Glory Info About Closing Entries And Post Trial Balance Downloading 26as

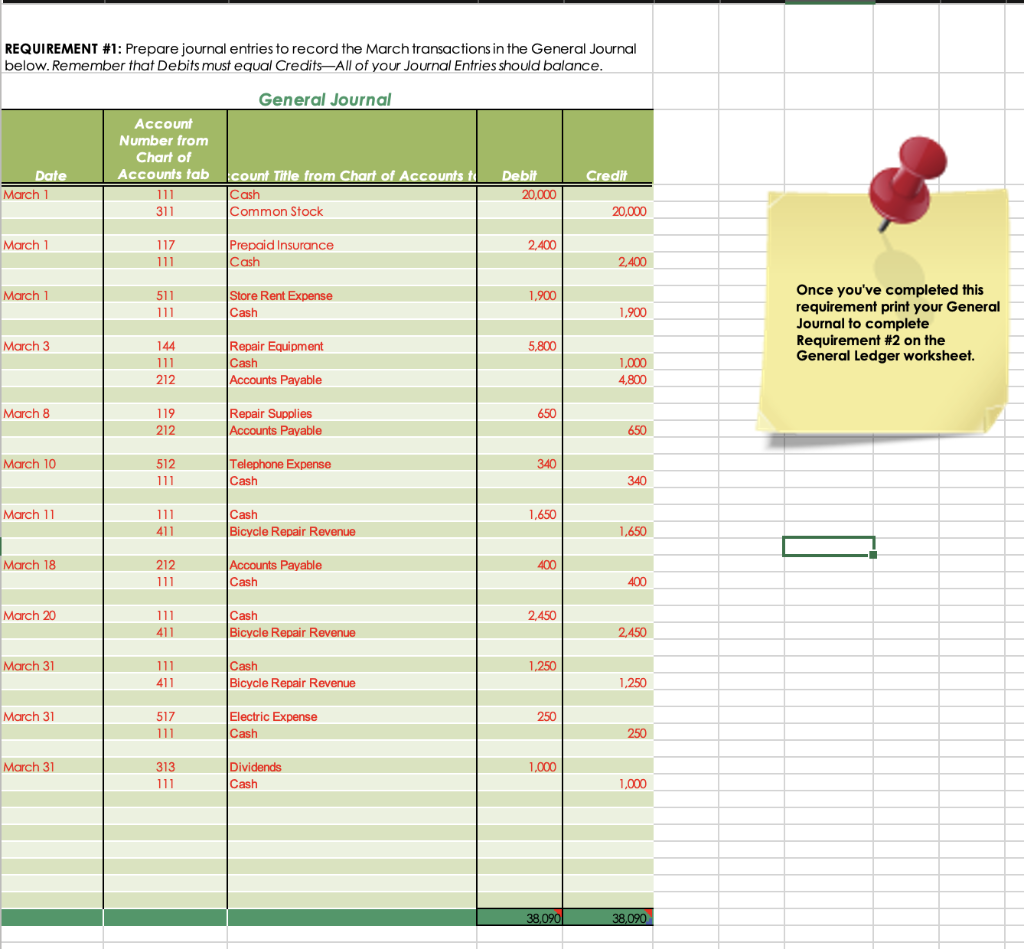

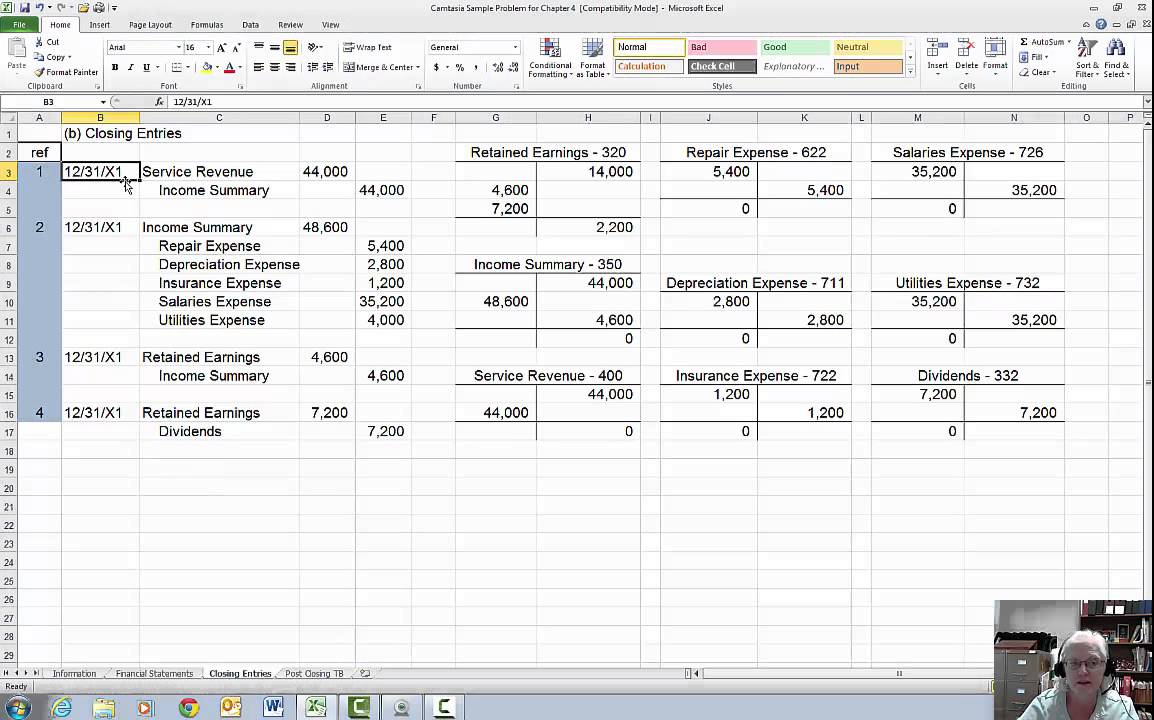

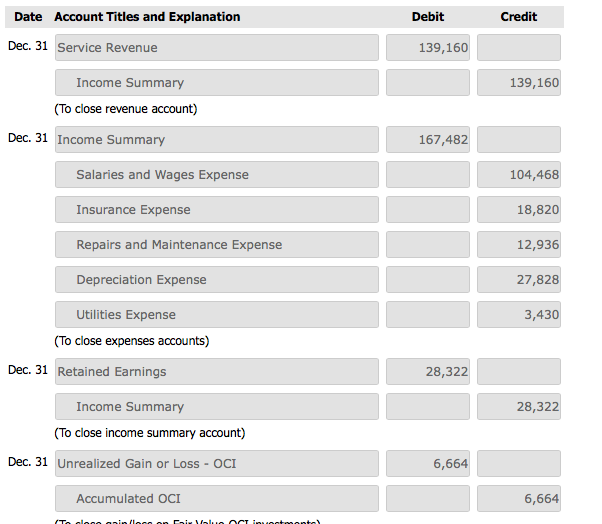

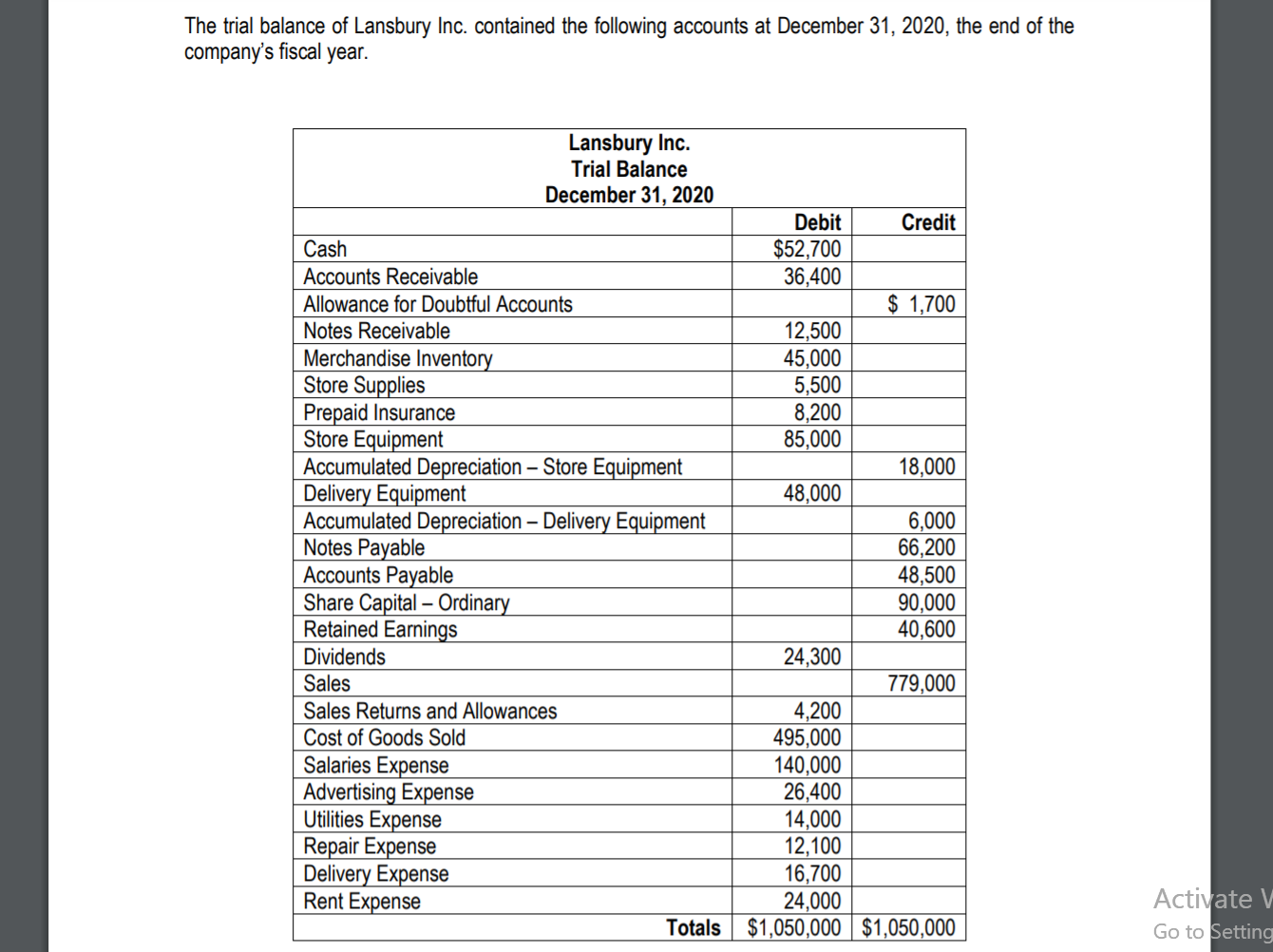

