Awesome Tips About Accounts Payable Trial Balance Yum Brands Financial Statements

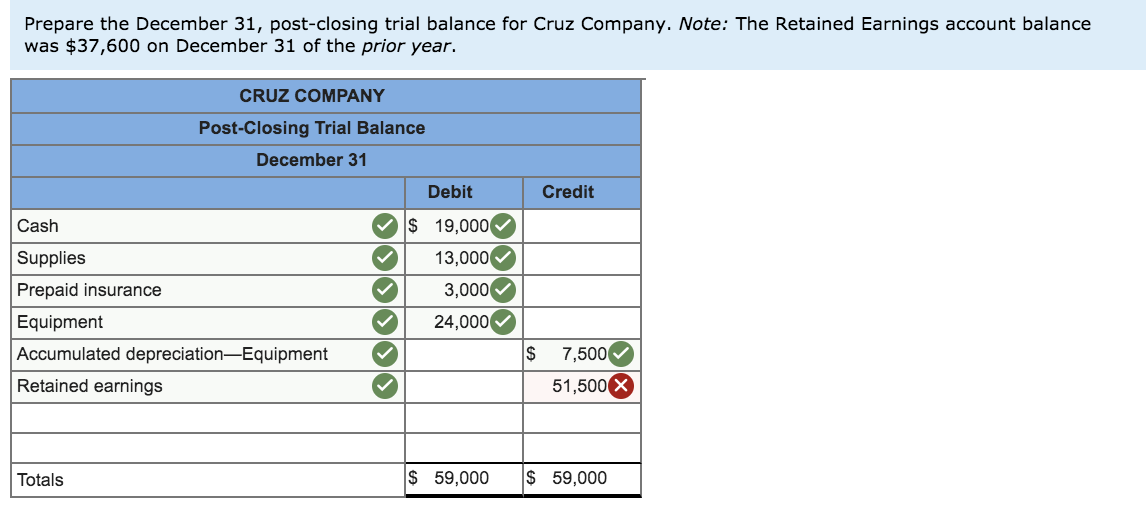

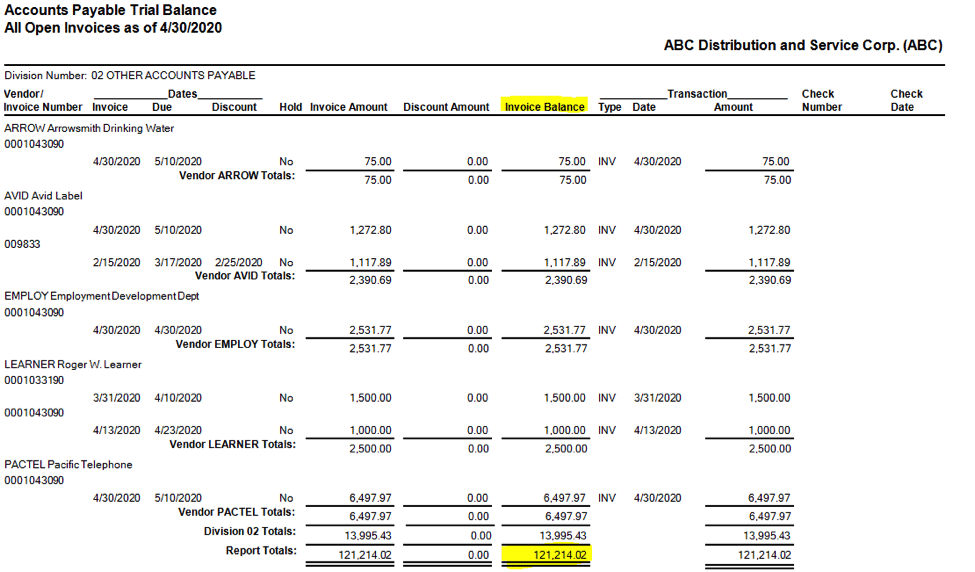

The payables trial balance report lists and subtotals, by supplier and liability account, all unpaid and partially paid invoices that oracle fusion payables transferred to the general ledger.

