Matchless Tips About Adjusting Entries Are Made To Balance Sheet Accounts Only What Is Class 11

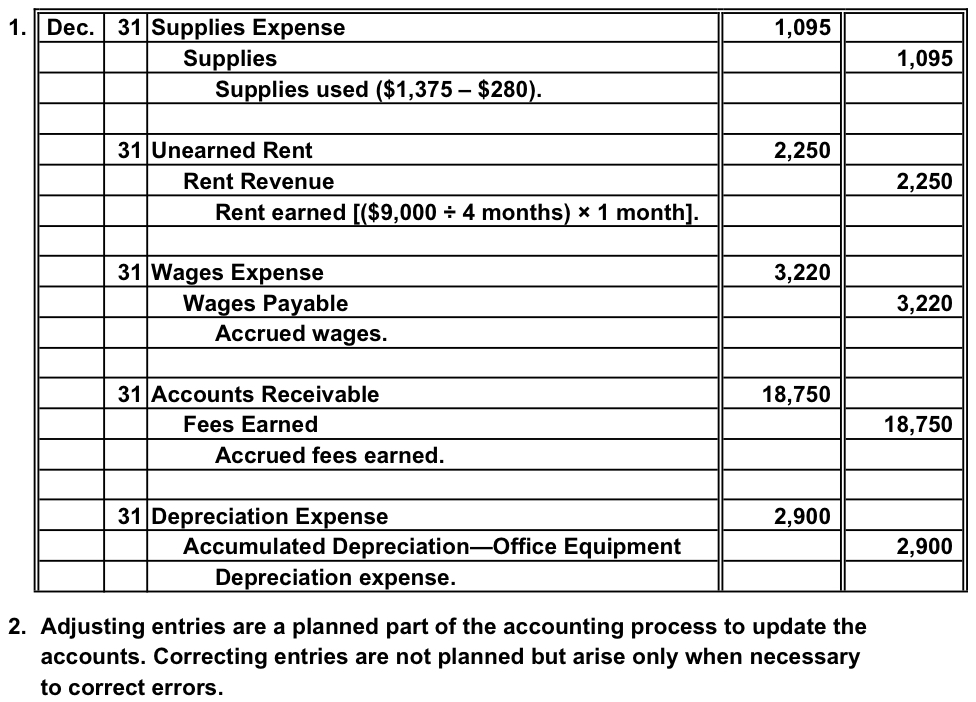

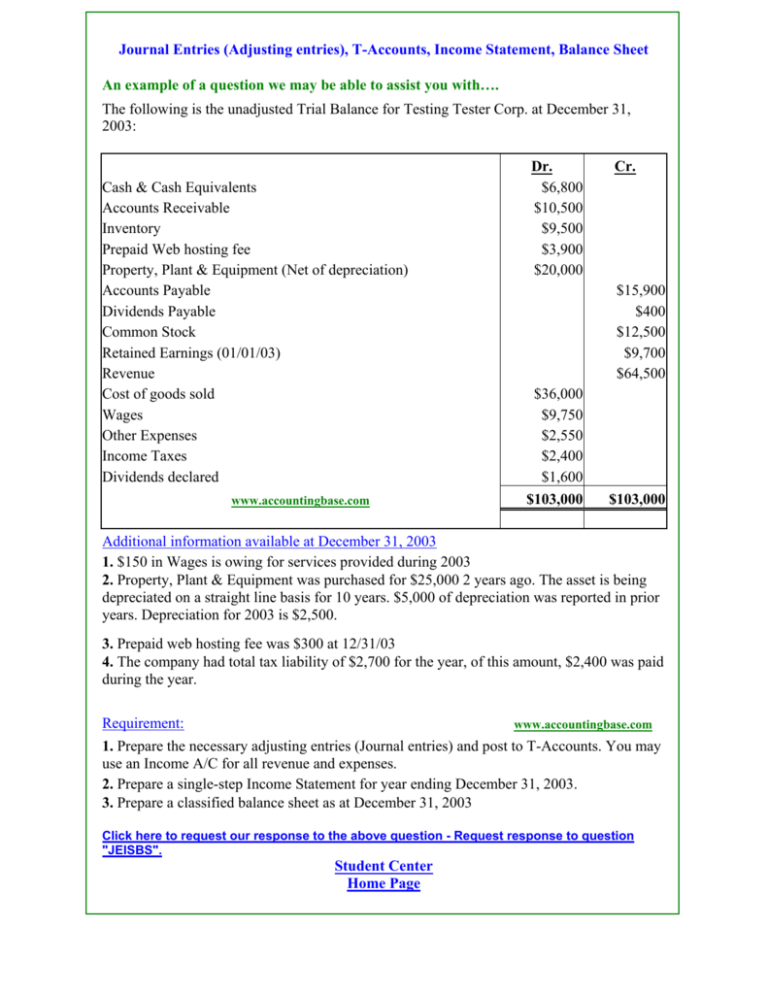

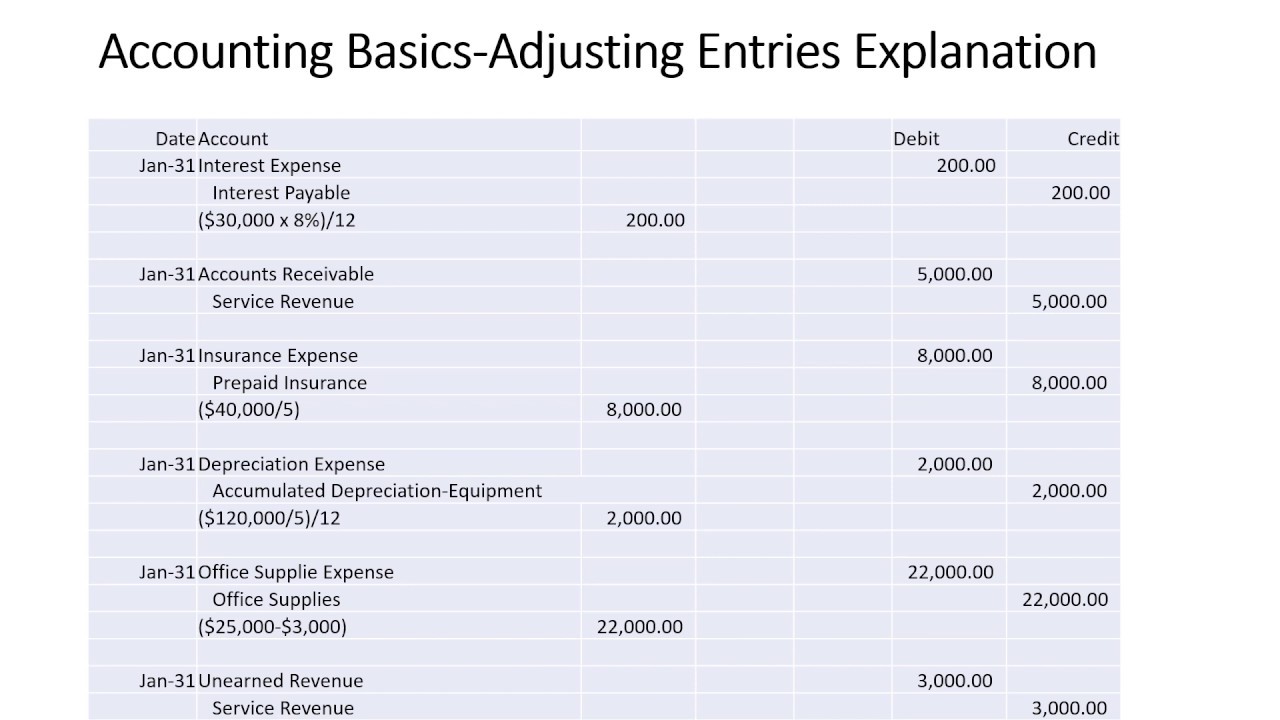

Adjusting entries update accounting records at the end of a period for any transactions that have not yet been recorded.

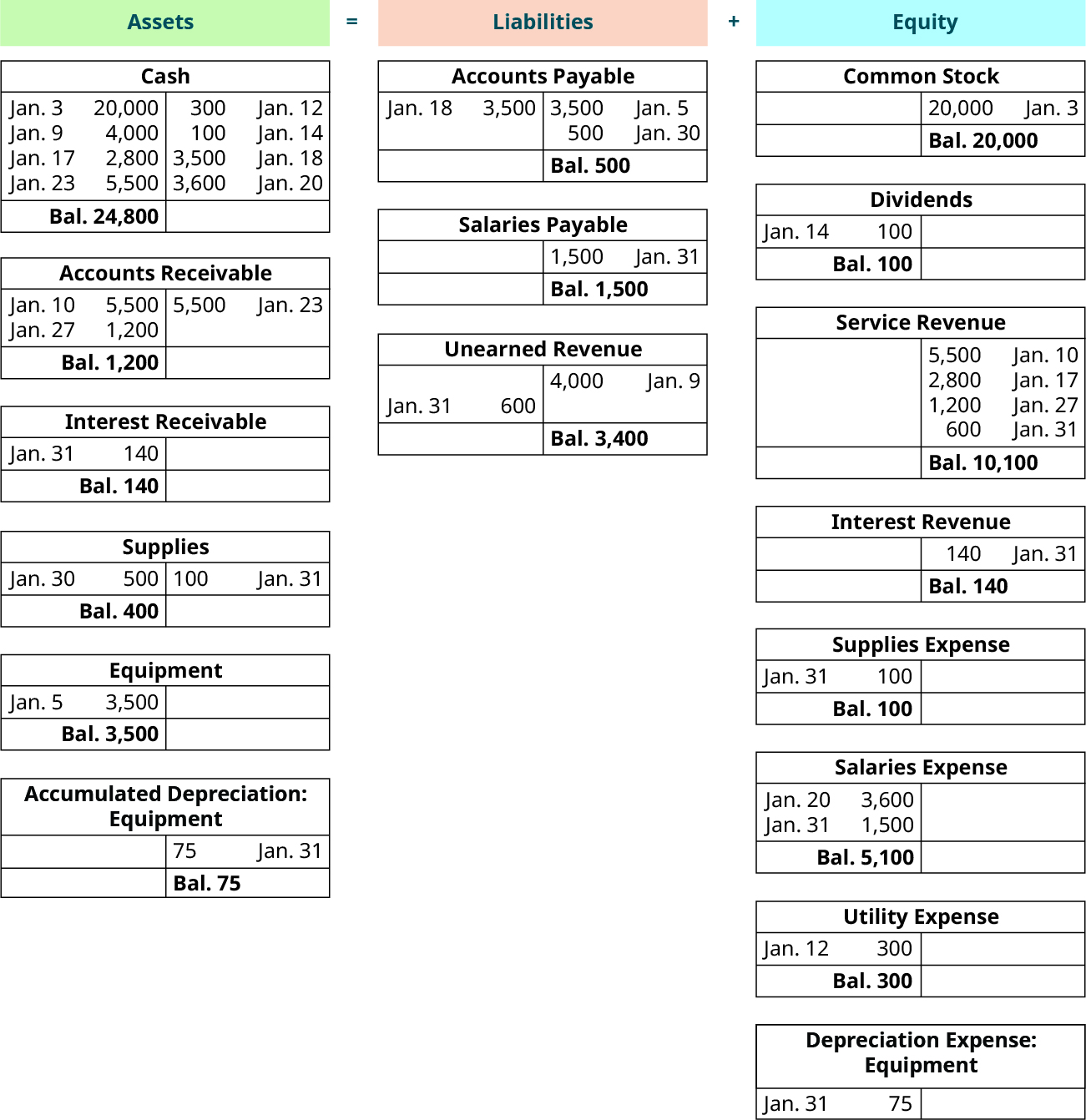

Adjusting entries are made to balance sheet accounts only. Adjusting entries are journal entries made at the end of the accounting period (month, quarter, or year) in order to bring the accounting books into alignment. Each adjusting entry has a dual purpose: Adjusting entries are made to ensure that income and.

Adjusting entries usually involve one or more balance sheet accounts and one or more accounts from your profit and loss statement. Every adjusting entry will have at least one income statement account and one balance sheet account. Adjusting entries are usually made on the last day of an accounting period (year, quarter, month) so that a company's financial statements.

D) made whenever management desires to change an account balance. An adjusting journal entry is typically made. An adjusting entry is an entry that brings the balance of an account up to date.

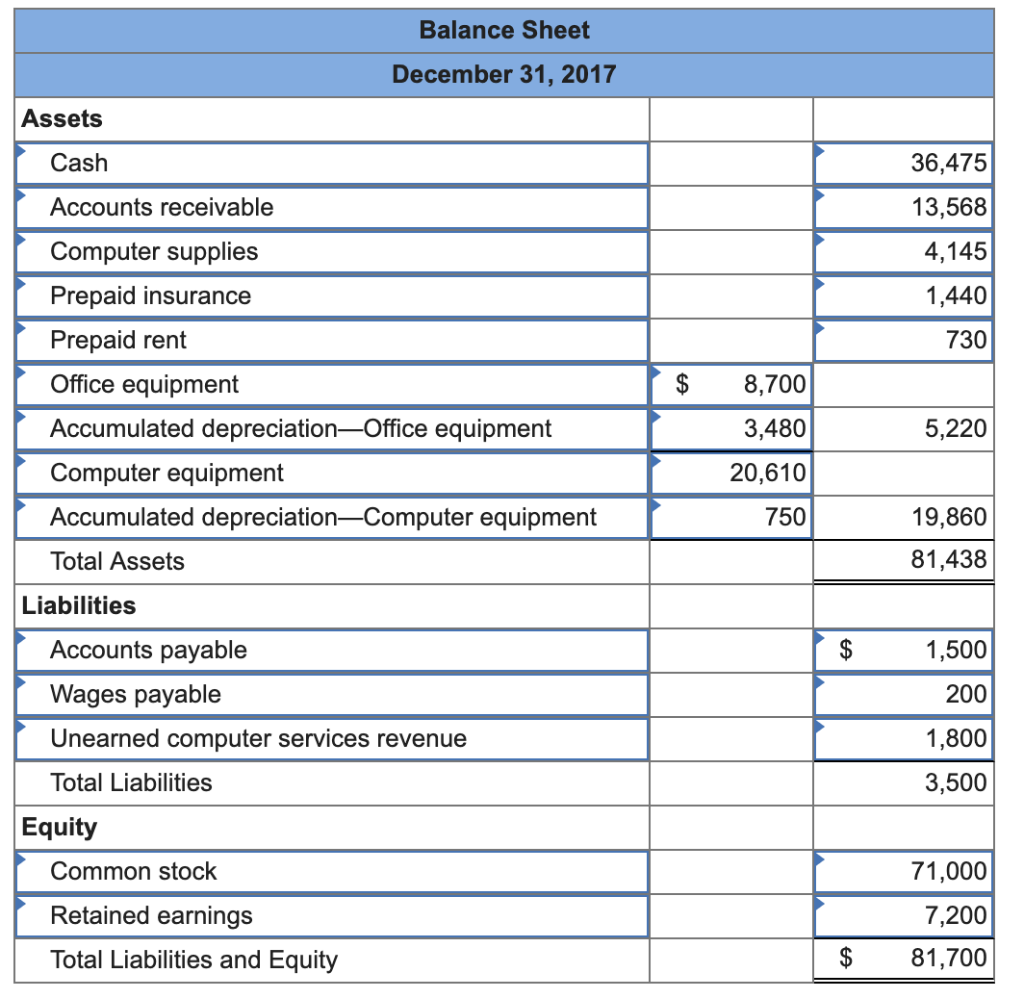

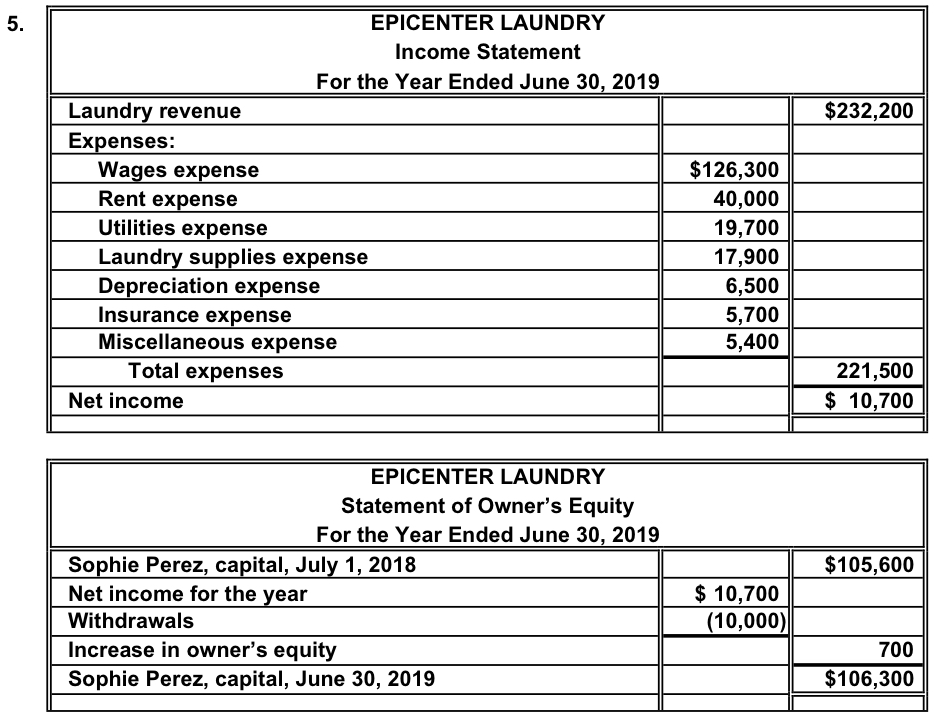

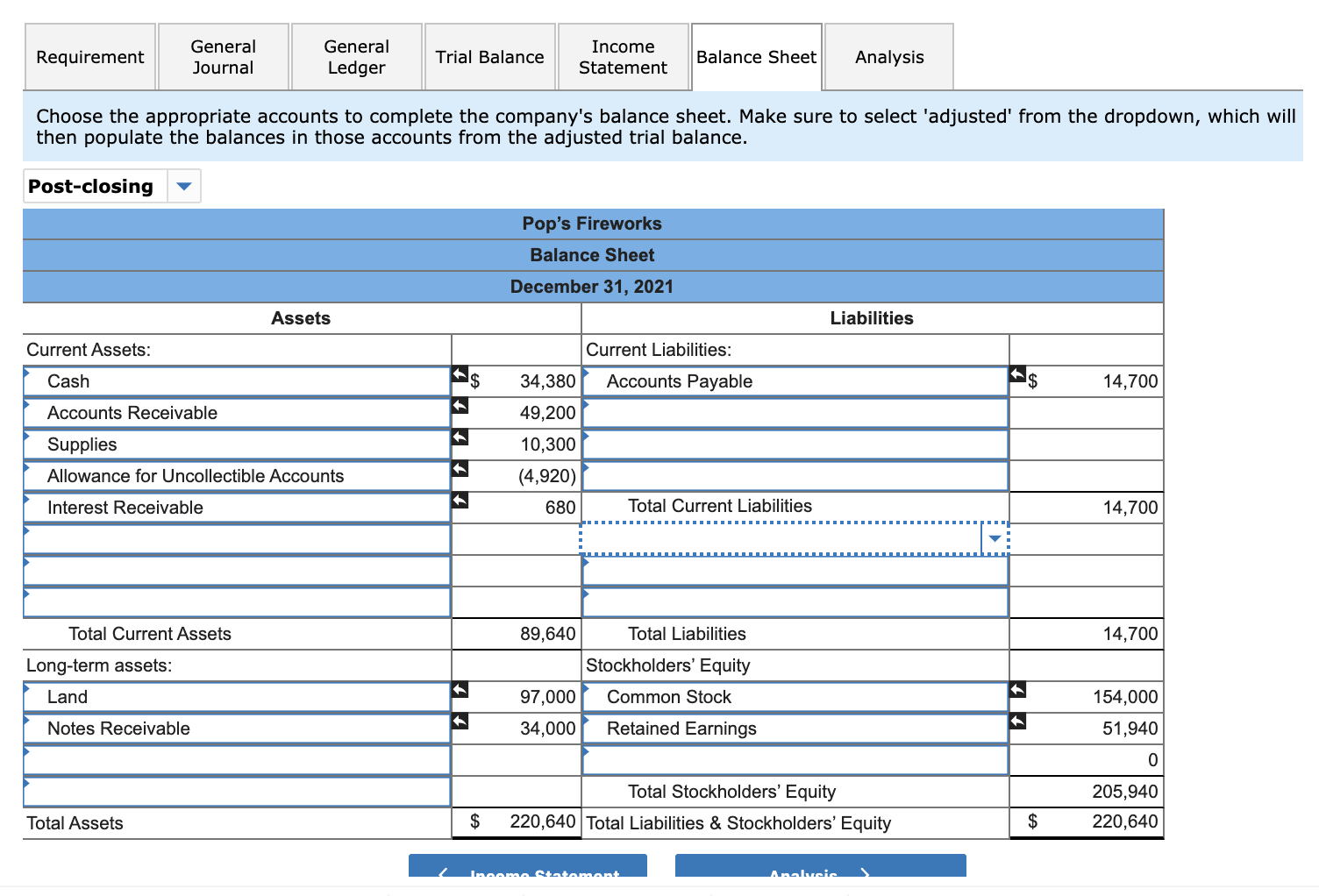

(1) to make the income statement report the proper revenue or expense and (2) to make the balance sheet report the proper asset. B) made to balance sheet accounts only. The purpose of adjusting entries is to ensure both the balance sheet and the income statement faithfully represent the account balances for the accounting period.

Adjusting entries follows the accrual principle of accounting and makes necessary adjustments that are not recorded during the previous accounting year. Cash will never be in an adjusting entry. Adjusting entries before financial statements are prepared, additional journal entries, called adjusting entries, are made to ensure that the company's financial records.

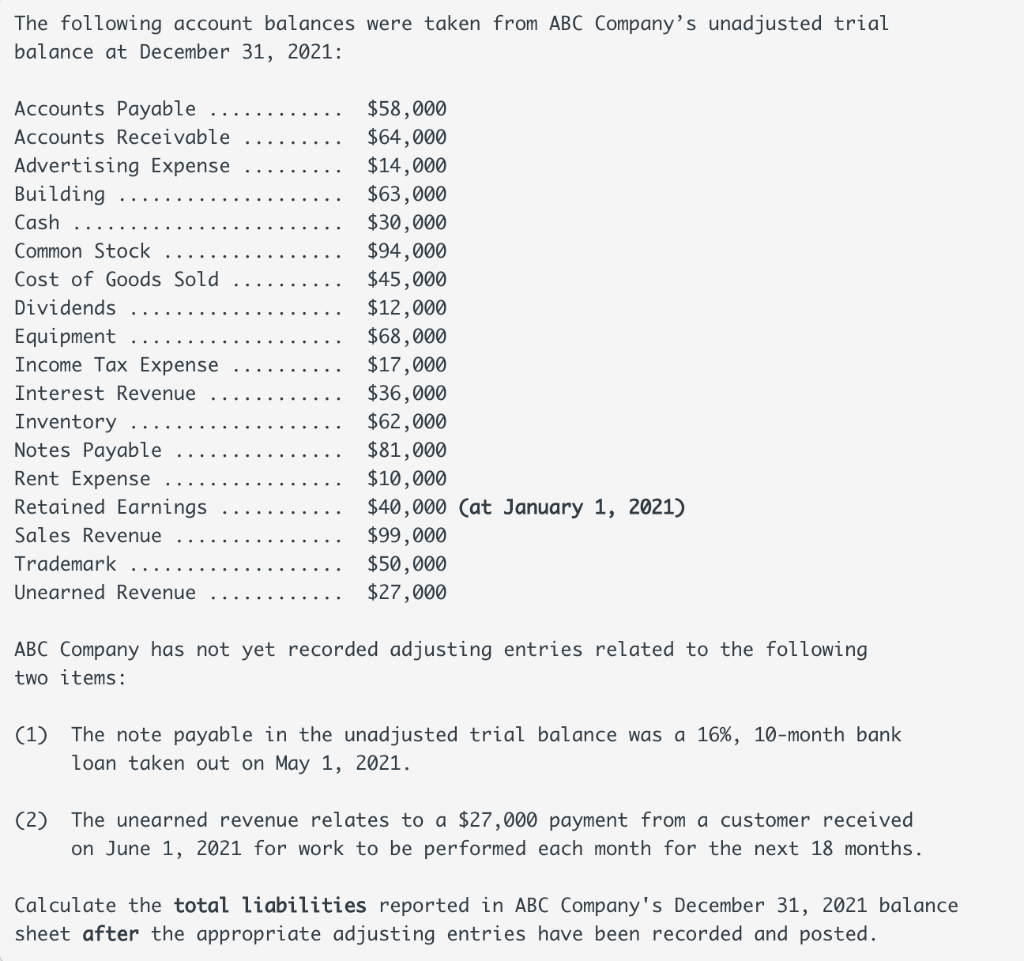

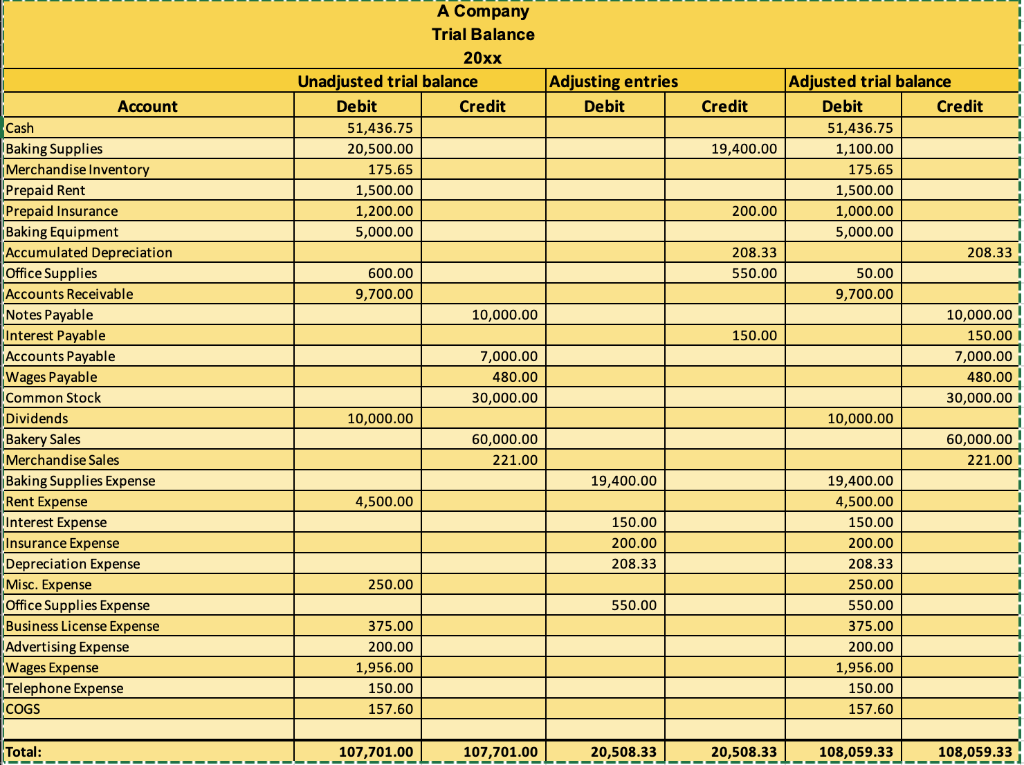

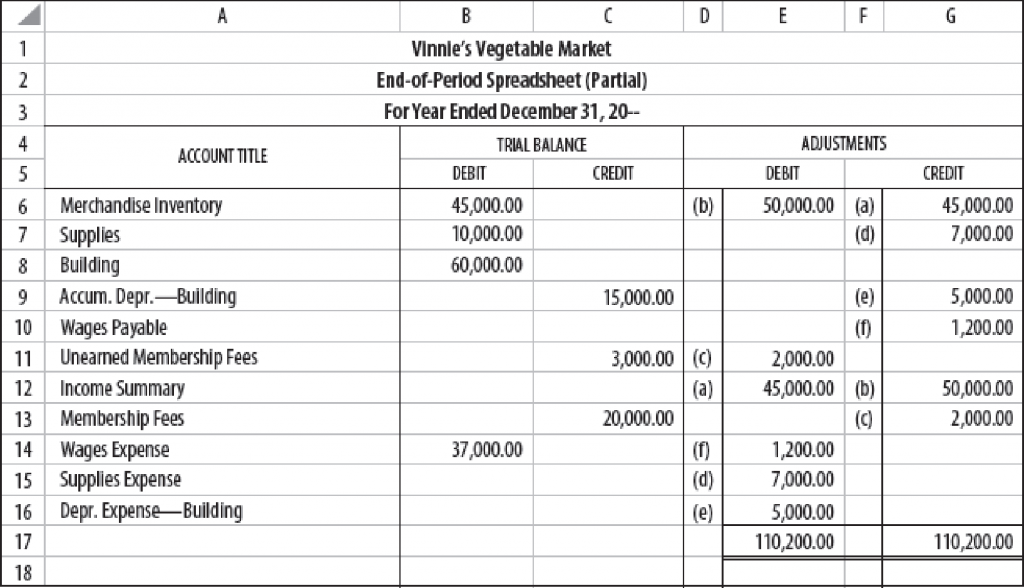

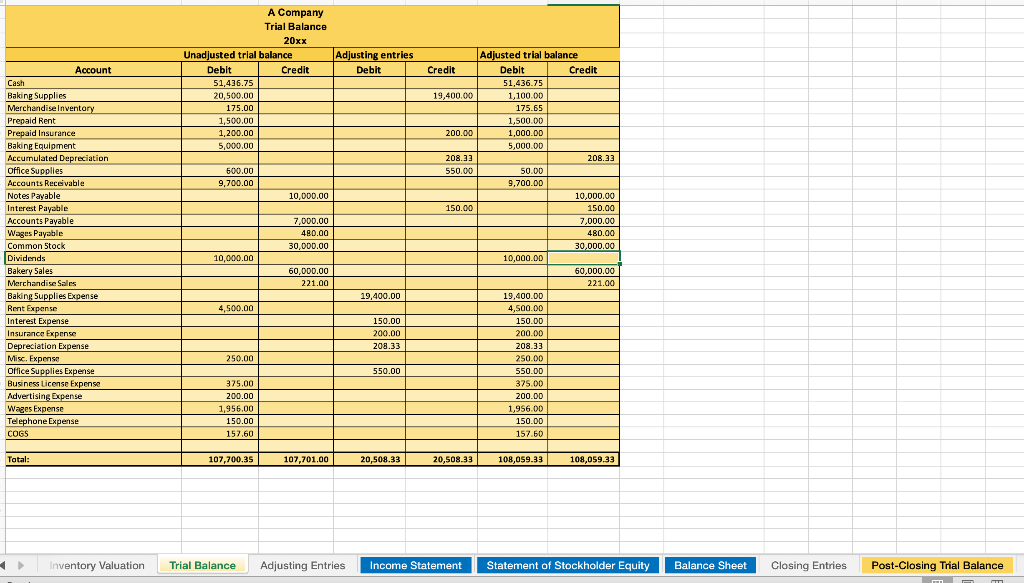

Adjusting entries are accounting journal entries that are to be made at the end of an accounting period. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. Adjusting entries are crucial to ensure the correct balance and correct.

One important accounting principle to remember is. If adjusting entries are not made, those statements, such as. Each adjusting entry has a dual purpose:

(1) to make the income statement report the proper revenue or expense and (2) to make the balance sheet report the proper asset. In other words, when you. C) required before financial statements are prepared.

Adjusting entries are accounting journal entries that convert a company's accounting records to the accrual basis of accounting.