Wonderful Info About Fair Value Reserve In Balance Sheet Big 4 Accounting Companies

Method a — balance sheet view;

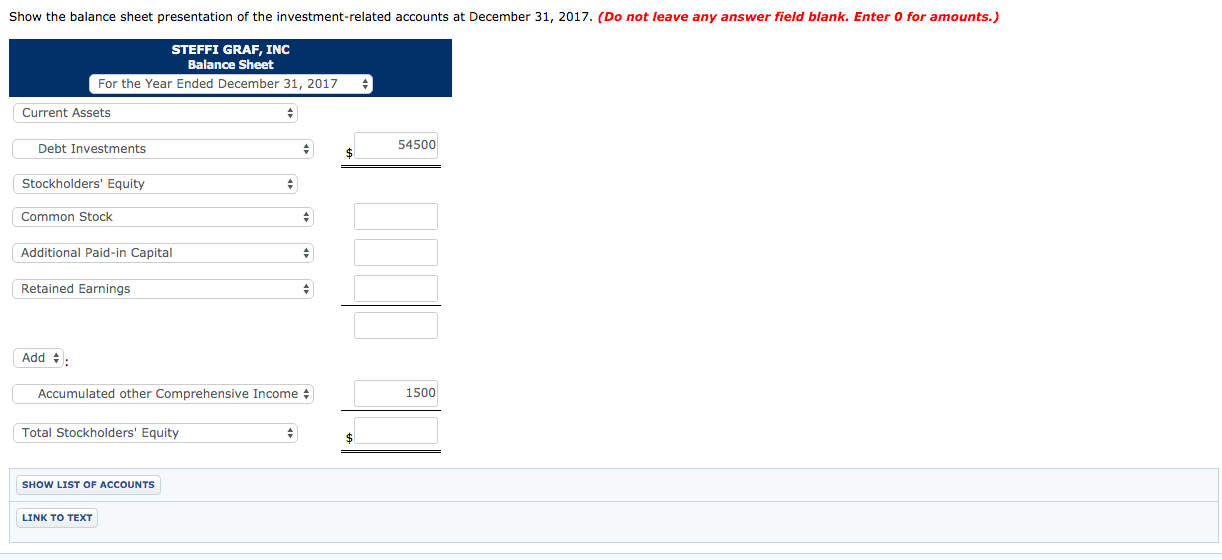

Fair value reserve in balance sheet. Equity reserve is the part of the equity section of the balance sheet which excludes share capital and retains earnings. Determine unrealized gains and losses as the fair value of the security less its amortized cost basis. The depreciable amount of the.

Since the modification of the law of 2010, nothing prevented the distribution of unrealised gains. The entity will need to restate its opening balance sheet at the date of transition (ie at 1 january 2014) and comparative balance sheet (ie at 31 december 2014) in accordance. Recording the unrealized gain or loss from the security in this account allows the.

This view holds that gains and losses are. Following initial recognition, financial assets and liabilities are measured according to their classification. Carried in the balance sheet at market values, if they are available, or at fair values calculated as an approximation of the market value by using a present value model for.

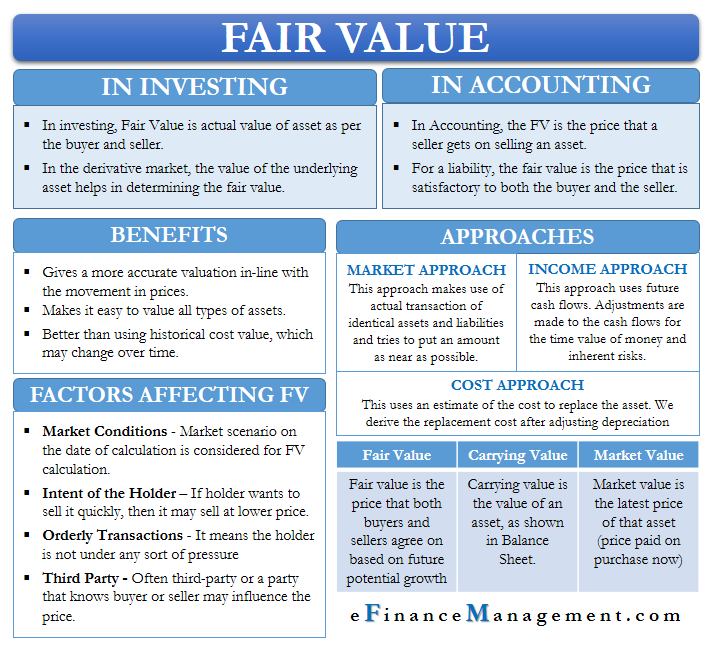

Fair value is the estimated price at which an asset is bought or sold when both the buyer and seller freely agree on a price. This ifrs defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the. The fair value adjustment account is an allowance account to the fair value of the security.

Distributable reserves in cases involving the use of the fair value option. The increase in value of the asset is credited to the reserve account. Individuals and businesses may compare.

Determining the total cost of the investment property. It presents the balance raised from other transactions such. Mark to market mechanism is applied at.

A reserve that captures the cumulative net change in the fair value of an asset as long as it is still recognized on the financial statements of an entity. For foreign reserve assets and liabilities, foreign currency exchange rate revaluation. Fair value accounting is the process of maintaining items in financial statements in their current valuation that is the fair value.