Fine Beautiful Info About Bad Debts In Cash Flow What Is The Main Purpose Of A Balance Sheet

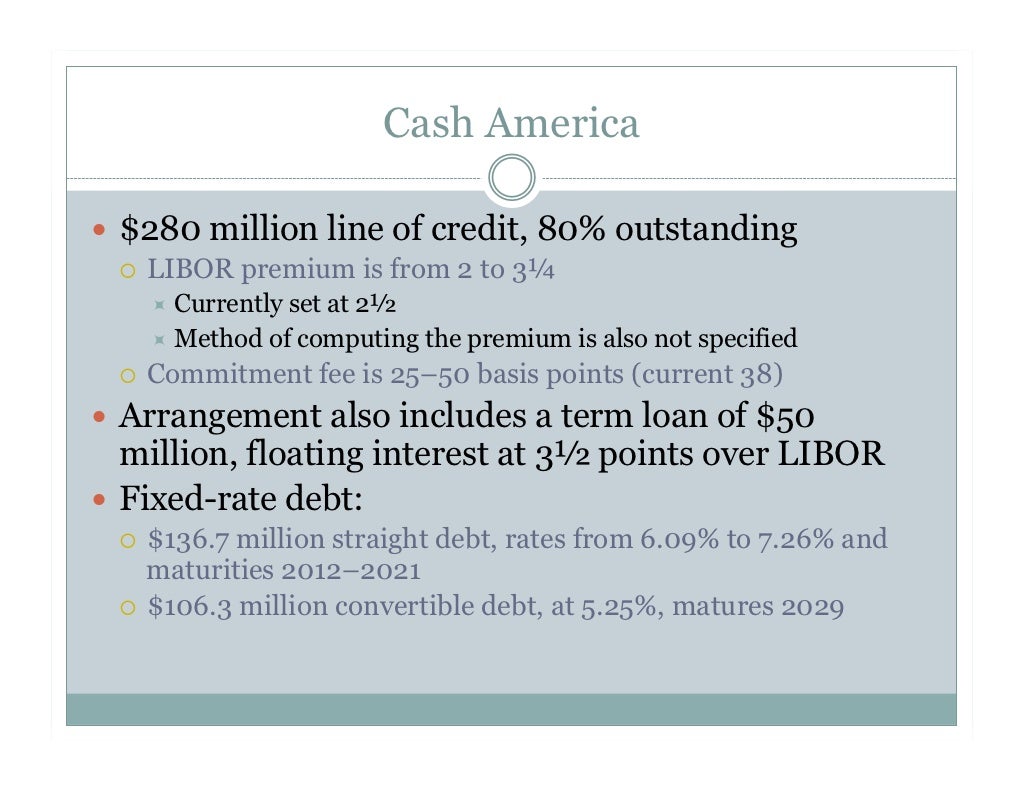

This ratio is a type of coverage ratio and can be used to.