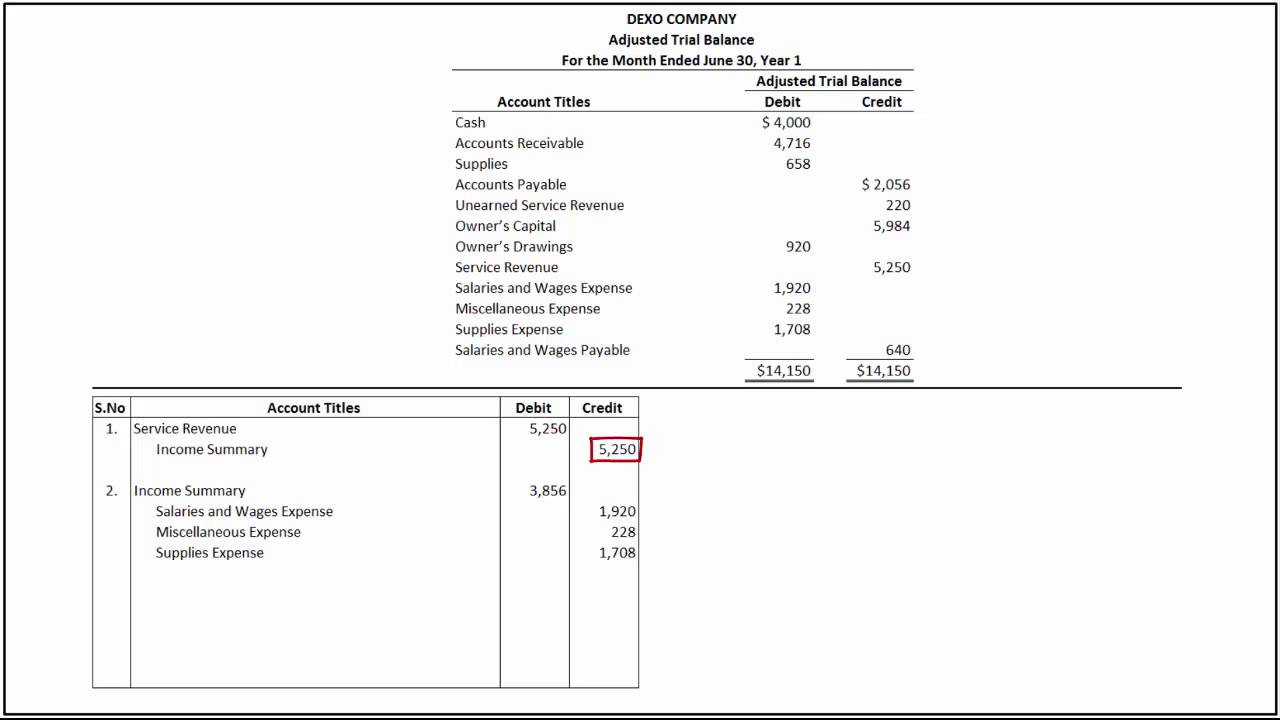

Let’s go through these closing entries step by step.

Closing entries and post closing trial balance. We also explain what the temporary accounts and permanent accounts are. We will debit the revenue accounts and credit the