Who Else Wants Tips About Private Equity Balance Sheet Examples Of Assets On A

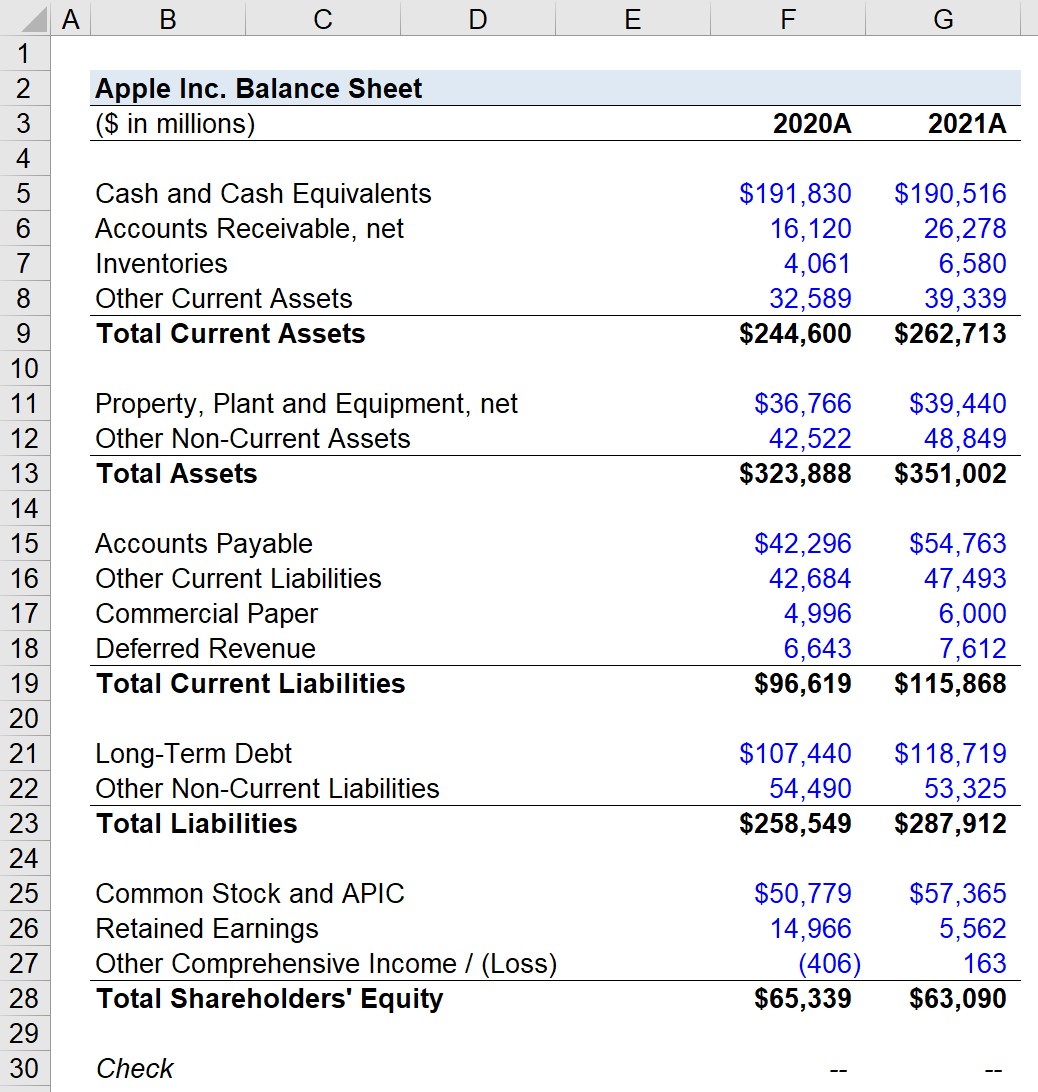

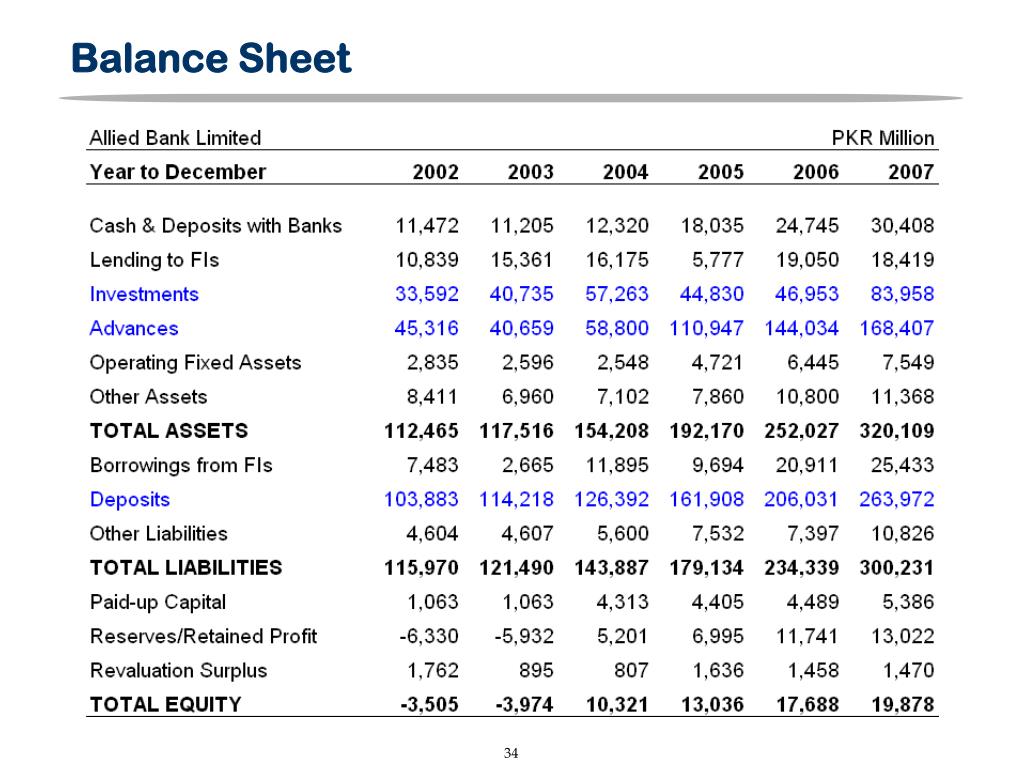

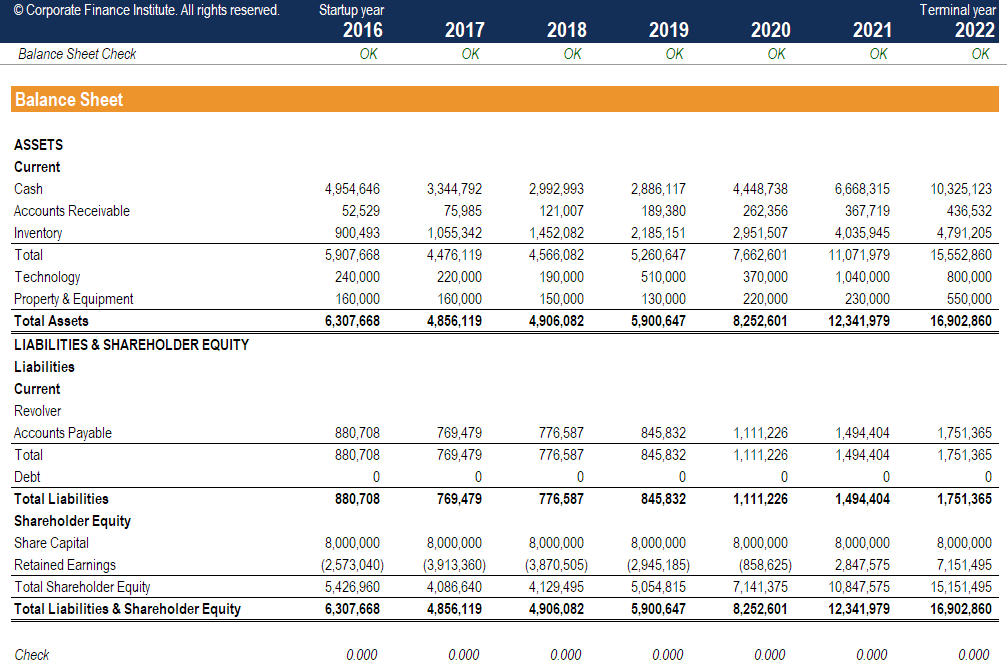

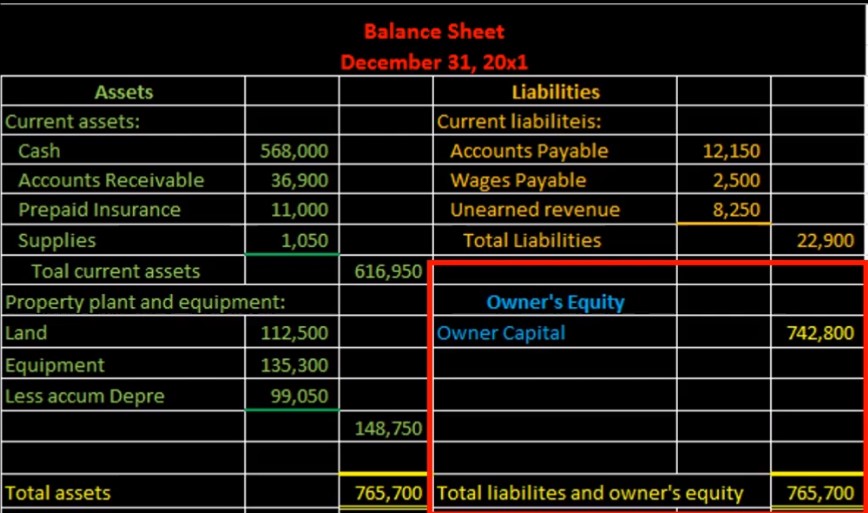

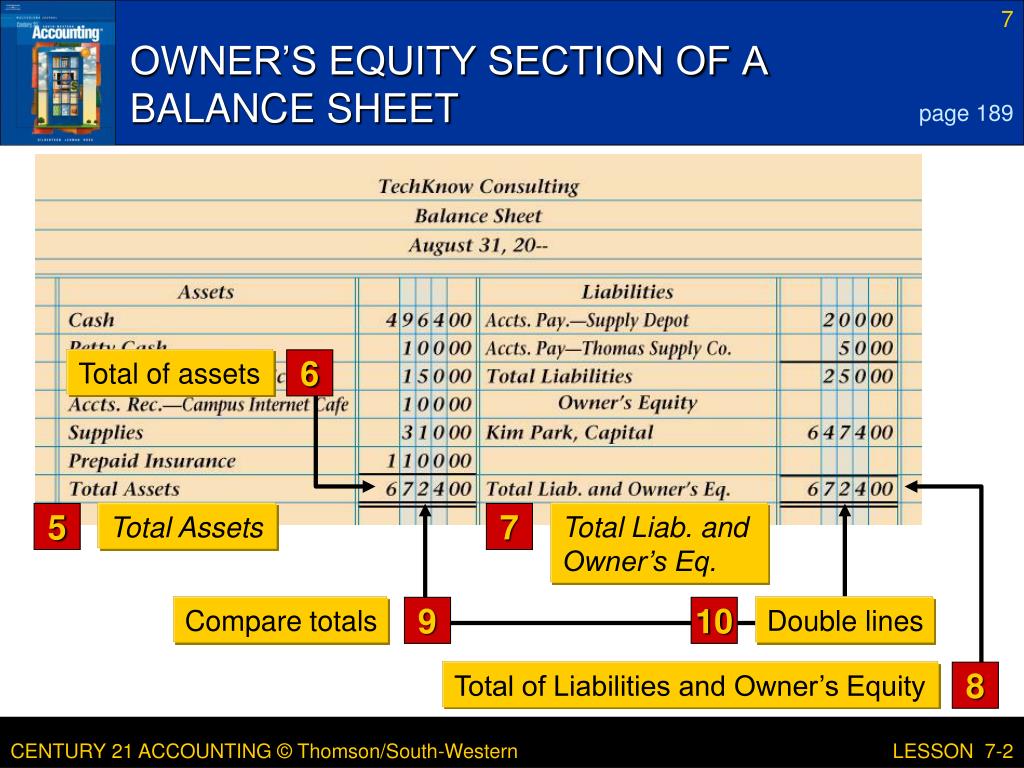

A balance sheet is a financial statement that presents a company's assets, liabilities, and equity at a specific date.

