Have A Tips About Quickbooks P And L Report Lufthansa Balance Sheet

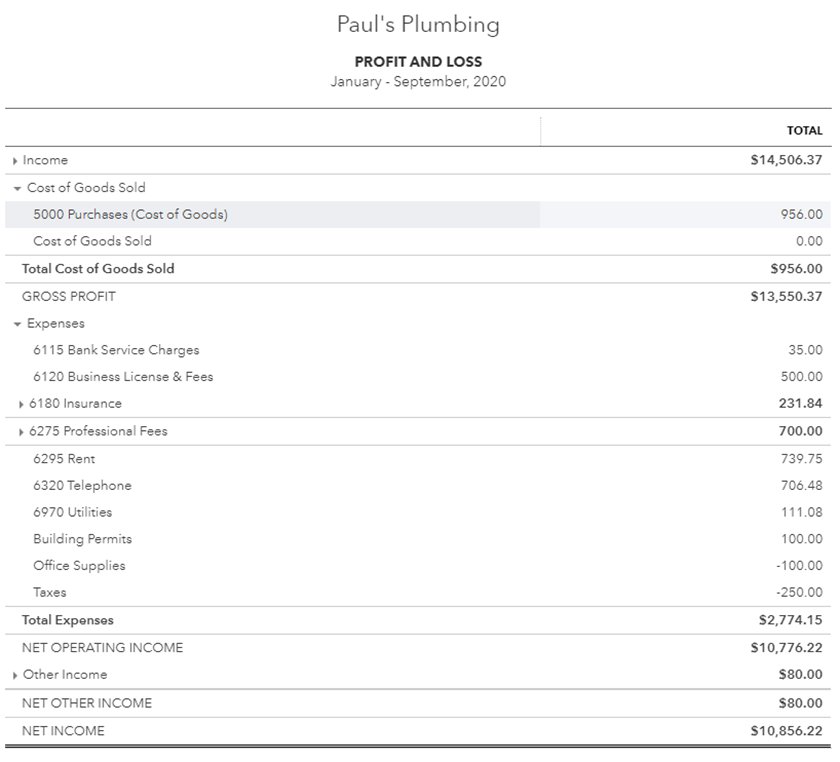

