Out Of This World Tips About Dr Balance Of Profit And Loss Account Accounting For Dividends From Consolidated Subsidiaries

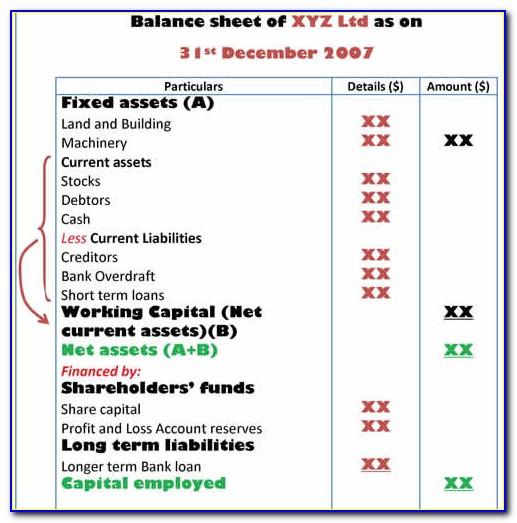

The basis of the balance sheet:

Dr balance of profit and loss account. The feature of p&l account: This is because we gain money, and in accounting terms, this is credit. Calculation of net profit ratio:

The balance in the profit and loss account represents the net profit or net loss. How do we prepare a trial balance? P/l dr balance is a fictatious asset.

