Build A Info About Consolidated Income Statement Format Uses Of Ratio Analysis

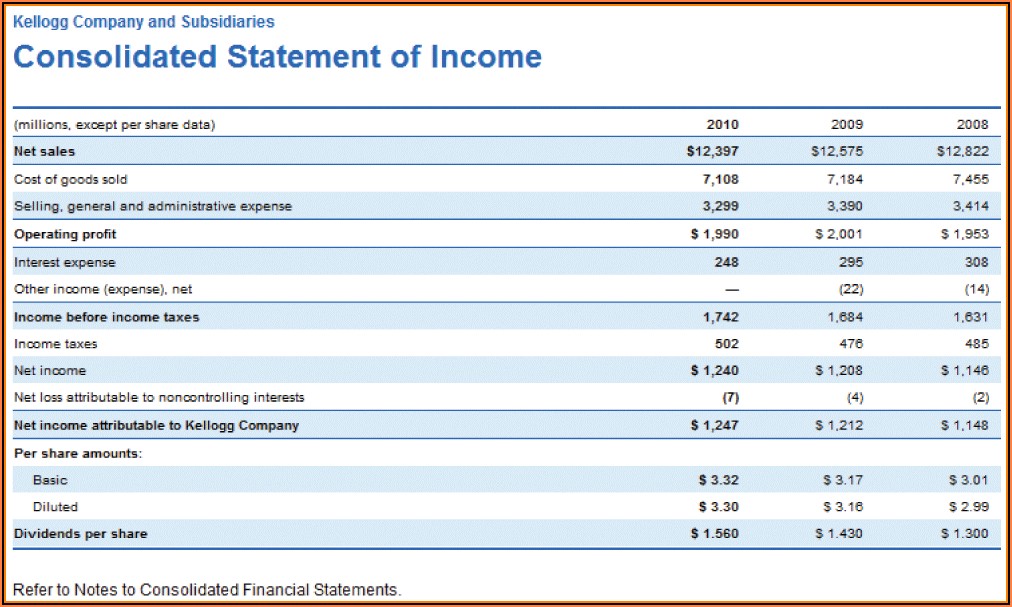

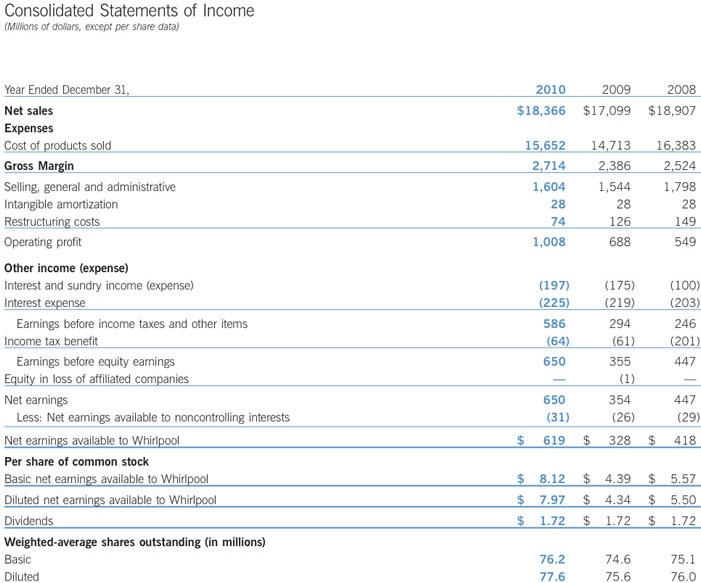

Learn how to read an income statement with a real example.

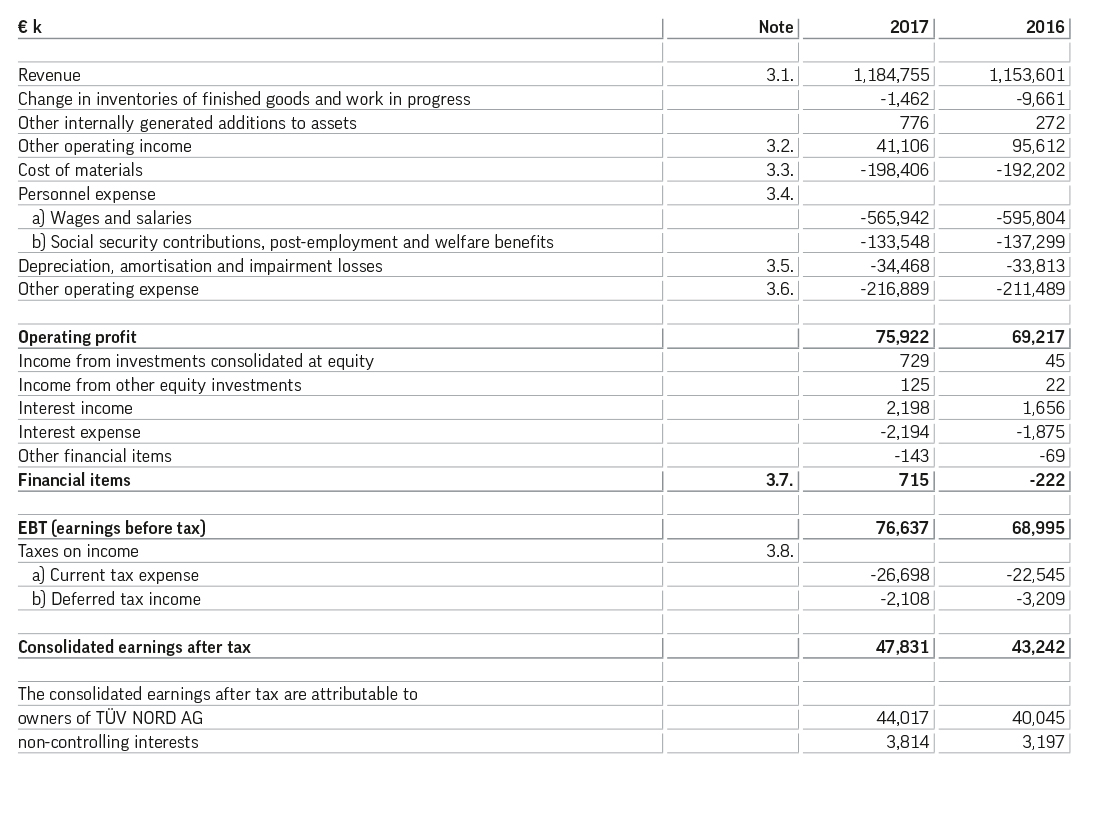

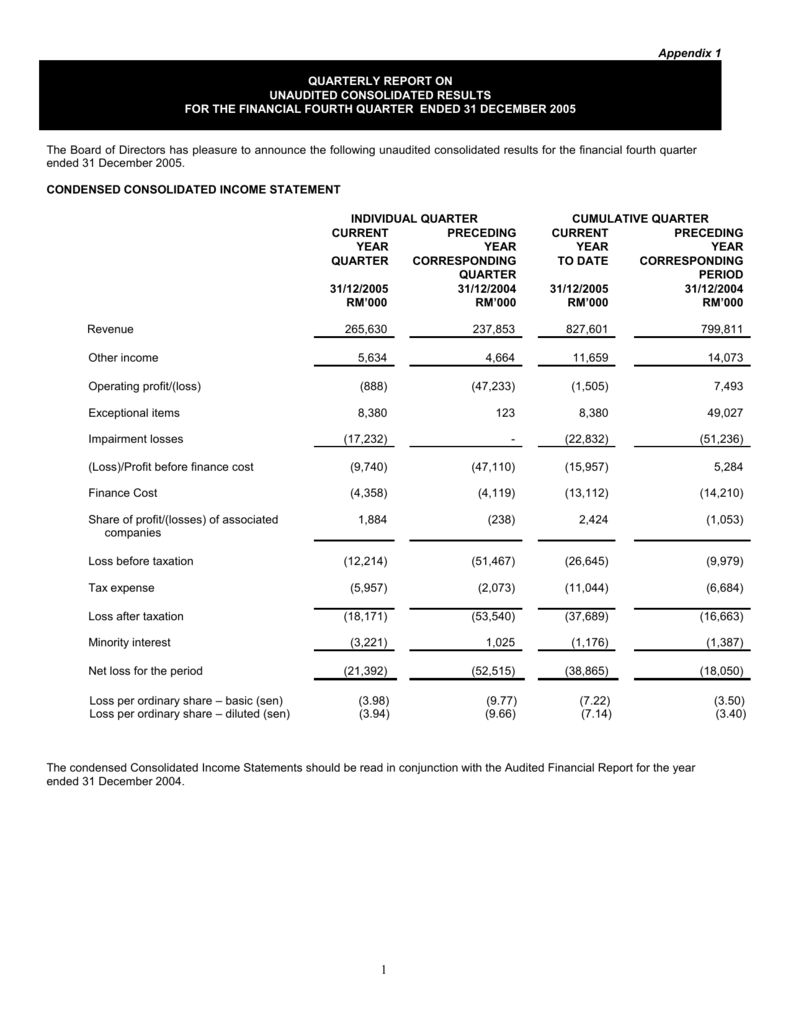

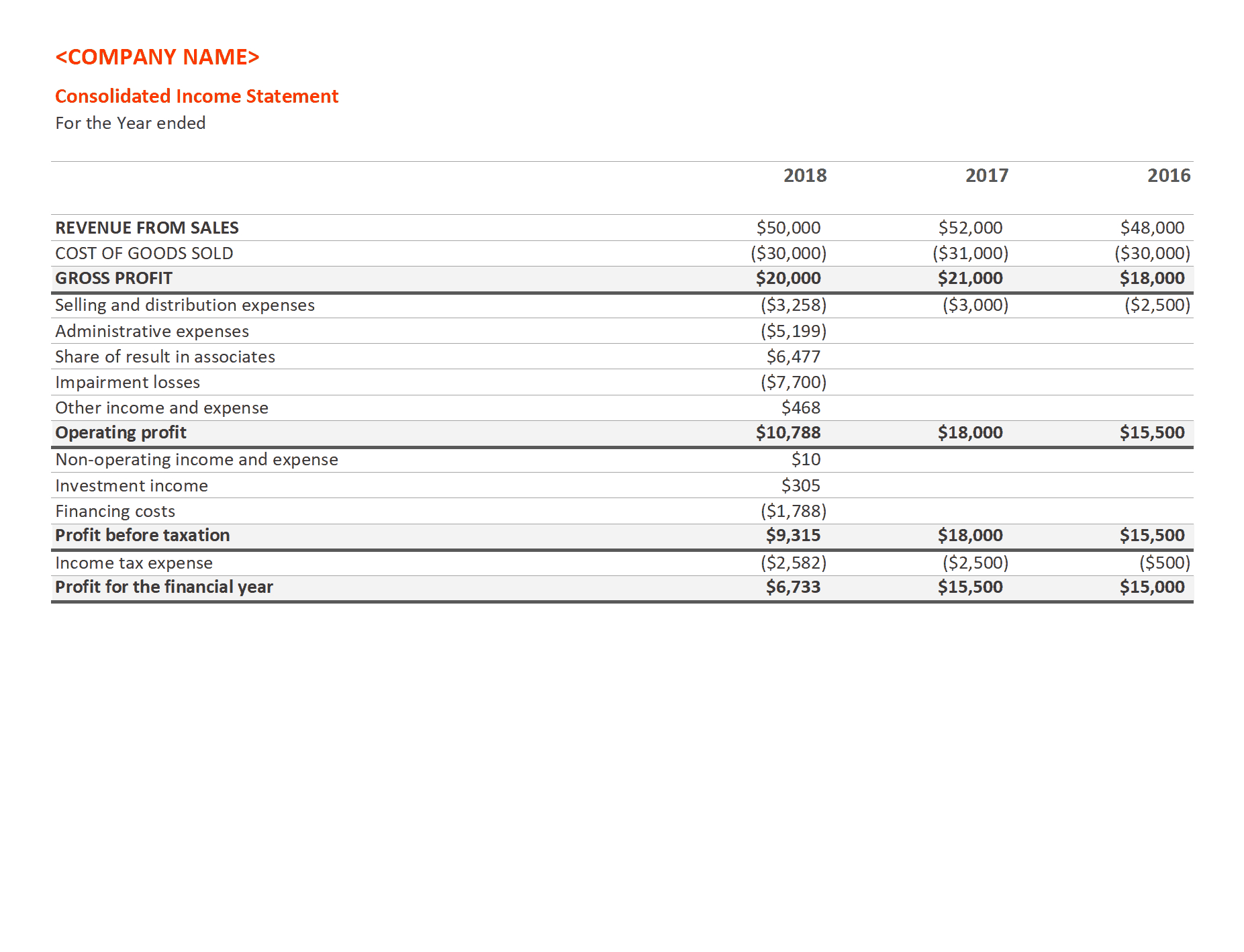

Consolidated income statement format. Consolidated financial statements normally include consolidated balance sheet, consolidated statement of profit and loss, and notes, other statements and explanatory material that form an integral part thereof. The terms ‘group’, ‘parent’, and ‘subsidiary’ are used in this context to refer to the. (1) add together the revenues and expenses of the parent and the subsidiary.

