Looking Good Info About Preparation Of Trial Balance Is Connected With Cash Flow Statement Net Profit Before Tax

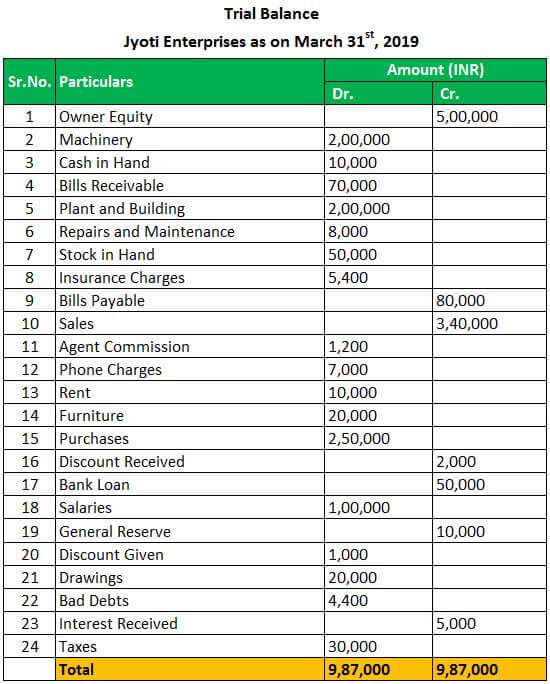

General rules for preparing the trial balance are:

