Out Of This World Info About 26as View Credit Taxable Income Statement

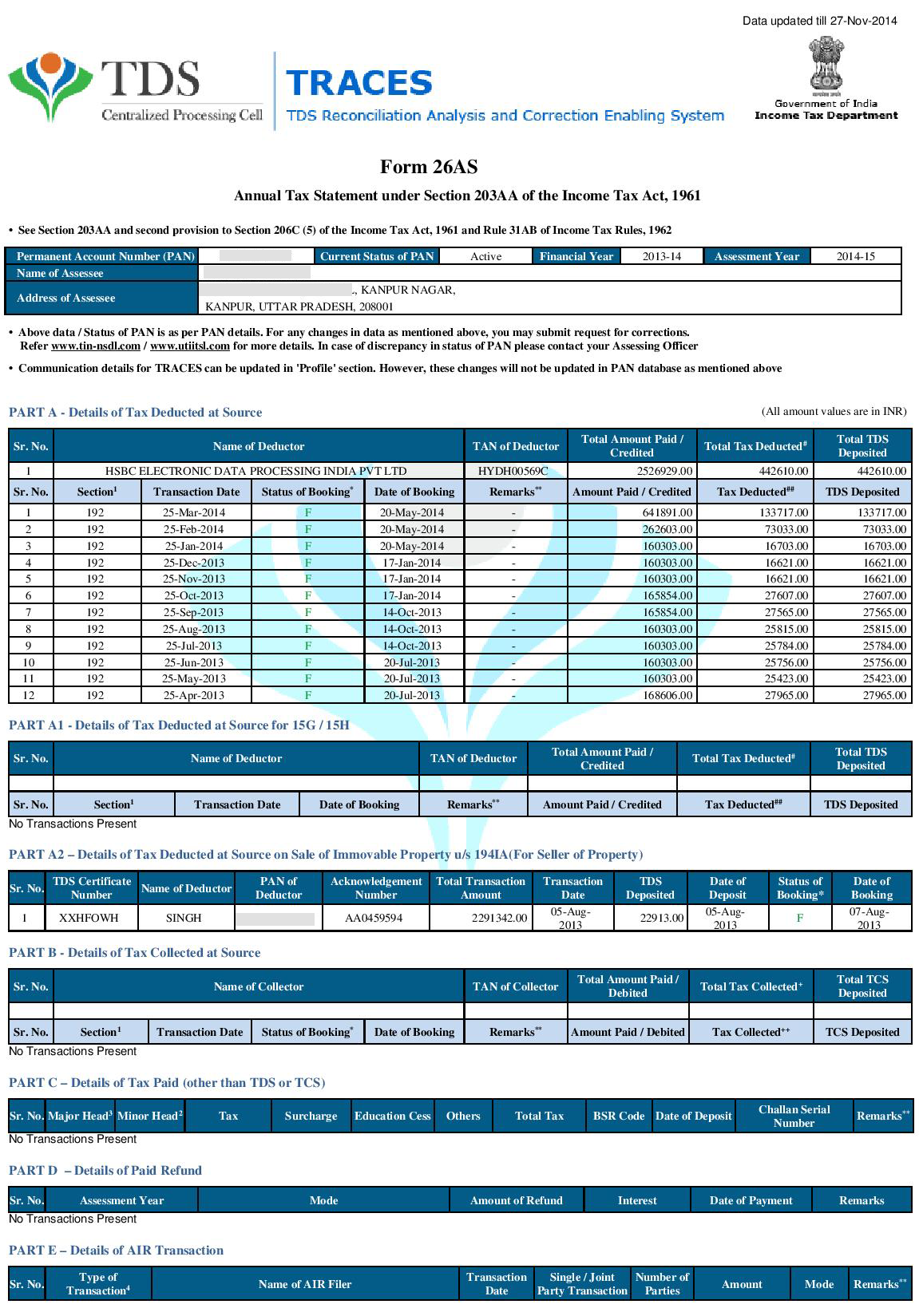

The tax credit statement, also known as form 26as, is an annual statement that consolidates information about tax deducted at source (tds), advance tax paid by.

26as view credit. Families with incomes of $75,000 or less ($85,000 for married taxpayers filing jointly) could get up to $1,200 for each qualifying child. Log into your net banking account. Form 26as can be viewed through:

The website provides access to the. The maximum tax credit available per kid is $2,000 for each child under 17 on dec. Users of retail.onlinesbi.sbi/personal can view tax credit in form 26as through bank login :

Steps to view or download the form 26as: Click proceed after choosing the box on the screen. Last updated on september 28th, 2023.

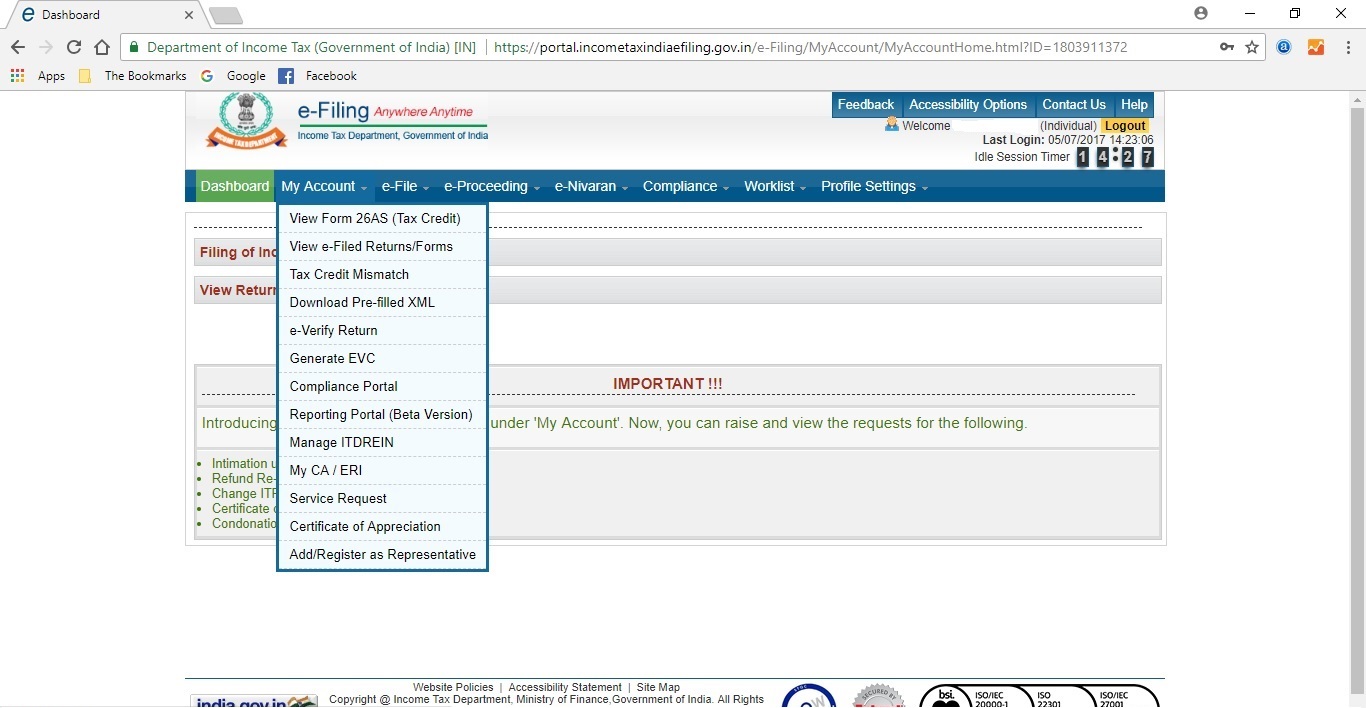

Enter your user id, which can be either your pan or aadhaar number. In case of an invalid user id,. Steps to view form 26as log in to income tax department website ( www.incometaxindia.gov.in) & get yourself registered there.

Users having pan number registered with their home branch can avail the facility of. For the tax year 2024, to $1,900;. In quick steps with mytaxcafe.

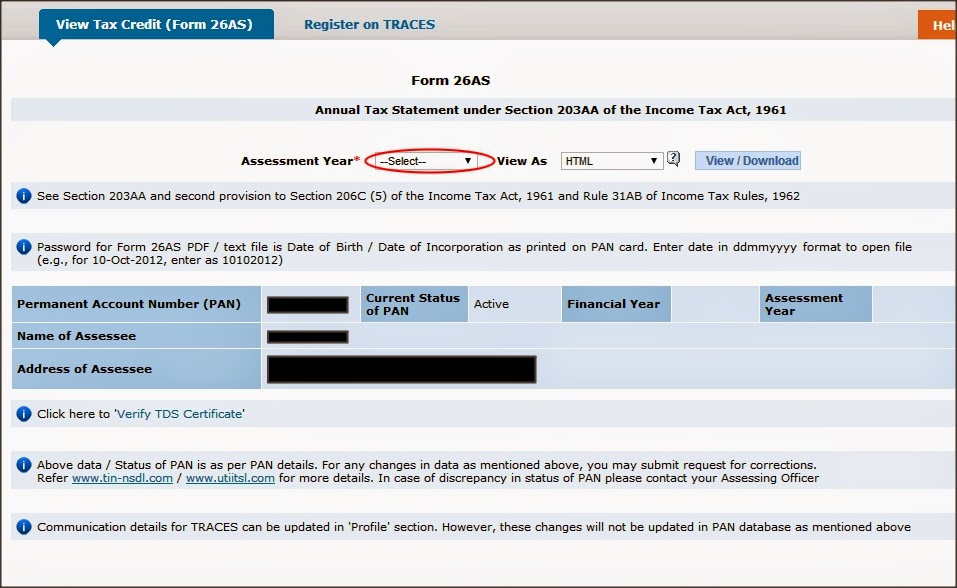

To view your form 26as, click the link at the bottom of the page and then select view tax credit (form 26as). It is known that filing an itr requires a dozen documents, which are essential for a. It is also known as tax credit statement or annual tax.

Form 26as means a tax credit statement and is an important document for taxpayers. The maximum tax credit available per kid is $2,000 for each child under 17 on dec. Find the tax tab from the.

For the tax year 2023, it would increase to $1,800; Form 26as is a consolidated tax statement issued to the pan holders. Only a portion is refundable this year, up to $1,600 per child.

The new rules would increase the maximum refundable amount from $1,600 per child. Click on the link view tax credit (form 26as) at the bottom of the. To qualify, dependents must be under 12 years old.

Click on the ‘view form 26 as (tax credit)' option. 26as full form is annual information statement (ais). Only a portion is refundable.