income summary account. Account names, debits, and credits.

The income summary account is temporary. It is used to close income and expenses. Since the closing entries transfer the balances of temporary accounts (i.e.

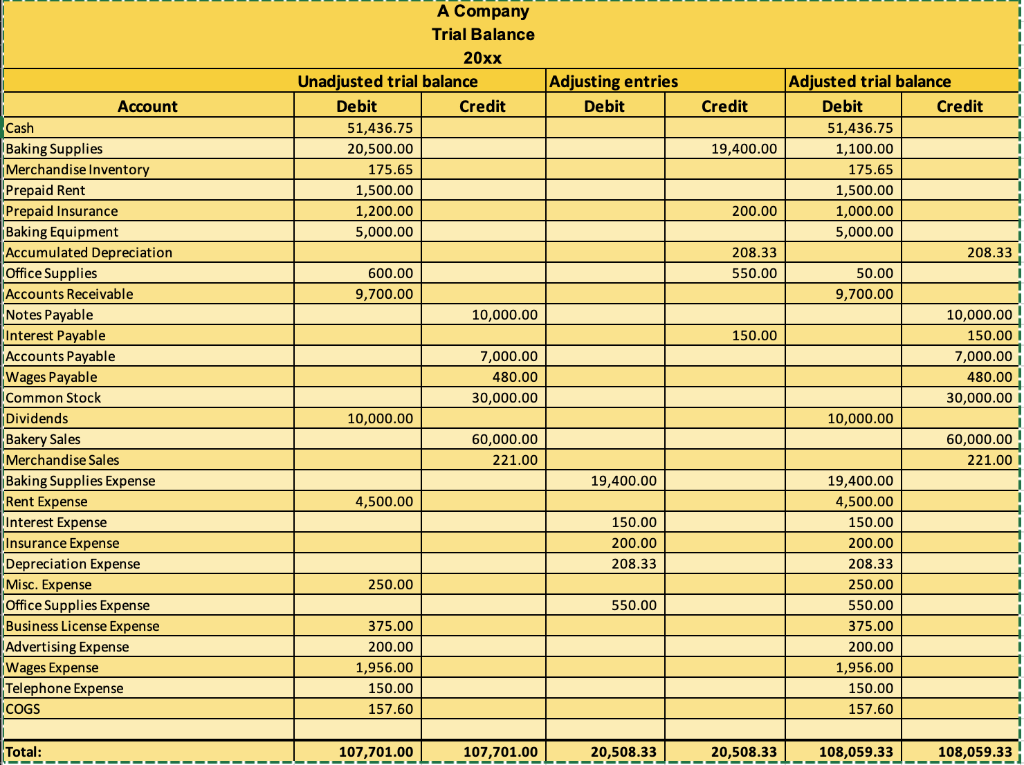

We see from the adjusted trial balance that our revenue account has a credit balance. To make the balance zero, debit the revenue account and credit the income summary account. You are preparing a trial balance after the closing entries are complete.