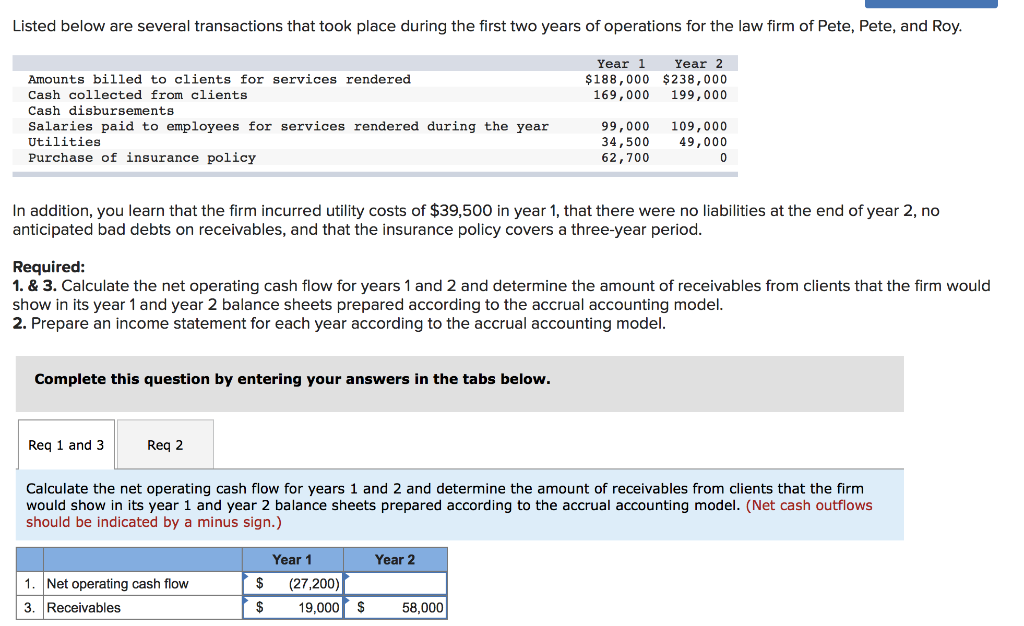

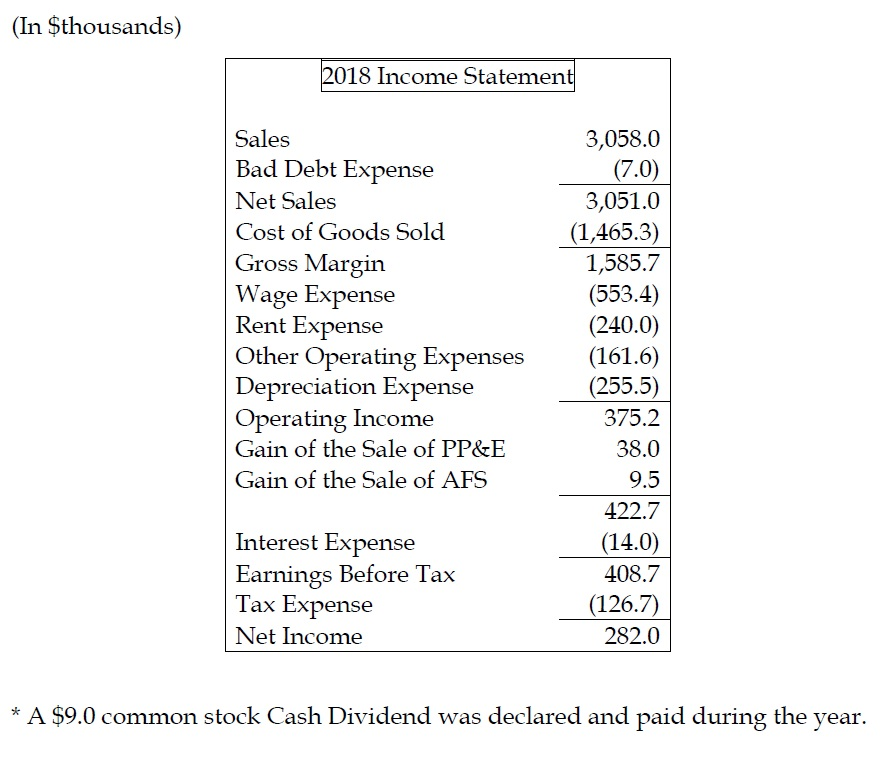

Bad debts in cash flow. Writing bad debts off is usually preferable as this allows companies to immediately deduct the loss from their taxes and remove them from the balance sheet. You see, bad debts are not an actual flow of cash. So, the bad debt expense will be estimated as follows:

