Marvelous Info About Trial Balance And Profit Loss Account Small Business Excel Template

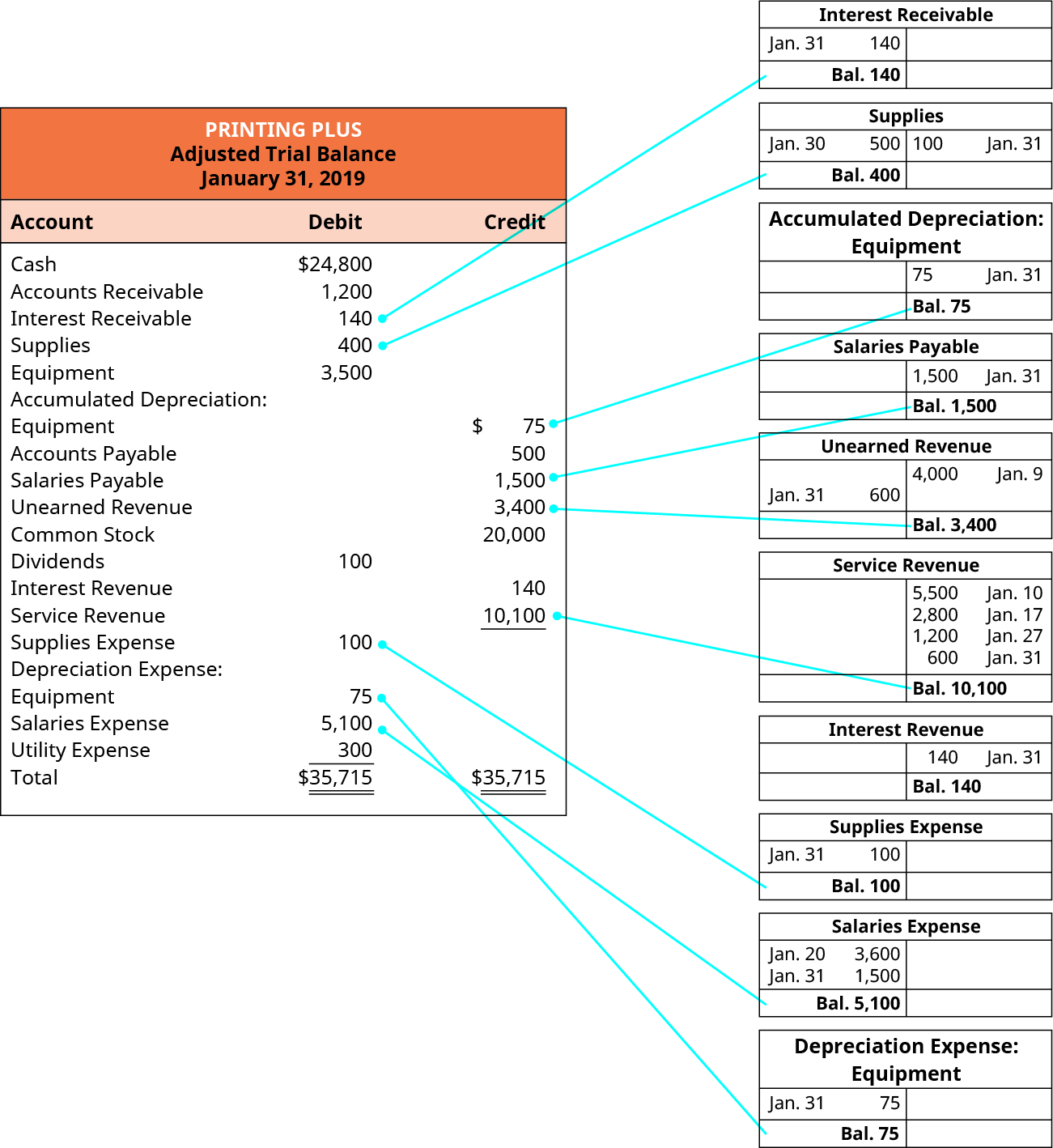

Trial balance is the first step in preparing the financial statements of any firm.

