Top Notch Info About Unadjusted Trial Balance Accounting Lupin Sheet

What is an unadjusted trial balance in accounting?

Unadjusted trial balance accounting. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. Refresh the general ledger tab to ensure proper posting of jes. How does it differ from the adjusted trial balance?

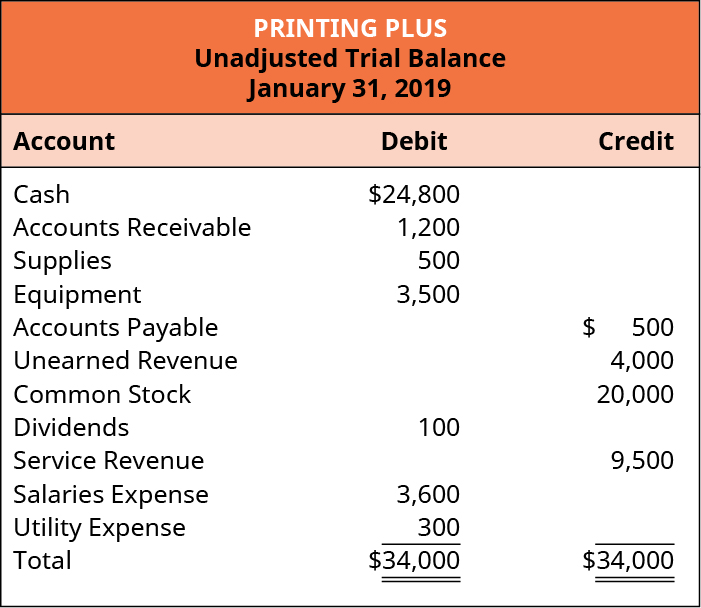

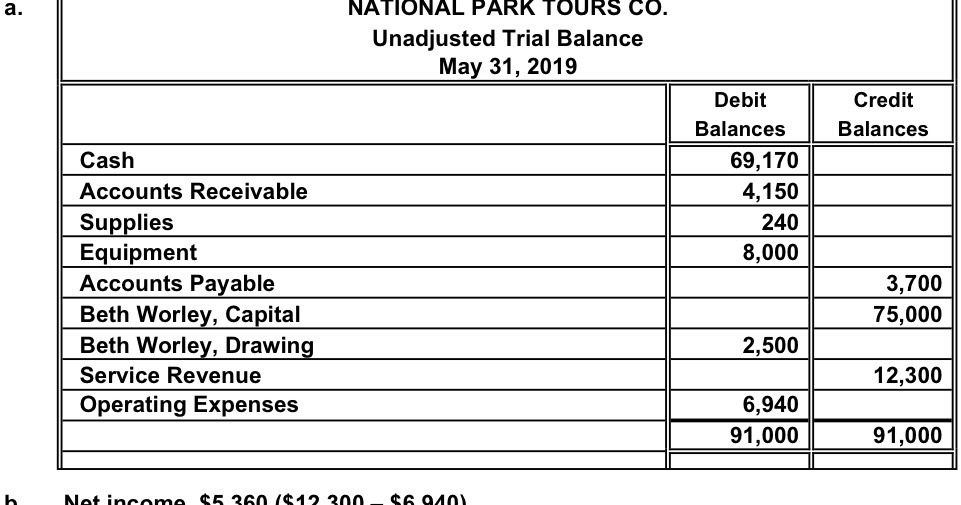

That is why this trial balance is called unadjusted. In this section, we are going to revisit neatniks’ october unadjusted trial balance. It serves as an intermediary step in the accounting cycle and is prepared at the end of an accounting period, typically at the end of a month or a year.

