Unbelievable Tips About Owners Equity Statement Sample Aicpa Audit Report

We have attached the referenced examples in the excel sheet attached to this file, and in total, there are two examples in two different tabs.

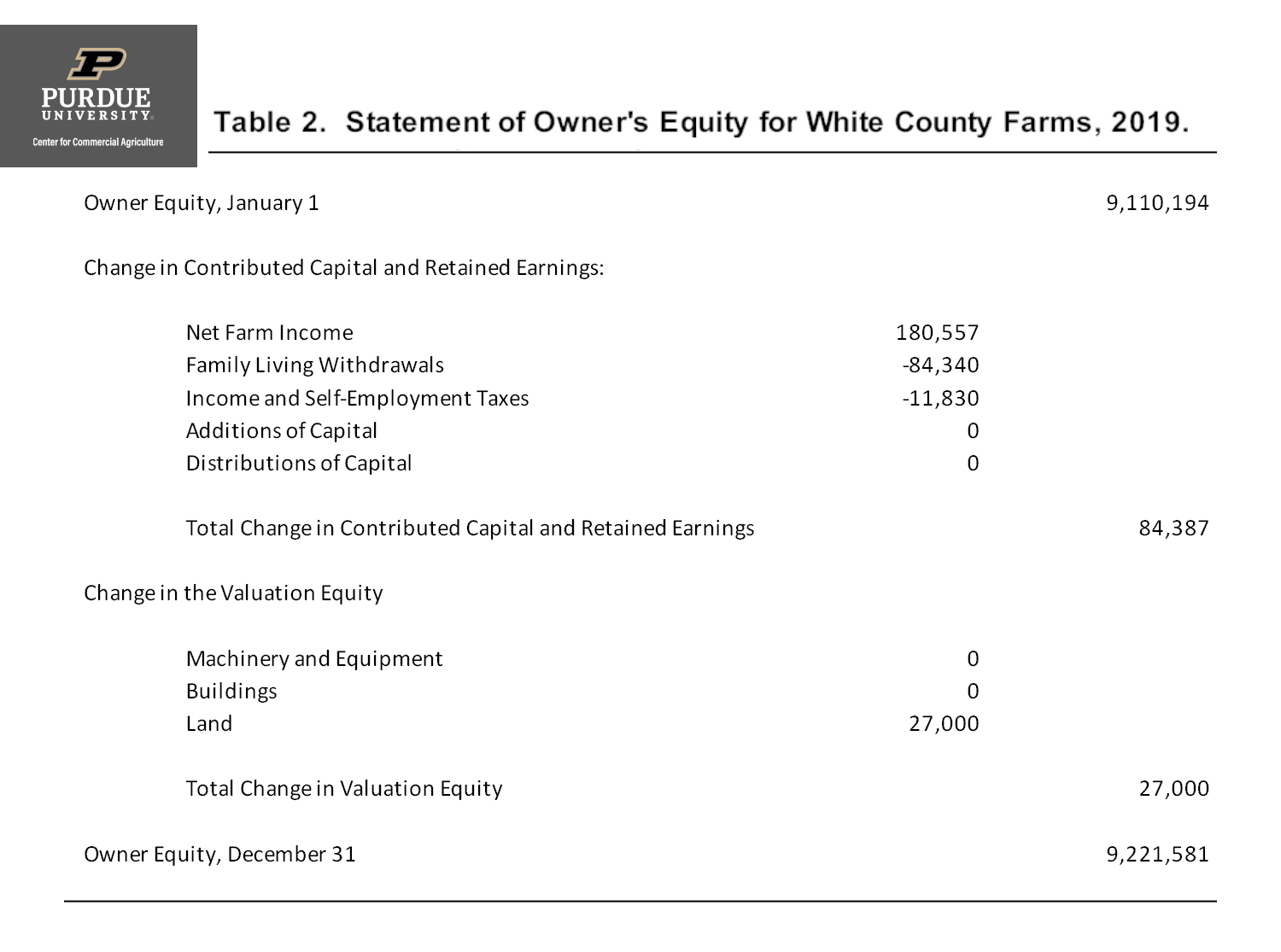

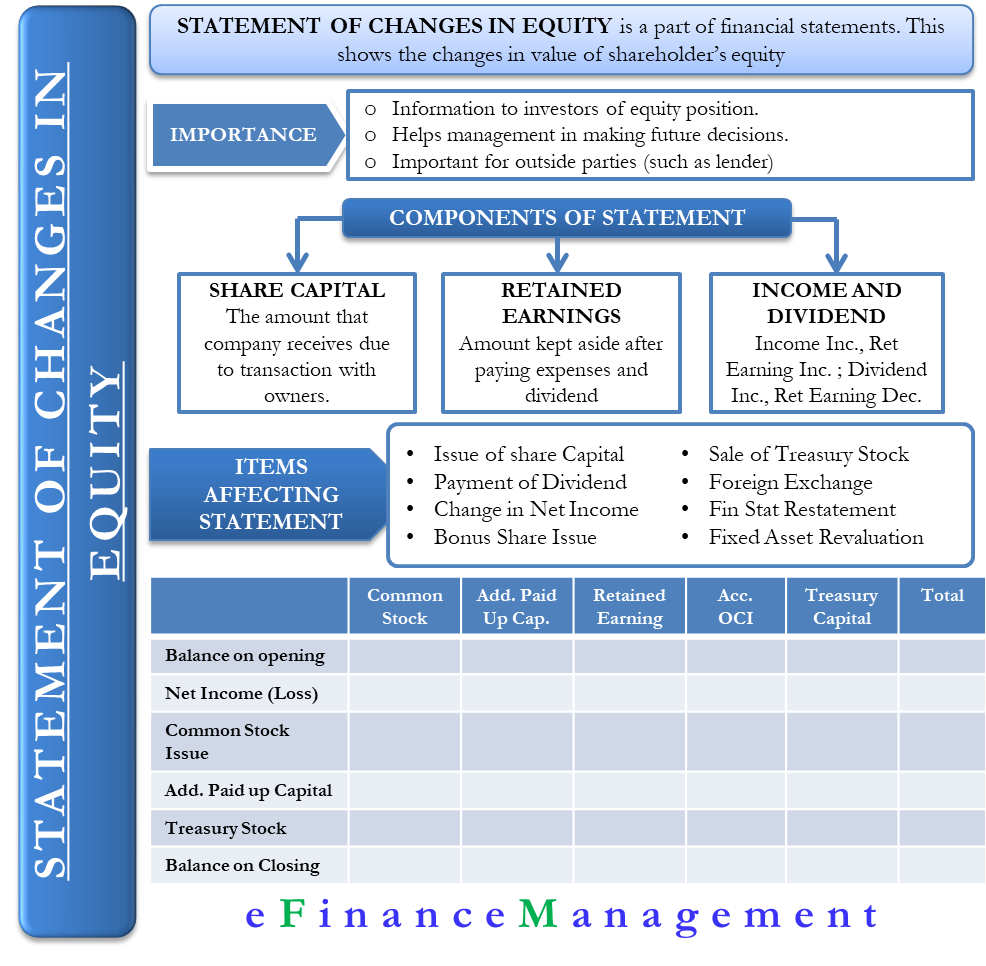

Owners equity statement sample. A statement of owner's equity helps investors understand the changes in equity value over an accounting period. Tracked over a specific timeframe or accounting period, the snapshot shows the movement of cashflow through a business. Examples of statement of owner’s equity here we will be discussing on few examples to demonstrate the concept of owner’s equity.