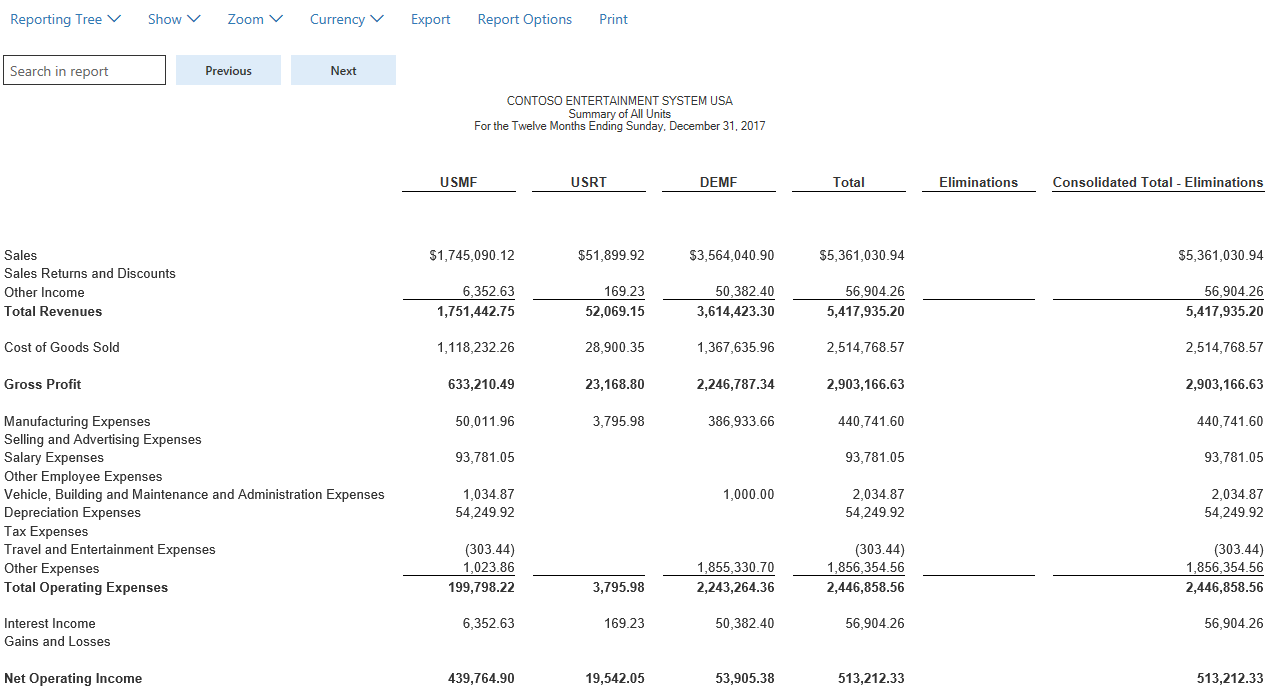

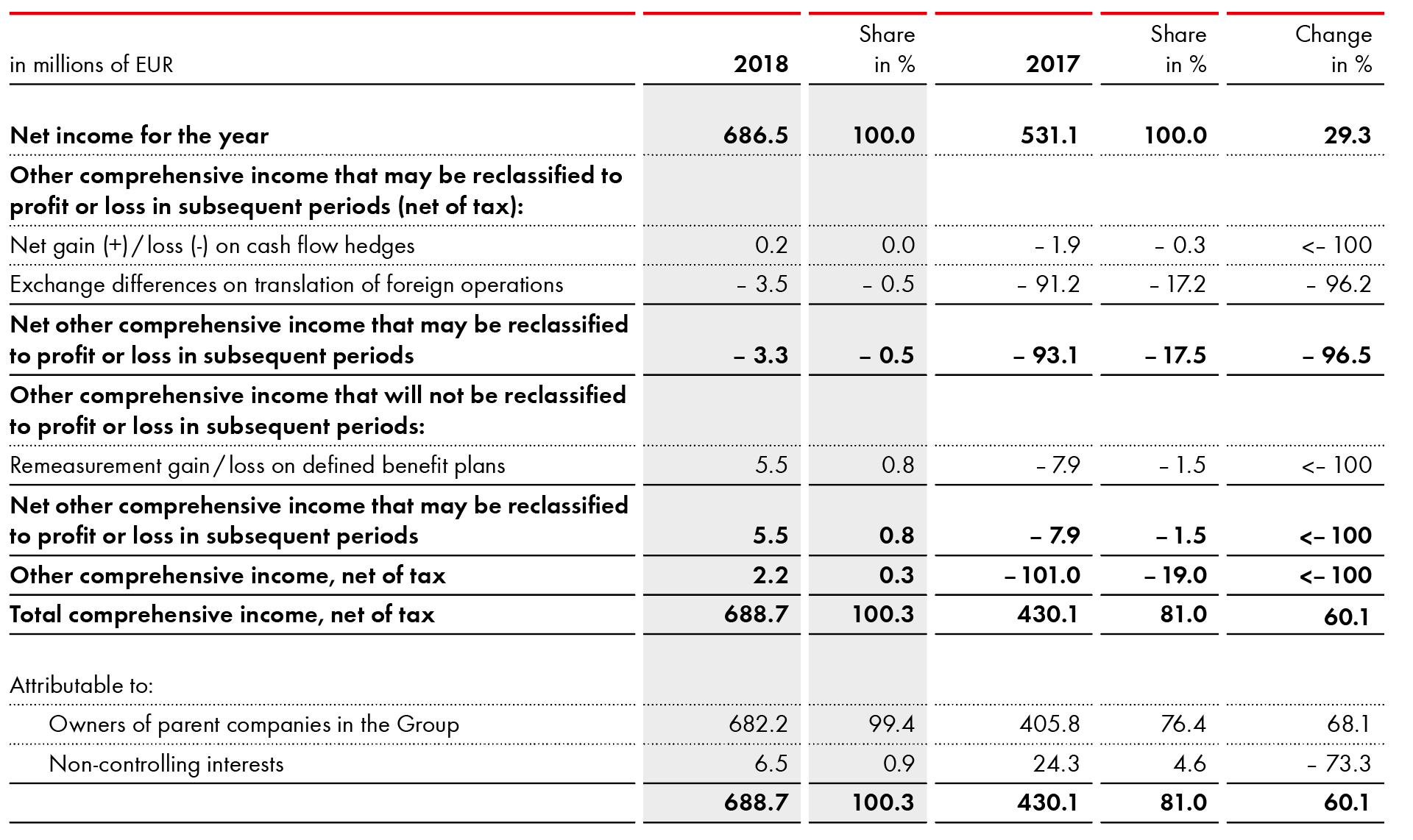

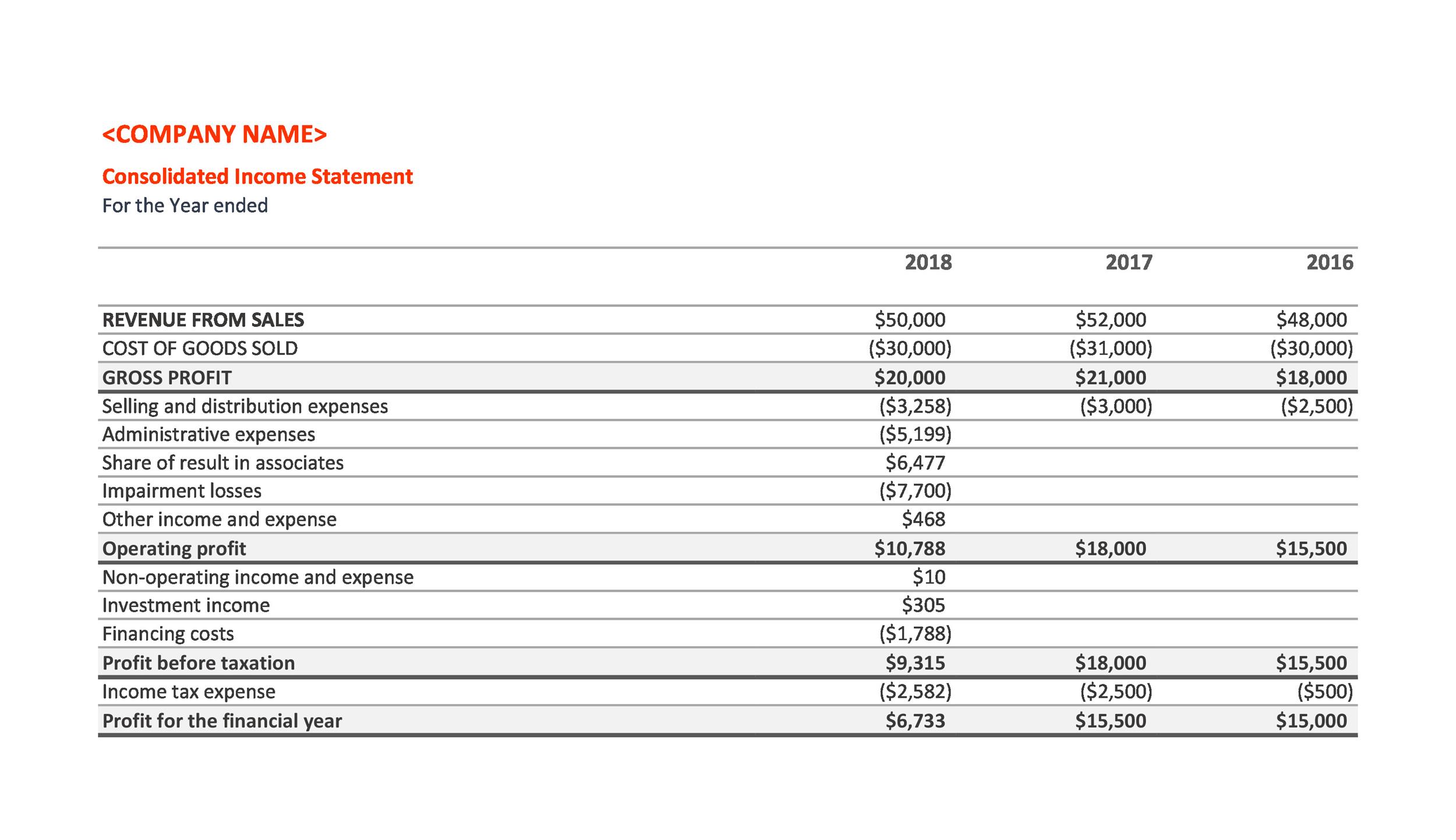

This brief article looks at how to prepare a consolidated statement of financial position. Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a company prepares the financial statements of the accounting period, and the same is presented after net income on the company’s income statement. You can either manually execute the process above and perform final calculations in excel or use financial consolidation software to automate the process.