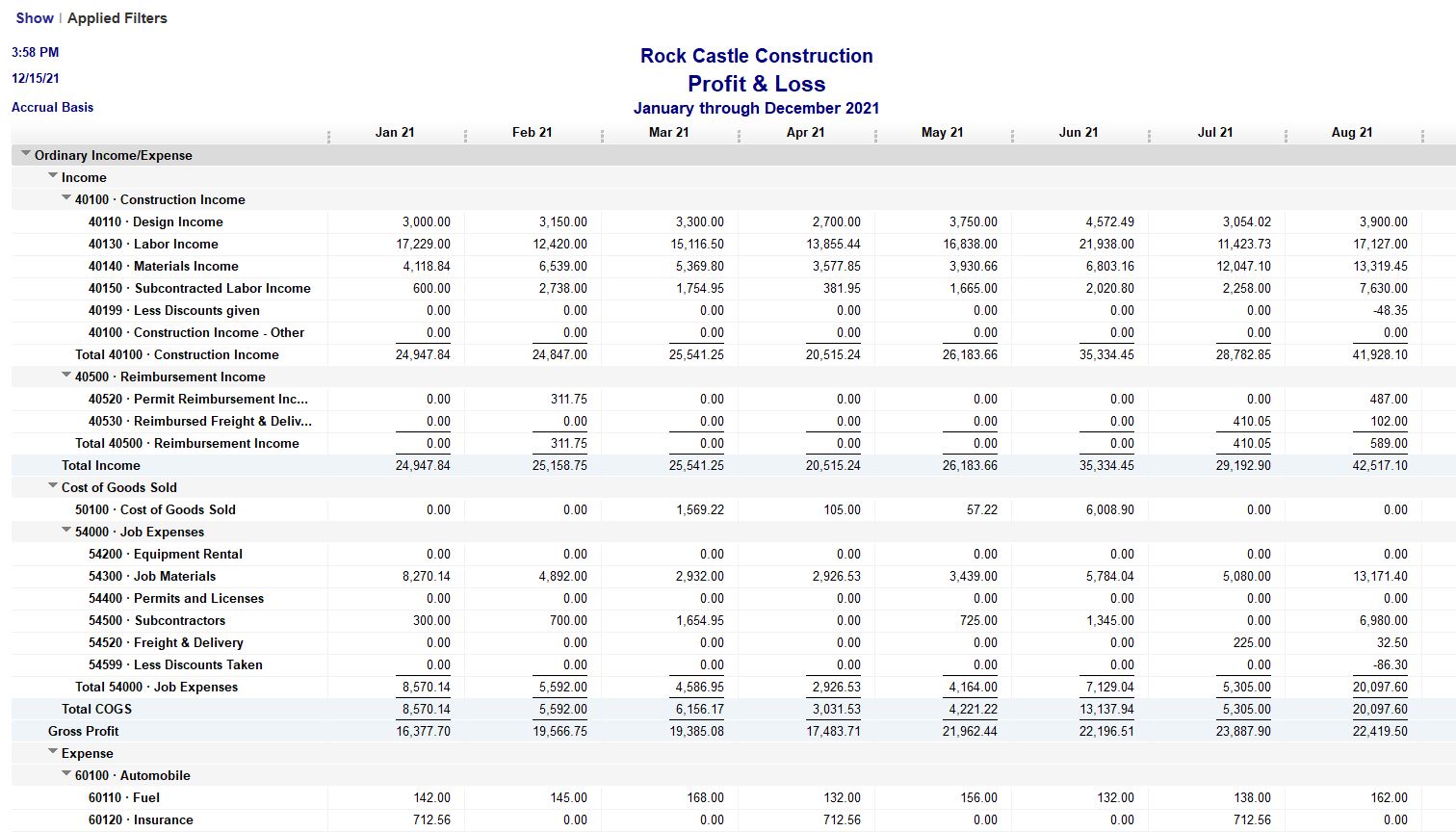

The p&l report summarizes the total income and expenses of your business at a specific time.