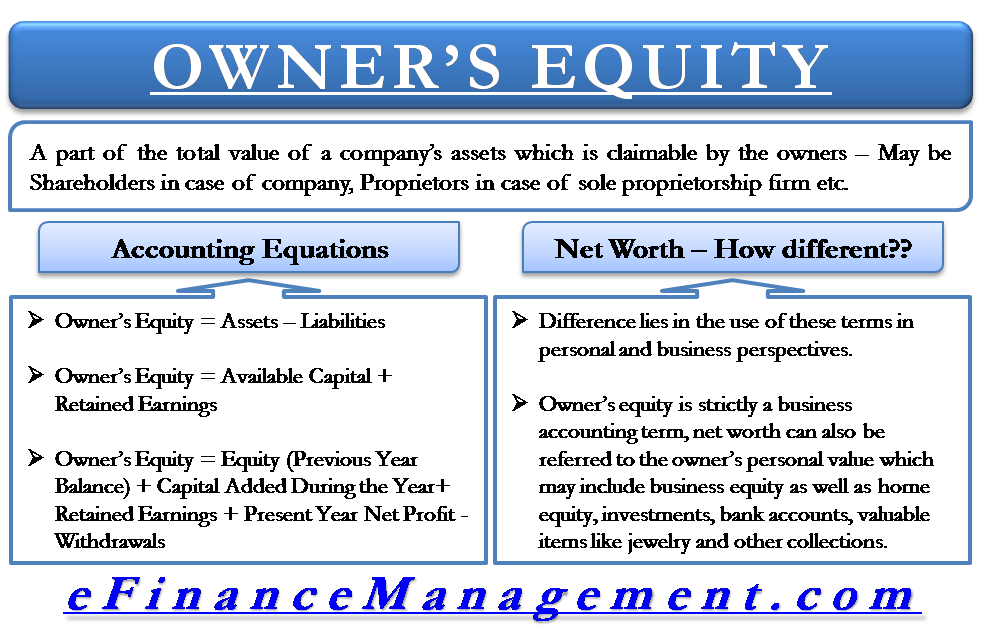

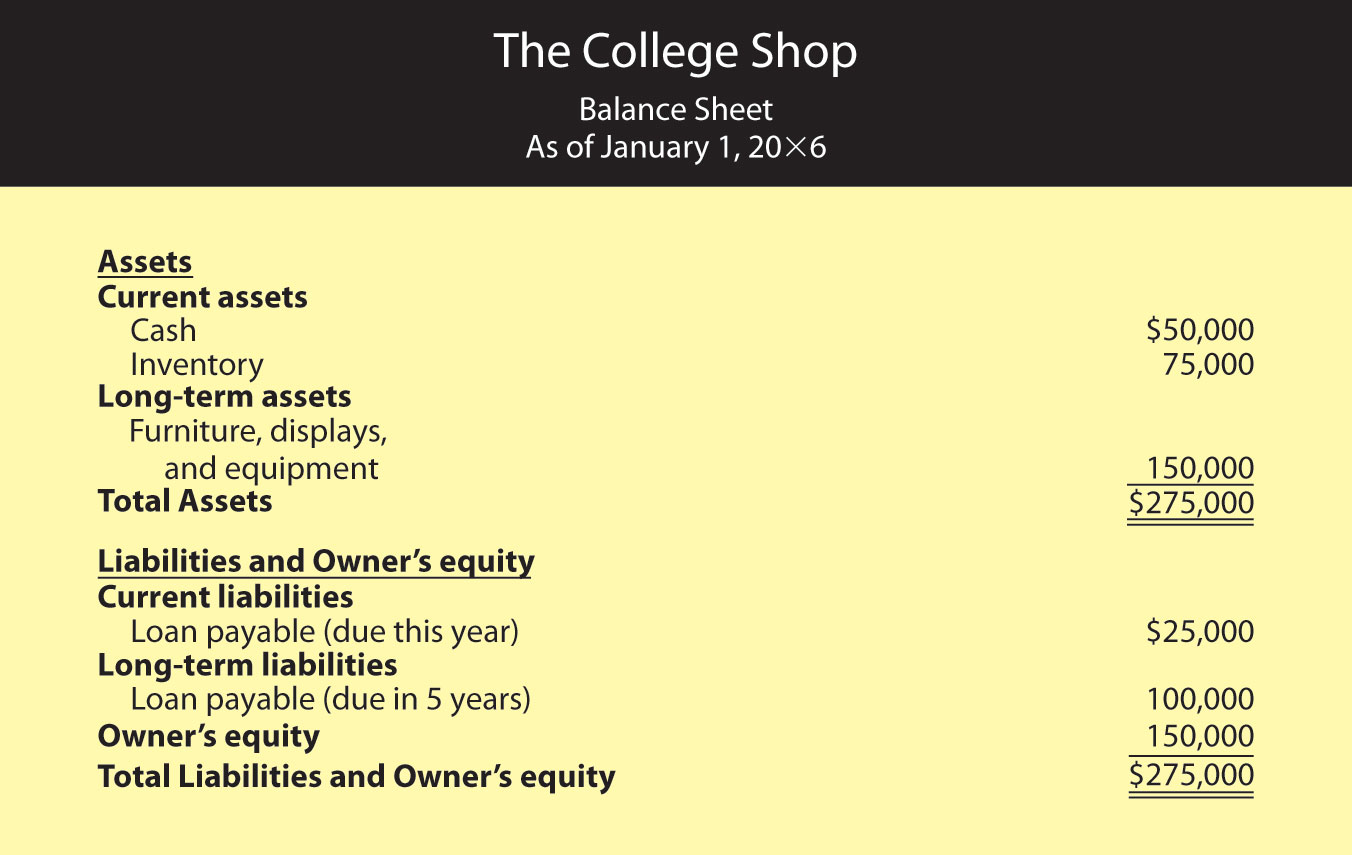

Owners equity = $9,00,000 + $3,30,000 + $4,60,000. Suppose a company’s equity accounts on january 1, 2020, the start of its fiscal year 2020, consists of the following. Whether equity has increased or decreased during the given timeframe, the owner’s equity statement serves to.

Let us take a detailed set of two for the same. Statement of owners equity example! The statement