Private equity balance sheet. Overall the objective should be to have your cash position grow relative to the amount of debt on the balance sheet. The balance sheet (also referred to as the statement of financial position) discloses what an entity owns (assets) and what it owes (liabilities) at a specific point in time. The reporting package there are five standard deliverables you will expect to receive from your fund accounting firm at a frequency you will determine when you set up the account.

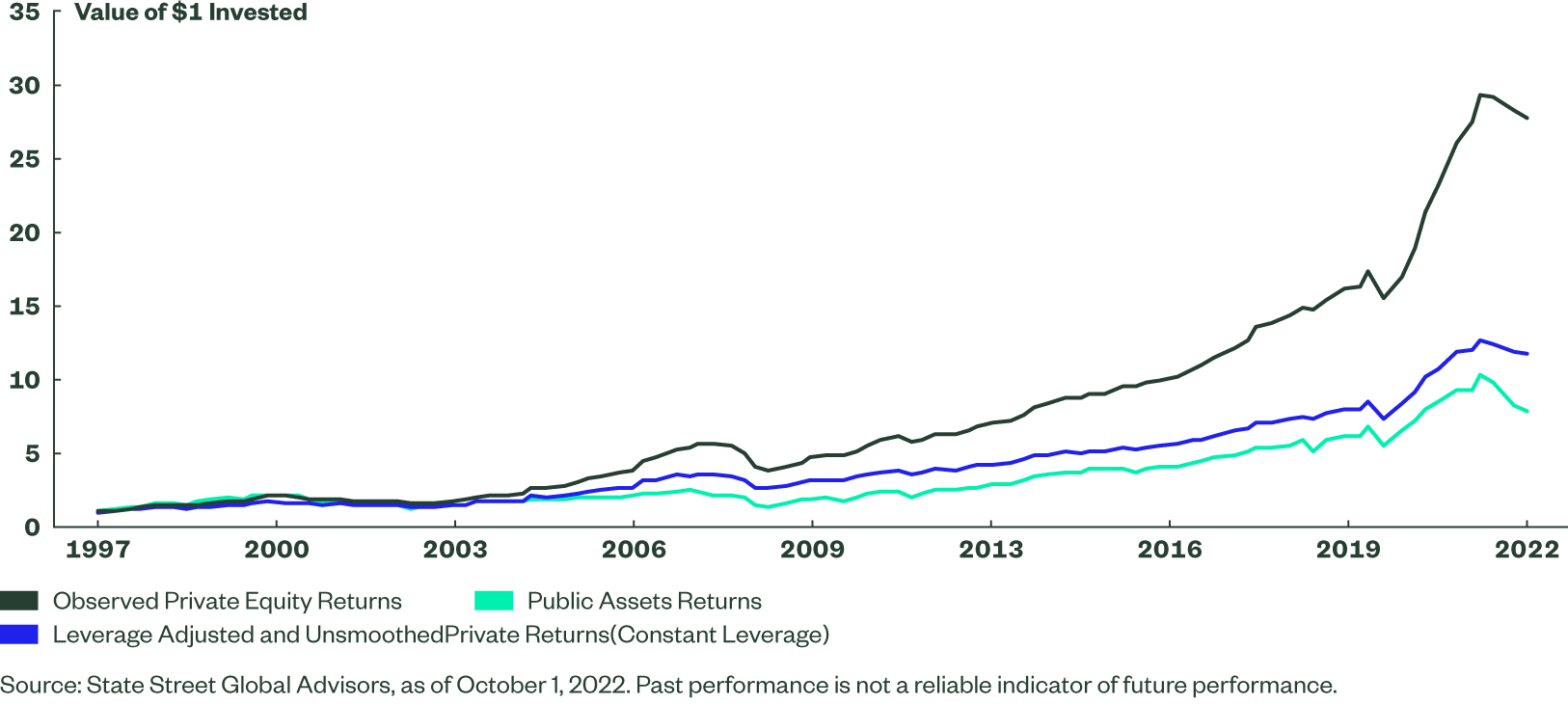

At the end of the year, this $200 investment is worth either $220 or $180. Now consider taking the initial $100 and borrowing another $100, using the combined total to purchase double the amount of the same stock. But junior to senior debt on a company’s balance sheet.

