Recommendation Tips About Group Accounts In Financial Reporting Sfas 160

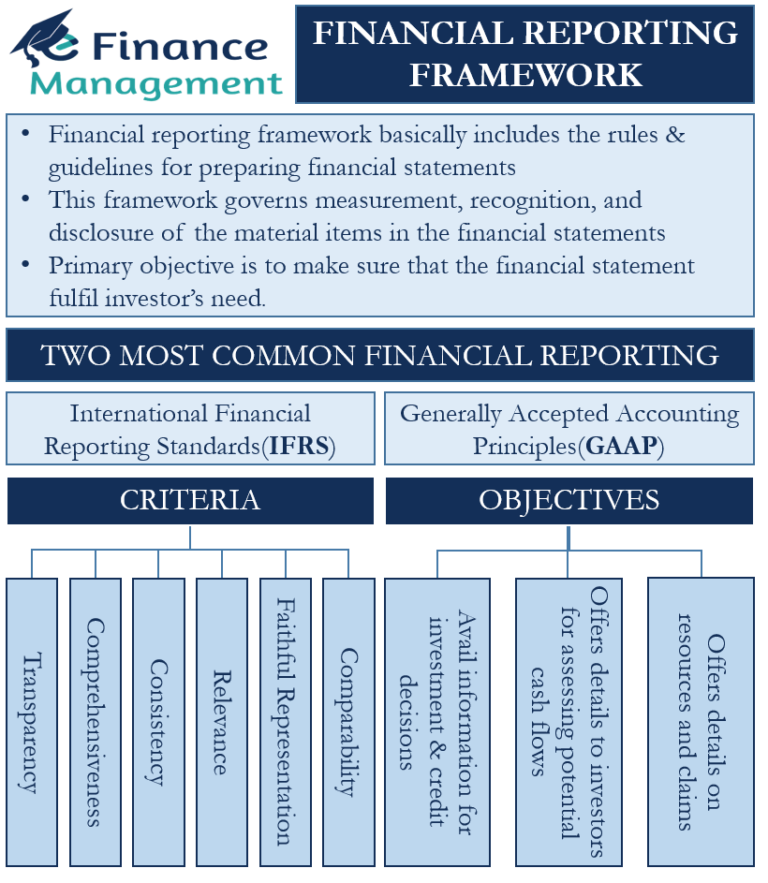

Ifrs 10 outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls.

