Awe-Inspiring Examples Of Info About Prepaid Expenses Treatment In Balance Sheet Oriole Company

Essentially, a business pays upfront for a good or service, and the benefit is received over time.

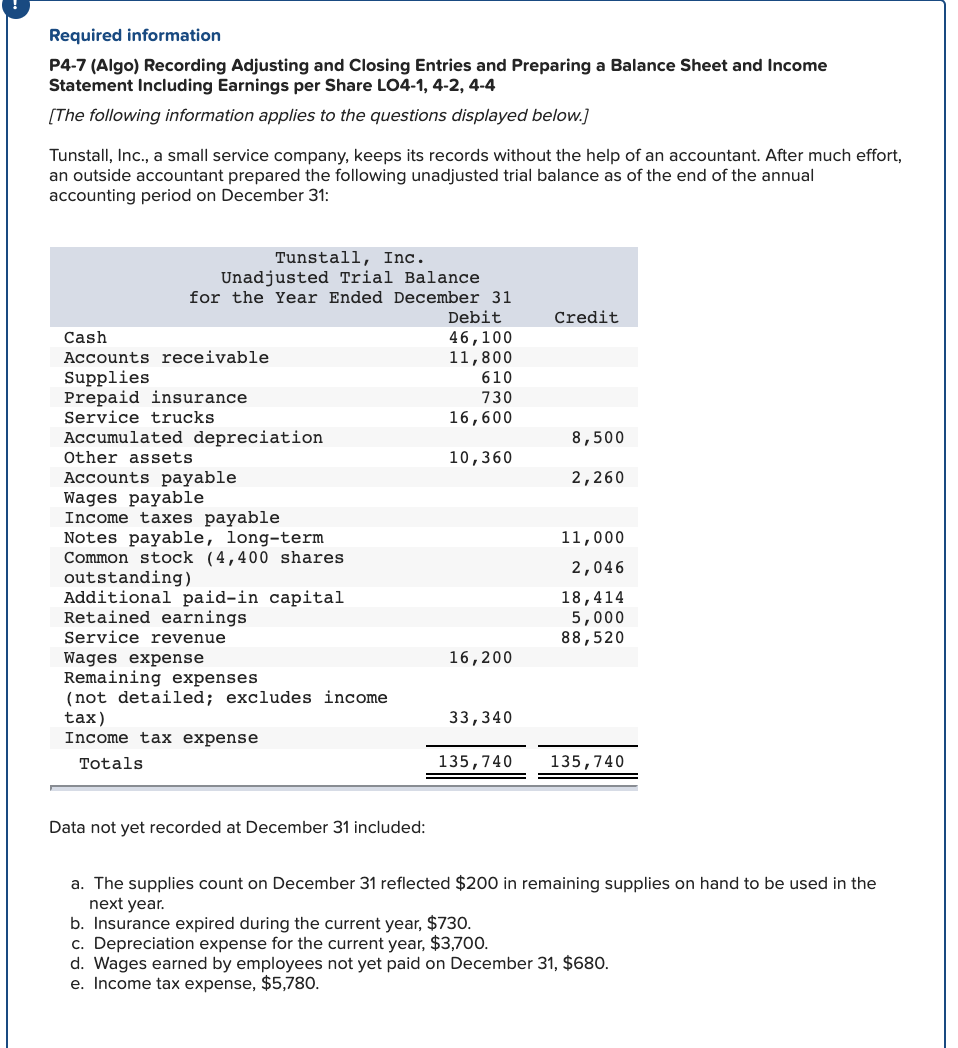

Prepaid expenses treatment in balance sheet. Prepaid expenses refer to payments made in advance for goods or services that a company will receive or use in the future. In essence, it represents a. To record a prepaid expense, create a.

