Beautiful Work Info About Cash Flows From Clearing Account On Balance Sheet

A positive level of cash flow must be maintained for an entity to remain in business, while positive cash flows are also needed to generate value for investors.

Cash flows from. Cash flow is a measure of the money moving in and out of a business. Learn more with detailed examples in cfi’s financial analysis course. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

This section of your cash flow statement would show: Industrial free cash flows (2) of €12.9 billion, an increase of 19% compared to 2022; The statement of cash flows acts as a bridge between the income statement and balance sheet by showing.

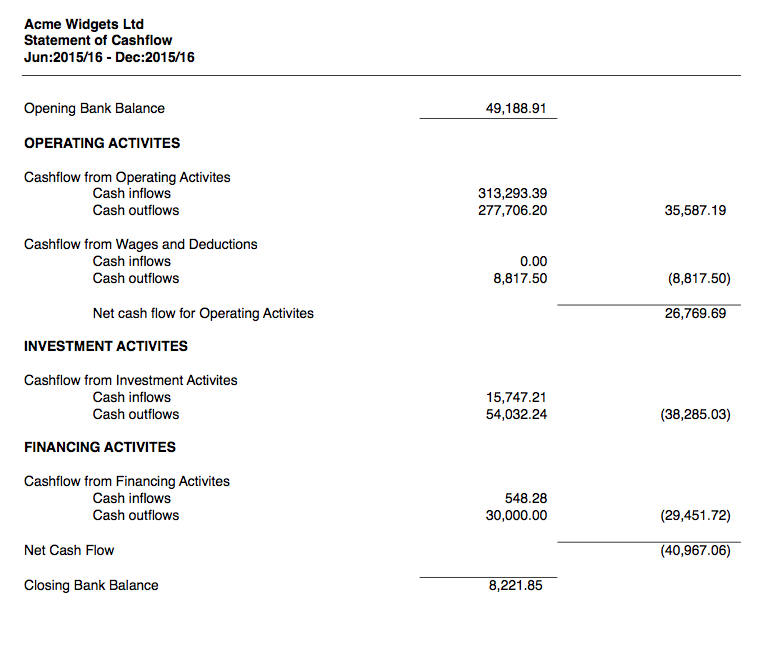

Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. So, say you financed part of the purchase, paying $2,000 down and signing a promissory note for the remaining $8,000 balance. With these etfs, cash flow is king.

Cash flow represents revenue received — or inflows — and expenses spent, or outflows. Cash flow is the net amount of cash that an entity receives and disburses during a period of time. The total net balance over a specific.

We will use these names interchangeably throughout our explanation, practice quiz, and other materials. The two different accounting methods,. The cfs measures how well a.

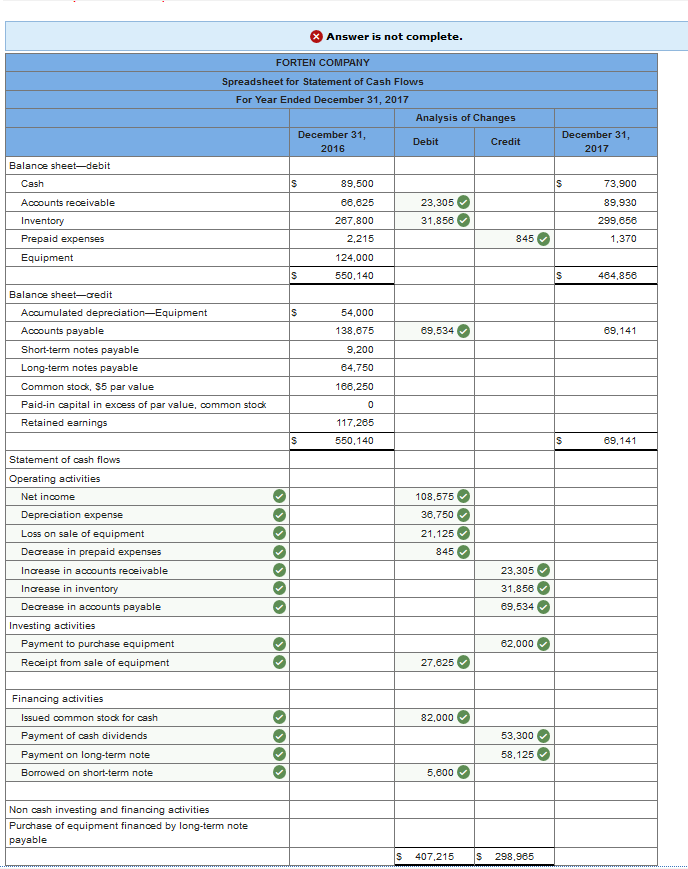

A typical cash flow statement comprises three sections: The cash flow statement is required for a complete set of financial statements. This section of your cash flow statement only shows cash transactions.

The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. A company creates value for. Purchase of property and equipment:

Taking into account the profit and cash generation in 2023, as well. Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year; A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

Strong balance sheet, with industrial available liquidity at €61.1 billion ; Cash flow frequently asked questions (faqs) key takeaways cash flow is an inward and outward movement of cash and cash equivalents during a specific period. The cash flow statement is typically broken into three sections:

The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. Stark bank, one of the few latin america startups to receive funding from jeff bezos ’ family office, is generating profits from its business of helping companies handle payments, while. The three main components of a cash flow statement are cash flow from operations, cash flow from investing, and cash flow from financing.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)