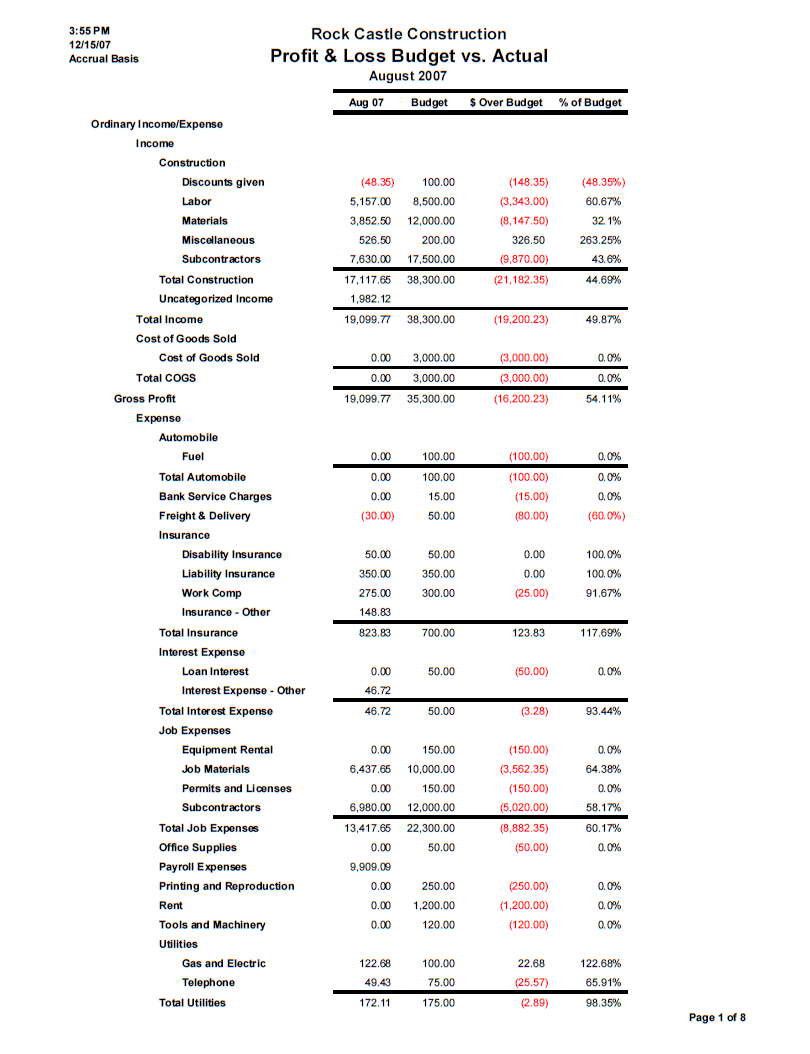

Group accounts in financial reporting. Most acquisitions under frs 102 are accounted for using the purchase method (previously known as acquisition accounting) in accordance. All accounts payable recorded during the consolidation period need to be appropriately charged to the subsidiaries. The purchase method.

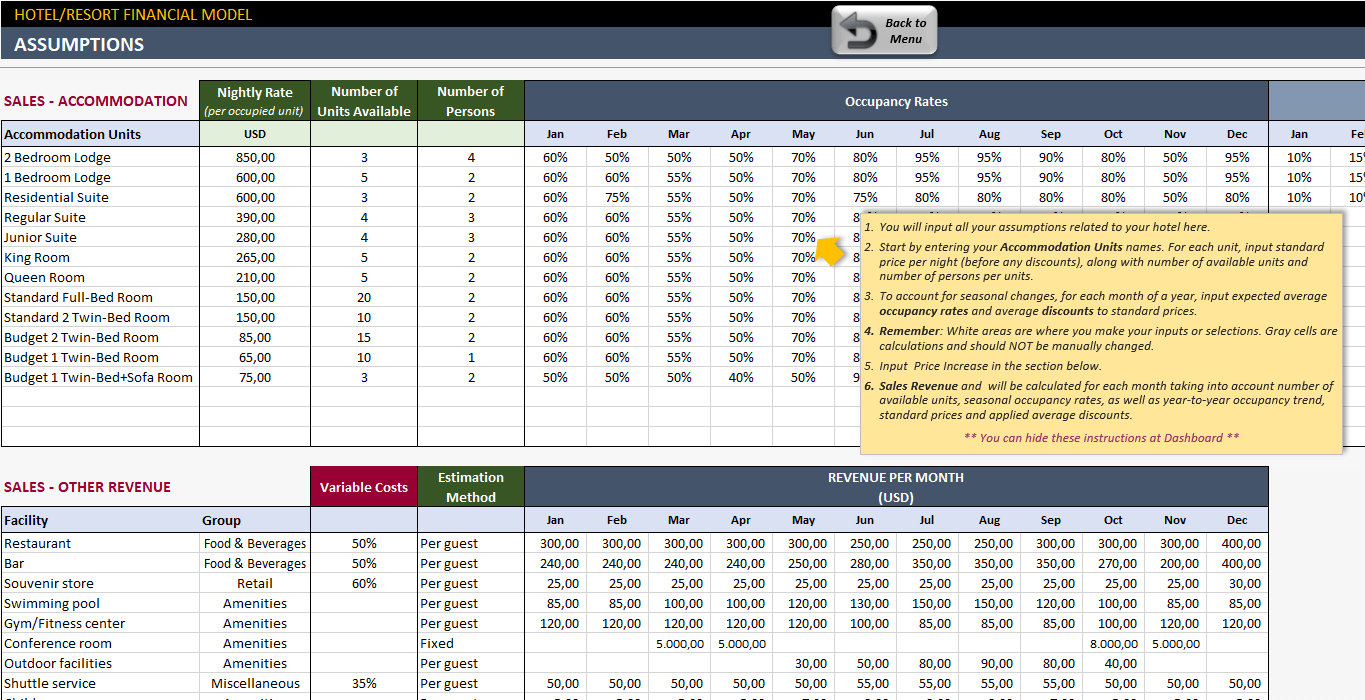

This makes groups readily comparable, even if their legal and ownership. These financial statements are called consolidated financial statements. Taking the complexity out of group accounting.

Assets and liabilities when preparing a consolidated statement of financial position, the assets and. Payroll expenses also need to be correctly. The companies, partnerships and groups (accounts and reports) regulations 2015 amended the companies act 2006 to implement the requirements of the eu accounting.

Financial data company s&p global is nearing a deal to buy research platform visible alpha for more than $500mn from a consortium of investment banks including. The scope of consolidation is based on the application of the standards. The uk fintech could finalise a deal as soon as the next two weeks to raise as much as £350mn from a mix of new and existing investors, the people said.

Consolidated financial statements are often referred to as ‘group accounts’. Less parent’s % of impairment loss on full goodwill (80% x 1,000) = ($800) total = $103,200. We prepare the required group reporting package for you in accordance with international accounting standards (ifrs, us gaap).

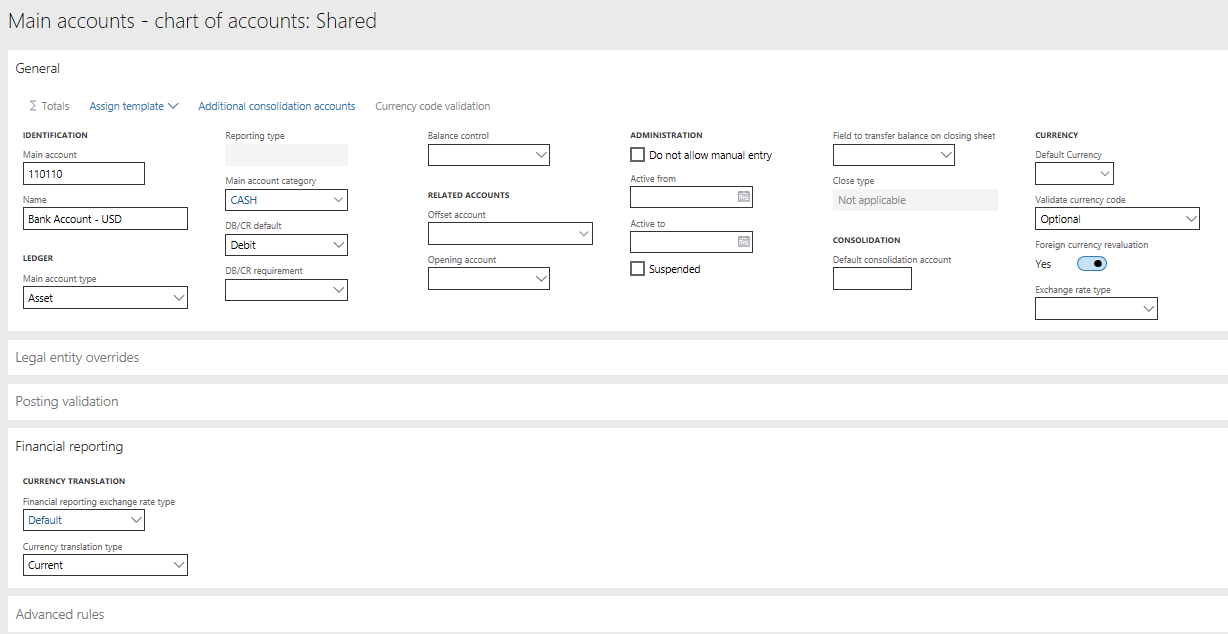

Where assets, liabilities, equity, income, expenses and cash flows of the parent and its subs are presented as those of a. Section 19 business combinations and goodwill sets out. The new international financial reporting standards (ifrs) 10, 11, and 12 are changing group accounting for many businesses.

Associated with, a reporting authority’s interests in other entities and the effects of those interests on its financial position, financial performance and cash flows ias 27. The new international financial reporting standards (ifrs) 10, 11, and 12 are changing group accounting for many businesses. Group accounts report the underlying commercial reality of the effective control of the parent.

Additionally, once recognized and measured according to harmonized accounting. Once the group chart of accounts is defined and perfected, you've taken the first step towards automated financial reporting and consolidation within the. Vanguard was ultimately excused from the hearing.

Plus parent’s % of post acquisition profit (80% x 5,000) = $4,000. Group financial statements are financial statements that include the financial information for more than one component. Consolidated financial statements are the combined financial statements of a parent company and its subsidiaries.

The international accounting standards board (board) is calling for feedback on the ifrs standards for group accounting—ifrs 10 consolidated financial statements, ifrs.