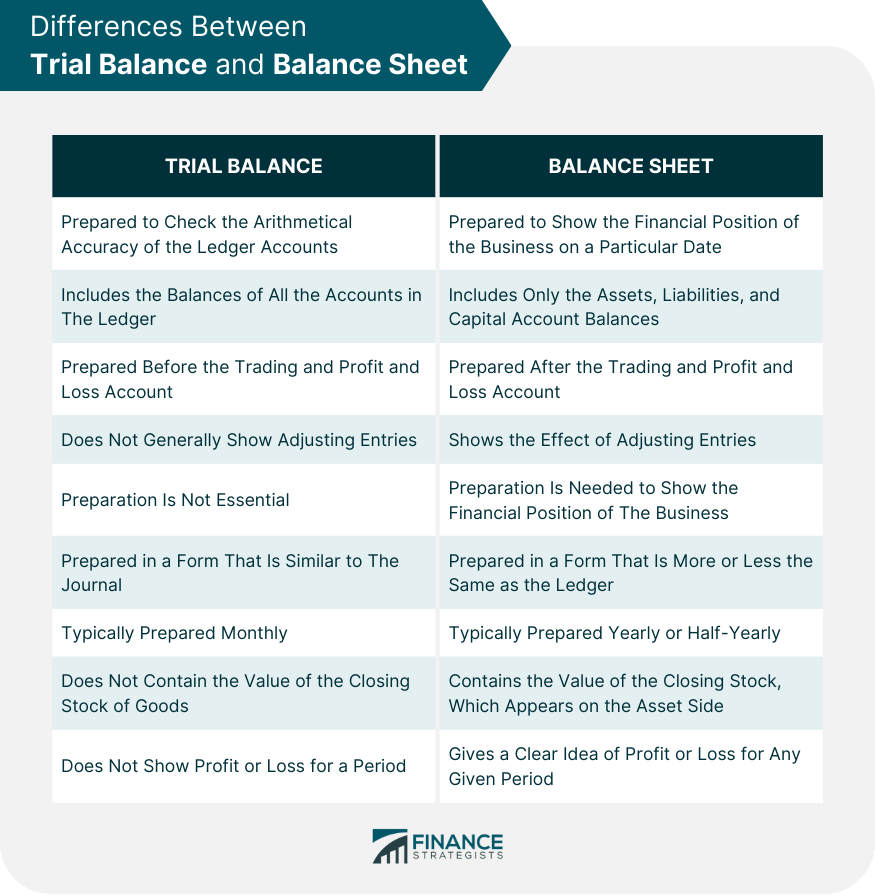

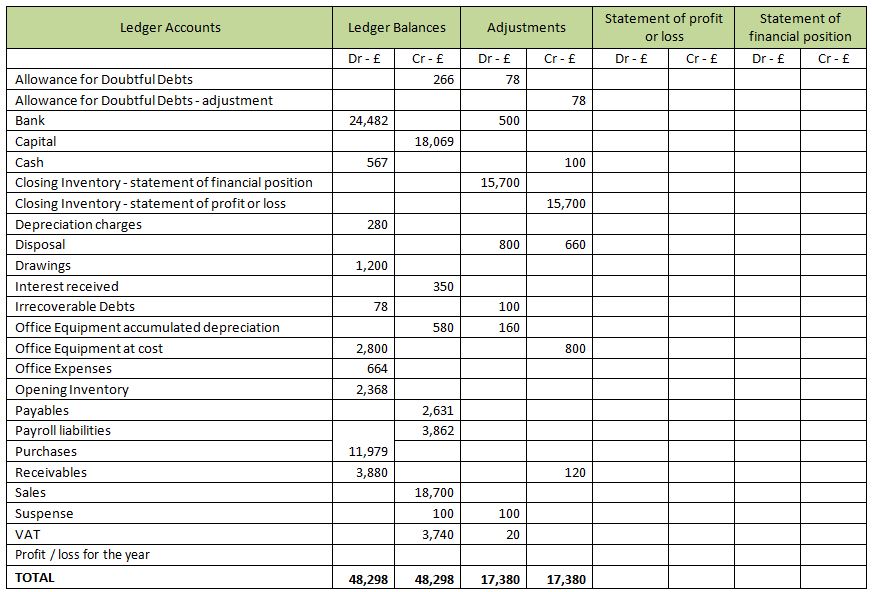

Trial balance and profit and loss account. Furthermore, a trial balance forms the basis for the preparation of the main financial statements, the balance sheet and the profit and loss account. The profit and loss account the balance sheet preparation of the profit and loss account and balance sheet the advantages of financial statements. Using the above p&l example, we can make the.

The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses ,. (iii) bad debts ₹ 6,000 and provision for bad and doubtful debts to 5% on debtors. Although a trial balance may equal the debits and credits, it does not mean the figures are correct.

