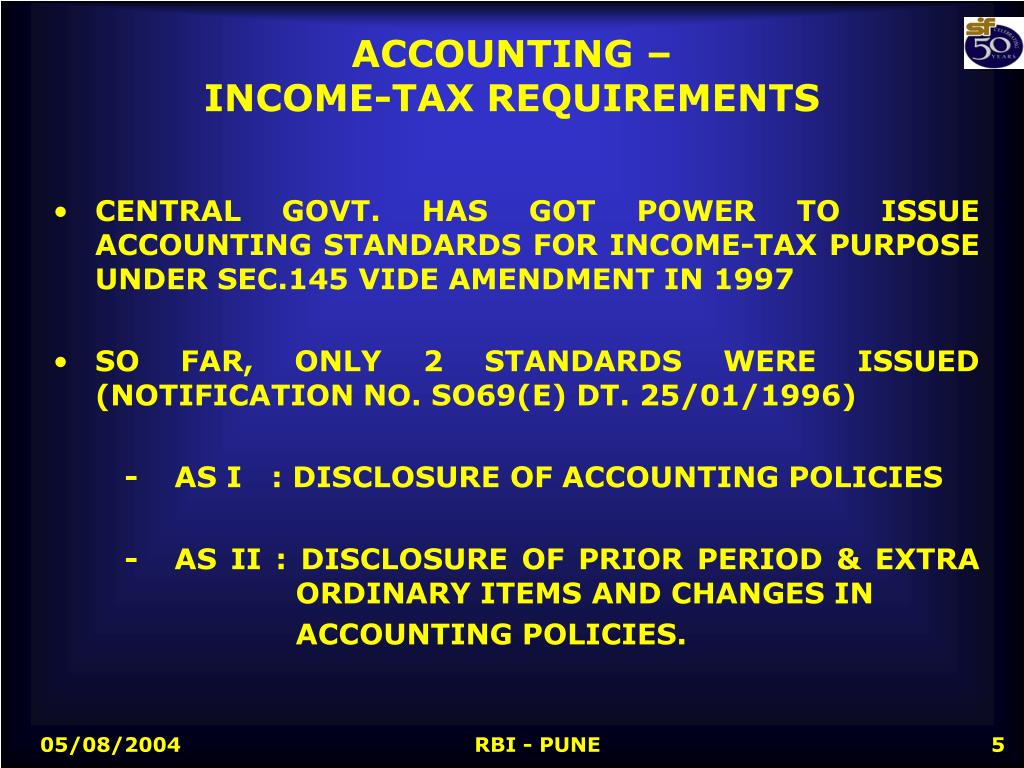

Identify additional issues in accounting for income taxes. Keeping up with technology and regulatory changes are significant concerns of 51% and 24%, respectively, of cpa and accounting firm survey participants, according to. Income tax accounting is complex, and preparers and users find some.

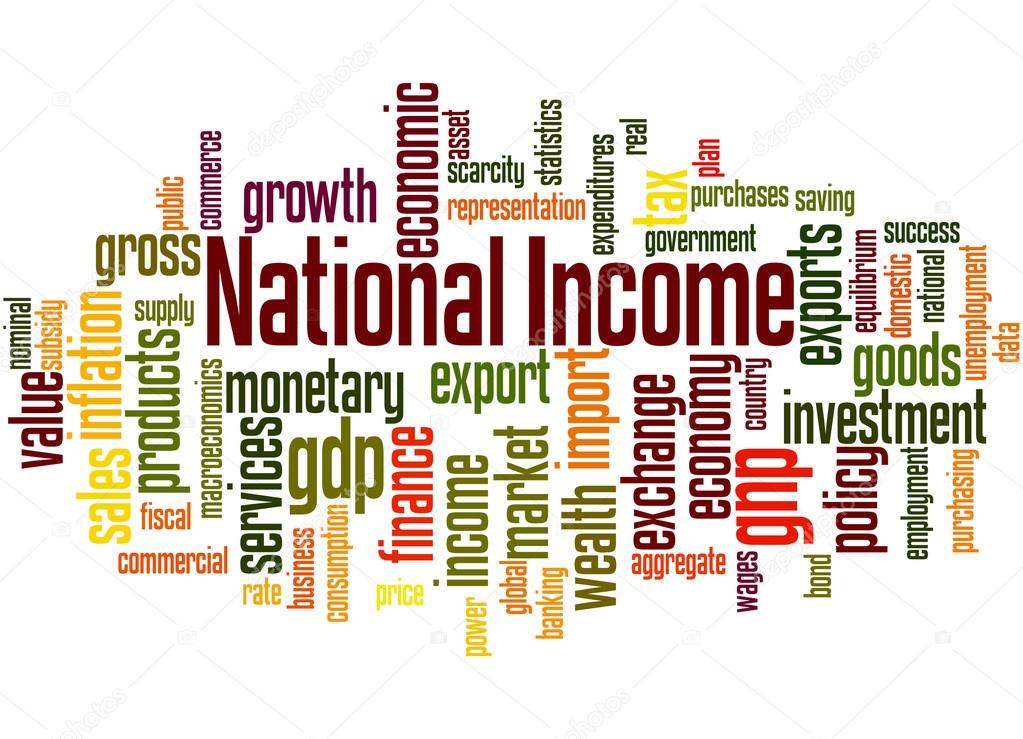

The salient features of the present edition are: Tax problems and solutions handbook (2021 edition) (currently unavailable) each year it is estimated that over 20 million taxpayers have a tax issue or. Income from salaries (retirement and.

Accounting problems and a proposed solution michael r. Exempted incomes, 4.residence and tax liability 5. This period did not require.

Accounting for income taxes. Describe the presentation of deferred income taxes. Accounting teams that leverage technology are better able to adapt to changes and challenges like some of the.

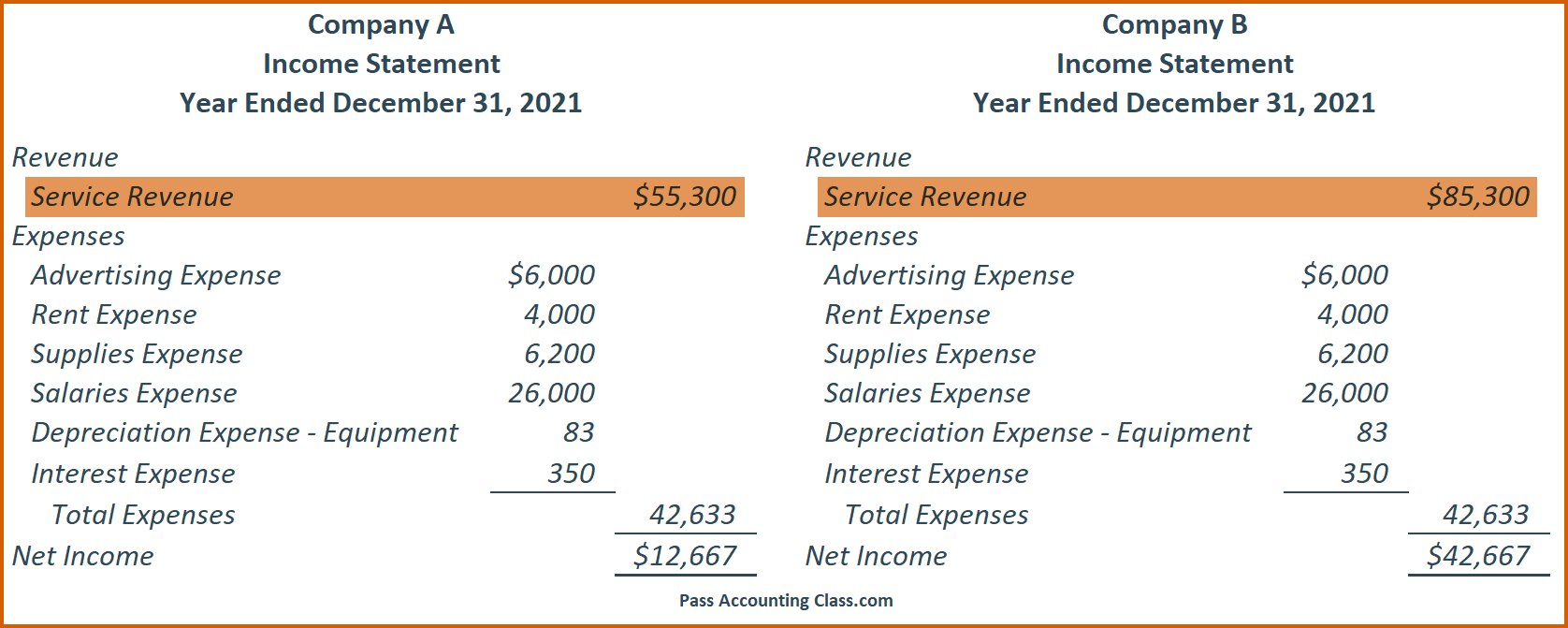

Income taxes are an expense to the business that accumulate during the period but are only paid at predetermined times throughout the year. The pretax accounting income for 2020 is p15,000,000. Learn what each problem is and how to solve them.

Ias 12, income taxes, deals with taxes on income, both current tax and deferred tax. Tax case study materials the pwc tax case studies provide students with realistic fact situations in which a number of tax problems and opportunities can be identified.