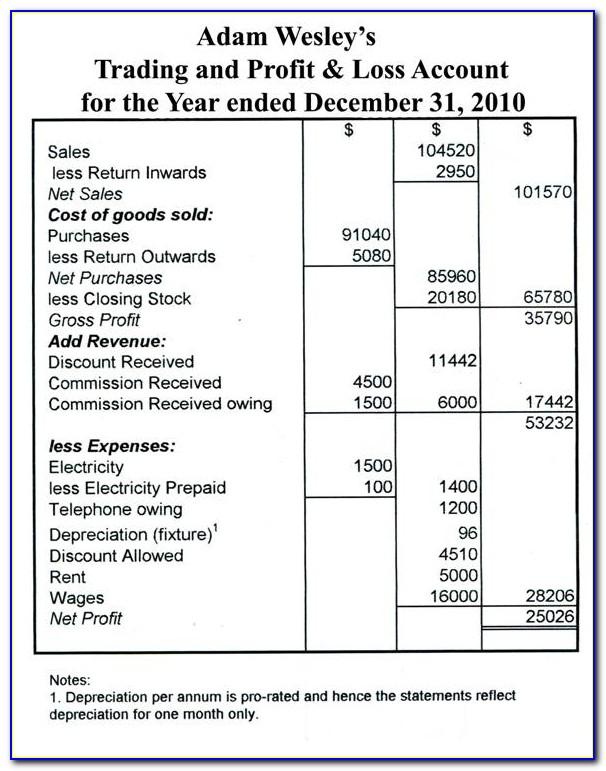

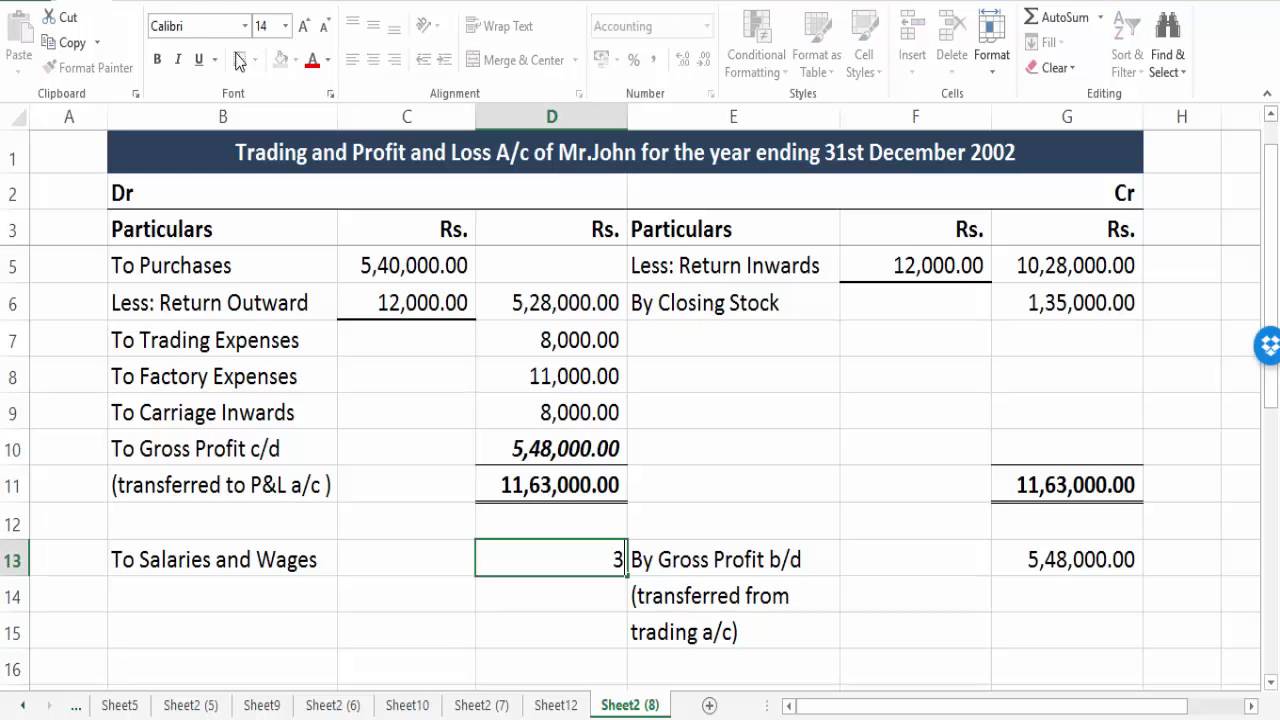

A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies. A profit and loss account is an account that shows the revenue and expenses of the firm from business operations during a financial year. The profit and loss statement is an apt snapshot of a company's financial health during a specified time.

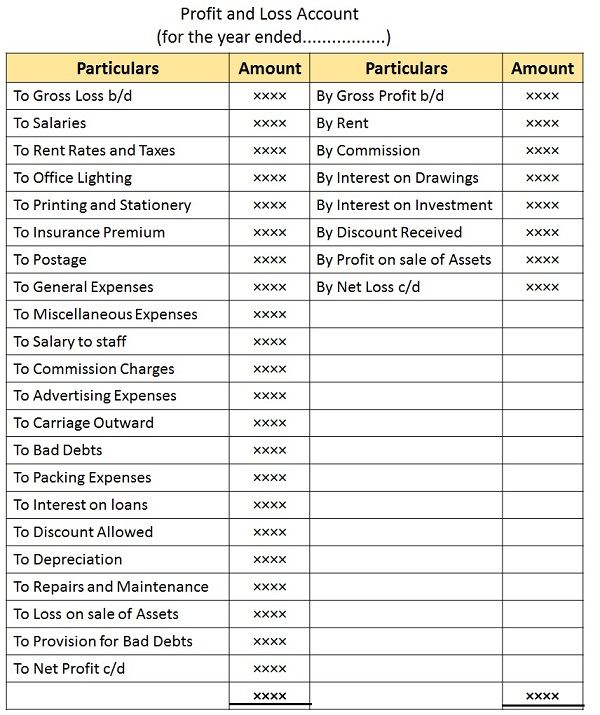

To capital a/c if the profit and loss account shows a net loss, the entry will be reversed. Balance of profit and loss appropriation account. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