Equity is the owners’ residual interest in the assets of a company, net of its liabilities. What separates fund accounting from general accounting is that, while small businesses, for example, make purchases. In contrast, boards of companies.

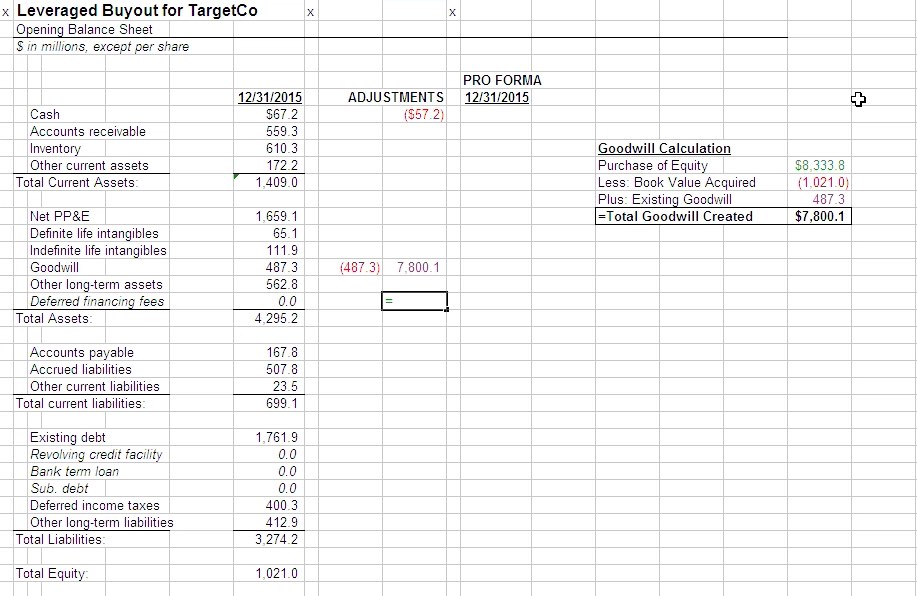

Private equity fund accounting includes compliance methods for reporting revenue. Just like how the assets side must be equal to the liabilities and equity side on the balance sheet, the “sources” side (i.e. With debt fueling their investments, some pe firms emphasize cash flow in a far.

The distribution yield for us private equity firms totaled 9% last year — below the 22% average figure in the past 25 years and the lowest level since the 2008 financial crisis, according to. Terms senior debt mezzanine debt It can also be referred to as a statement of net worth or a statement of financial position.

Private equity fund managers can use them as a master guide, with sample disclosures for common scenarios. Private equity fund, l.p. Within the owners’ equity section, there may be several.

What is net worth or owners’ equity? Initially, the investor has total assets of $200, a loan of $100 and net worth of $100. Different types of private equity investments;

Private equity is capital that is not noted on a public exchange. A balance sheet adheres to the fundamental accounting. On a company’s balance sheet, owners’ equity shows what the owners of the business (or shareholders) would have if the company paid off all its debt with its assets.

Consolidation crypto assets derivatives and hedging equity method investments and joint ventures fair value measurements financial statement presentation financing transactions foreign currency health care entities ifrs and us gaap: Why does the sources and uses matter in an lbo? This debt creates obligations of interest and principal payments that are due on a timely basis.

In a control private equity transaction, debt is commonly employed to acquire a business. Private equity funds invest in promising private businesses with a goal of increasing their value over time before eventually selling the company at a profit. The balance sheet is based on the fundamental equation:

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/ExxonBS09-30-2018copy2-5c7ecb5c46e0fb00019b8e8a.jpeg)