2 the basic principles the consolidated income statement follows these basic principles: From revenue to profit for the year include all of p’s income andexpenses plus all of s’s income and expenses (reflecting control ofs), subject to adjustments (see below). Preparation of consolidated financial statements when an entity controls one or more other entities.

A consolidated income statement provides a statement of how the income is distributed between parent and minority shareholders. Consolidated financial statements are usually needed when an entity owns more than 50% of the outstanding common voting stock of another company. (b) defines the principle of.

The diagram below shows an example of a typical group structure: Distribution of income: An income statement shows you a company's profit or loss for a specific period.

Parent) that controls one or more other entities (subsidiaries) to present consolidated financial statements; Consolidated financial statements are financial statements of an entity with multiple divisions or subsidiaries. Consolidated financial statements are often referred to as ‘group accounts’.

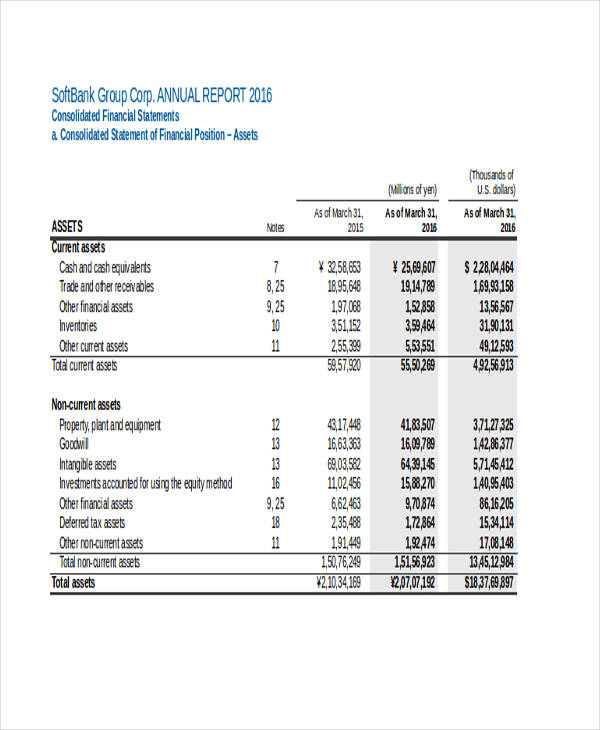

Consolidated financial statements provide a comprehensive overview of a company's financial operations for the entire group of entities. Consolidated statement of profit or loss 5 consolidated statement of comprehensive income 7 consolidated statement of financial position 8 consolidated statement of changes in equity 10 consolidated statement of cash flows 11 notes to the ifrs example consolidated 12 financial statements To meet the objective in paragraph 1, this ifrs:

Check the example of cfs with format and its benefits. If the subsidiary is acquired part way through the year all the revenues and expenses of the subsidiary must be time apportioned during the consolidation process. Ias 27 defines consolidated financial statements as ‘the financial statements of a group presented as those of a single economic entity.’ a group is made up of a parent and its subsidiary.

Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity.’. Is a critical part of income statement for companies that are required to calculate and present their eps (mainly companies listed on a stock exchange). Consolidated financial statements present the financial position of a parent and subsidiaries of a single company.

(a) requires an entity (the. The consolidated statement of profit and loss (including other comprehensive income), the consolidated cash flow statement and the consolidated statement of changes in equity for the year then ended, and a summary of the significant accounting policies and other explanatory information. These statements are prepared in accordance with ifrs 10.