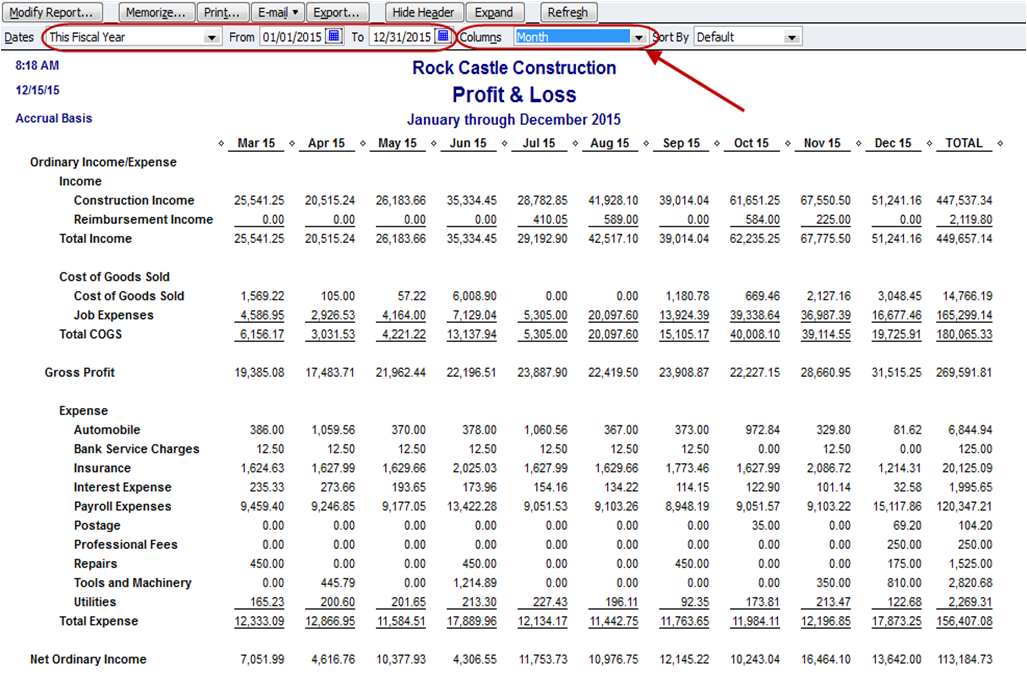

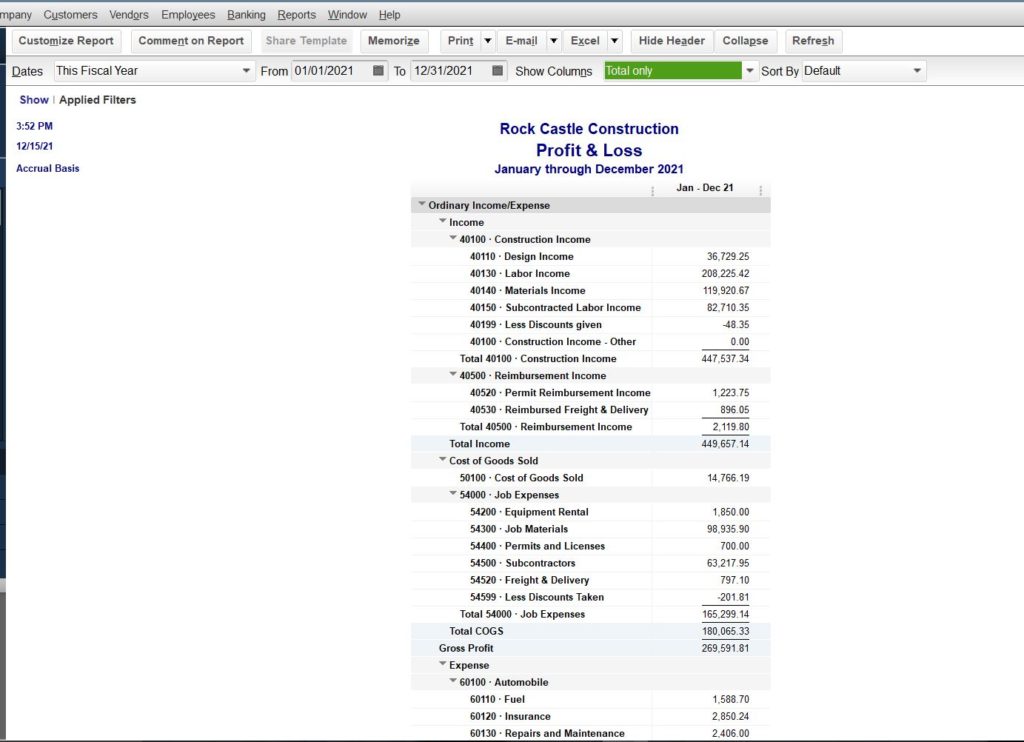

Quickbooks p and l report. Go to reports and click on the company and financial tab. The p&l report lists revenue, expenses and other information to provide insight into the company's performance. Let me guide you on how to do it.

