Great Info About On A Trial Balance Information In The Financial Statements

This information is then used to prepare financial statements.

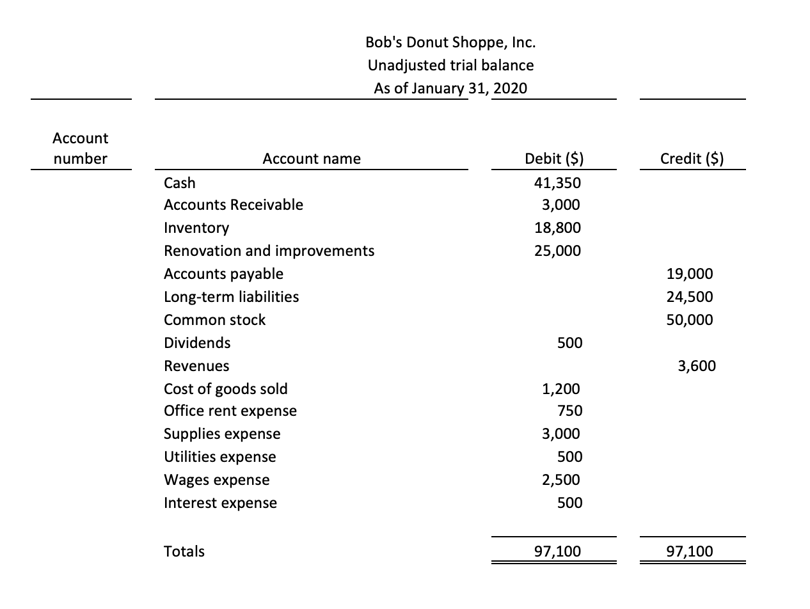

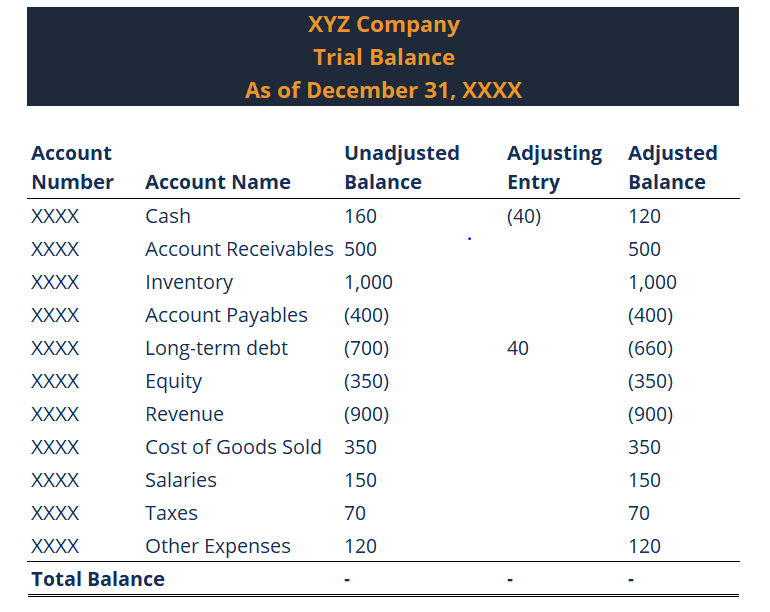

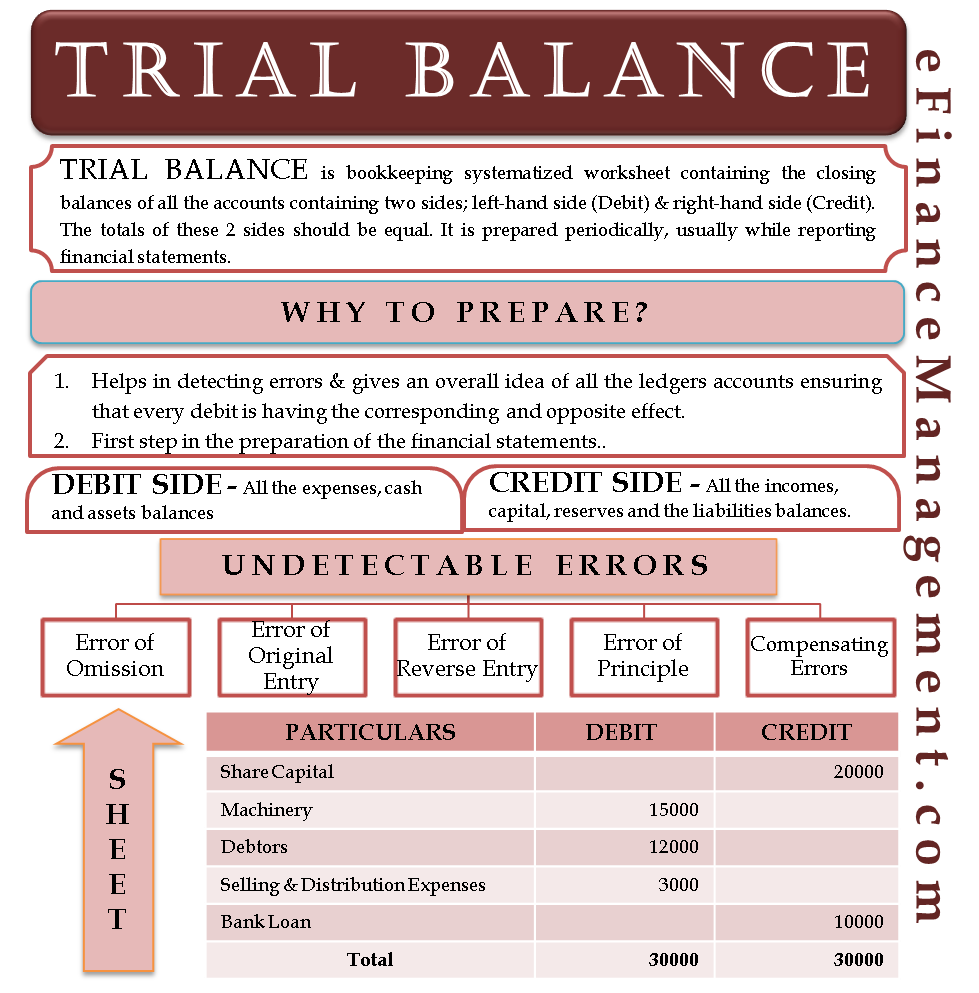

On a trial balance. A trial balance is a tool accountants use to check that the general accounting ledger is accurate and to minimize errors occurring in a company’s financial statements. Here’s an example trial balance. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements.

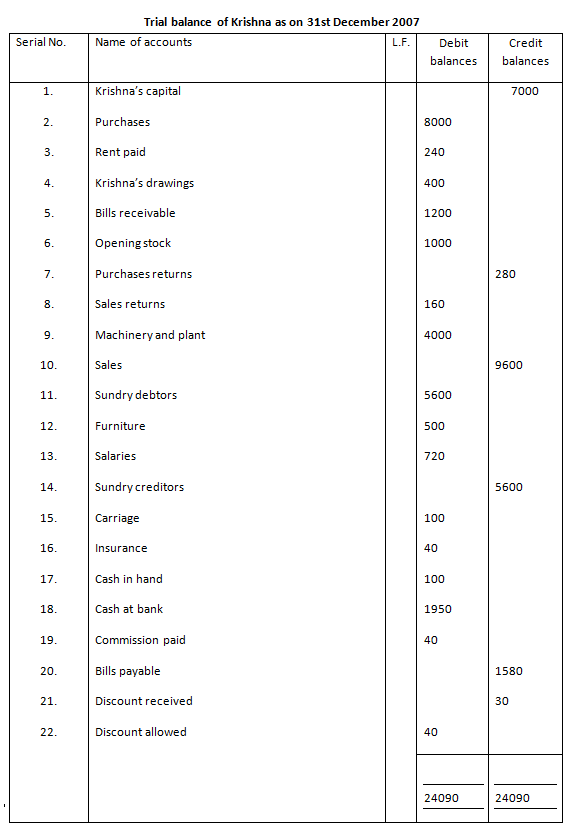

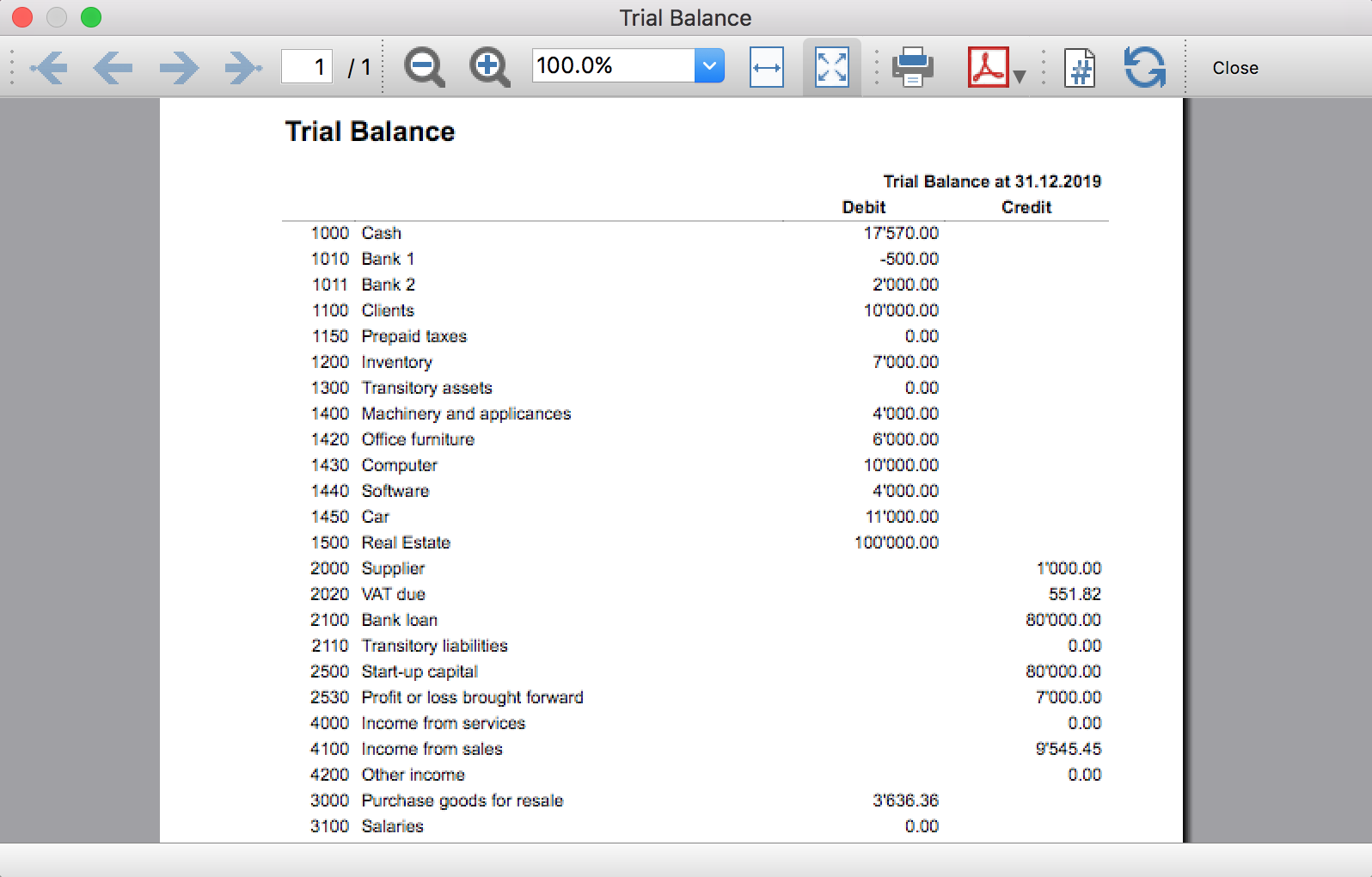

A trial balance is a statement that keeps a record of the final ledger balance of all accounts in a business. When the accounting system creates the initial report, it is. Before complex accounting procedures are applied, it is necessary to check the accuracy of the work that has already been done.

Note that for this step, we are considering our trial balance to be unadjusted. One column should be the names of. Judge arthur f.

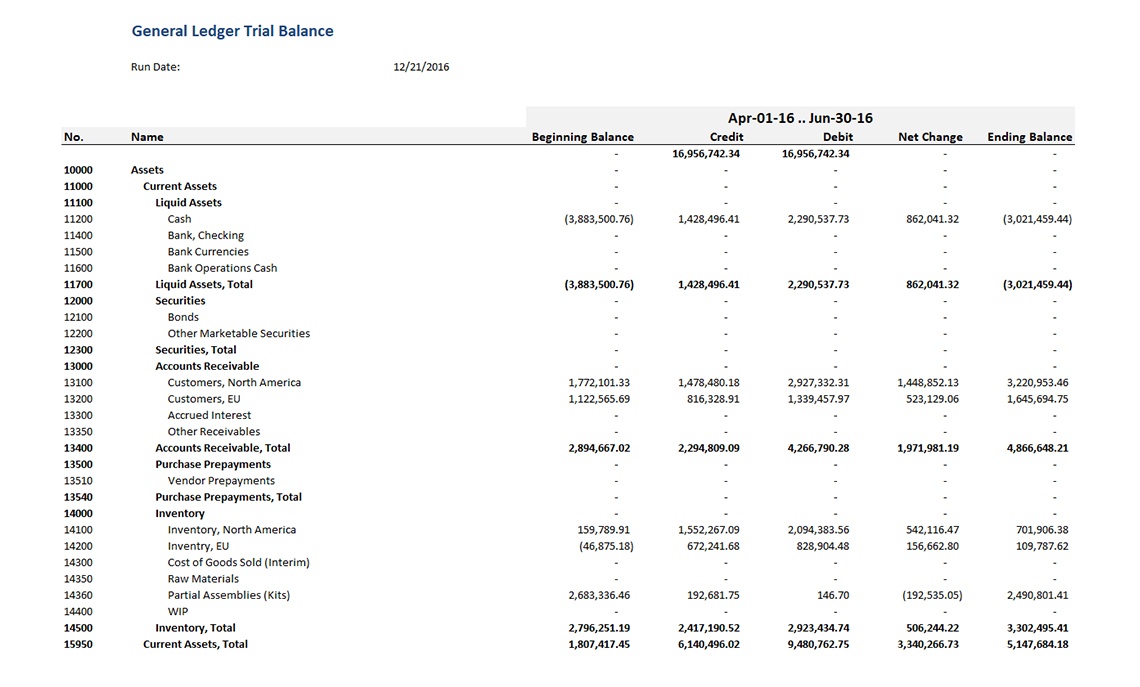

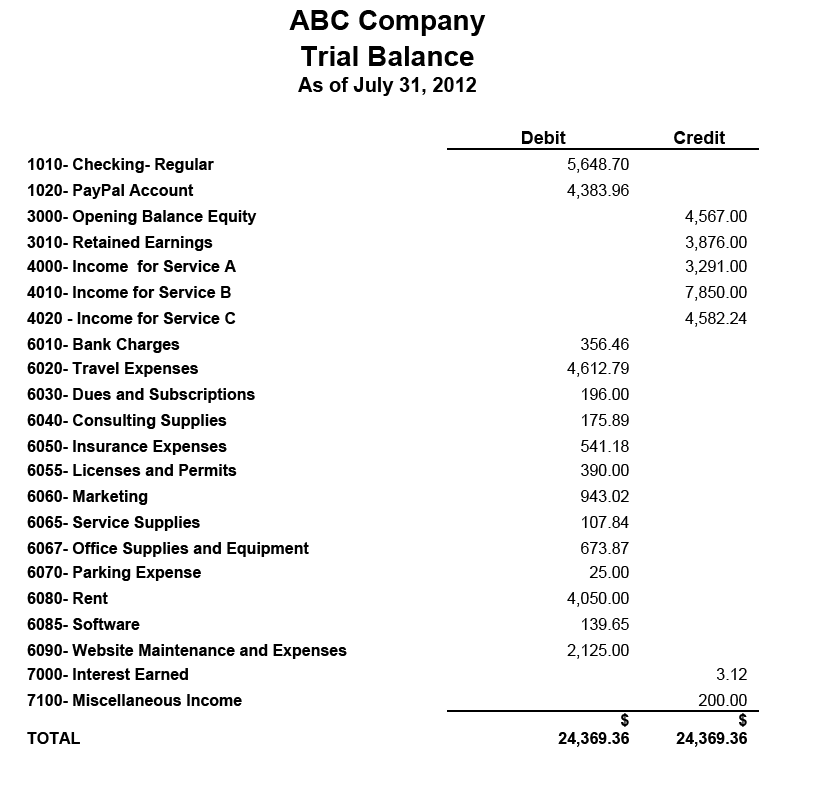

In contrast, individual transactions are recorded as credit and debit entries in the general ledger. The trial balance format is easy to read because of its clean layout. The trial balance is an accounting report that lists the ending balance in each general ledger account.

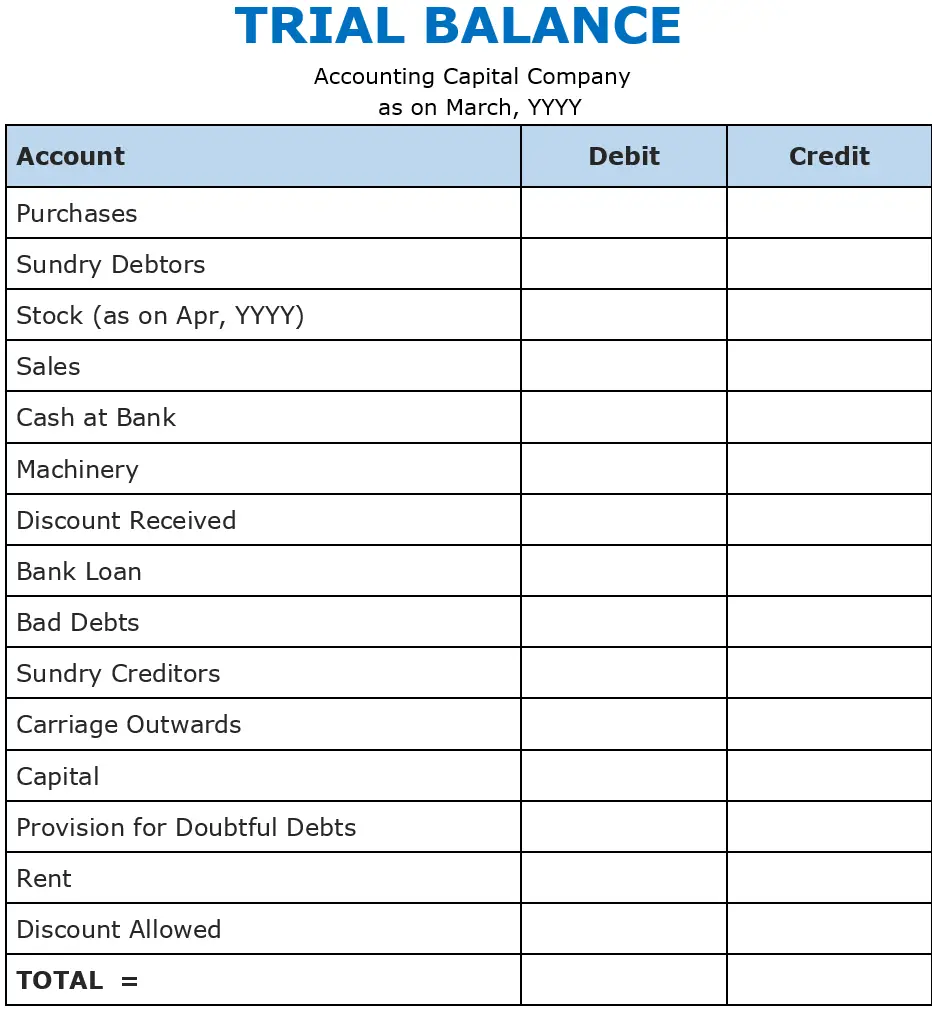

Trial balance trial balance format. Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet. Although a trial balance may equal the debits and credits, it does not mean the figures are correct.

All journal entries are posted in their respective ledger accounts. The report is primarily used to ensure that the total of all. It consolidates each account's credit and debit balances to determine the overall credit and debit balances.

In trial balance, all the ledger balances are posted either on the debit side or credit side of the statement. A trial balance includes the figures from the profit and loss (income statement) and the balance sheet financial statements. Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements.

What is trial balance? Trial balance is the third phase of the accounting cycle. The total debit balances will match the credit balances if the general ledger is accurate.

What is a trial balance? 14, 2024 3:16 pm pt. The result is a report that shows the total debit or credit balance for each account, where the grand total of the debits and credits stated in the report sum to zero.

The accounts included are the bank, stock, debtors, creditors, wages, expense codes and sales. The trial balance supports this by ensuring that for every financial action there is a traceable and corresponding counteraction, confirming that all transactions are recorded honestly. What are the methods of preparing trial balance?