First Class Info About Tax Expense In Cash Flow Statement Johnson And Financial Statements 2018

By allocating income taxes in the cash flow statement, the income tax effects of transactions and events would be reported in the same section of the cash flow.

Tax expense in cash flow statement. The correct answer is a. The cash flow statement reflects the actual amount of cash the company receives from its operations. Remove the effect of gains and/or losses from.

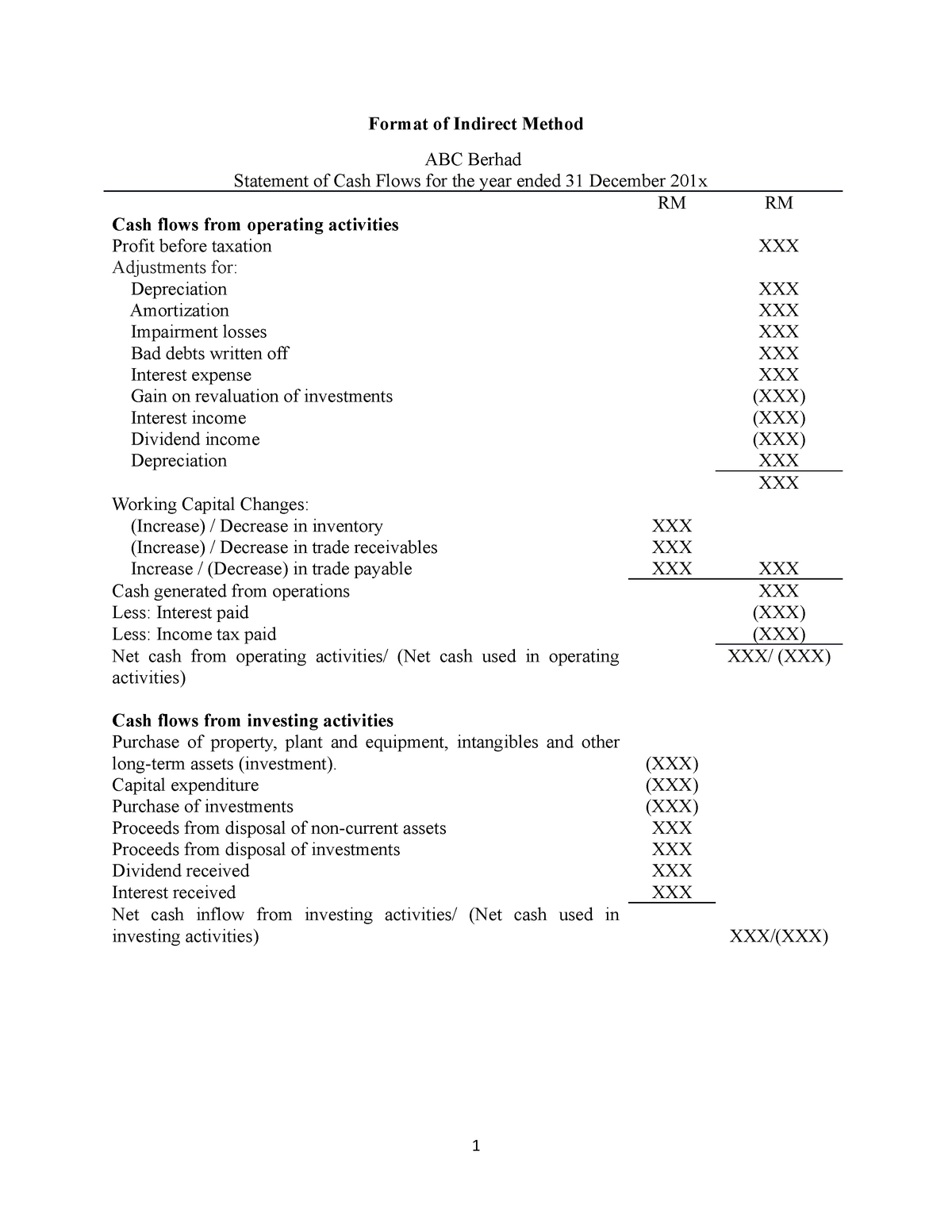

Identifying how much cash was received from customers. Operating activities investing activities financing activities operating activities detail cash flow. Determining how much cash was paid for income taxes.

Deferred tax is the difference between a company’s tax liability and tax paid to the. To prepare the statement of cash flows for clear lake sporting goods, we need the beginning cash balance from the balance sheet, net income and depreciation expense. Begin with net income from the income statement.

Profit the first figure we start with when calculating operating cash flows the indirect way is the profit figure. 1 4 6 7 10 13 16 reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency. How does deferred tax impact statement of cash flows?

It can be found on a company's annual or quarterly cash flow statement. Inflows and outflows of cash and cash. Add back noncash expenses, such as depreciation, amortization, and depletion.

Taxes are included in the calculations for the operating cash. We use the operating profit before tax, but after. The diagram above illustrates a big picture view of.

Cash flow definitions cash flow: The purpose of the statement of cash flows is to provide a means “to assess the enterprise’s capacity to generate cash and cash equivalents, and to enable users to. The cash flow statement is typically broken into three sections:

It is an expense on reported profits for the period based on the matching principle: The tax incurred in the current accounting period goes down on your income statement as an expense.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)