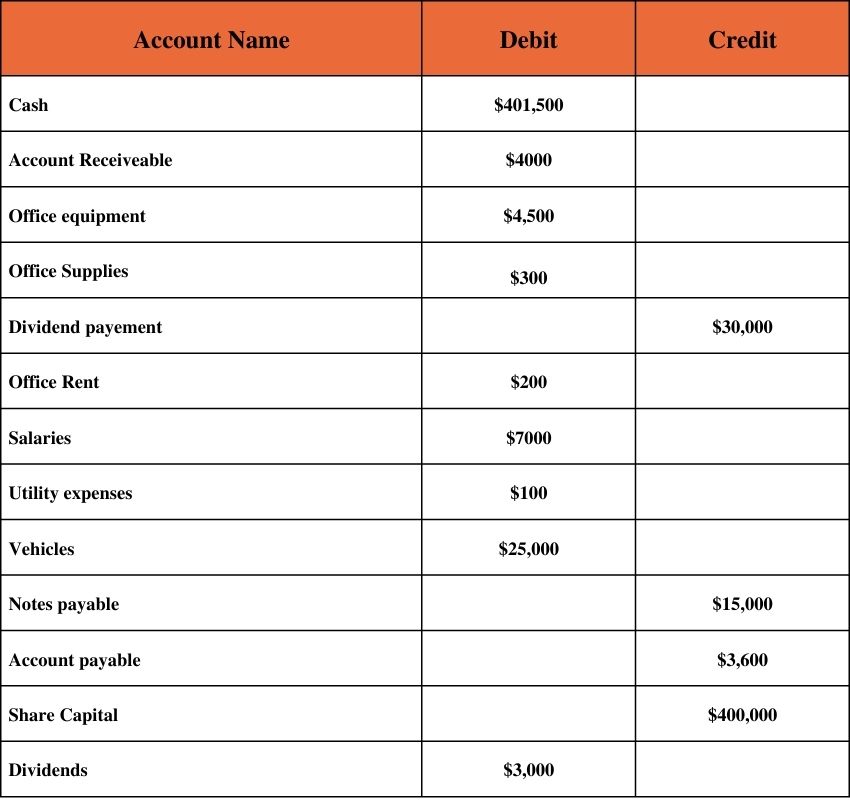

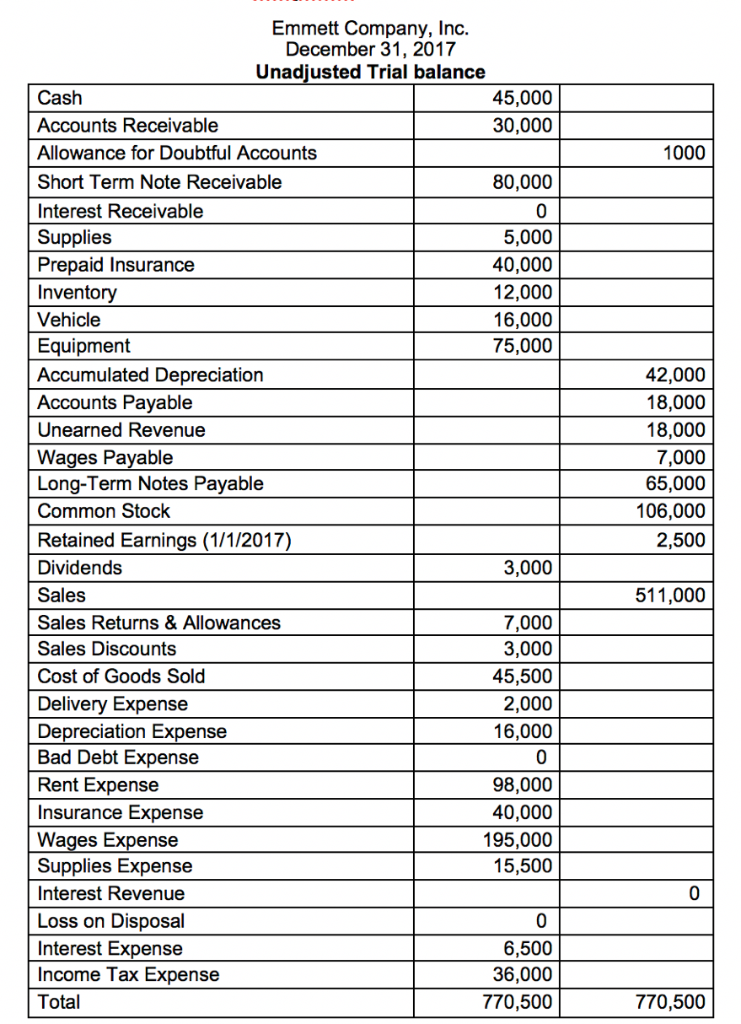

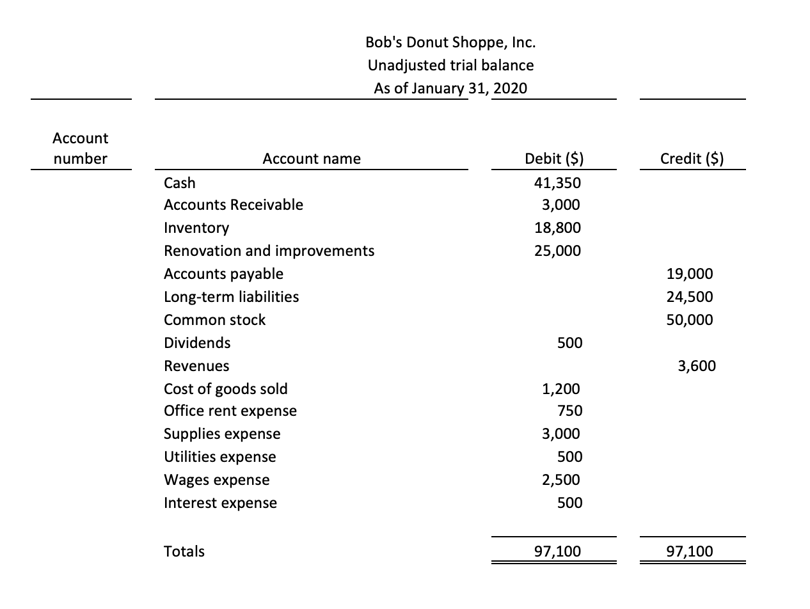

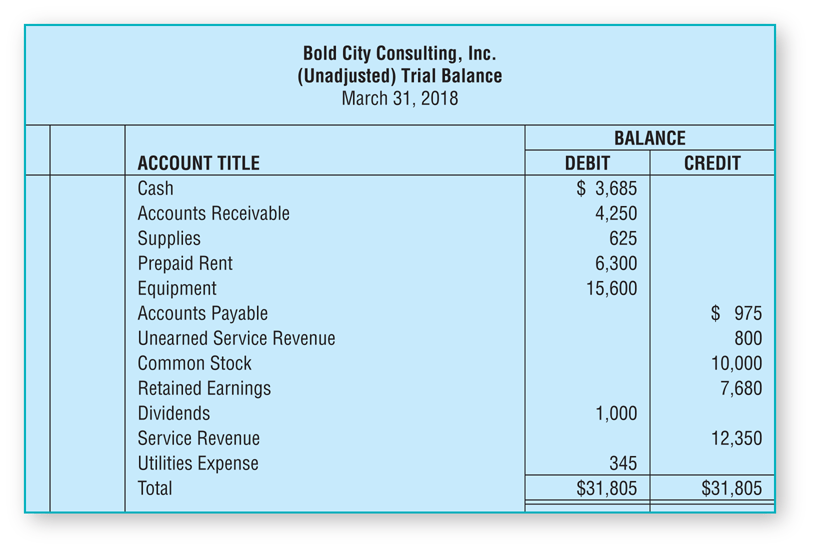

The unadjusted trial balance (utb) document summarizes all of the accounts in an organization at a single point or period. Preparing an unadjusted trial balance is the fourth step in the accounting cycle. An unadjusted trial balance is a list of all the company’s accounts and the balances in each account before any adjustments to the financial statements are made.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. It helps you detect errors and analyze company accounts. The unadjusted trial balance is the listing of general ledger account balances at the end of a reporting period, before any adjusting entries are made to the balances to create financial statements.

In other words, a trial balance which is prepared at the first instance before making any sort of adjustments in the record is called an unadjusted trial balance. Creating the adjusted trial balance. The unadjusted trial balance is the preliminary trial balance report or document that lists all ending balances or totals of accounts to determine if total debits and credit balances for account totals in the general ledger are equal.

It will include all revenue, expenses, and assets. Journalize adjusting entries using information provided for. Since, in double entry accounting we record each transaction with equal debit and credit effect, therefore the total of debit and credit balances of the trial balance are always equal.

An unadjusted trial balance is a list of all the general ledger balances without making any adjustment entries. Any difference shall indicate some mistake in the. An unadjusted trial balance is only used in double entry bookkeeping, where all account entries must balance.

It helps to confirm that all debits are equal to credits and identify any errors. It is a starting point for analyzing account balances and adjusting entries. This is the third step in the accounting cycle.

Accountants create an unadjusted trial balance to check if the total debits equal the. Adjusted trial balance takes into account all necessary adjustments to ensure accurate financial statements. An unadjusted trial balance is a list of all the balances from a company’s accounting ledger before any adjusting entries are made.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. What is an unadjusted trial balance? Look for any accounts that need to be adjusted in order to bring it into compliance with gaap, run the adjusted trial balance, which will be the final check.

![Unadjusted Trial Balance [Definition + Examples]](https://crushthecpaexam.com/wp-content/uploads/2019/03/Unadjusted-Trial-Balance..png)