Casual Tips About Cash Flows From Operations Ratio Statement Of Comprehensive Income Definition

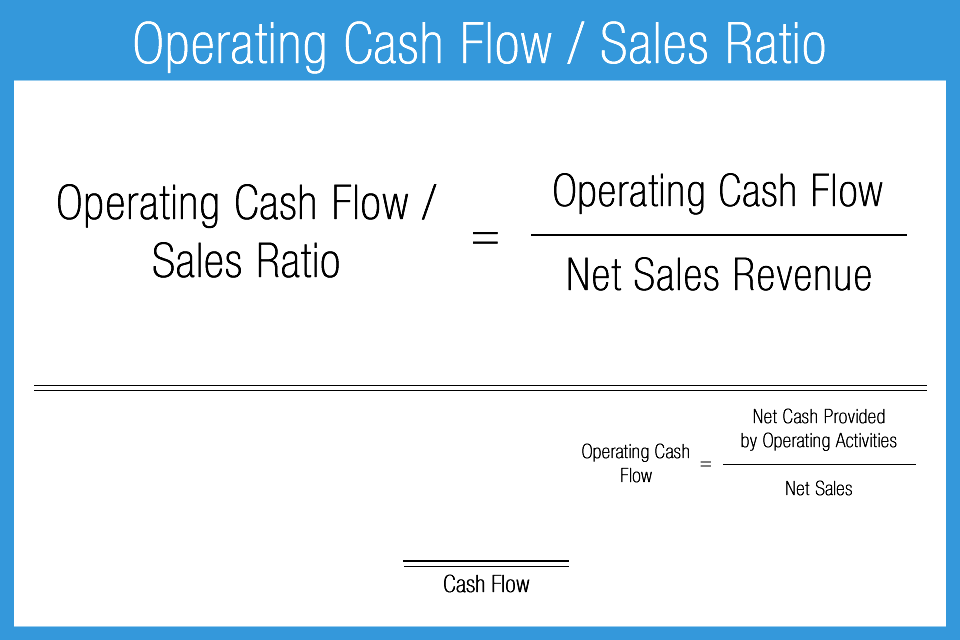

Here's the formula for calculating the operating cash flow ratio:

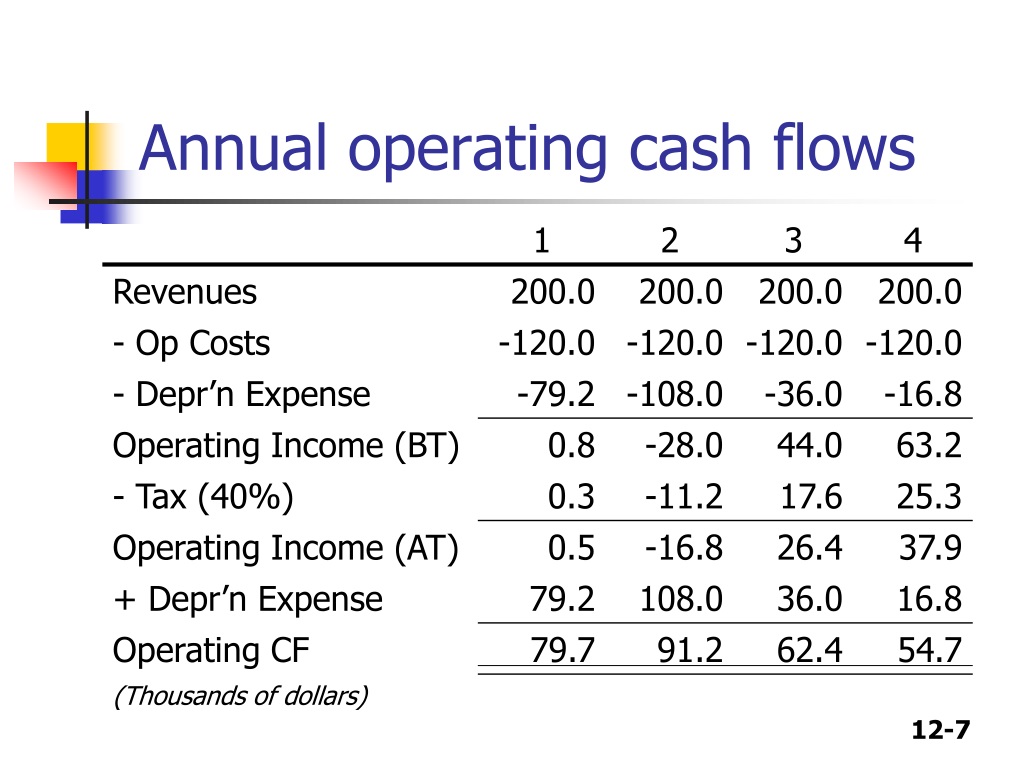

Cash flows from operations ratio. If ocf deviates substantially from net income, it implies. Operating cash flow ratio is an important measure of a company’s liquidity i.e. Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting operating expenses from total revenues.

Meanwhile, its current liabilities are $100,000 in accounts receivable. The operating cash flow ratio, also known as the cash ratio or cash flow ratio, ascertains if the cash flows obtained from the operations of a firm are adequate to cover the current liabilities. A higher ratio means that a company has generated more cash in a period than what was immediately needed to pay off.

Operating cash flow (ocf) is a measure of the amount of cash generated by a company's normal business operations. The formula can also be written as: Like operating margin, it is a.

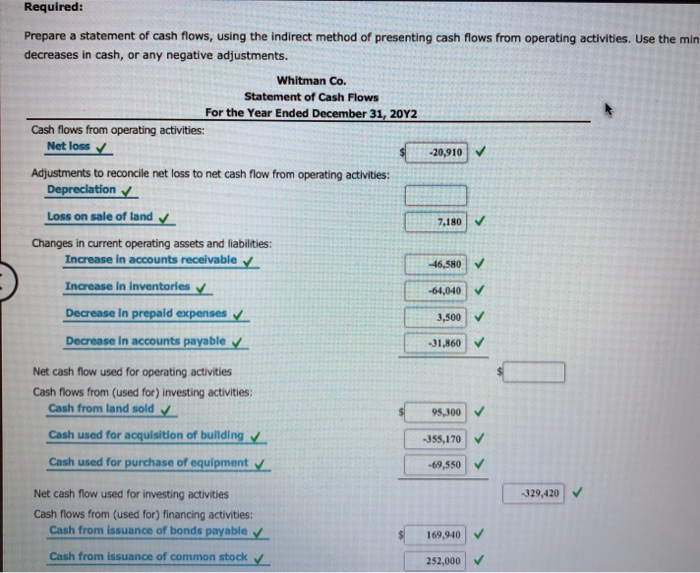

Cash flow from operations can be found on a company’s statement of cash flows. All cash generated from firm’s core business operations is termed as operating cash. Operational cash flow ratio is computed by dividing cash flow resulting from core operations by the firm’s current liabilities.

Cash flow from operations ratio is the ratio that helps in measuring the adequacy of the cash which are generated by the operating activities that can cover its current liabilities and it is calculated by dividing the cash flows from the operations of the company with its total current liabilities. Below is an example of amazon’s operating cash flow. The operating cash flow ratio measures the ability of a business to pay for its current liabilities from its reported operating cash flows.

Operating cash flow is a liquidity ratio that determines the capability of a company to. Operating cash flow ratio formula. A higher level of cash flow indicates a better ability to withstand declines in operating performance, as well as a better ability to pay dividends to investors.

Ocf ratio = cash flow from core operation / current liabilities. Cfo / cl = ocf ratio. Cash flow margin ratio (cfmr):

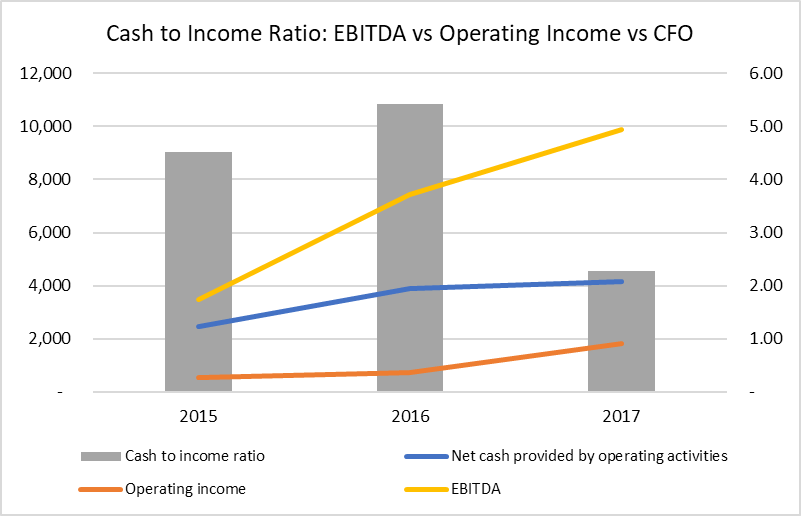

Cash flow from operations example. November 02, 2023 what are cash flow ratios? The two metrics that the ocf ratio compares can be found on the cash flow statement (cfs) and balance sheet (b/s).

Price/cash flow ratio = harga saham / arus kas operasi per saham rasio ini memberikan gambaran tentang nilai perusahaan di mata investor. Rasio ini mengungkapkan hubungan antara kas yang dihasilkan dari operasi dan penjualan. The key here is to focus on your company’s regular business operations.

The formula to calculate the operating cash flow ratio. Operating cash flow ratio also known as cash flow from operations ratio is calculated by dividing cash flow from operations by current liabilities. Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)