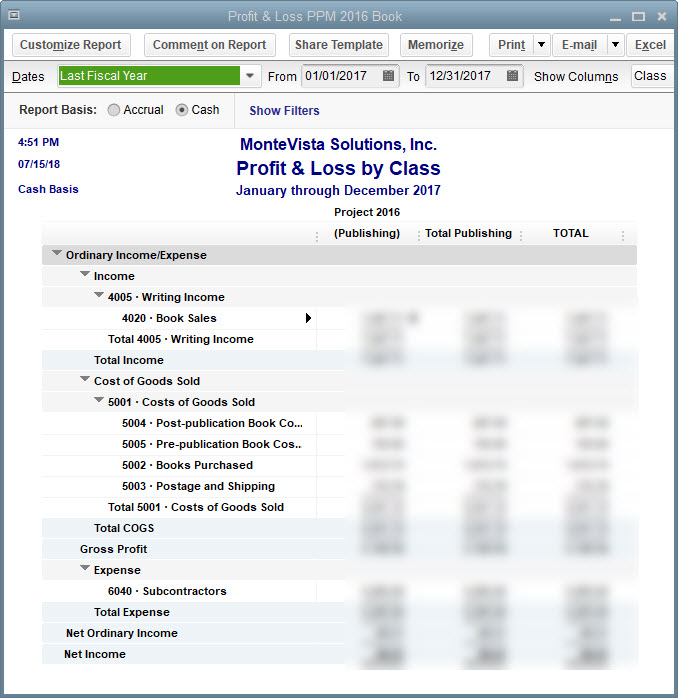

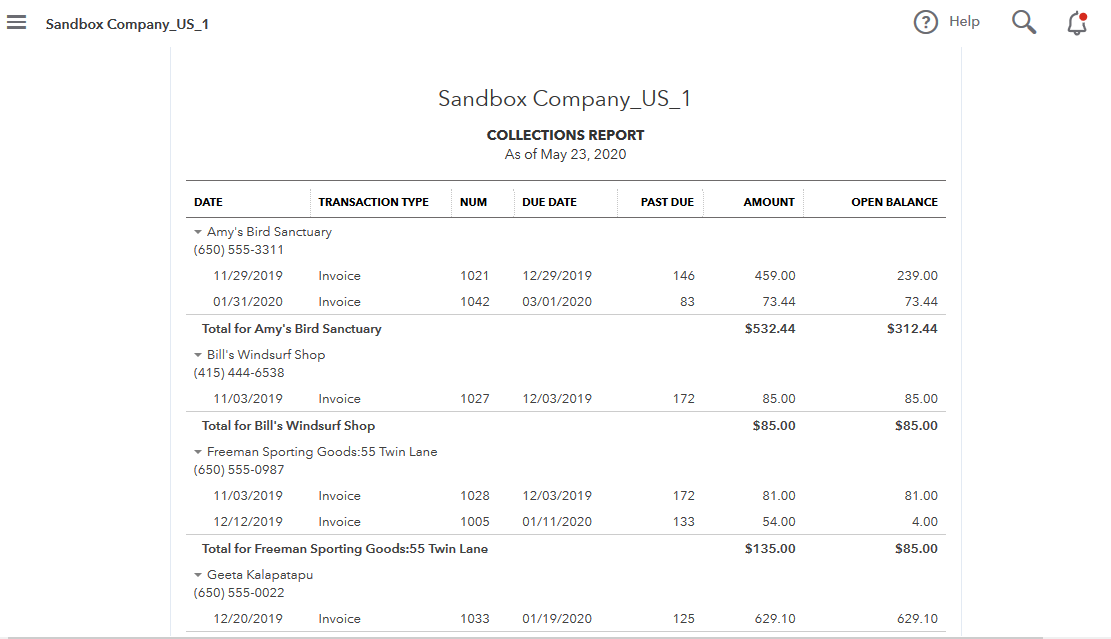

P&l statements tend to follow a standard format: It is also known as the income statement or the statement of operations. With location tracking enabled you can set up a location for each bank account.