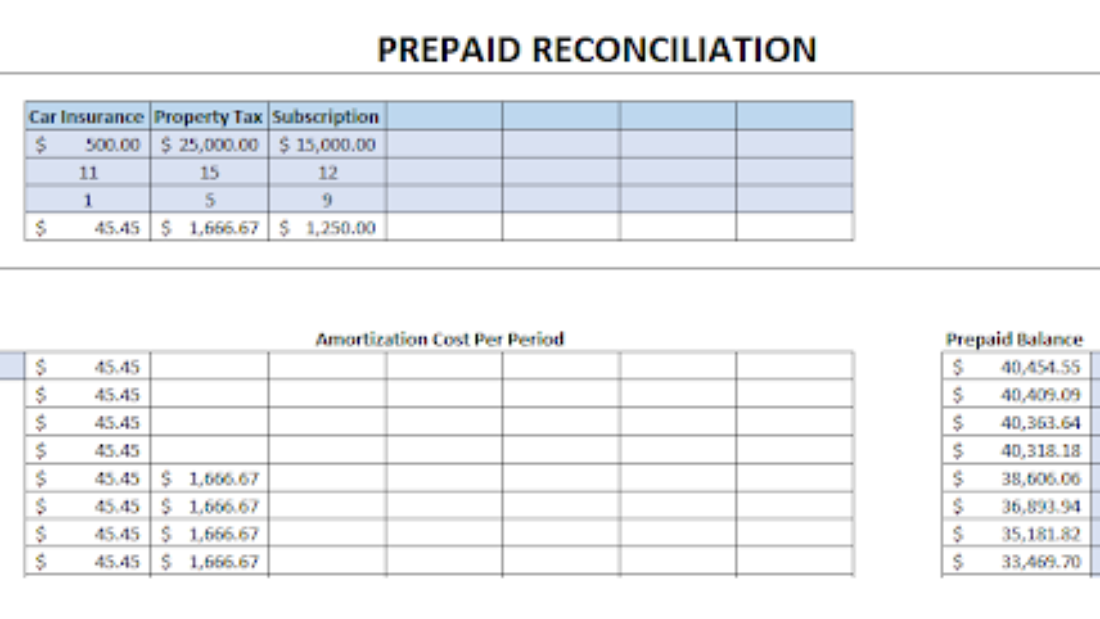

For example, refer to the first example of prepaid rent. Table of contents what are prepaid expenses in accounting? Prepaid expenses result from one party paying in advance for a service.

