What Everybody Ought To Know About Interpretation Of Accounting Ratios Pdf Current Investment In Cash Flow

Galligan page 1 of 9 n:\1m\accountancy\ratios\ratios.doc b.

Interpretation of accounting ratios pdf. Calculate and analyze all kinds of financial ratios: Introduction a sustainable business and mission requires effective planning and financial management. Students studying for cat scheme paper 6 and professional.

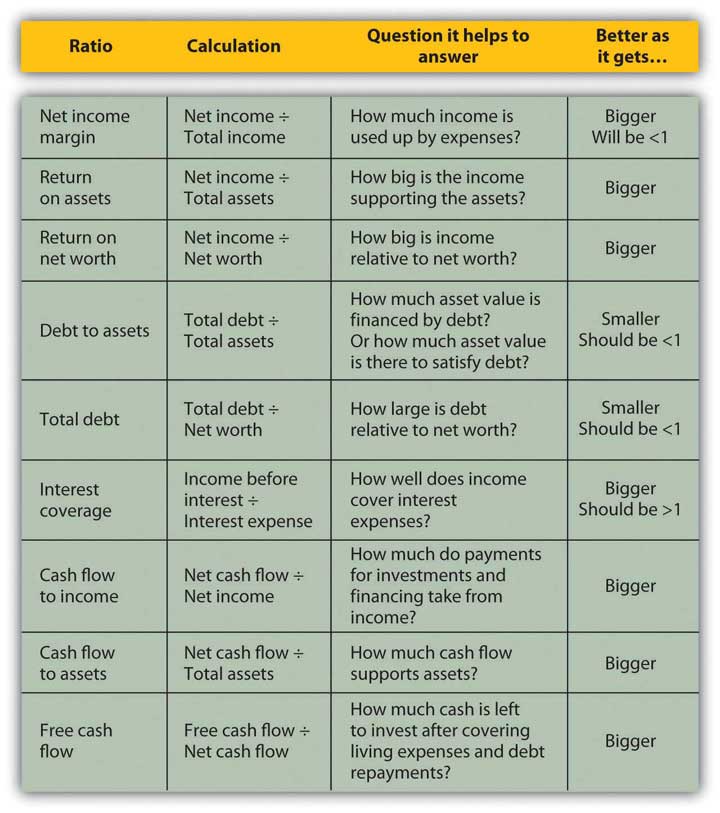

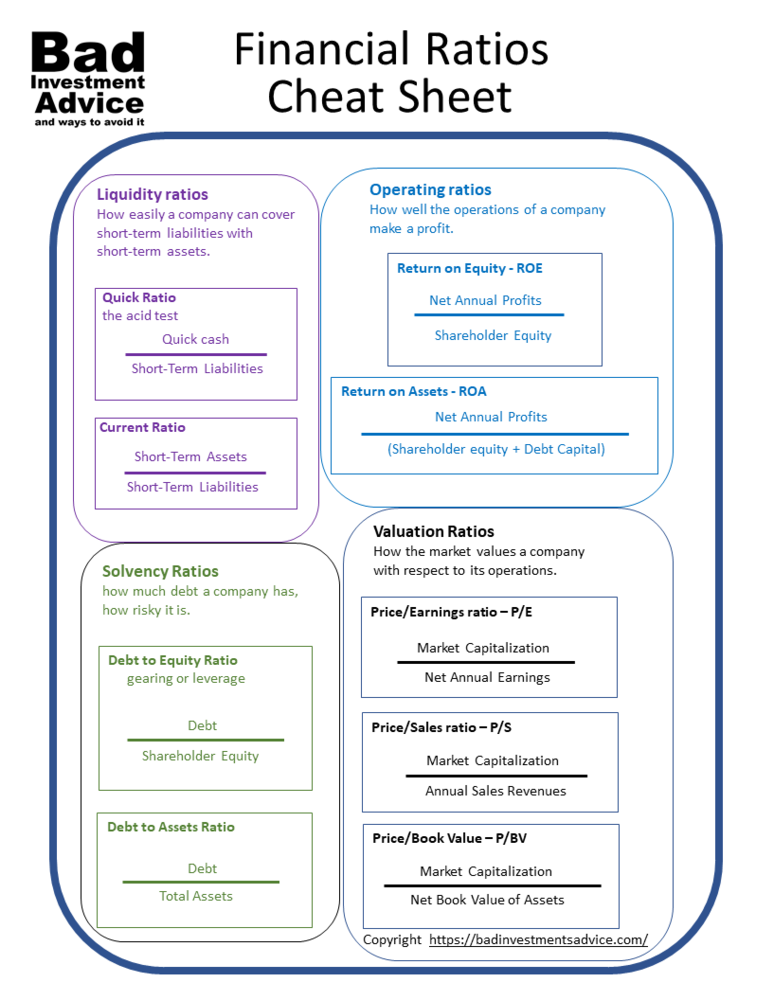

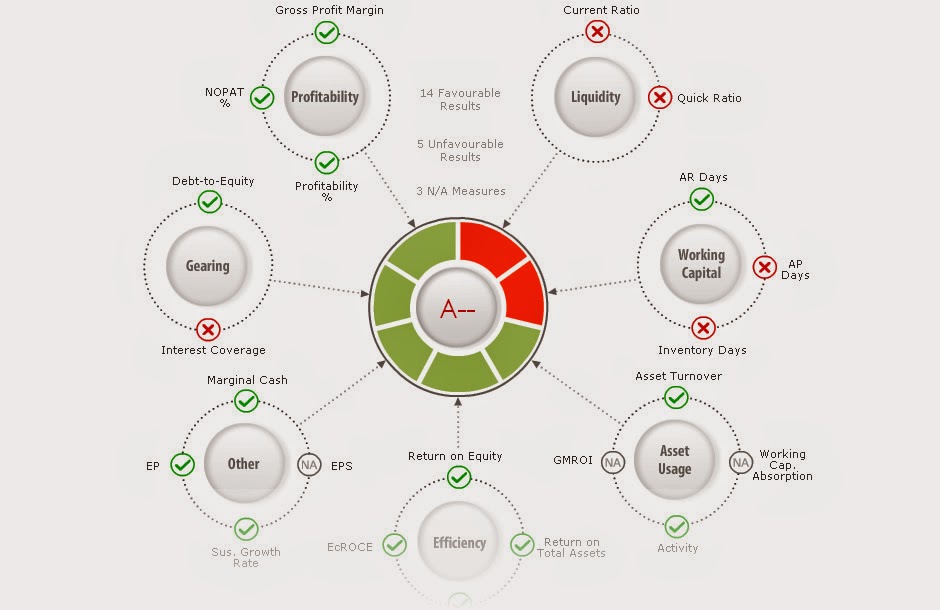

It may be used to identify unusual. Corporate finance ratios are quantitative measures that are used to assess businesses. Working capital, profitability, debt levels and liquidity.

The concepts developed here are a step toward a more technology. Leverage ratios measure the amount of capital that comes from debt. Accounting ratios are an important tool used by accountants and others for interpreting accounting statements.

The trouble is, each ratio is unique and tells a different story about a firm's. Purpose of the analysis and interpretation.

Total of financed by :. The purpose of this paper is to provide financial statement users and accounting academics with some useful insights when working with financial ratios.

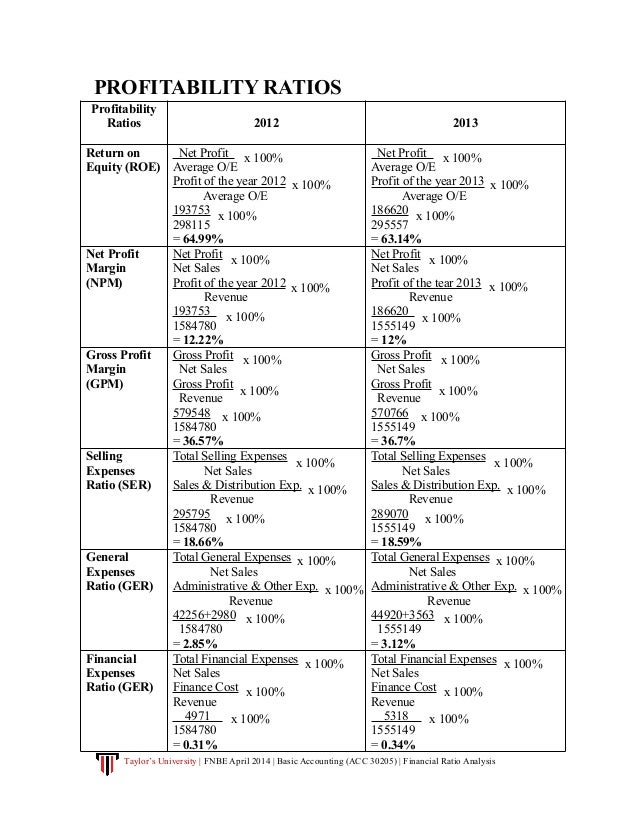

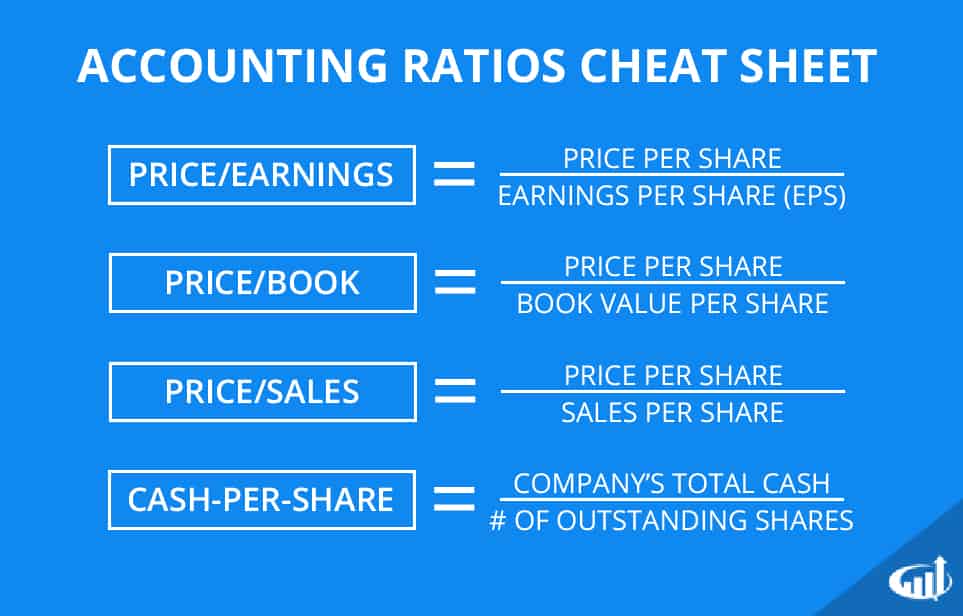

Calculate accounting ratios for profitability, liquidity, efficiency, capital structure and. Ratio analysis is a method traditionally used by people who wish to understand more fully the financial statements and performance of an entity. Current ratio = current assets/current liabilities 2.

These ratios are used by financial analysts, equity research analysts, investors, and. Financial ratio formula sheet fsa note: Learningobjectives after studying this chapter , you will be able to :

Interpretation the current ratio ranging from 1.5 to 3 is considered healthy in general. Liquidity concerns are typically indicated by ratios less than one, while working capital.

Accounting ratio can be of. In other words, leverage financial ratios are used to evaluate a company’s debt levels. Understand why interpretation of financial statements is necessary.

We examine whether mandatory transition to ifrs affects the credit relevance of financial statements. Ratio analysis is a useful management tool that will improve your.

/GettyImages-1165045615-3989ced2efa44ab28634ac73786b8121.jpg)