of owner’s equity shows the changes in owner’s equity over a period of time through income, additional investments, draws and prior period adjustments.

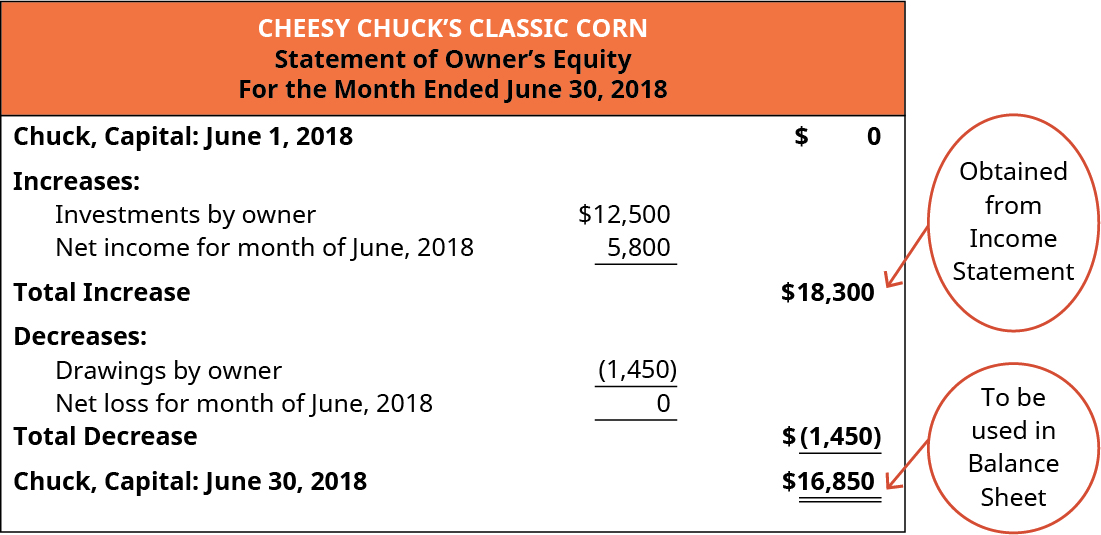

Changes in shareholders’ equity in companies. If a real estate project is valued at $500,000 and the loan amount due is $400,000, the amount of owner’s equity, in this case, is $100,000. Figure 2.12 statement of owner’s equity for cheesy chuck’s classic corn.

Additional paid in capital (apic) = $6 million. This is where owner’s equity comes in: The balance sheet contains the ending balances of the owner’s equity, but it does not help in determining the reasons behind the changes occurring in the owner’s equity accounts.

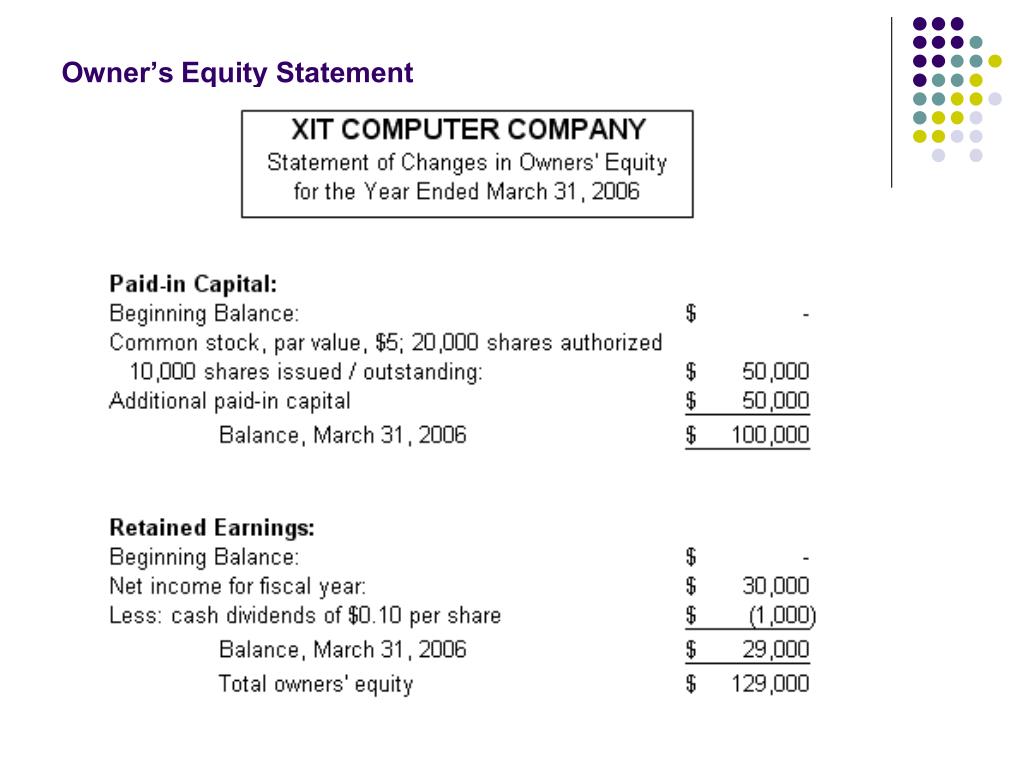

Here is a sample statement of owner's equity of a service type sole proprietorship business, carter printing services. Statement of equity: Common stock ($) = $12 million.

Note that the word owner’s (singular for a sole owner) changes to owners’ (plural, for a group of owners) when preparing this statement for an entity with multiple owners versus a sole proprietorship. For example, if a company has total assets of $1,000,000 and total liabilities of $500,000, its owner's equity would be calculated as follows: Generate statement of owner’s equity with examples.

Gather the needed information the statement of changes in owner's equity is prepared second to the income statement. The statement of owner’s equity reports the changes in company equity, from an opening balance to and end of period balance. Assume that the company started the year 2021 with $100,000 capital.

Statement of owner's equity example. The changes include the earned profits, dividends, inflow of equity, withdrawal of equity, net loss, and so on. Now let’s reflect on some examples from the point of view of shear calculation.

The statement of owner’s equity demonstrates how the equity (or net worth) of the business changed for the month of june. As fixed assets age, they begin to lose their value. Statement of owner’s equity definition:

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)