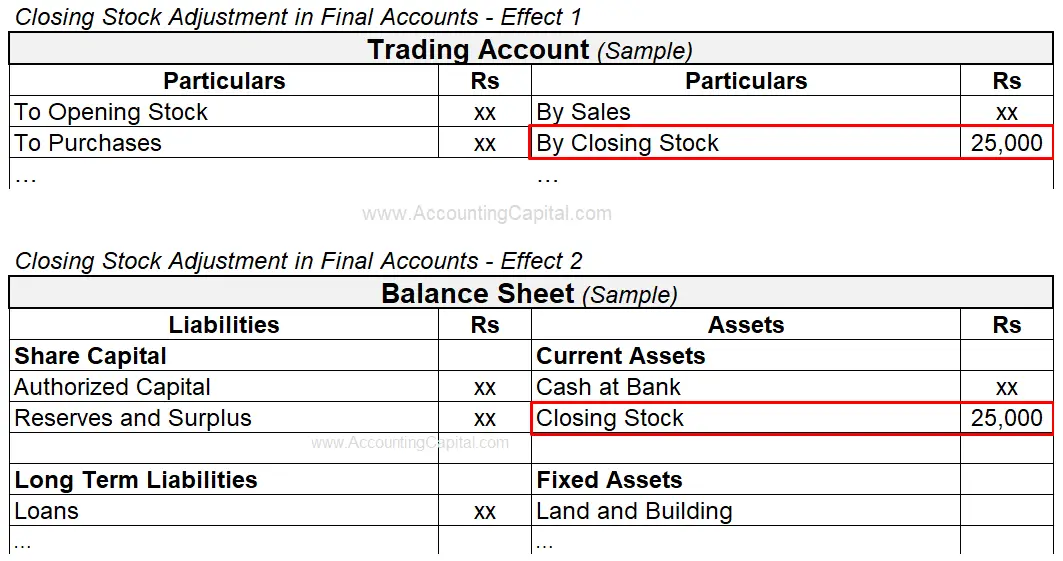

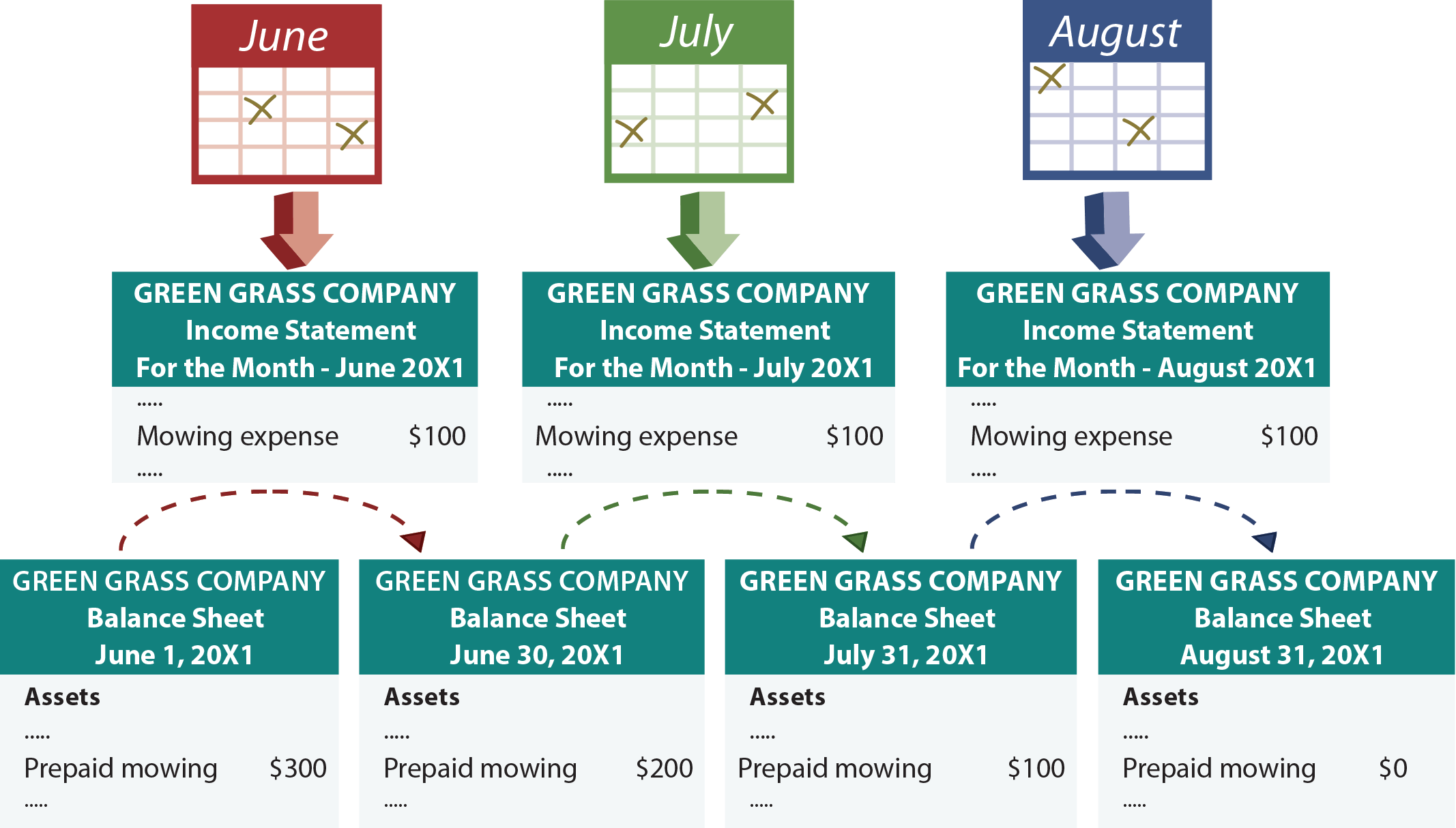

Cash basis presentation on the. Instead, prepaid expenses are first recorded on the balance sheet. These are both asset accounts and do not increase or decrease a company’s.

