Glory Info About Cash Flow Statement Intercompany Transactions What Financial Is Service Revenue On

Streamline and automate intercompany transaction netting and settlement to ensure cash precision.

Cash flow statement intercompany transactions. Intercompany elimination is the process of elimination of / removal of certain transactions between the companies included in the group in the preparation of. Intercompany accounting is defined as all financial and commercial transactions carried out and recorded between separate legal entities or subsidiaries. Intercompany transactions occur after a and mergers.

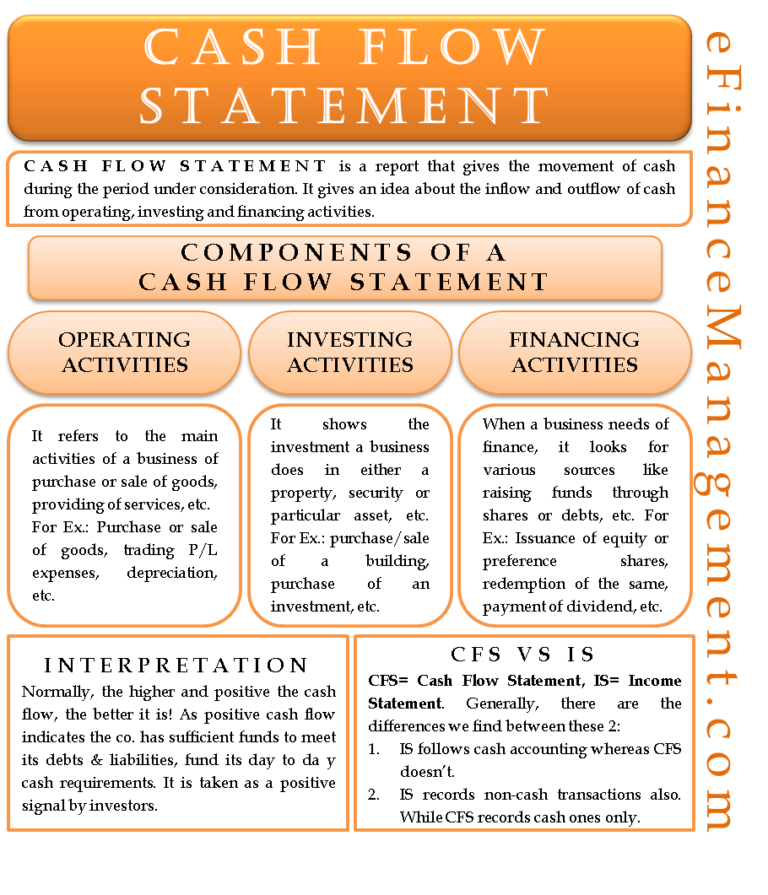

Discover out in this guide. The statement of cash flows is a primary financial statement, mandated for presentation by all entities, irrespective of their business profile. In a perfect world, investors and lenders should be able to look at a company's financial statements and.

These transactions may be monetary, such as a payment from one. Capital injections, loans, or payments between entities. Cash flow and financing:

Intercompany transactions are transactions between two entities under common ownership. Make, and stick to, intercompany agreements. Intercompany transactions might impact cash flow movements within the group.

Enable greater collaboration between accounting and. The successful candidate will play a crucial role in managing. Why is it important to understand intercompany transactions?

Intercompany accounting refers to the process of managing financial transactions between companies that belong to the same corporate group. Refer to appendix e of. Amounts subtracted from gross income are.

Collect the financial statements of the parent company and its subsidiaries, including balance sheets, income statements, and cash flow statements. It holds equal prominence with other. Transfer prices play a large role in determining the overall.

As this text previously discussed, a significant volume of transfers between the related companies composing a business combination often. Asc 810 establishes basic consolidation principles, which include (1) any intercompany income on assets remaining within the consolidated group of companies should be. Create an agreement, enforce the agreement.

Our frd publication on statement of cash flows has been updated to further enhance and clarify our interpretive guidance in several areas. But as are the best practice for navigating them?