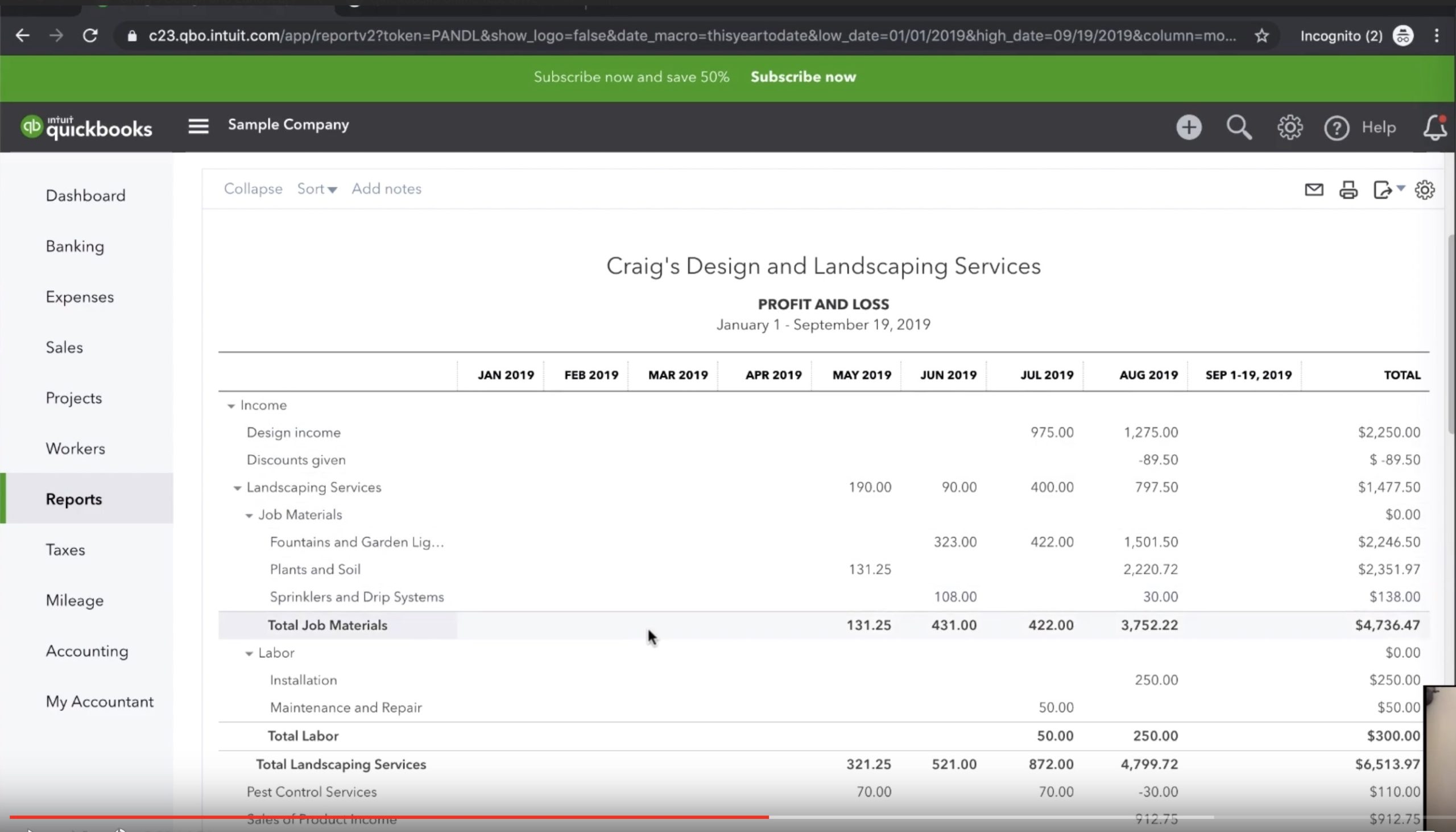

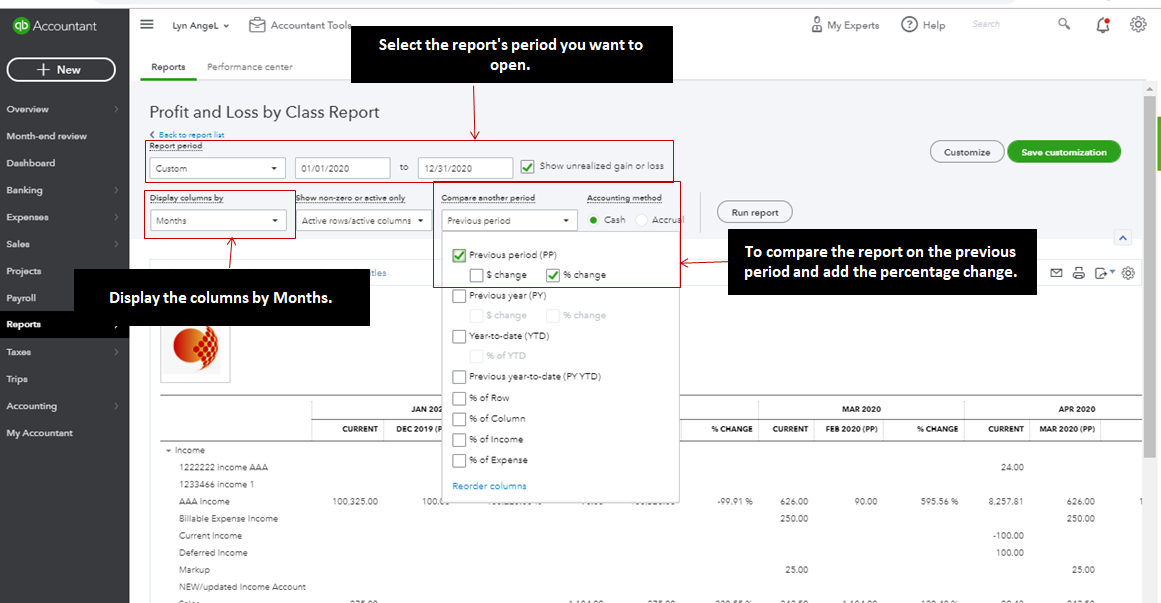

Navigate to profit and loss in quickbooks online This video shows you how to create a profit and loss report a.k.a an income statement in quickbooks and how to customize this report to show you only the information you want and need. You can compare your performance this week, month, or year to other timeframes.

July 13, 2020 12:14 pm greetings, @newyorktutor. It only showed one taxes and licenses transaction, for my $68 business license fee. A profit and loss (p&l) report is a critical piece of information for a company that states whether a company is profitable.

Understanding the profit and loss statement | tutorial | introduction to quickbooks online quickbooks international 21.3k subscribers subscribe 1.3k views 11 months ago #quickbooksonline. Create the standard profit & loss report (reports > company & financial > profit & loss standard). This means that all of your income and expense transactions (invoices, sales receipts, bills, checks, credit memo/refund) recorded in quickbooks desktop (qbdt) will post to this report.

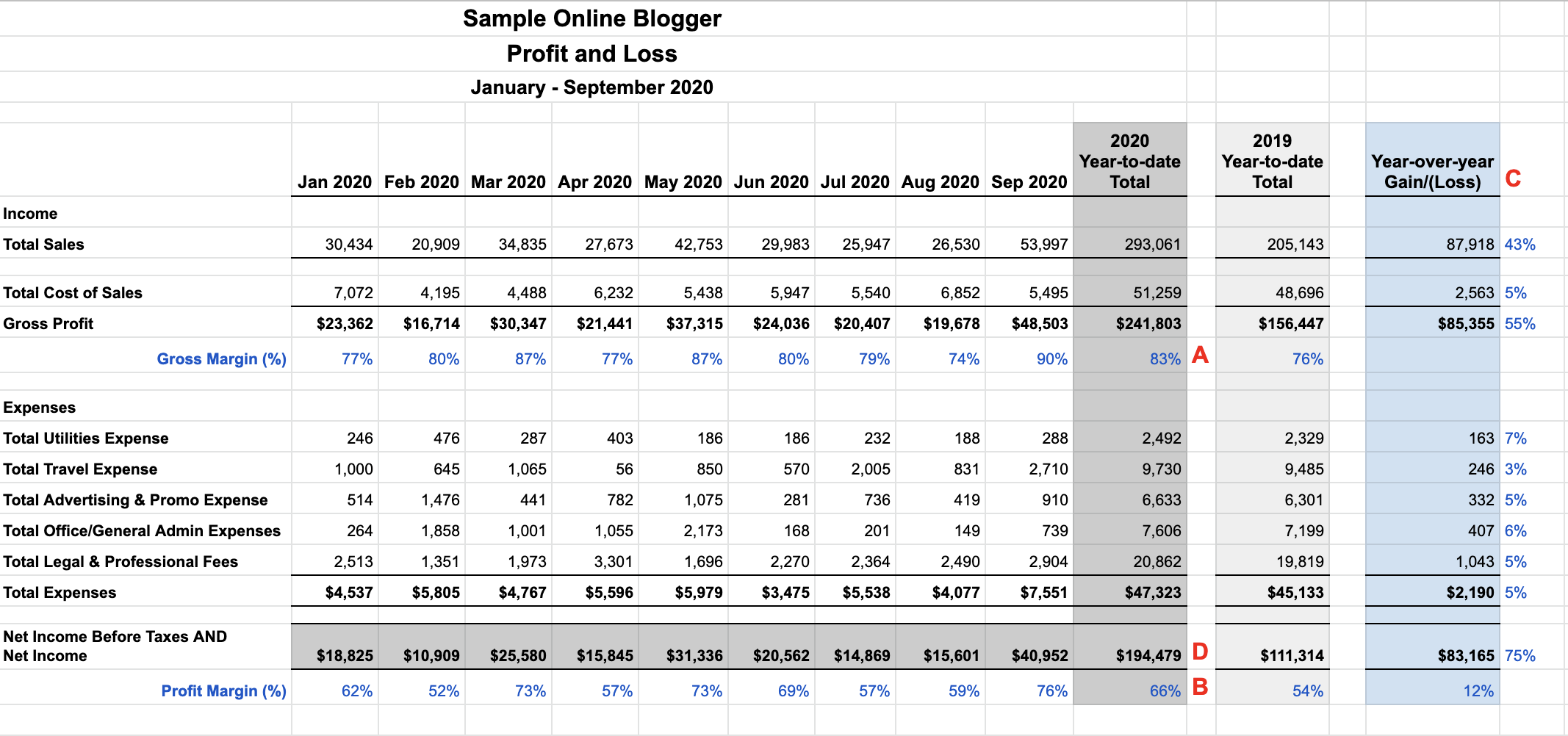

A profit and loss statement (p&l) is an effective tool for managing your business. Change the dates to the year desired (for a calendar year from january 1 to december 31 for the year desired) 3. A p&l statement tells you how much money you’re making, and how much you’re losing.

Go to the reports menu. Change the columns to display to month (as indicated by the arrow below) 4. Select the profit and loss detail report under the business overview section.

It tells you your bottom line net profit or net. Example of a p&l statement. The profit and loss report summarizes the total income and expenses of your business, so balance sheet accounts don't affect it.

However, you can generate and customize the transactions list by date report so it would display the information your client needs. How to run a profit and loss report (p&l) in quickbooks online (2021) ⬇⬇⬇⬇ click 'show more' to expand ⬇⬇⬇⬇ as a small business owner, it's important to understand your financial. On the left of your quickbooks online (qbo), click reports.

Modify the reporting period to a specific month. You can easily customize the date with the dates drop down or the calendar selectors at the top of the report. In quickbooks desktop, run the p&l under reports>company & financial>profit & loss standard.

![[QODBCDesktop] How to run a Profit and Loss By Class Report in QODBC](https://support.flexquarters.com/esupport/newimages/ProfitAndLossByClass/step3.png)