Favorite Tips About Balance Sheet Without Liabilities What Is A Ytd Profit And Loss Statement

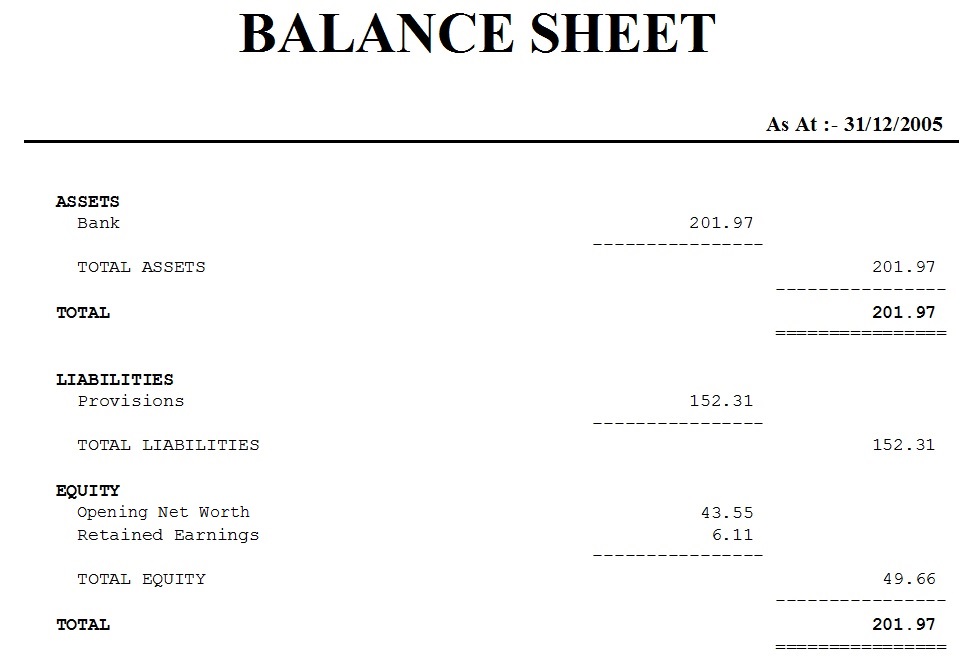

Wire the balance sheet so that it always balances by making retained earnings equal to total assets less total liabilities less all other equity accounts.