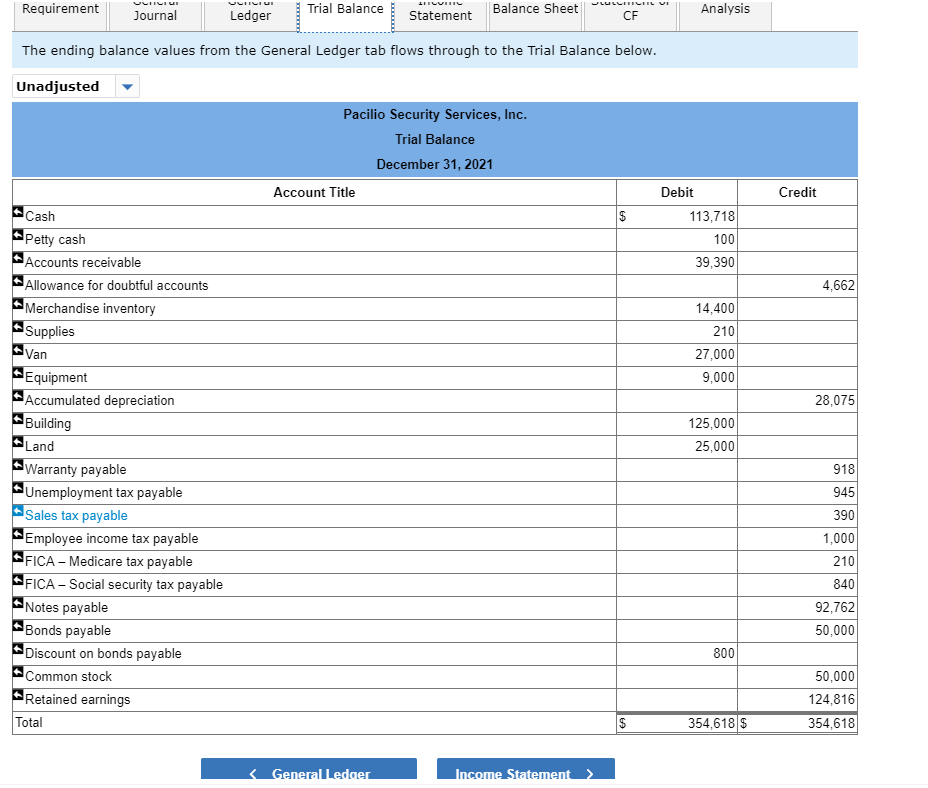

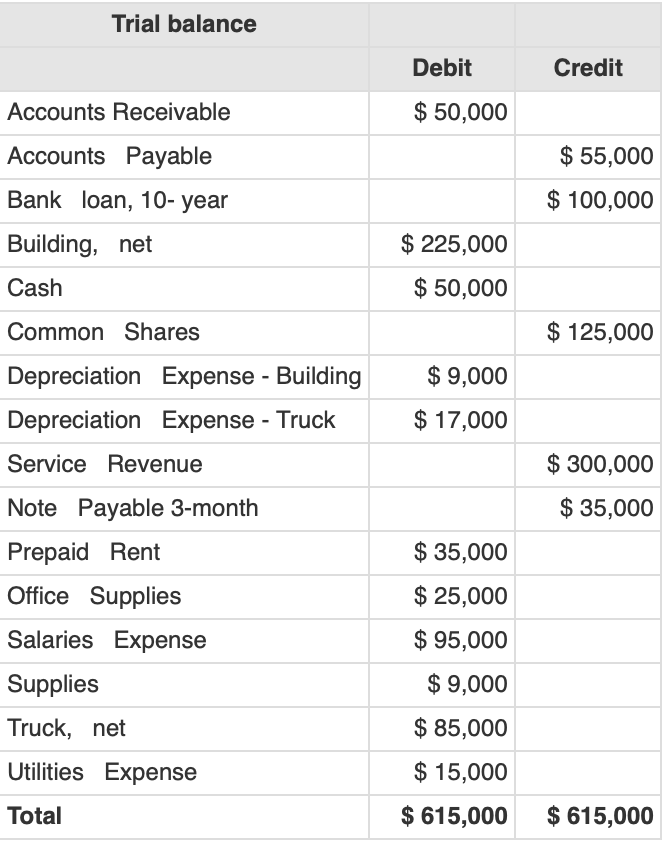

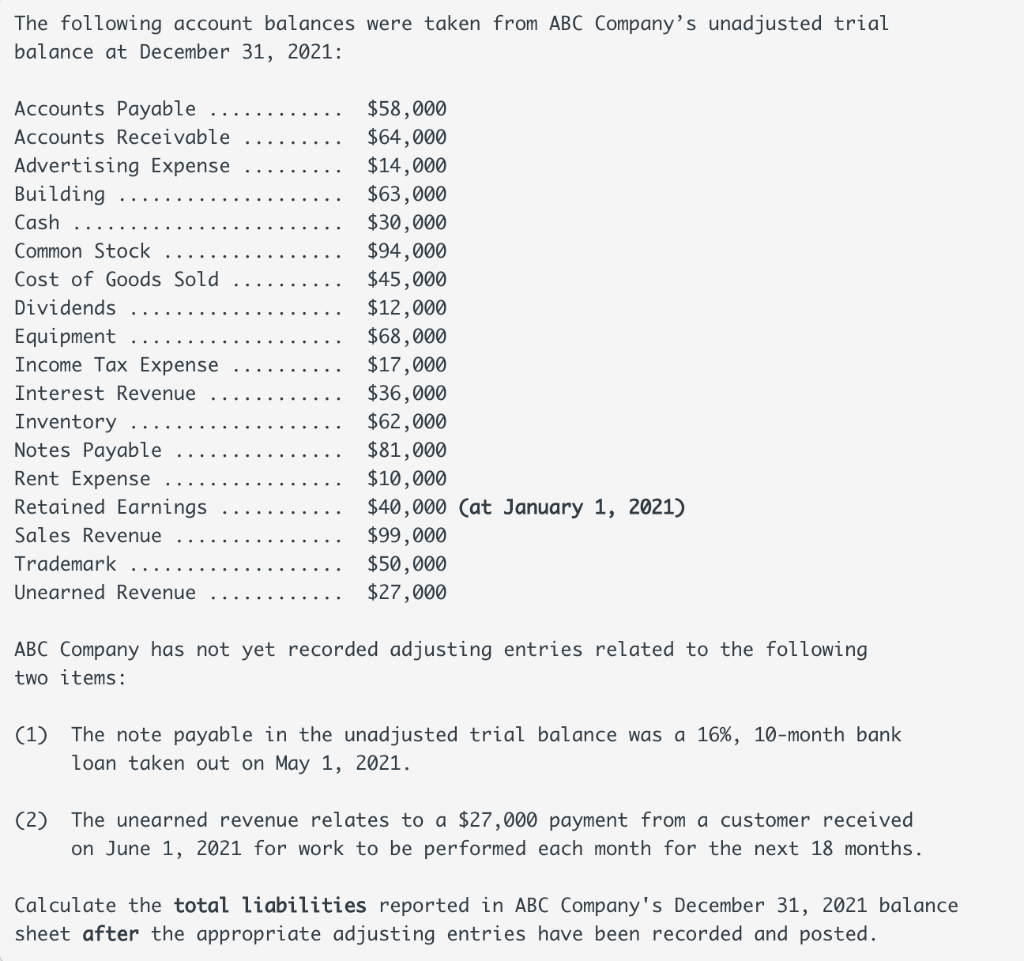

Accounts payable trial balance. Before closing a period, you can compare the cumulative total liability provided by this report with the total liability provided by your general ledger to. These credit balances would transfer to the credit column on the unadjusted trial balance. Accounts payable is current liability by nature as it is short term debt and obligation is to be paid within 12 months.

