Best Of The Best Tips About Accounts Profit And Loss Account Format Sample Balance Sheet For Llc Departmental Income Statements Are Called

If your business owns more than it owes, then the balance sheet total will be a positive figure.

Accounts profit and loss account format sample balance sheet for llc. We will look at the relationship between the profit and loss account and the balance sheet and provide an introduction to the relationship between profit (or loss) and cash flow. 7.1 the profit and loss account The cash flow statement looks forward to when the business expects to receive or spend cash.

Of these three statements, two are commonly confused: The other two are the profit and loss statement and cash flow statement. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

The balance sheet shows a company’s. The balance sheet reports the assets, liabilities and shareholder equity at a specific point in time, while a p&l statement summarizes a company's revenues, costs, and. The balance sheet, the profit and loss (p&l) statement, and the cash flow statement.

A profit and loss account is prepared to determine the net income (performance result) of an enterprise for the. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. The balance sheet shows a snapshot of the accounts on any date and used by business owners, investors and banks.

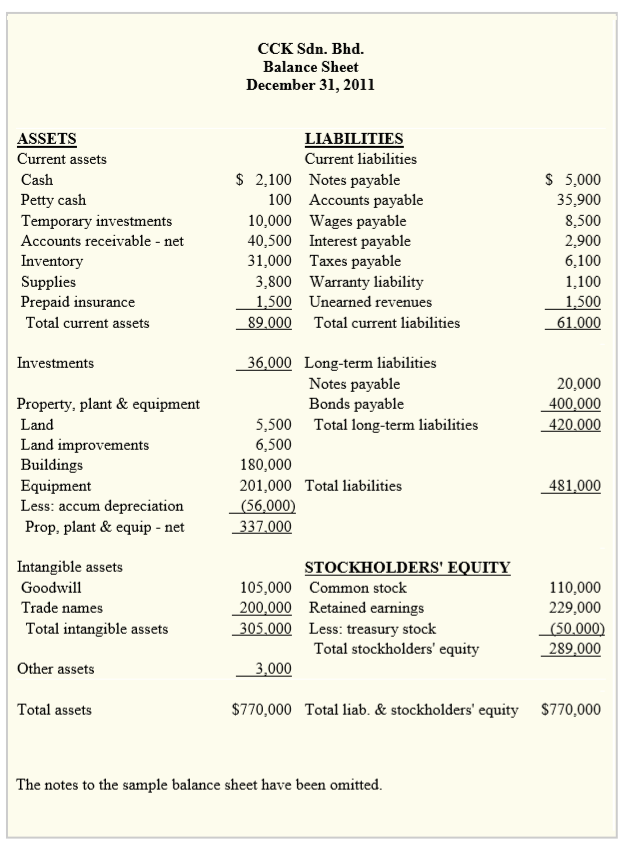

It includes all the assets, liabilities and equity of a business. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. The balance sheet presents an account of where a company has obtained its funds and where it has invested them.

The best way to find out is to create a profit and loss statement. Download, open, and save the excel template download and open the free small business profit and loss statement template for excel. Summarizes revenues, expenses, and profits or losses over a specific period (e.g., a month, quarter, or year).

Download free small business profit &. A business has primarily two sources of funds which are shareholders and lenders. A profit and loss account of a limited company in the appropriate format.

What is the difference between a profit & loss accounting statement and a balance sheet? Then, it subtracts the costs of making those goods or providing those services, like. Prepare a statement of owner’s equity.

The following illustration will help demonstrate how to prepare the both trading, profit and loss account and the balance sheet at the end of the financial period. Provides a snapshot of the company's financial position at a specific point in time. Profit and loss statement of a company is an important statement for any company because it helps in knowing whether the company is earning the profits or not, which is the main motive or.

Identify the three main components of the statement of cash flows. Profit & loss account and balance sheet objectives this chapter will enable the business owner to develop an understanding of: Example of preparing trading,profit and loss account.