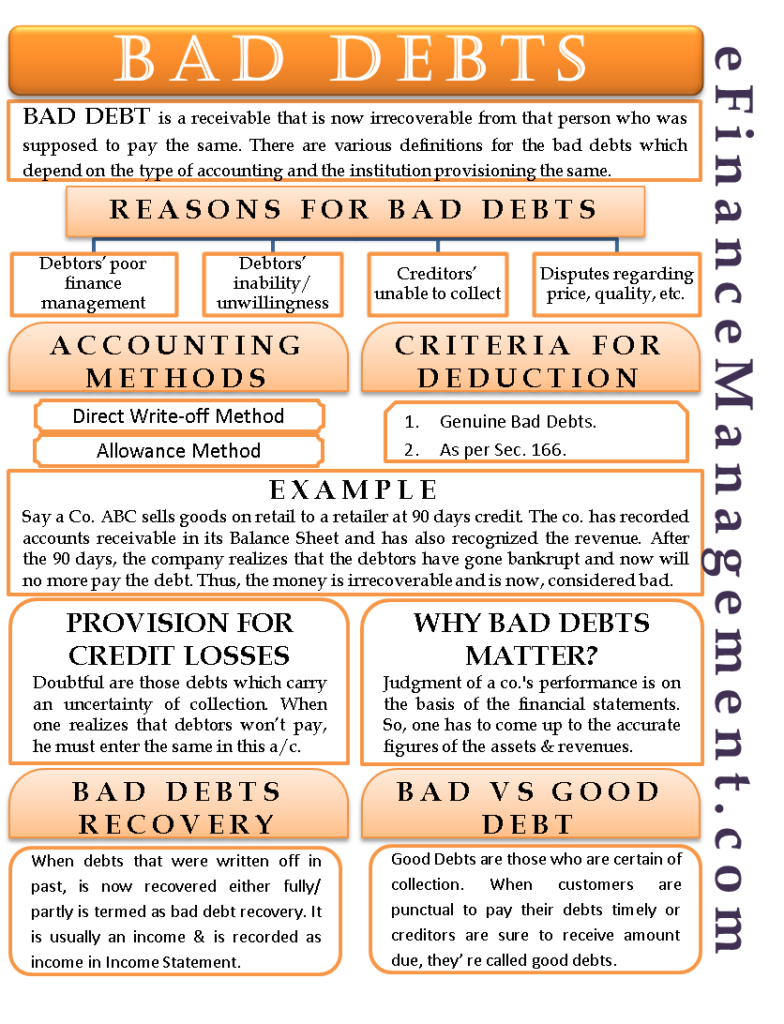

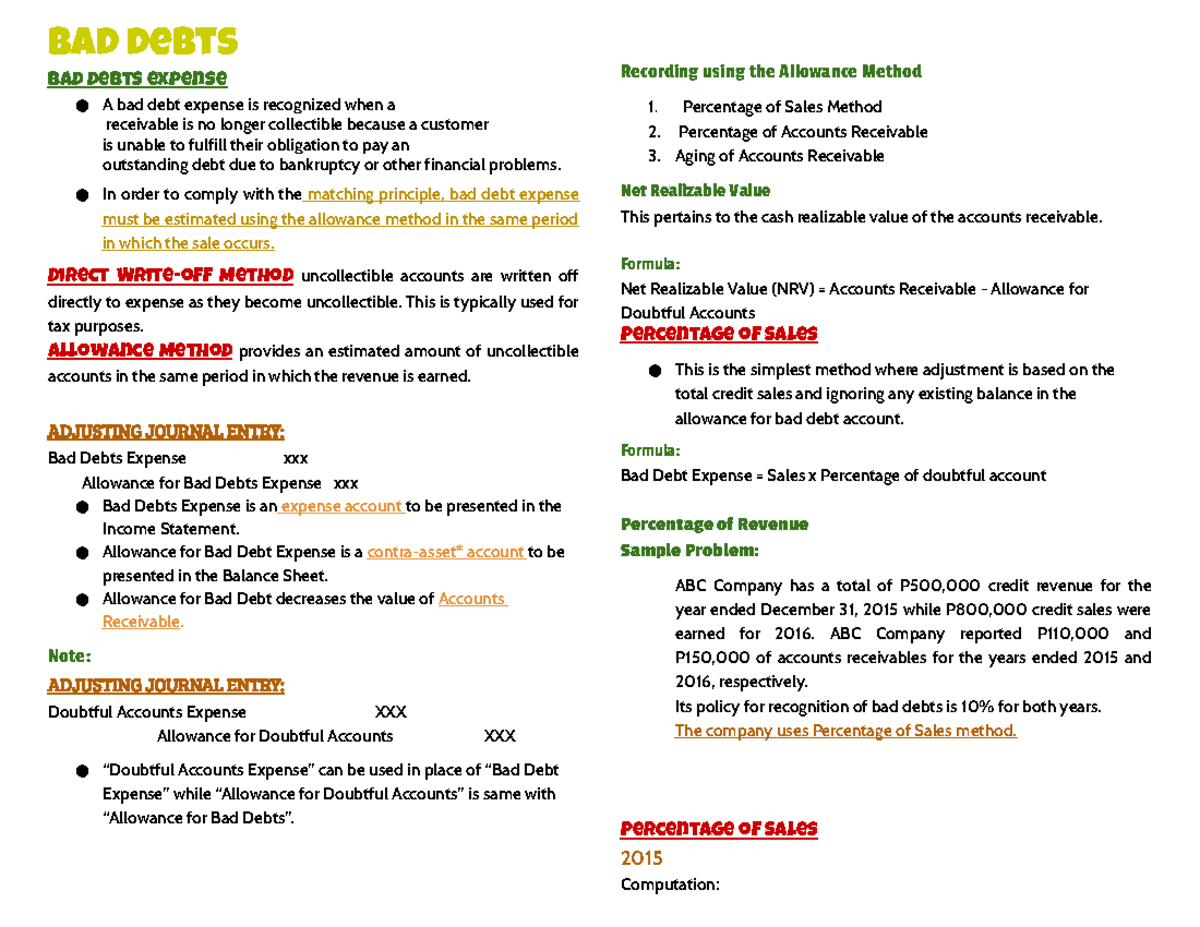

A bad debt expense is a portion of accounts receivable that your business assumes you won’t ever collect. Provisions for bad debts and inventory; Here’s an example of how to work out what a bad debt really.

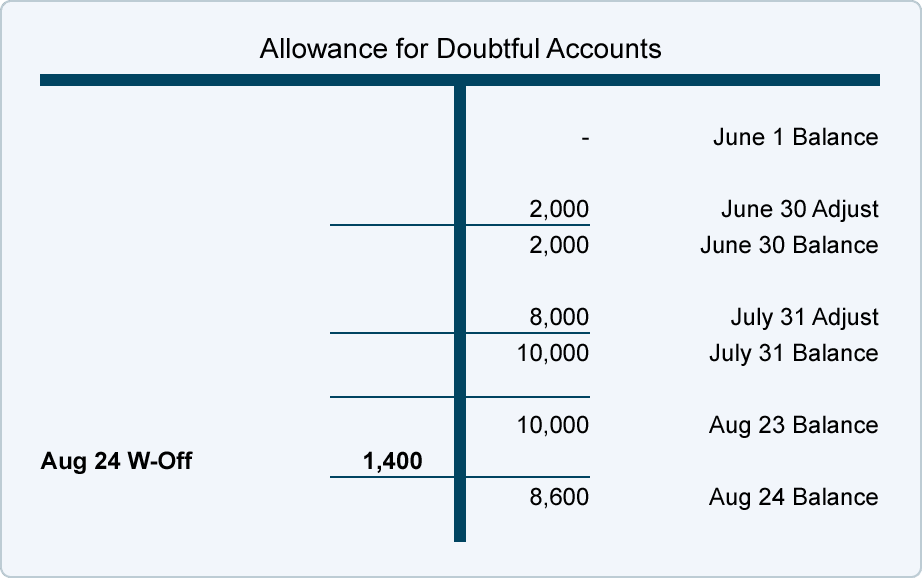

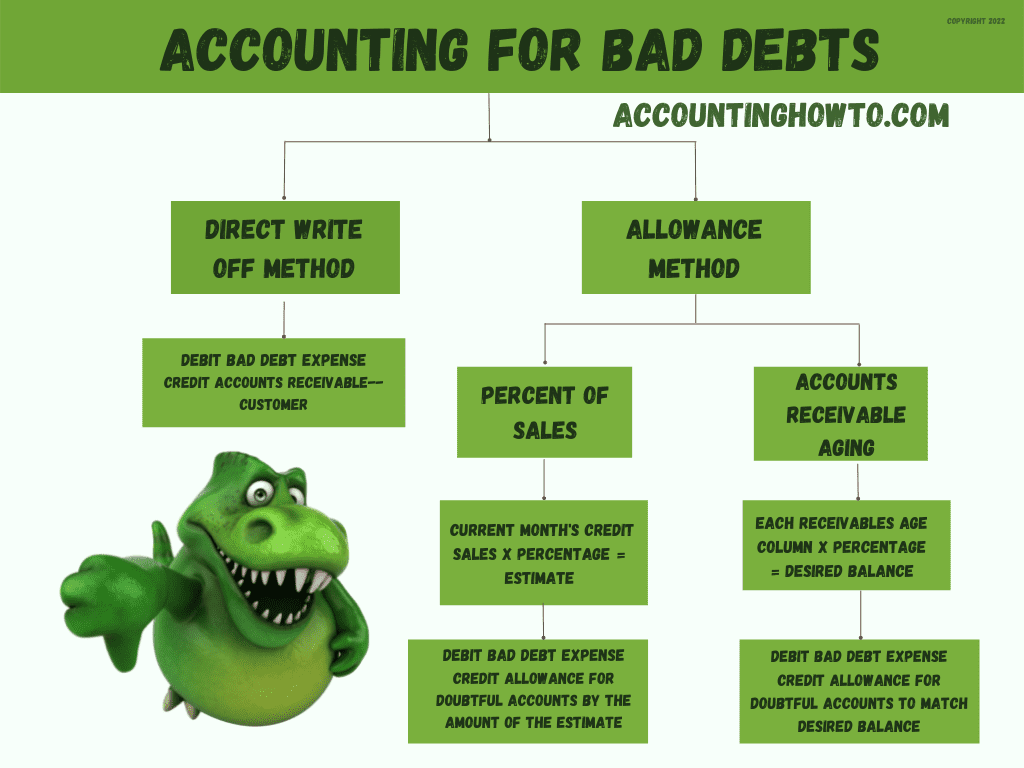

How bad debt is accounted for depends on whether or not your company uses a bad debt. The bad debt provision reduces your accounts receivable to allow for customers who don't pay up. There are two main accounting schemes to record bad debt:

Also called doubtful debts, bad debt expenses are. Bad debt expense = (£50,000 x 1%) + (£30,000 x 5%) bad debt expense = £500 + £150 = £650. When that happens, you need to write off the receivable as bad debt.

The treatment of provision in the cash flow statement occurs through cash flows from operating activities. However, bad debts and/or changes in the allowance for doubtful accounts are an example of accounts receivable reducing in a bad way. Bad debt is a financial burden for businesses, as it impacts their cash flow and overall financial stability.

The sharp deterioration took place in the last year after delinquent commercial property debt for the six big banks nearly tripled to $9.3bn. Unrealized foreign currency transaction gains or. Discover how to stay one step ahead with loanpro.

Hi katrien, that's kind of a trick question. The first, which is also. In this technique, the bad debt is directly considered as an.

To keep your cash flowing, you need to find ways to avoid bad debts. Bad debt is the term used for any loans or outstanding balances that a business deems uncollectible. What is bad debts (bd) example?

If your business is hit with bad debt expense, you could run into cash flow problems and even risk bankruptcy. As mentioned above, the first part includes removing the expense. What does a bad debt really cost you?

For businesses that provide loans and credit to.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)