Fun Tips About Trial Balance With Adjustment Fnsacc311

Step 6, preparing an adjusted.

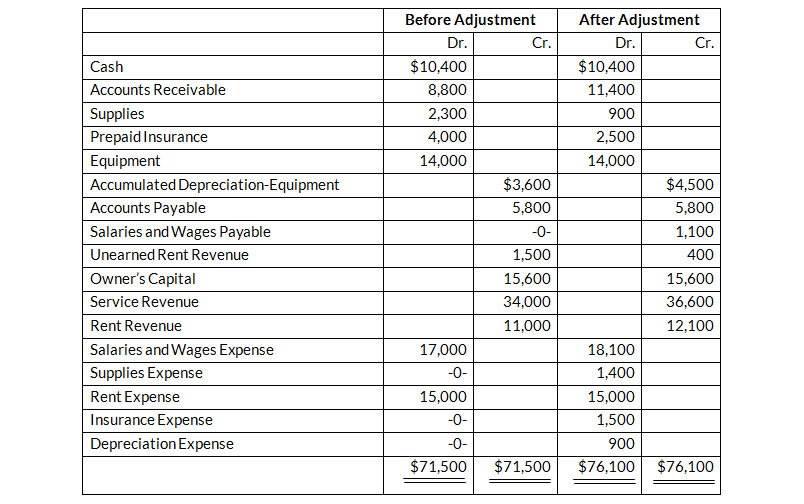

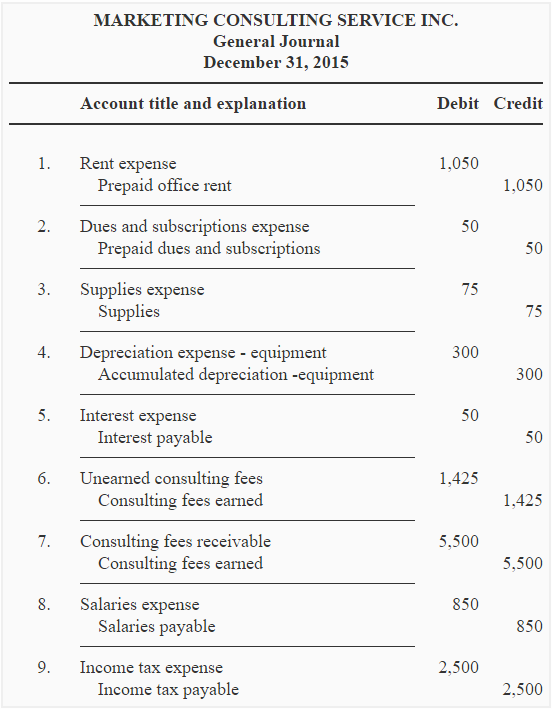

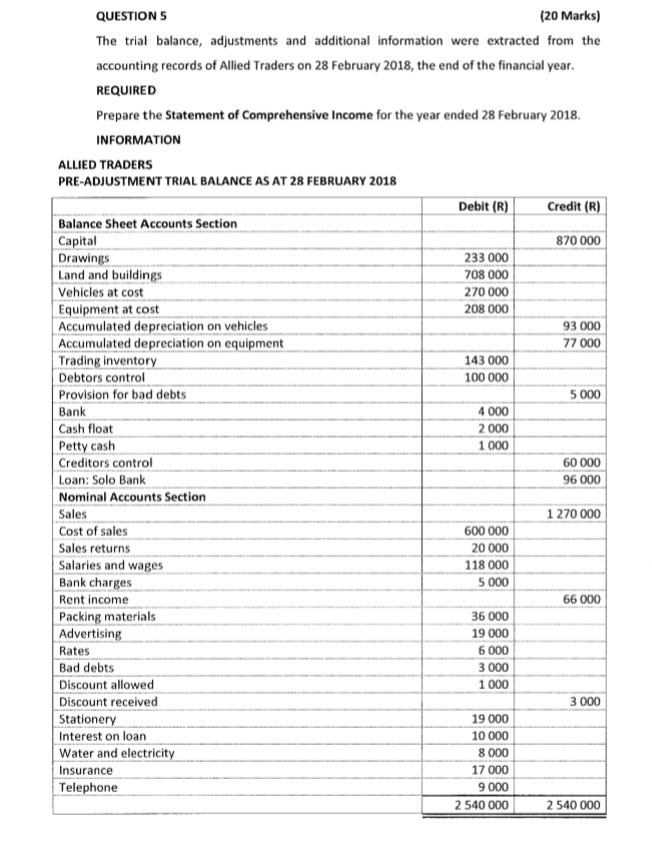

Trial balance with adjustment. Record all transactions before you balance a company's accounts, ensure that you have a record of all the transactions of money or assets coming into and out of. Understanding adjustment entries and the trial balance is essential to comprehend the significance of adjustment entries. Note that for this step, we are considering our trial balance to be unadjusted.

This trial balance is an important step in the. The adjustments total of $2,415 balances in the debit and credit columns. There are several steps in the accounting cycle that require the preparation of a trial balance:

This is the second trial balance prepared in the accounting cycle. 16 rows the following report shows an adjusted trial balance, where the initial, unadjusted balance. To get the $10,100 credit balance in the adjusted trial balance column requires adding together both credits in the trial balance and adjustment columns (9,500 + 600).

The trial balance is a statement. The accounts reflected on a trial balance are related. Adjusted trial balance records the account balances of an organization after adjusting the transaction to various expenses, including the depreciation amount, accrued expenses, payroll expenses, etc.

After adjusting entries are made, an adjusted trial balance can be prepared. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances. Run an unadjusted trial balance the above trial balance is a current summary of all of your general ledger accounts before any adjusting entries are.

4.4 use the ledger balances. This, in turn, gives businesses a clear picture of where. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

Understand the trial balance's role and identify adjustments like. The next step is to record information in the adjusted trial balance columns. An adjusted trial balance represents a listing of all the account balances after posting of all the necessary adjusting entries in ledger accounts.¹ the purpose of.

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. Its purpose is to test. 4.2 discuss the adjustment process and illustrate common types of adjusting entries;

Having said that, it is more important to. In this concise tutorial, we demystify accounting jargon and guide you through each step. 4.3 record and post the common types of adjusting entries;

The unadjusted trial balance in this section includes accounts before they have been.

![[Solved] Extract of preadjustment trial balance o SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/09/6141c27f41f7d_1631699574070.jpg)