Smart Info About 26as View Tax Credit List Of Ifrs Standards 2019

If you are not registered with traces, please refer to our e.

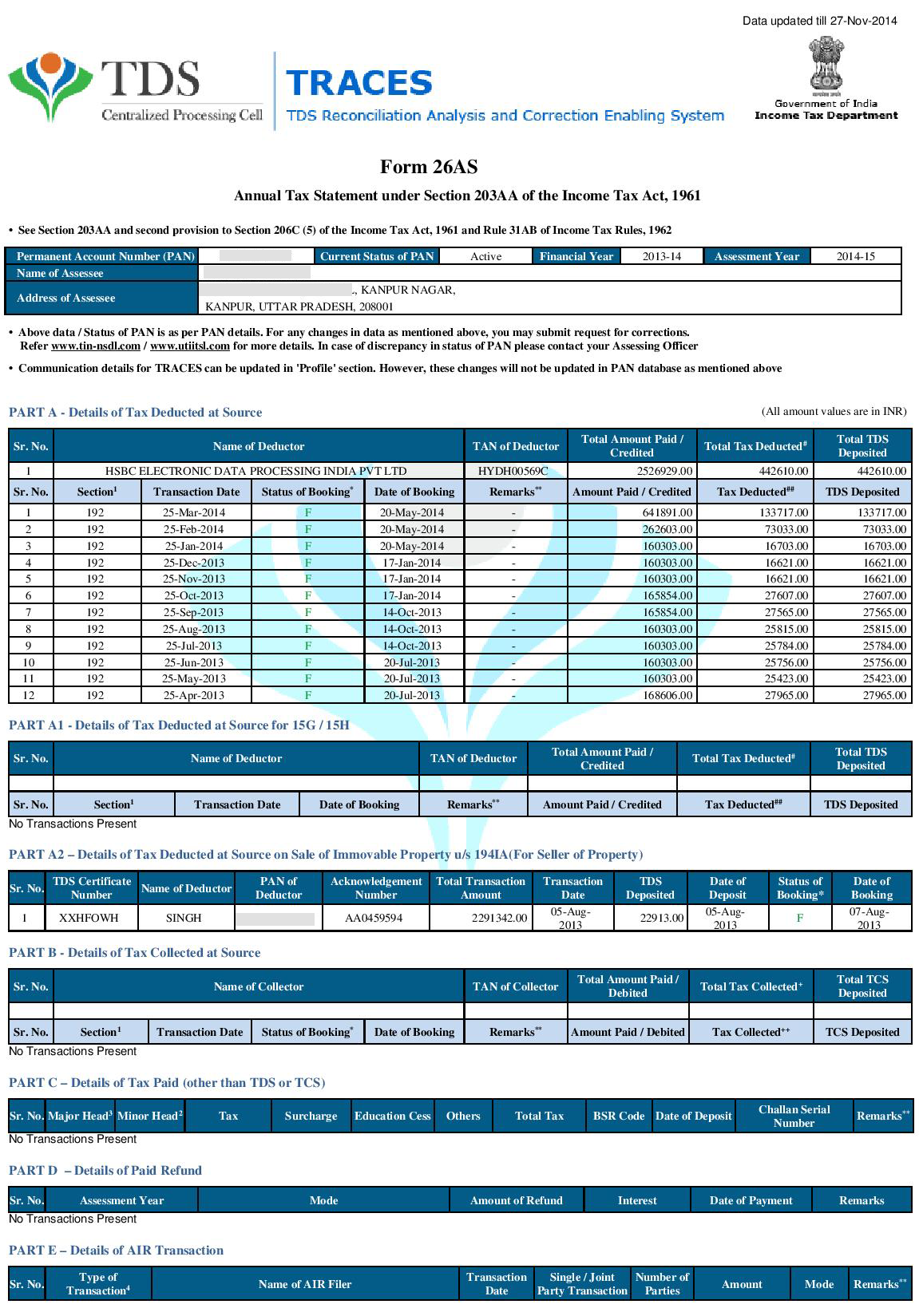

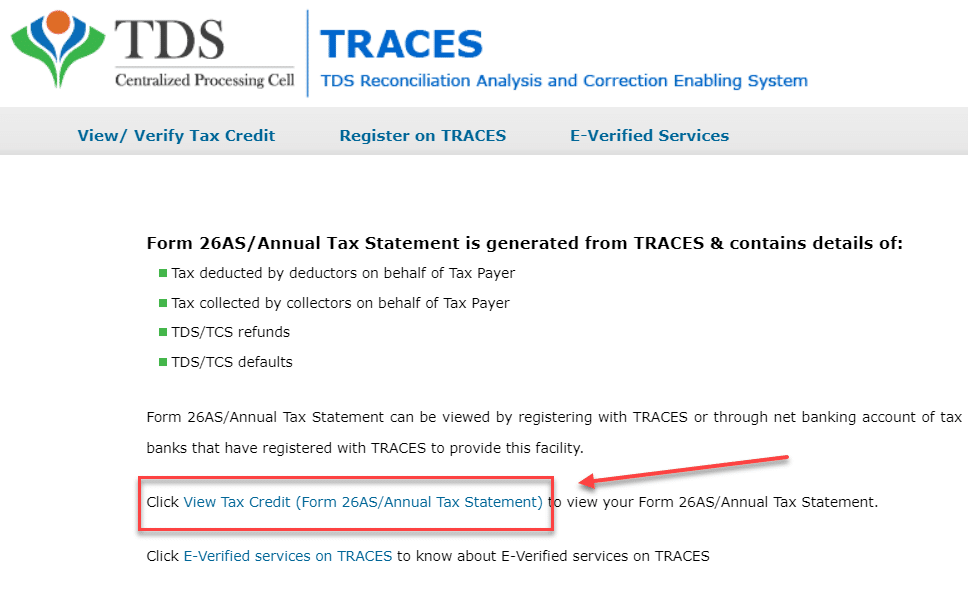

26as view tax credit. The tax credit statement, also known as form 26as, is an annual statement that consolidates information about tax deducted at source (tds), advance tax paid by. Tax credit statement (form 26as) can be viewed/accessed in three ways: Click on the link at the bottom of the page that says 'view tax credit (form 26as)' to access your form 26as.

Form 26as is a tax credit statement that provides the complete record of the taxes paid by a taxpayer. View and download form 26as online. The tax credit details can be accessed by the registered users through online form 26as.

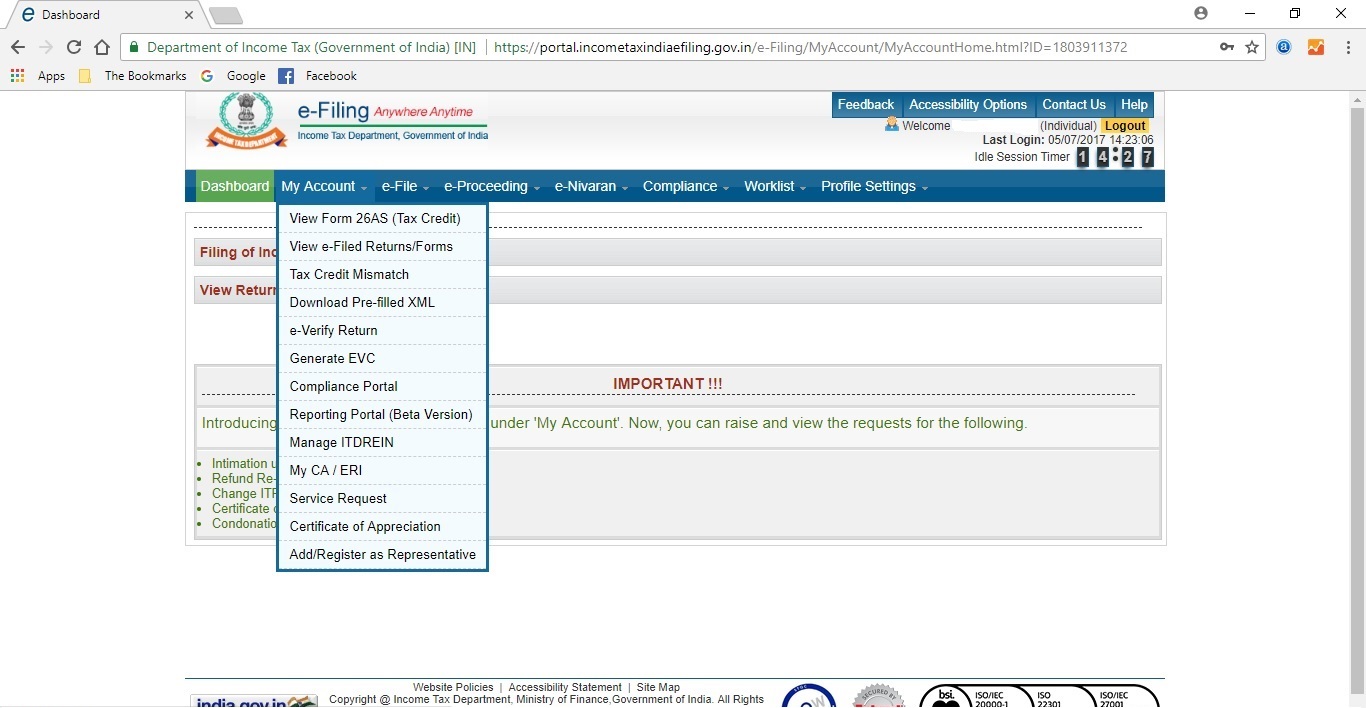

Go to 'my account' > 'view form 26as (tax. Steps to view or download the form 26as: The requirement to manually file it returns.

The taxpayers are advised to view their updated tax credit statements in form 26as on. Users have to provide their user id and pan number for check the tax credits. Read the disclaimer, click 'confirm' and the user.

Form 26as, tax credit, tcs, tds kindly refer to privacy policy & complete. Steps to view form 26as log in to income tax department website ( www.incometaxindia.gov.in) & get yourself registered there. Choose the assessment year and the.

Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. The website provides access to the pan holders to view the details of tax credits in form 26as. Retail.onlinesbi.sbi/personal can view tax credit in form 26as through bank login :

Click on the link view tax credit (form 26as) at the bottom of the. Users having pan number registered with their home branch can avail the facility of online. The generation of 26as has been discontinued through nsdl w.e.f.

Form 26as (income tax credit) statement shows details of credit received against your pan for tds deducted by your employer and other dedutors, advance tax.