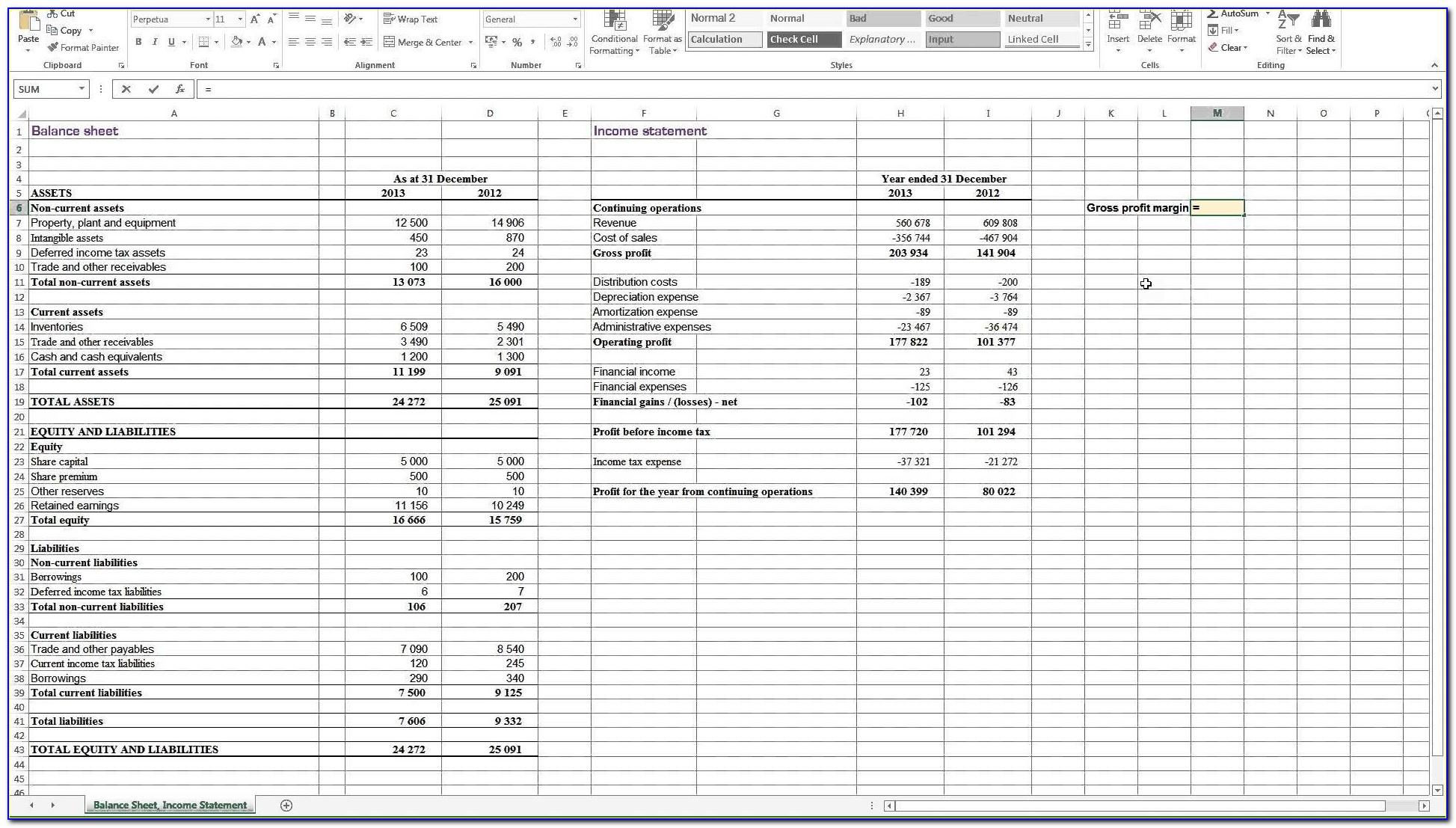

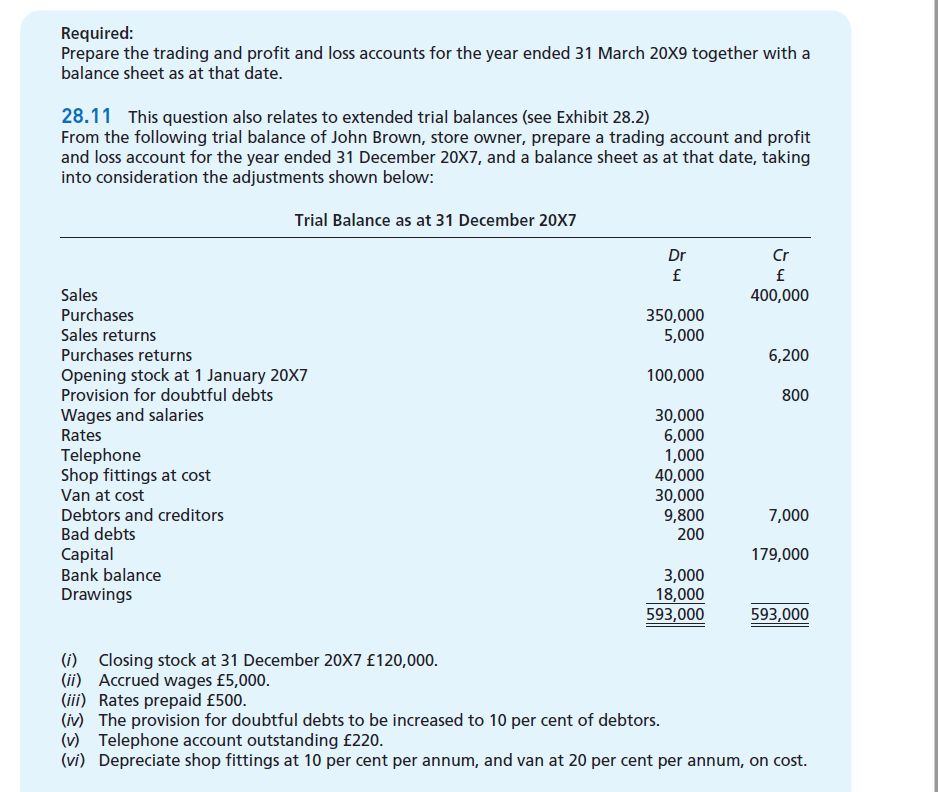

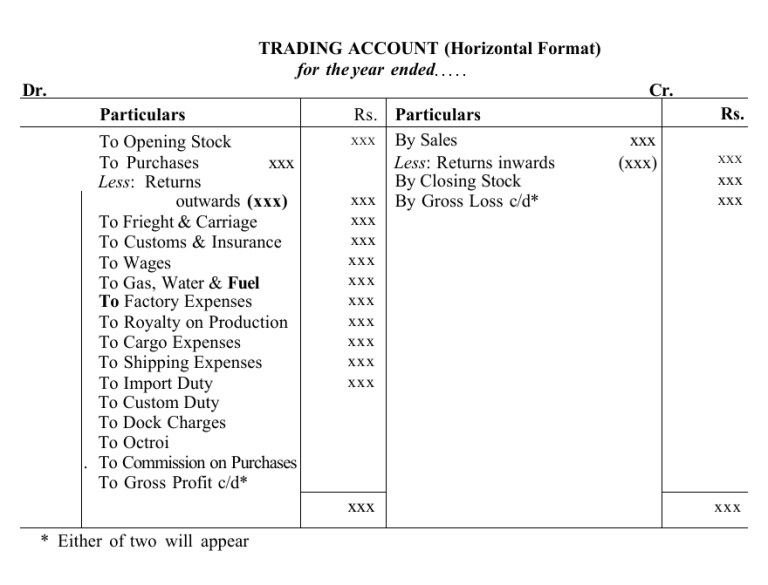

Furthermore, a trial balance forms the basis for the preparation of the main financial statements, the balance sheet and the profit and loss account. Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period. The segregated view of the financial inflows and outflows enables organizations to track their financial performance and implement ways to keep up the same or improve it.

Shows how much revenue the company earned, what expenses were incurred in generating that revenue, and whether the company made a profit or a loss during an accounting period. The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. Profits & incomes are placed on the credit side (right).

Such statements provide an ongoing record of a company's. Under international accounting standards, the profit and loss account is superseded by the statement of profit or loss and other comprehensive income. £120 debit to debtors on the balance sheet.

The profit and loss account is also another name for the profit and loss reserve in the balance sheet. Here the double entries are: A net loss is a debit in the profit and loss account.

The following entry is made when the profit and loss account shows a net profit: Profit and loss account is made to ascertain annual profit or loss of business. £20 credit to the vat creditor on the balance sheet.

It is prepared to determine the net profit or net loss of a trader. Explanation a profit and loss account is prepared to determine the net income (performance result) of an enterprise for the. A profit and loss account (or statement or sheet) is, on a simple level, used to show you how much your company is making or how much it is losing.