Best Of The Best Tips About Accounting For Dividends Received From Subsidiary Opening Stock In Trial Balance Debit Or Credit

Dividends from a subsidiary, a joint venture or an associate are recognised in the separate financial statements of an entity when the entity’s right to receive the dividend is.

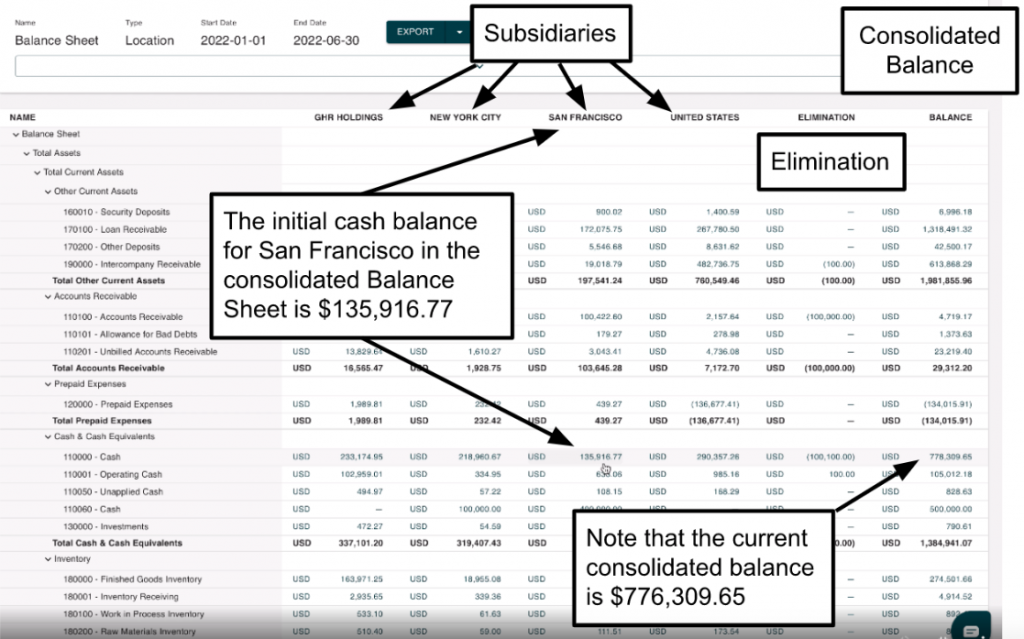

Accounting for dividends received from subsidiary. Accounting treatment a request arises like to how earnings receives from a foreign should be counted for in the parent’s individual financial statements under frs 102, where the. Accounting for subsidiary subsidiary is a company that is owned by another company, parent or holding company. I assume a debit entry would be cash/bank and.

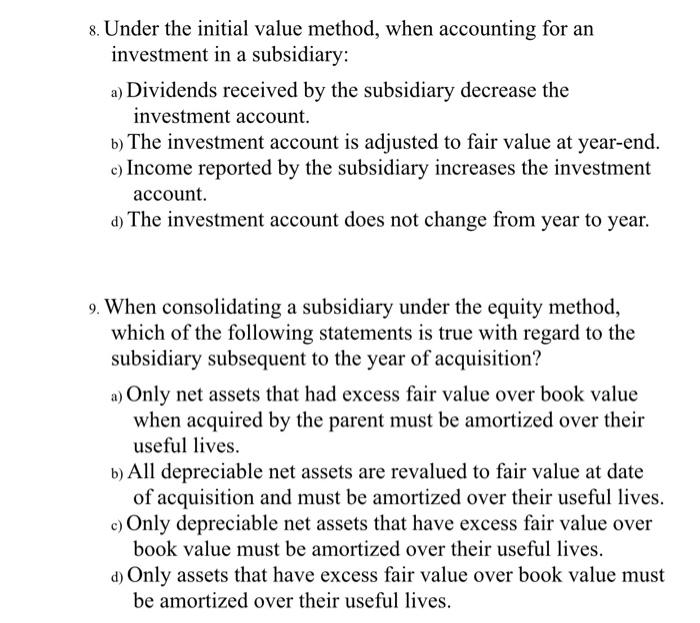

The consolidated method doing accounting for subsidiaries can be complex, but we’ll walk through it together. Under consolidated accounting, dividend payments are considered internal transfers of cash and are not reported on the public statements. Dividends received from subsidiary in certain cases, a company may have subsidiary entities in which it holds a controlling interest.