The information needed to prepare closing entries comes from the adjusted trial balance. You are preparing a trial balance after the closing entries are complete. Close revenue accounts close means to make the balance zero.

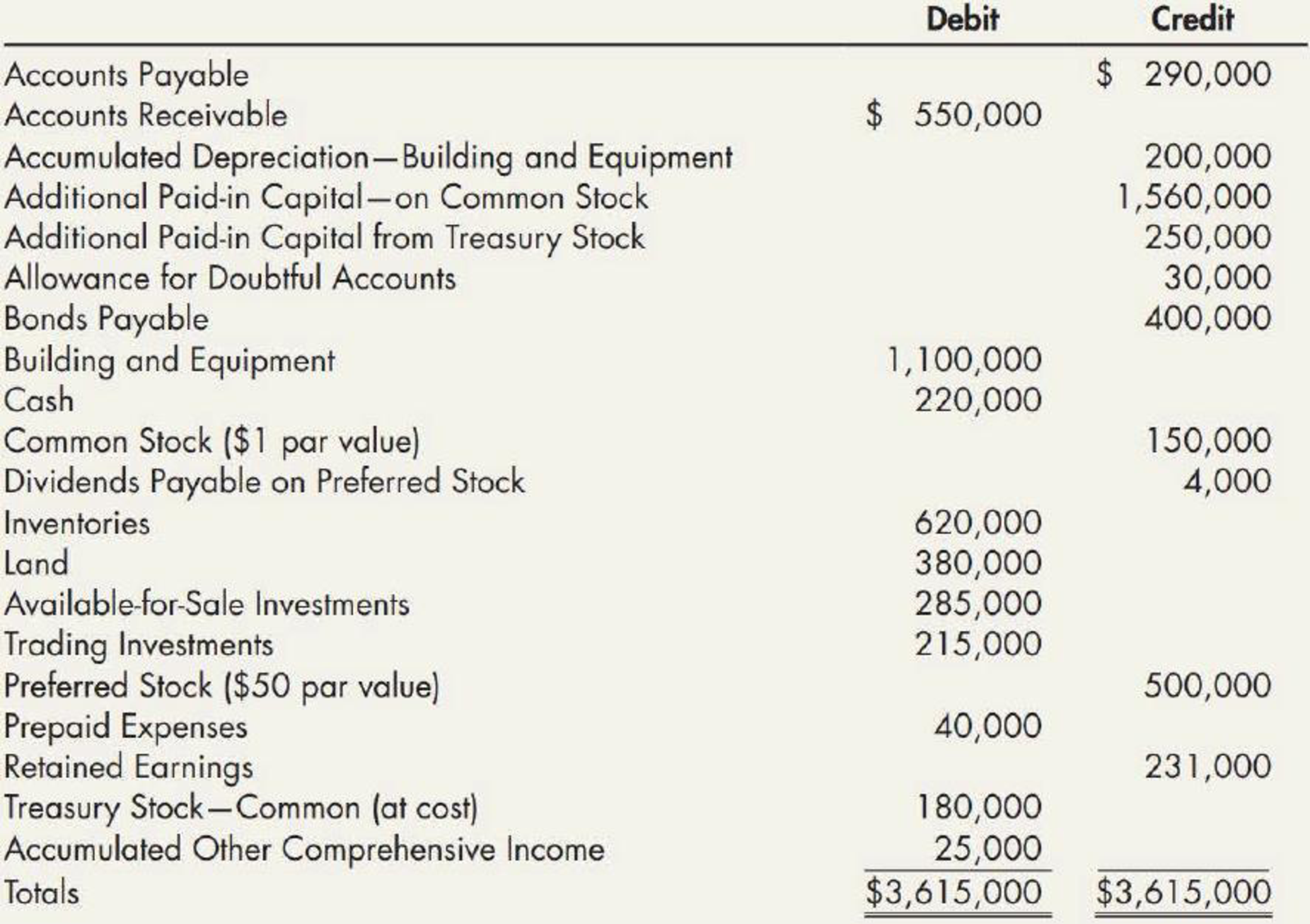

The word “post” in this instance means “after.”. However, i'm facing challenges with the. To transfer temporary account balances to permanent accounts

The word “post” in this instance means “after.”. Learn the four closing entries and how to prepare a post closing trial balance. Closing entries and the postclosing trial balance.

