Outstanding Tips About Cash Flow From Investing Activities Example Statement Of Functional Expenses

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

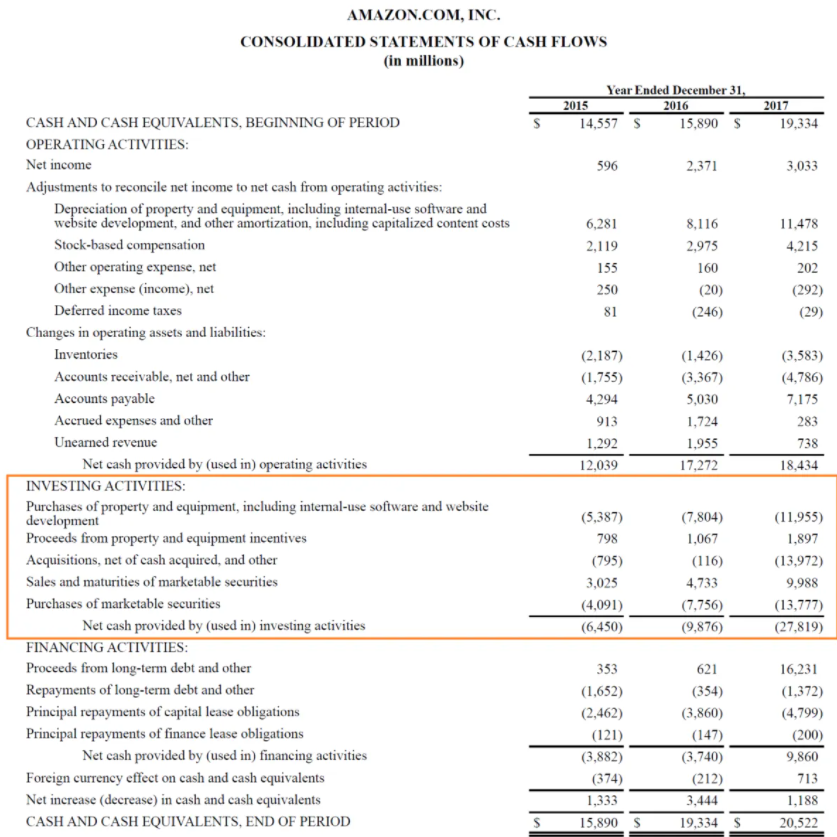

Before analyzing the different types of positive and negative cash.

Cash flow from investing activities example. Considering that your business’s reported. Cash flow from operating activities , cash flow from investing activities , and cash flow from financing activities. Here are some examples of investment activities to track.

The md&a section of apple's annual report provides a detailed explanation of the company's financial performance, its cash flows from operating, investing, and financing activities, and the factors that have. Cash from financing activities explains how a firm raises money and covers the return of the cash raised to investors. Cash flow from investing activities (cfi) is one of the three sections presented on your company’s cash flow statement, alongside cash flow from operations and cash flow from financing activities.

The format of a cash flow statement is as follows: As an example, let's say a company has the following information in the financing activities section of its cash flow statement: Definition of investing activities investing activities often refers to the cash flows from investing activities, which is one of the three main sections of the statement of cash flows (or scf or cash flow statement).

The main components of the cfs are cash from three areas: Cash flow from investing activities refers to cash inflow and outflow of cash from investing in assets (including intangibles), purchasing of assets like property, plant and equipment, shares, debt, and from sale proceeds of assets or disposal of shares/debt or redemption of investments like a collection from loans advanced or debt issued. How does cash flow from investing activities work?

What are some examples of investing activities? $1,000,000 (cash outflow) proceeds from. Let us take an example to understand the calculation of cash flows from investing activities:

Operating activities, investing activities, and financing activities. Let’s look at the various types of investing activities: Company a buys a new plant for $800 million in year 1.

You can show the first operating activities, in center investing activities and last financial activities. The sum of all three results in the net cash flow of the company for the year. The two methods of calculating cash flow are the direct method and.

Overall, the cash flow statement provides an account of the cash used in operations,. Cash flow from operating activities Cash flow from operating operations, cash flow from investment activities, and cash flow from financing activities.

A statement of cash flows typically breaks out a company's cash sources and uses for the period into three categories: However, cash payments to manufacture or acquire assets held for rental to others and subsequently held for sale as described in paragraph 68a of ias 16 property, plant and equipment are cash flows from operating activities. The cash flows from investing activities line item is one of the more important items on the statement of cash flows, for it can be a substantial source or use of cash that significantly offsets any positive or negative amounts of cash flow generated from operations.

So what is considered to be investing activities? Let’s look at an example of what investing activities include. Most people are obsessed with the idea of owning a personal home.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)