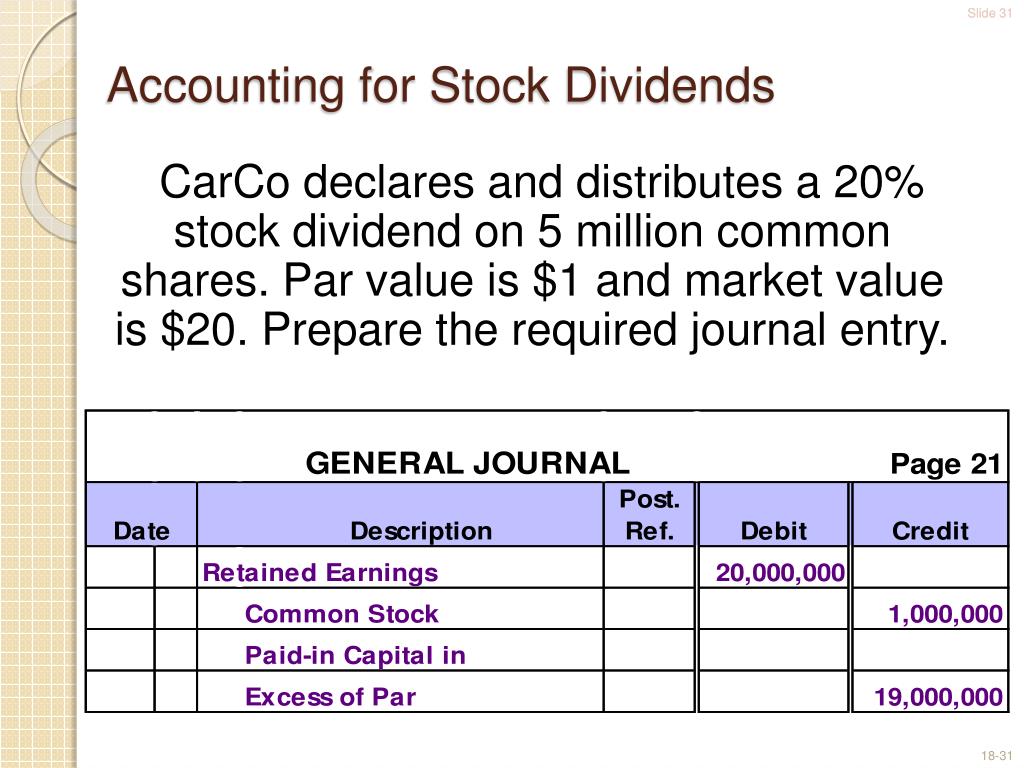

Ias 27 consolidated financial statements and accounting for investments in subsidiaries: Accounting for dividends is a relatively simple process. An entity shall recognise a dividend.

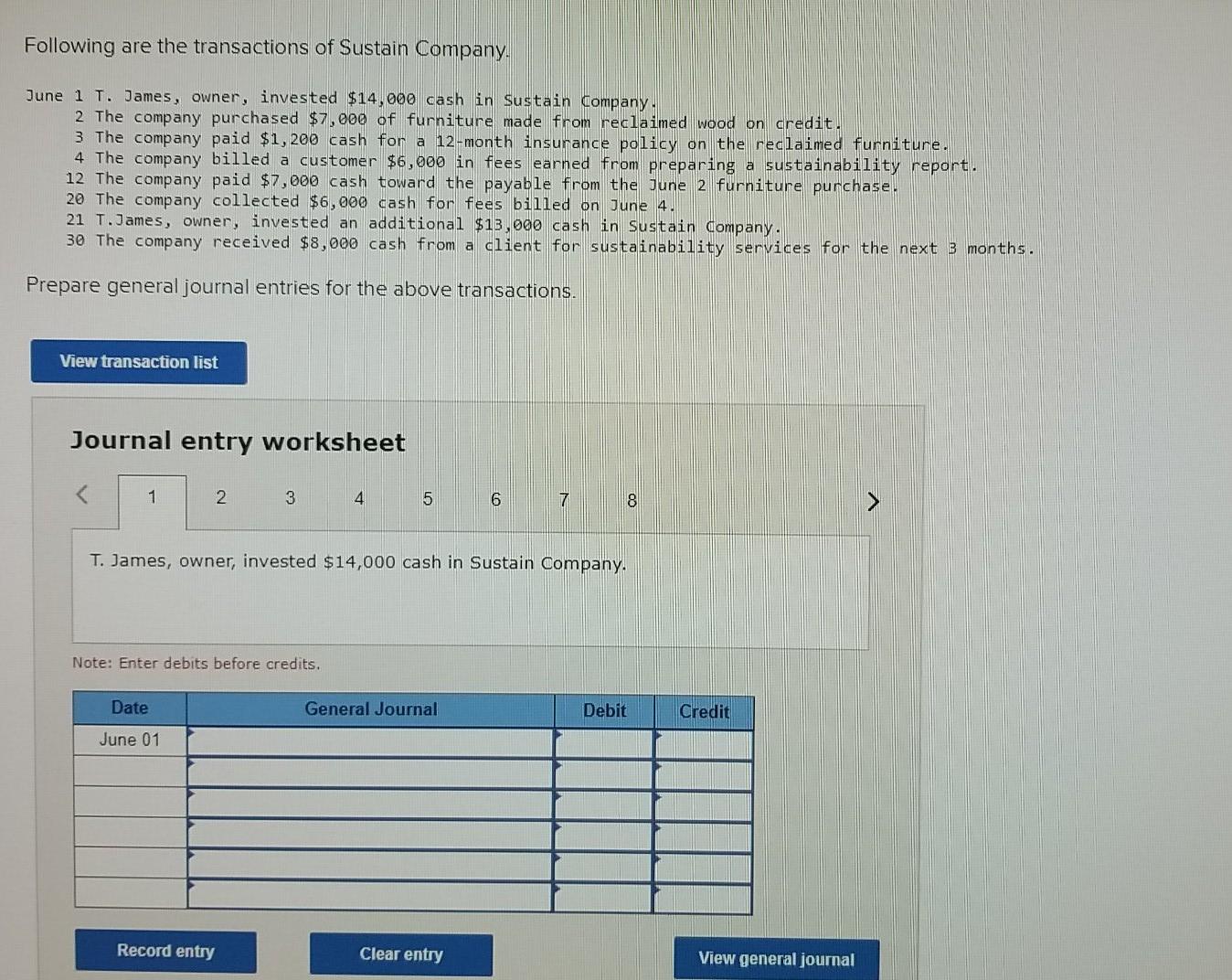

To record a dividend, a reporting entity should debit retained earnings (or any other appropriate capital account from which the dividend will be paid) and credit dividends. In this case, we need to record this. I need to make double enteries for dividends received from a subsidiary by a parent company(owns 100% shares).

My understanding that this is not subject to corporation tax by the holding company. Subsidiaries pay dividends to their owners ( parent and nci). Cash dividends received from subsidiaries should be classified within operating activities or investing activities on the statement of cash flows, depending on whether they are a.

Acca has a technical factsheet guide which looks at company law, reporting, and tax issues to provide a broad overview of issues in relation to dividends and distributions in specie. If you’re looking to sit the: Dividend from subsidiary as a parent company, we may also receive the cash dividend from time to time from the subsidiary companies.

Overview when the company makes a stock investment in another’s company, it may receive the dividend from the stock investment before it sells it back. A wholly owned subsidiary is paying a dividend to its holding company. Effective date of ias 27 (1989).

Cost of an investment in a subsidiary, jointly controlled entity or associate may 2008 • the application of the cost method, including the accounting for dividends received from.