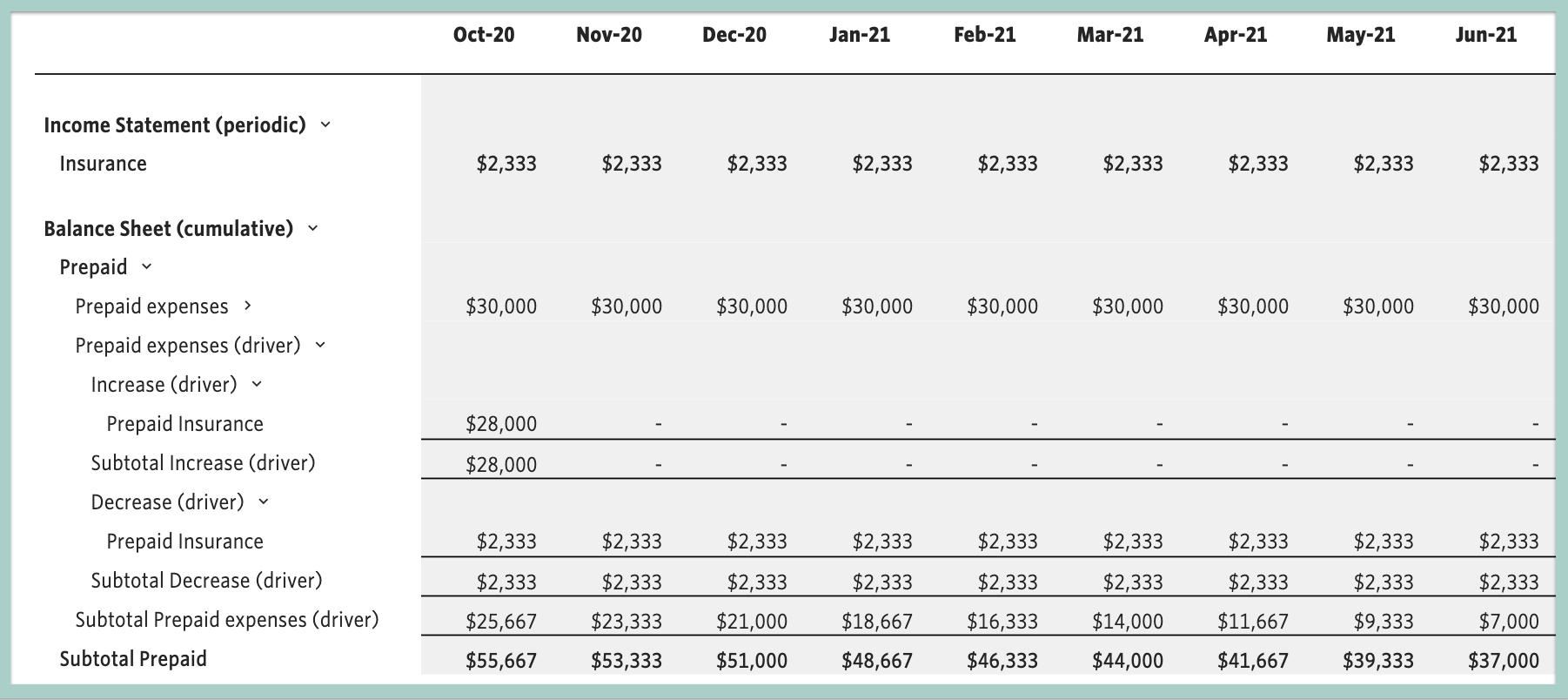

As each month passes, the prepaid expense account for rent on the balance sheet is decreased by the monthly rent amount, and the rent expense account. Prepaid expenses recorded as current assets. Examples of prepaid expenses include insurance premiums, rent, or.

Their primary purpose is to allocate. In accounting, prepaid expenses are costs paid for in advance and their benefits are received over time. 3 rows prepaid expenses and accrued expenses are the two categories of expenses that constitute.

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Introduction definition of prepaid expenses reasons for prepaid expenses classification of prepaid expenses on the balance sheet presentation of. They are listed on the balance sheet as assets because they.

But, as the benefit of the prepaid expense is realized, or as the expense is incurred, it is. Prepaid expenses are treated as current assets on the balance sheet. Understanding prepaid expenses in accounting how to record prepaid expenses?

The initial journal entry for a prepaid expense does not affect a company’s financial statements. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. How to find prepaid expenses on the balance sheet?

Prepaid expenses are costs that a company pays in advance for goods or. Accounting for prepaid expenses accrual basis vs. In the company’s balance sheet, the prepaid expenses are recorded as a current asset account.

Introduction prepaid expenses is a financial maneuver that allows businesses to navigate their financial obligations with finesse. A bookkeeper first needs to ensure they have a proper prepaid expense account record to. Table of contents prepaid expenses definition prepaid expenses examples prepaid expenses in accounting lesson summary frequently asked.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-04-59546336082445fa8db2dd9bbfcf58cb.jpg)