The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. A company prepares a trial balance. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

Balance sheet vs profit & loss account A profit and loss (p&l) account shows the annual net profit or net loss of a business. A profit and loss account is an account that shows the revenue and expenses of the firm from business operations during a financial year.

Such statements provide an ongoing record of a company's. (i) closing stock ₹ 6,40,000. The accounts included are the bank, stock, debtors, creditors, wages, expense codes and sales.

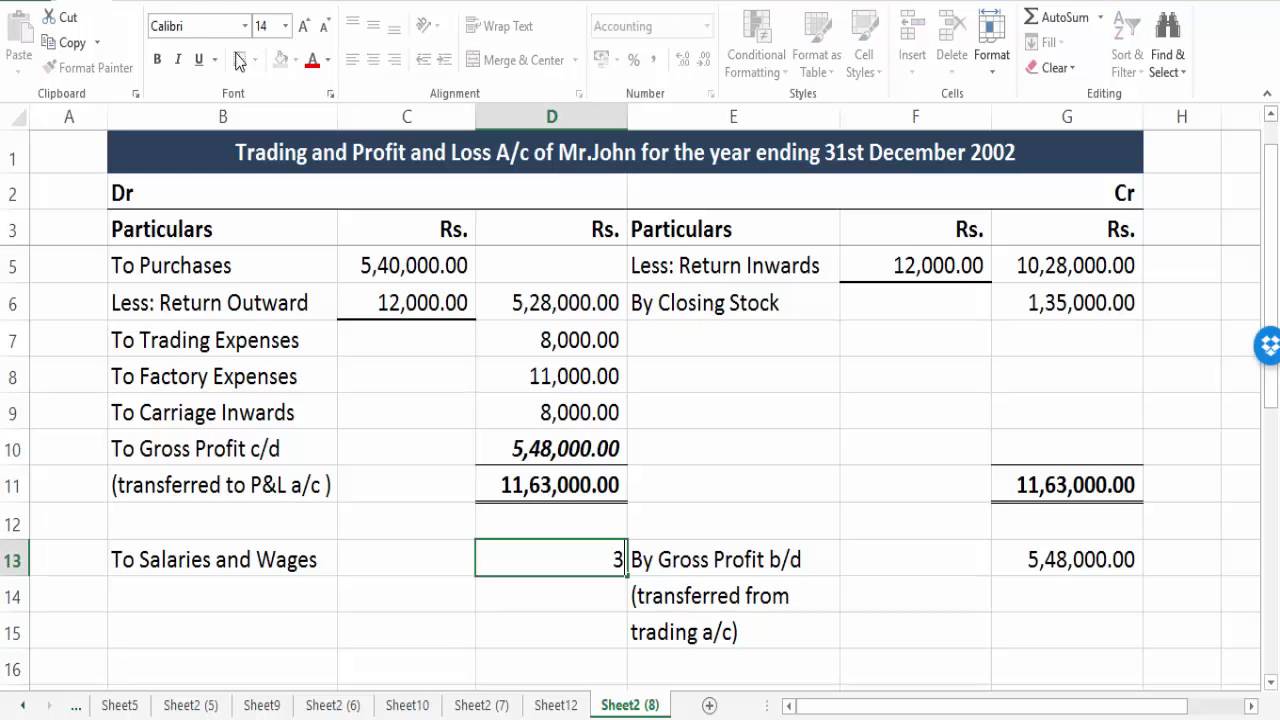

Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. Prepare trading and profit and loss account and balance sheet from the following trial balance and information as on 31st march, 2019:adjustments:i closing stock was valued at र 1,12,500.ii commission include チ 1,200 being commission received in advance. Below is a profit and loss account example in the uk for a period of a year.

Byju's answer standard x mathematics vat prepare tradi. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal.

Balancing profit and loss account. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate. We proceed with preparing other financial statements, such as profit and loss accounts, balance sheet, etc., by using trial balances.

From the following trial balance of m/s arjun and sons as on 31st march, 2018, prepare trading and profit and loss account and balance sheet: Dr trading account or profit & loss account cr expense account (i.e close the respective expense account) the following illustration will help demonstrate how to prepare the both trading, profit and loss account and the balance sheet at the end of the financial period. This statement comprises two columns:

(iv) rent is paid for 11 months. This will involve adjusting for the following items: 7.1 the profit and loss account