Amazing Info About Healthy Balance Sheet Ratios Spa Annual Report

Balance sheet ratios are the ratios that.

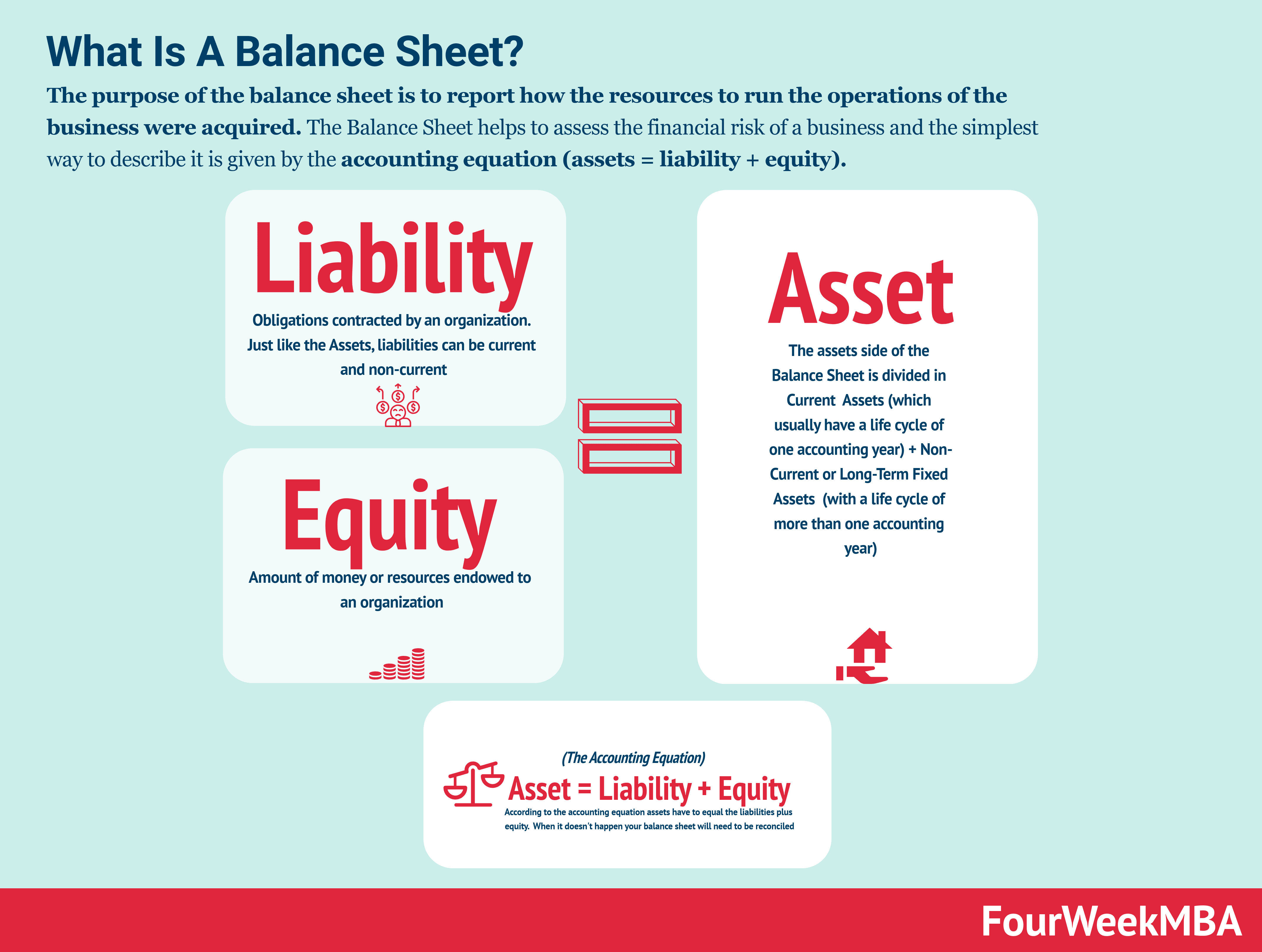

Healthy balance sheet ratios. Assets = liabilities + equity to summarize, we can state that your balance sheet provides a glimpse into the future and the current financial health of your business. It indicates the overall operational performance of the company. This article will explain the basics of balance sheets and how to interpret them.