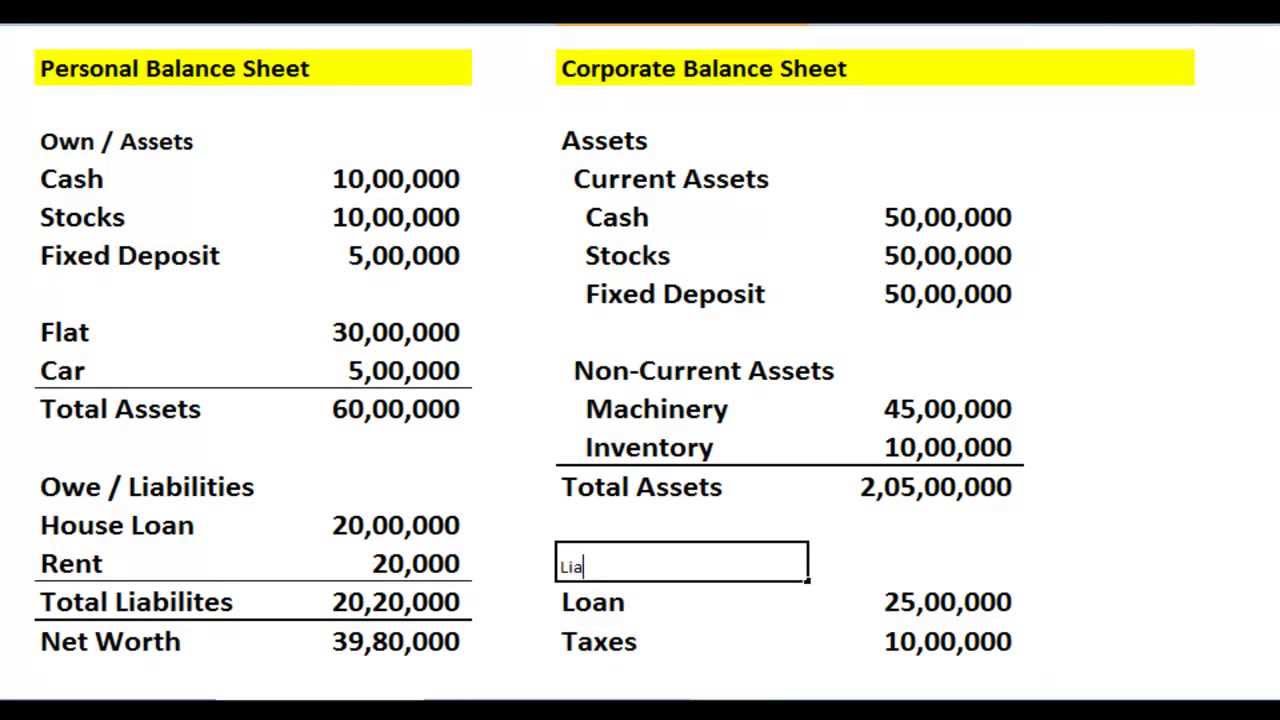

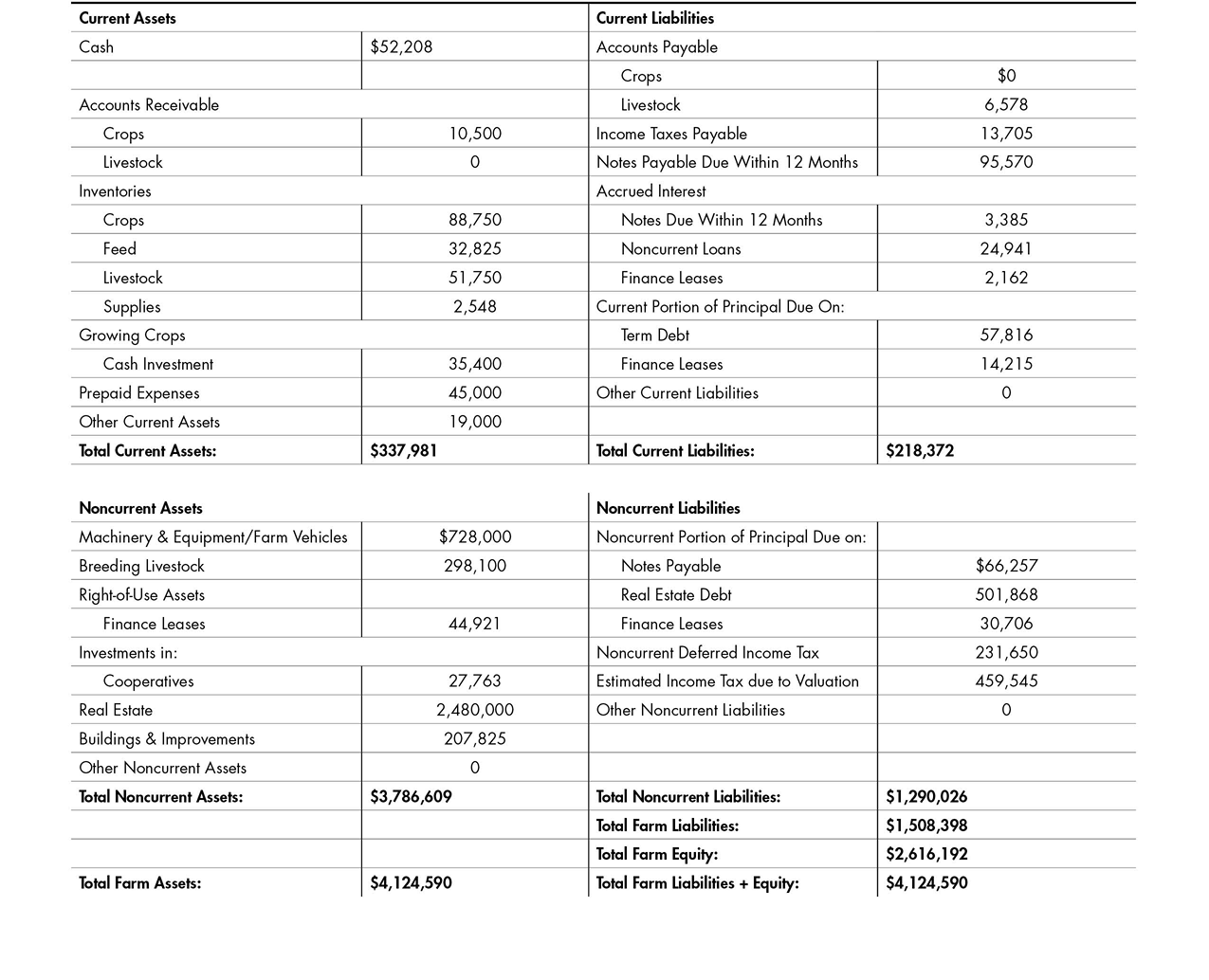

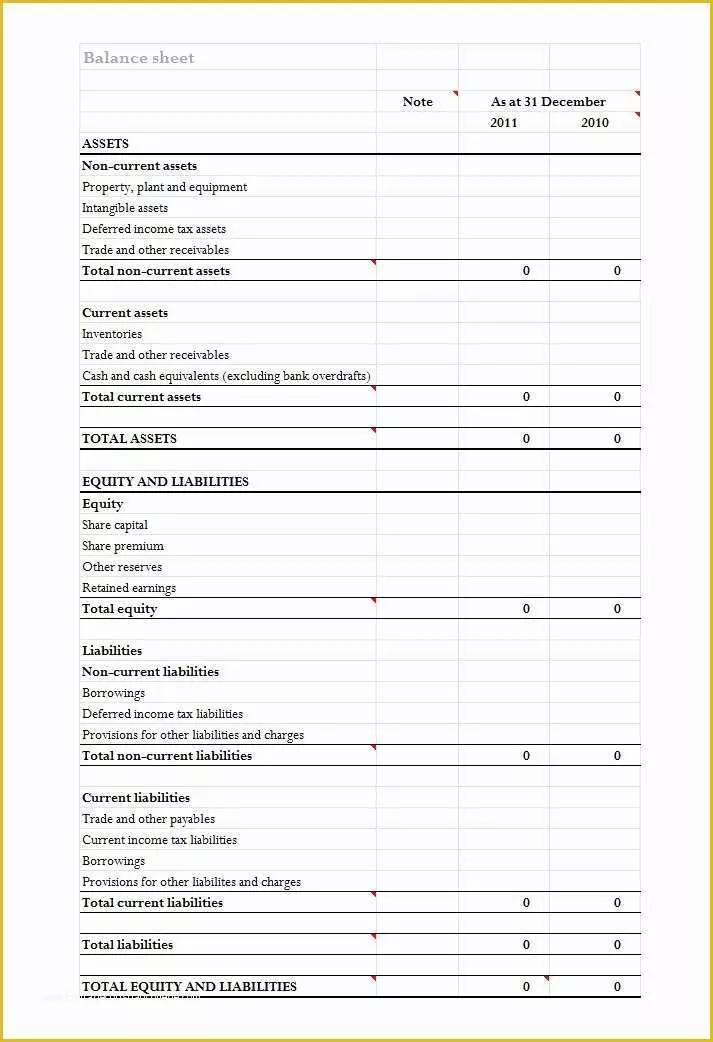

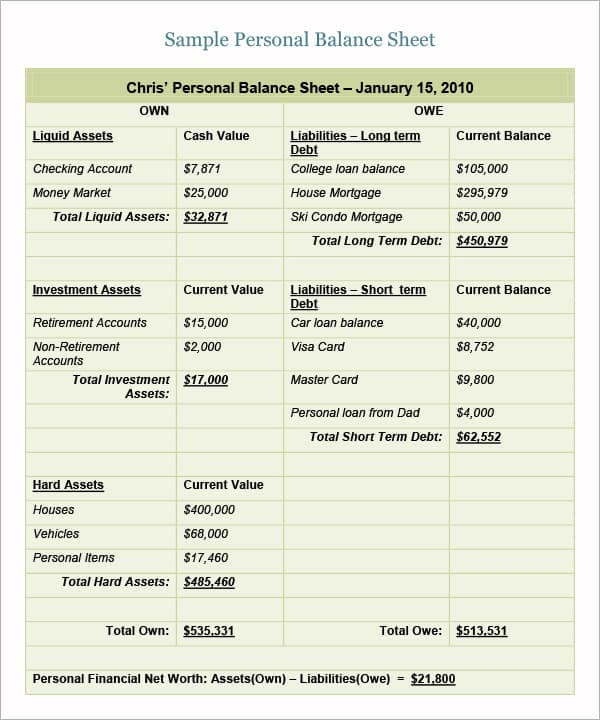

Balance sheet without liabilities. List your assets at reporting time. In a horizontal format, assets and liabilities are presented descriptively. Balance sheets serve two very different purposes depending on the audience reviewing them.

In this sheet, you would compare your assets against your liabilities, where the sum of your assets is always equal to the sum of your equity and liabilities. The basic equation underlying the balance. It can also be referred to as a statement of net worth or a statement of financial position.

Add each asset as a line item within the relevant category and assign appropriate values. A balance sheet provides a summary of a business at a given point in time. · have debt no more than 10% of the company’s net worth.

This type of income doesn’t show up on a company’s balance sheet. The name balance sheet is based on the fact that assets will equal liabilities and shareholders' equity every time. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

Core financial accounting leading with finance email print a balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. A balance sheet is used to present a company’s financial position on a specific day. The balance sheet is based on the fundamental equation:

The liabilities and assets are listed in the 1st and 3rd column of the balance sheet respectively. The balance sheet is one of the three core financial statements that are used to. No liabilities, no obligations.

The balance sheet provides information on a company’s resources (assets) and its sources of capital (equity and liabilities/debt). The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. A balance sheet is a popular tool for business organizations, but even for personal use, it’s equally useful.

A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. Investment income is money earned from various financial assets. For a balance sheet to have no liabilities, it means that the company has no obligations or debts to pay.

This could be interest from bonds, dividends from stocks, or profits from the sale of assets. In this case, the line for liabilities would still appear on the balance sheet, but it would show a zero dollar balance. A balance sheet summarizes your firm’s current financial worth by showing the value of what it owns (assets) minus what it owes (liabilities).

Current and noncurrent (see figure 5.6). Enter hardcodes across one row of the balance sheet for each year that doesn’t balance). Or, if you prefer to look at it in equity terms: