Painstaking Lessons Of Info About Cash Receipts From Customers In Flow Statement Calculating Net Income Balance Sheet

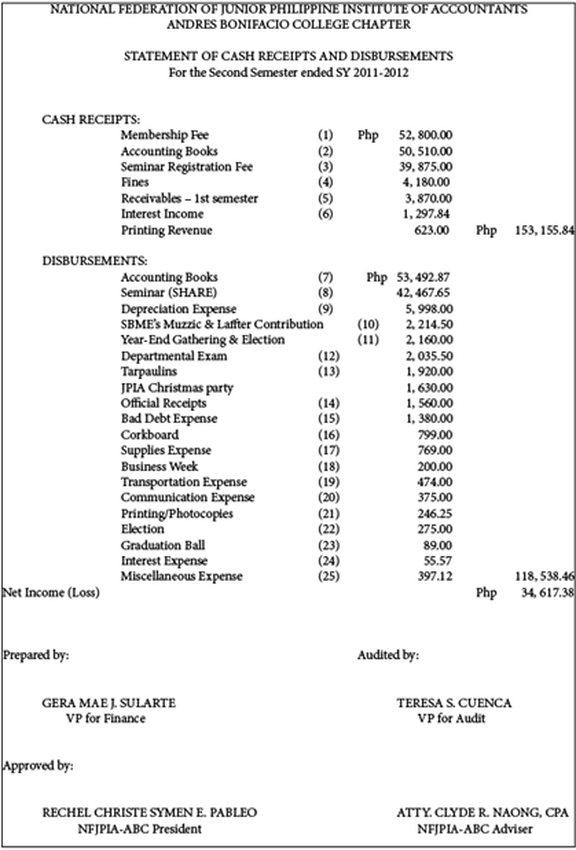

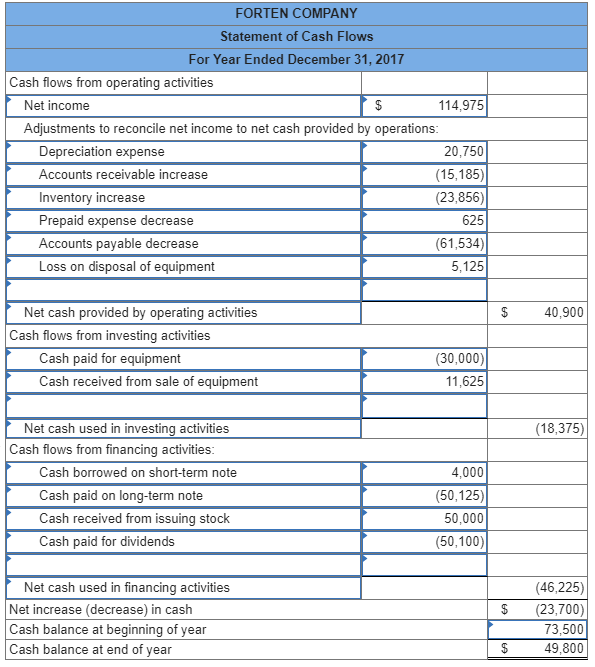

Explanation and pointers statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period.

Cash receipts from customers in cash flow statement. The cash flow statement is required for a complete set of financial statements. A cash flow statement tells you how much cash is entering and leaving your business in a given period. The direct method is the method preferred by the financial accounting standards board (fasb) because.

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. Inflows and outflows of cash and cash equivalents (learn more in cfi’s ultimate cash flow guide ).

What are some examples of cash receipts? Cash on hand and demand deposits (cash balance on the balance sheet). Cash paid to suppliers and employees ( 27,600) cash generated from operations.

This will ensure that your cash flow and ultimately your profit are correct. To properly state cash receipts, add the change in a/r to the income statement's sales revenues. Likewise, cash payments to suppliers equal to purchases plus ending inventory minus beginning inventory plus beginning accounts payable minus ending accounts payable.

Cash receipts are proof that your business has made a sale. The goods can be sold either cash or credit basis. Increase in debtors mean more credit sales.

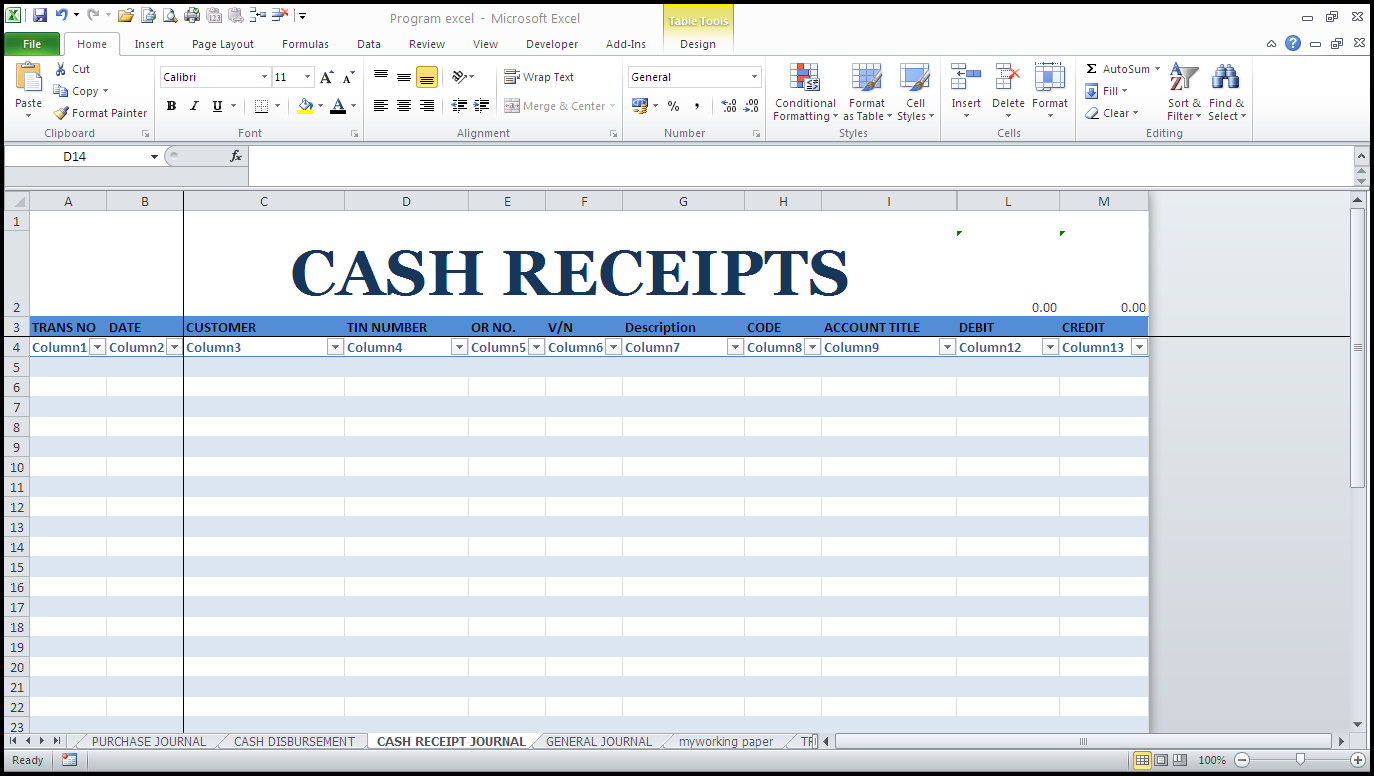

The direct method adds up all the various types of cash payments and receipts, including cash paid to suppliers, cash receipts from customers and cash paid out in salaries. Cash receipts from customers, including cash sales, were $800,000. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

While preparing cash flow statement, there is no change between cash and credit sales. We will use these names interchangeably throughout our explanation, practice quiz, and other materials. Additional informationduring the year, depreciation of $50,000 and amortisation of $40,000 was charged to the statement of profit or loss.

The cash flow direct method determines changes in cash receipts and payments, which are reported in the cash flow from the operations section. Cash flow definitions cash flow: Interest paid ( 270) income taxes paid ( 900) net cash from operating activities.

Between gathering and organizing receipts, bank statements, worrying about filing deadlines and c. Direct method statement of cash flows. The cash flow statement reflects the actual amount of cash the company receives from its operations.

Cash receipts and payments on behalf of customers (for example, receipt and repayment of demand deposits by banks, and receipts collected on behalf of and paid over to the owner of a property) Cash receipts are also necessary to minimize theft. Advertisement cash received from customers example suppose you use accrual accounting and your current income statement shows you've earned $100,000 in sales for the quarter that just ended.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)