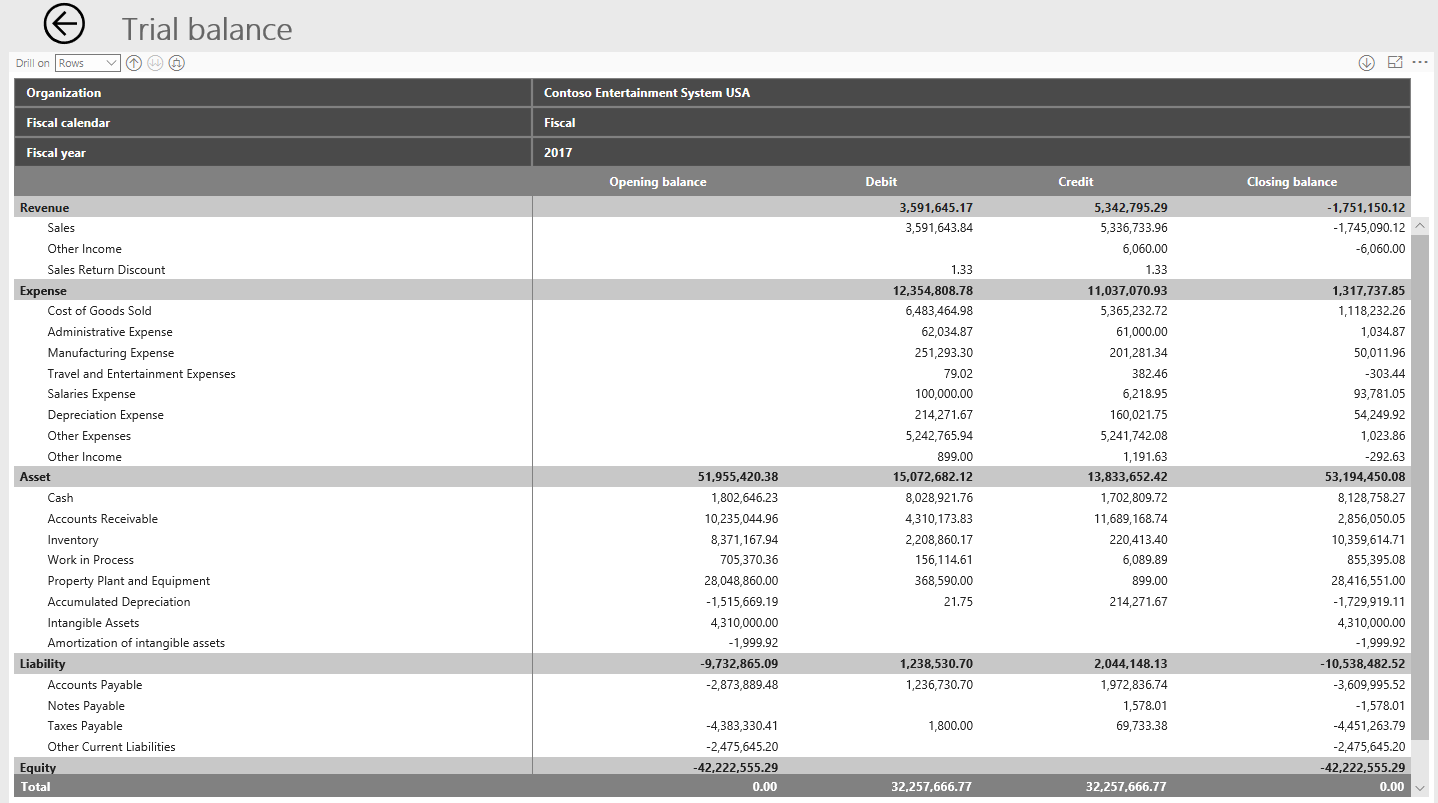

Preparation of trial balance is connected with. You can prevent many of these mistakes by relying on a trial balance to keep track of your financial transactions. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. On the trial balance the accounts should appear in this order:

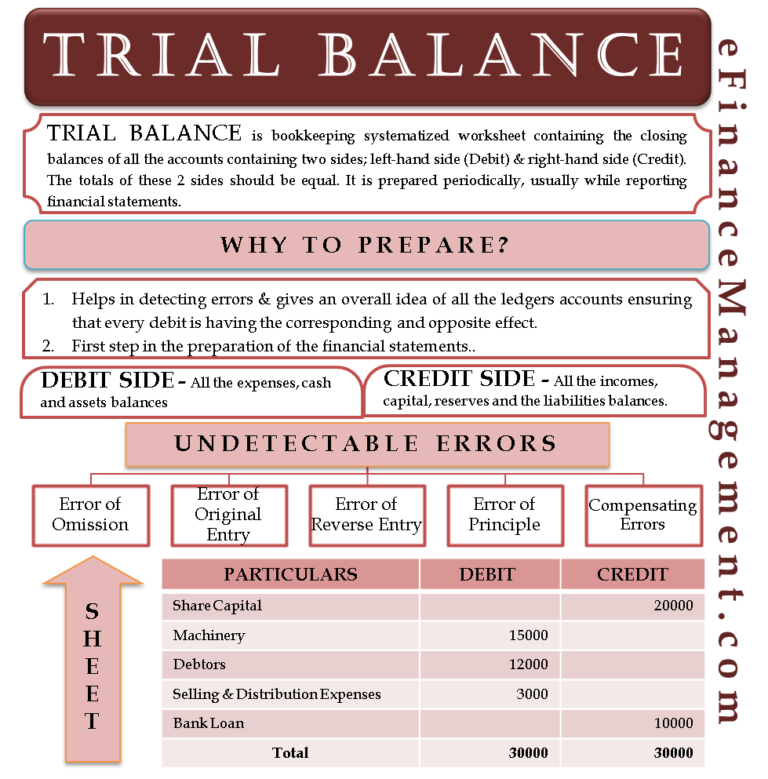

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other. What are the methods of preparing trial balance? A trial balance is a financial report that lists a company's general ledger accounts closing balances at a certain period.

Let us take a look at the steps in the preparation of trial balance. A trial balance can help a company detect some types of errors and make adjustments to the trial balance and accounting ledgers before the books are closed for the accounting period and financial statements are prepared. Rerun the trial balance after making adjusting entries and again after making closing entries.

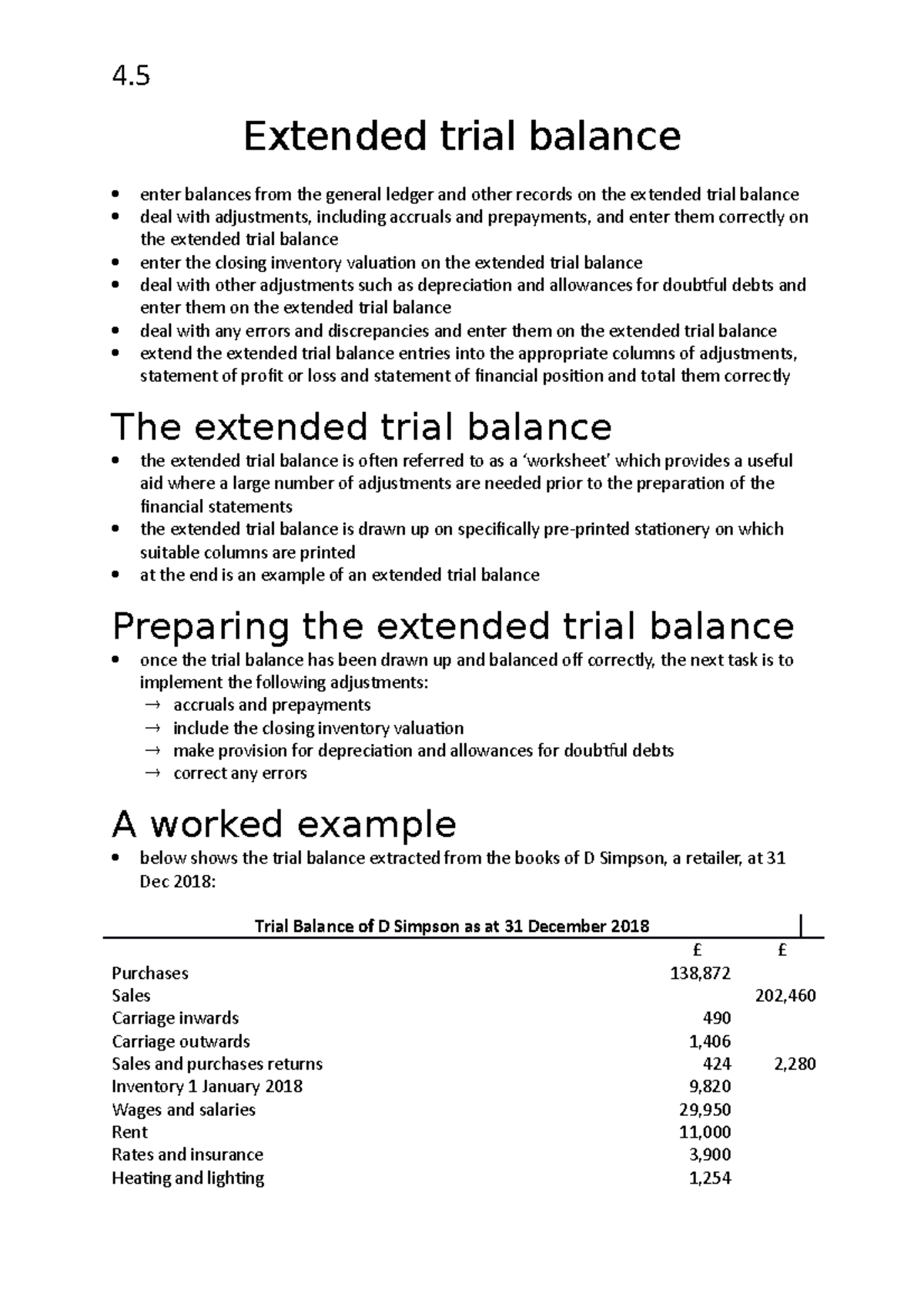

The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses , gains, and. These cover the initial entries into the spreadsheet.

Preparation of trial balance is the third step in the accounting process. To prepare a trial balance, follow these steps: The main objective of preparing a trial balance is to detect the mathematical accuracy of the ledger balances.

The trial balance is prepared using a loose sheet of paper. It includes the calculation of debit and credit accounts separately. However, trial balances are mostly prepared at the end of an accounting period.

Typically, trial balance is prepared at the end of an accounting year. For every debit entry, there is. 2 objectives of preparing a trial balance 2.1 to ensure arithmetical accuracy 2.2 to identify accounting entry errors 2.3 to facilitate the preparation of final accounts 2.4 to facilitate comparison and analysis 2.5 to prepare budget 3 trial balance preparation 3.1 total method 3.2 balance method 4 example of trial.

Assets, liabilities, equity, dividends, revenues, and expenses. It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct. The preparation of a trial balance helps consolidate, verify, and rectify journal entries, shaping tax.

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. Although you can prepare a trial balance at any time, you would typically prepare a trial balance before preparing the financial statements. A trial balance is a sheet recording all the ledger balances categorized into debit and credit.

However, a business may choose to prepare the trial balance at the end of any specific period. All liabilities and incomes are ——credit. What is a trial balance?

![Procedure for Preparing a Trial Balance [Notes with PDF] Trial Balance](https://everythingaboutaccounting.info/wp-content/uploads/2020/01/Procedure-for-Preparing-a-Trial-Balance-1-1024x536.png)