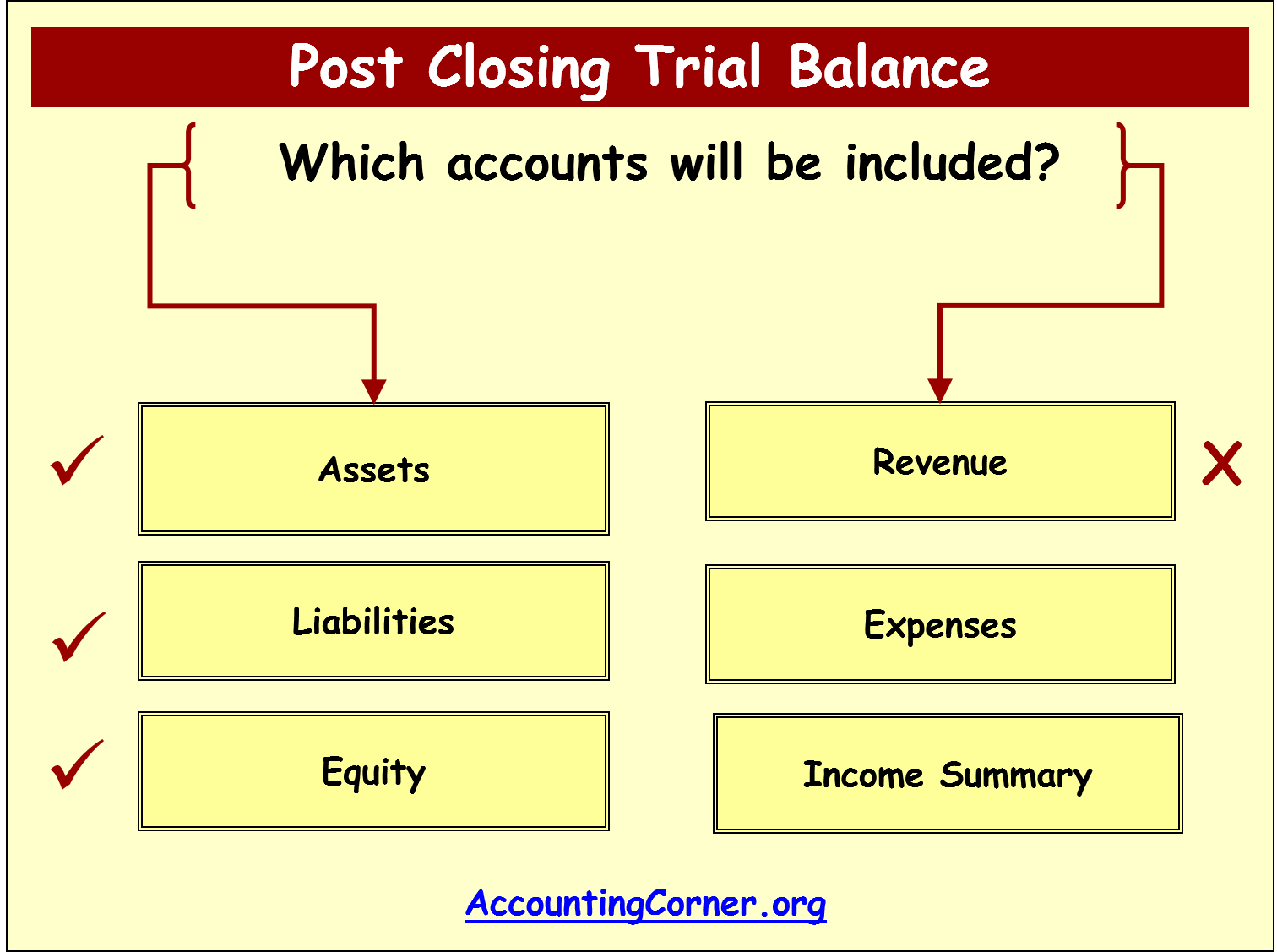

The payables trial balance report lists and subtotals, by supplier and liability account, all unpaid and partially paid invoices that oracle fusion payables transferred to the general ledger. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal.

Print an unadjusted trial balance. Accounts payable trial balance report. Structures the report by g/l account and accounts payable.

This statement comprises two columns: Accounts payable represent a liability for a company when goods or services are purchased on credit from suppliers. Hence, being liability it is to be shown on the credit side of the balance sheet.

The following figure is an example of the report. Solution in this document goal solution This means that it states the total for each asset, liability, equity, revenue, expense, gain, and loss account.

R12 trial balance faqs (doc id 579631.1) last updated on august 26, 2023. The trial balance is an accounting report that lists the ending balance in each general ledger account. The steps for doing so are as follows:

The report identifies the accounts payable balance at period end and provides the invoice. They are to be grouped as “accounts payable”. A trial balance is used to determine whether all posted debit transactions equal posted credit transactions.

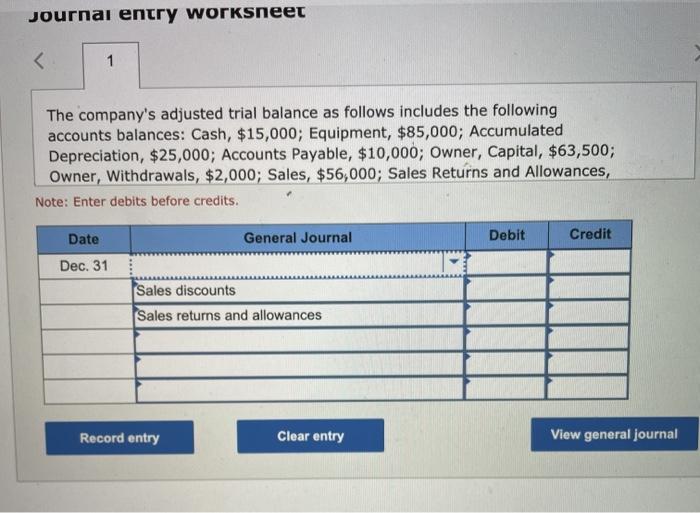

Goal how do you create a new accounts payable trial balance report definition? Use the accounts payable trial balance to provide a complete recap of accounts payable invoices with details of payments, adjustments, or other activities that affect the accounts payable balances during a period. (doc id 1392396.1) last updated on december 07, 2023 applies to:

A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses ,. Select accounts payable reports menu > accounts payable trial balance.

This view shows the individual balances in the local currency as well as in the line item currency. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.