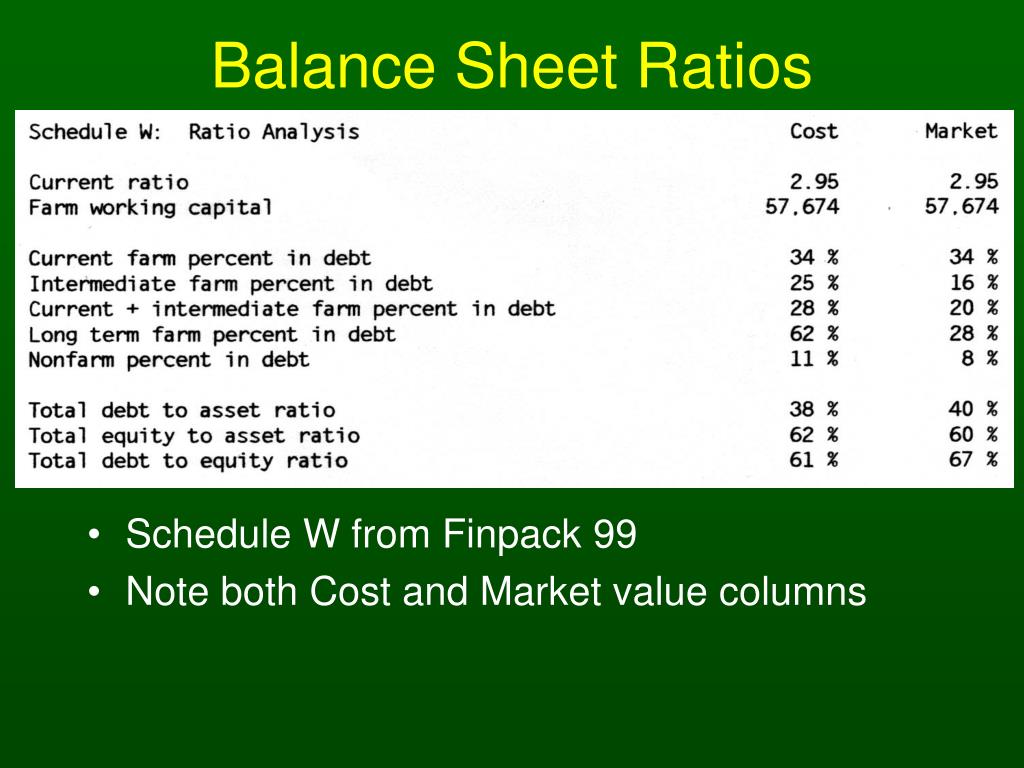

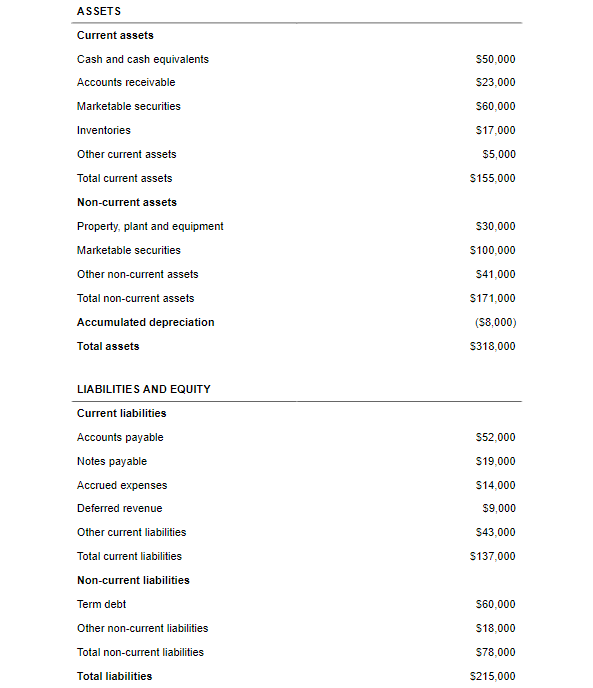

The analysis goes over various sections of wef’s balance. Balance sheet ratios formula and example definition. Balance sheet ratios are formulas you can use to assess your finances based on your balance sheet information.

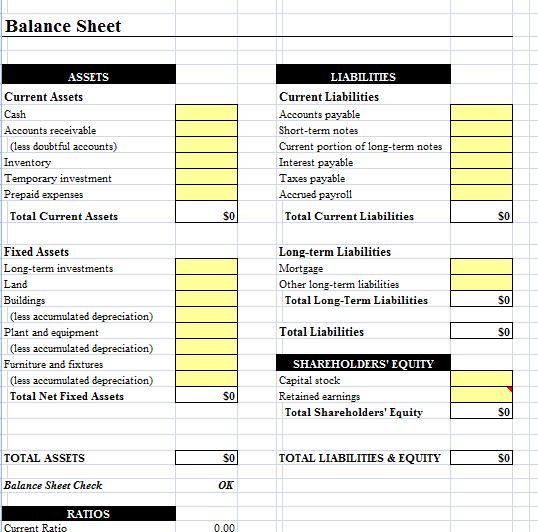

Every business has three financial statements: Entrepreneurs who believe that all they need to know about their companies’ finances is revenue and expenses are fooling themselves. Here are a few ratios to consider:

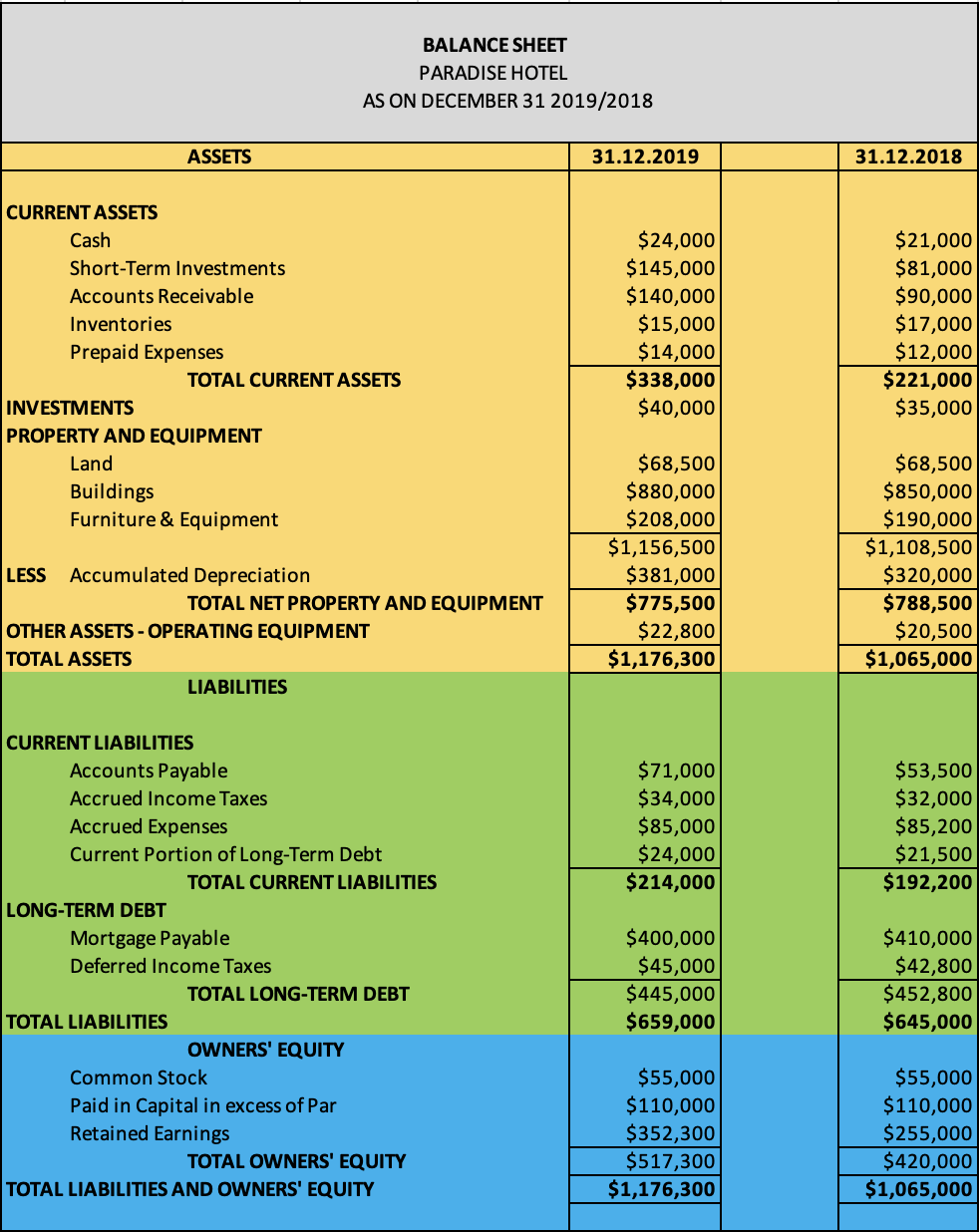

Having a healthy balance sheet also involves having adequate capital for your business. Quick ratio = quick assets / current liabilities. The 20 best balance sheet ratios, formulas, and metrics to analyze a company's health and discover undervalued stocks.

Here are my favorite financial ratios or formulas for balance sheets with detailed instructions on how to use them. Ratio analysis of the balance sheet is a good first step in determining the health of the underlying business. Quick assets = $140,000 + 250,000 + 300,000 = $690,000.

Key ratios for a healthy balance sheet nvsi team business it’s an outdated concept: 20 balance sheet ratios to help you determine the financial health of a company & includes a pdf download. Current liabilities = $300,000 + 40,000 + 20,000 = $360,000.

Analyze the balance sheet the balance sheet is a statement that shows a company’s financial position at a specific point in time. Calculate the quick ratio from the balance sheet shown below. Stephanie cheung · follow published in zetl · 5 min read · may 17, 2021 every company has a balance sheet.

The latest balance sheet data shows that lonza group had liabilities of chf2.76b due within a year, and liabilities of chf4.57b falling due after that. According to the last reported balance sheet, fastenal had liabilities of us$661.3m due within 12 months, and liabilities of us$452.8m due beyond 12 months. It determines a company’s level of indebtedness, in other words, the proportion of its assets that is owned by its creditors.

What does a healthy balance sheet look like? The income statement, cash flow statement, and the balance sheet. So it can boast us$194.8m more liquid assets than.

A detailed reading of the balance sheet is incomplete without quantitative analysis. After all, that’s what analysts, proprietary traders, and institutional investors do. Balance sheet ratios use balance sheet ratios to further understand your business’s financial standing.

![What does a 'healthy' balance sheet look like? [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/What does a healthy balance sheet look like-1.png?width=1250&name=What does a healthy balance sheet look like-1.png)

![Download [Free] Balance Sheet with Ratios Format in Excel](https://exceldownloads.com/wp-content/uploads/2021/09/Balance-Sheet-Template-Feature-Image.png?v=1685413421)