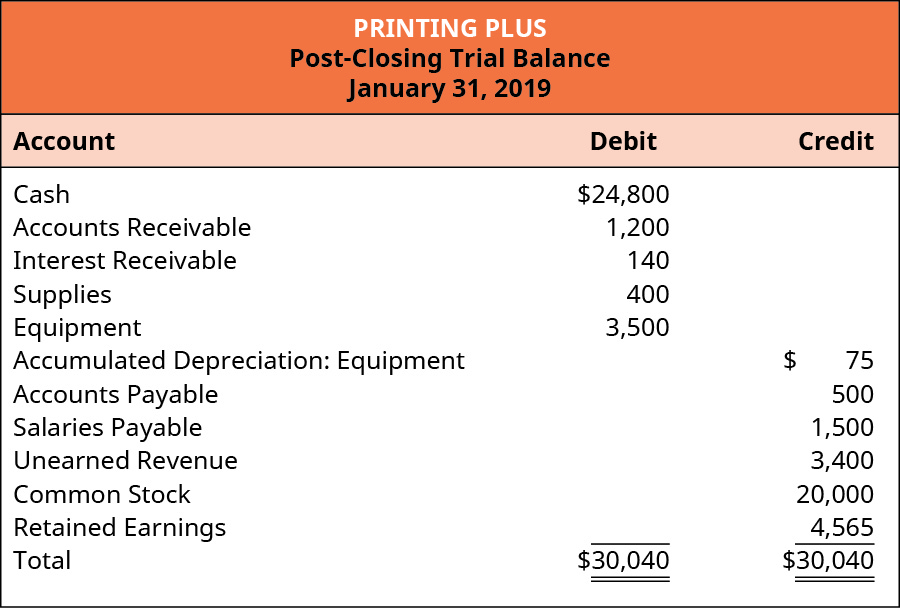

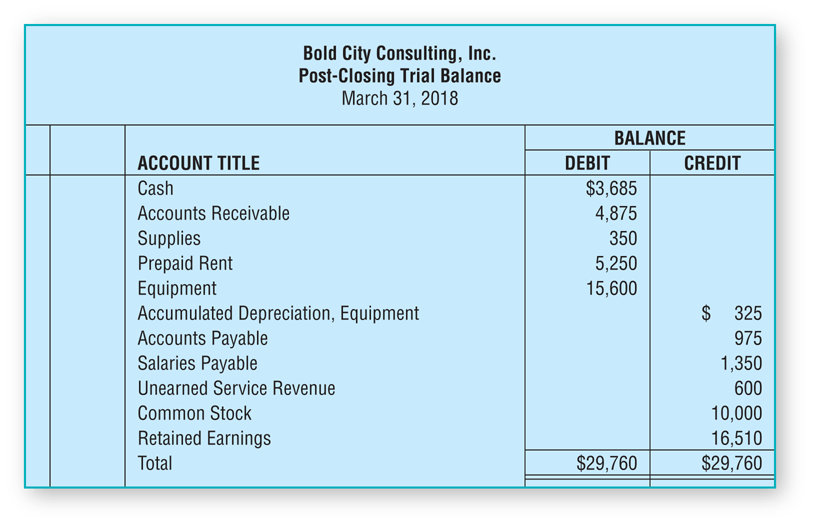

The post closing trial balance is a list of accounts or permanent accounts that still have balances after the closing entries have been made. Once we are satisfied that everything is balanced, we carry the balances forward to the new blank pages of the. Its purpose is to test the equality between debits and credits after closing entries are prepared and posted.

Prepare a postclosing trial balance. To close an account means to make the balance zero. Journalize and post closing entries.

The post closing trial balance is a list of all accounts and their balances after the closing entries have been journalized and posted to the ledger. To make them zero we want to decrease the balance or do the opposite. We use a post adjustment trial balance to do.

To close that, we debit service revenue for the full amount and credit income summary for the same. It has a credit balance of $9,850. Purpose of closing entries these entries serve two primary purposes: