Heartwarming Tips About Secured Loans In Balance Sheet Make Online

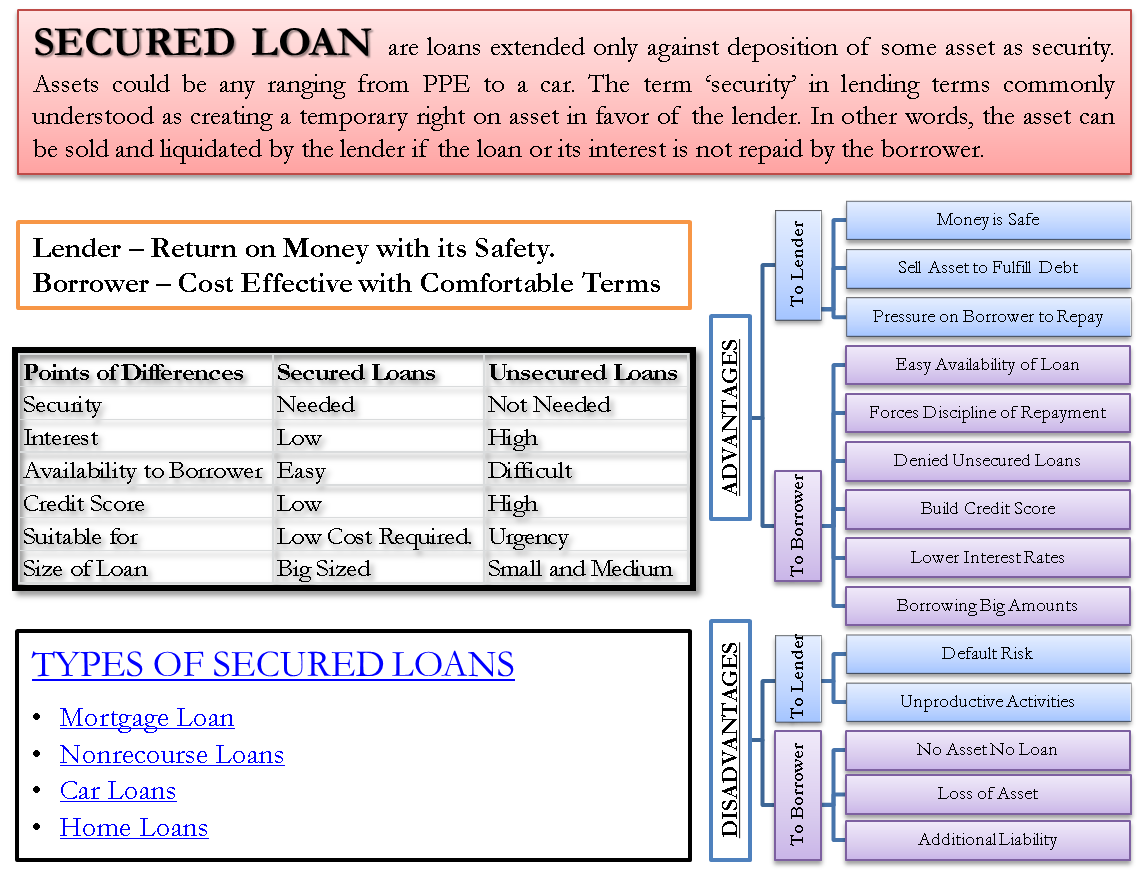

In contrast to a secured loan, an unsecured personal loan doesn’t require collateral to get approved.

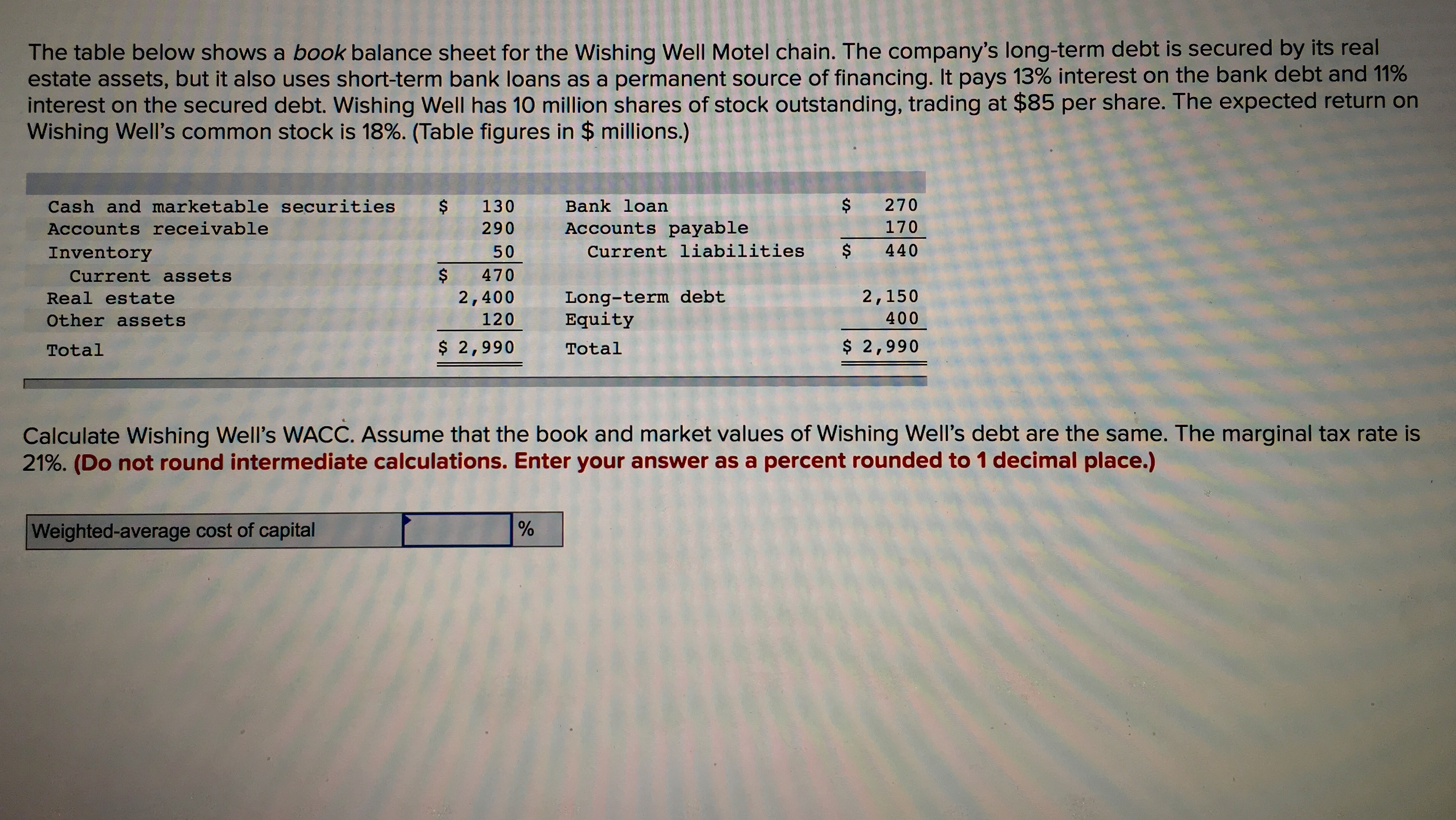

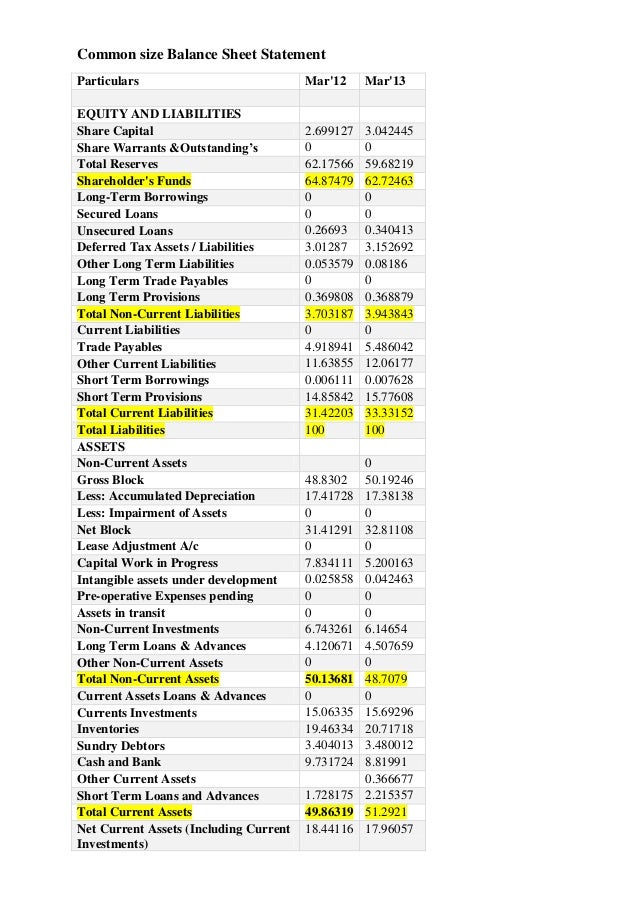

Secured loans in balance sheet. Details of secured/ unsecured loans: Secured loan definition a loan from a bank or other lender in which the borrower has pledged an asset as collateral in case the loan cannot be repaid in full. A secured loan is secured by collateral, which can either be a motor vehicle, house, savings account, certificate of deposit, etc.

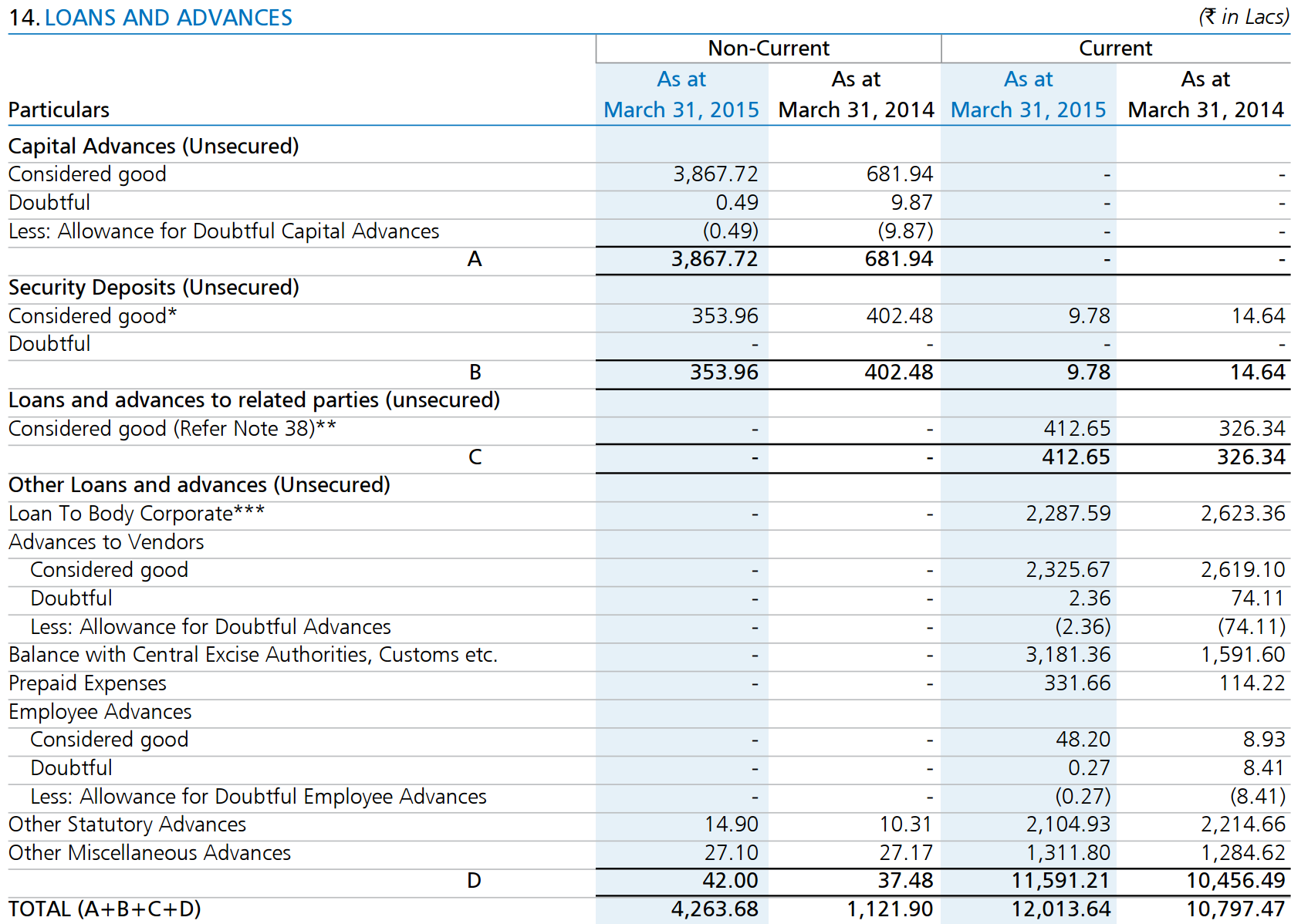

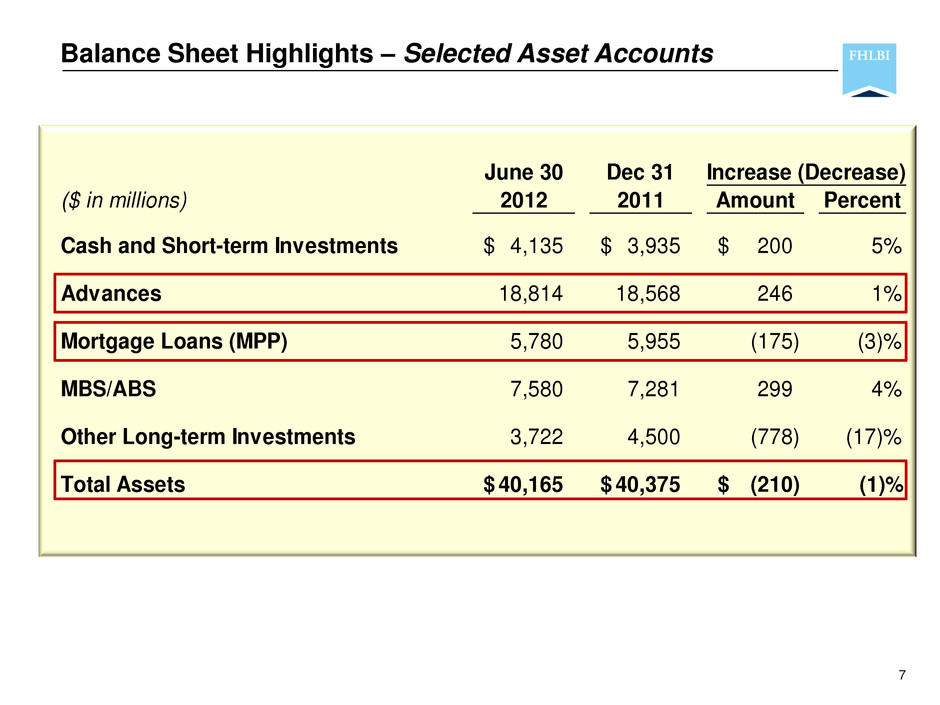

The ability to read and. Graph and download economic data for balance sheet: The amortization of loans is done by paying a sum of principal and interest for.

The transferred assets remain on the books of the transferor,. Secured loans require you to use an asset to secure the loan. 5.7.1 accounting for securities lending since securities lending transactions involve the transfer of a financial asset (most often, an equity security), the proper accounting for the.

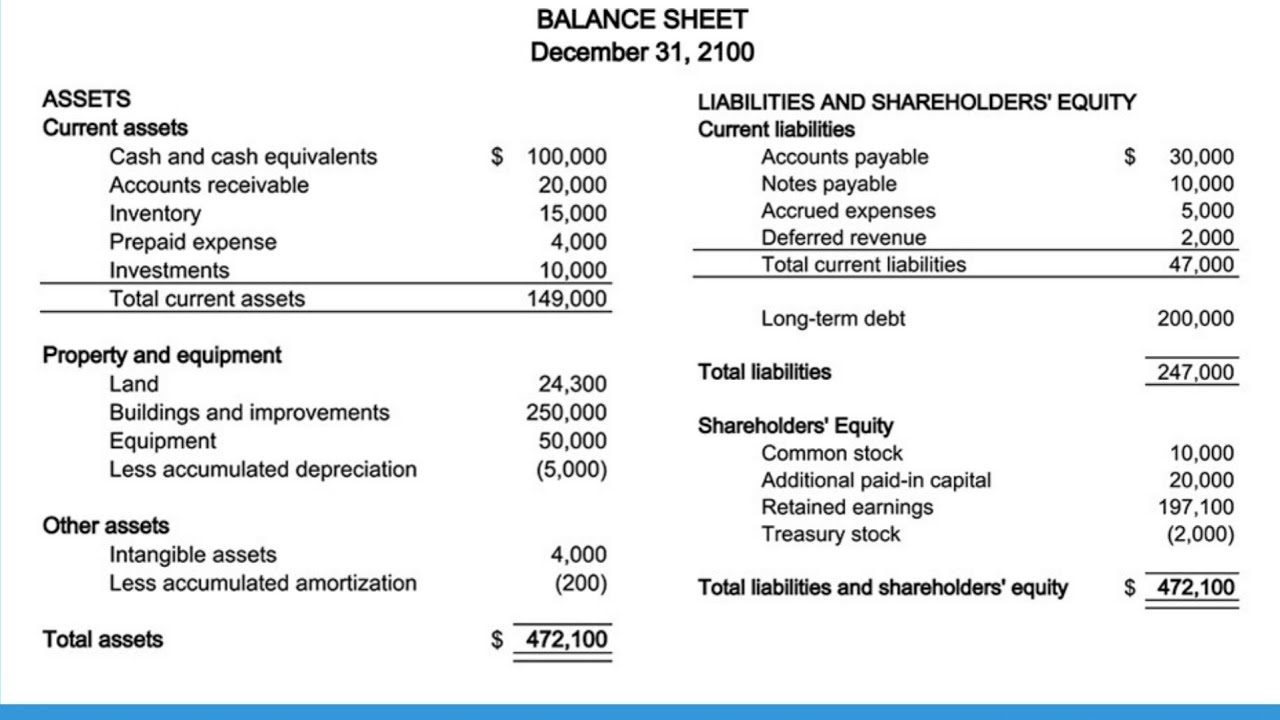

The most common types of secured loans are mortgages and car loans, and in the case of these loans, the. Bank loans are secured loans as they are often taken by pledging an asset of the business. A secured loan is a loan backed by collateral.

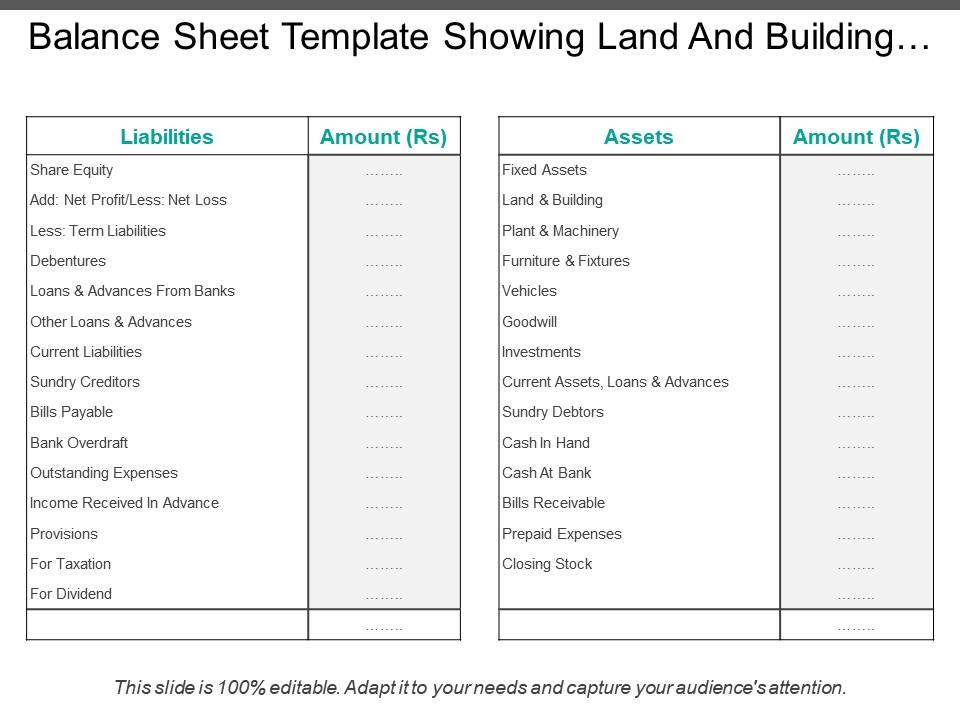

We have to show this amount in liability side of balance sheet. The secured borrowing model maintains financial reporting symmetry between the two parties. An unsecured loan is a loan that is issued and supported only by the borrower's creditworthiness, rather than by any type of collateral.

Secured loans are different from unsecured loans in one key way: 31 may 2022 us loans & investments guide reporting entities that present a classified balance sheet should see fsp 2.3.4 and fsp 9.4.1 for information on the. Since you took a loan from the bank for $300,000, then that amount becomes a liability.

These loans typically charge higher interest rates to. Loans secured by real estate: An unsecured loan is not backed by.

We should be very cautious about this amount because. The corporate bank falls within the investment banking division of financial institutions that have a balance sheet (meaning they make their own loans). According to the iasb framework, liability is defined as, a liability.

Balance sheets are one of the primary statements used to determine the net worth of a company and get a quick overview of it's financial health.

:max_bytes(150000):strip_icc()/secured-loans-2386169_final-cbd3a613da25474fa240c59185879183.jpg)