Simple Info About Other Payable In Balance Sheet Ifrs Operating Profit

Ap automation refers to the use of technology to streamline and optimise the accounts payable process.

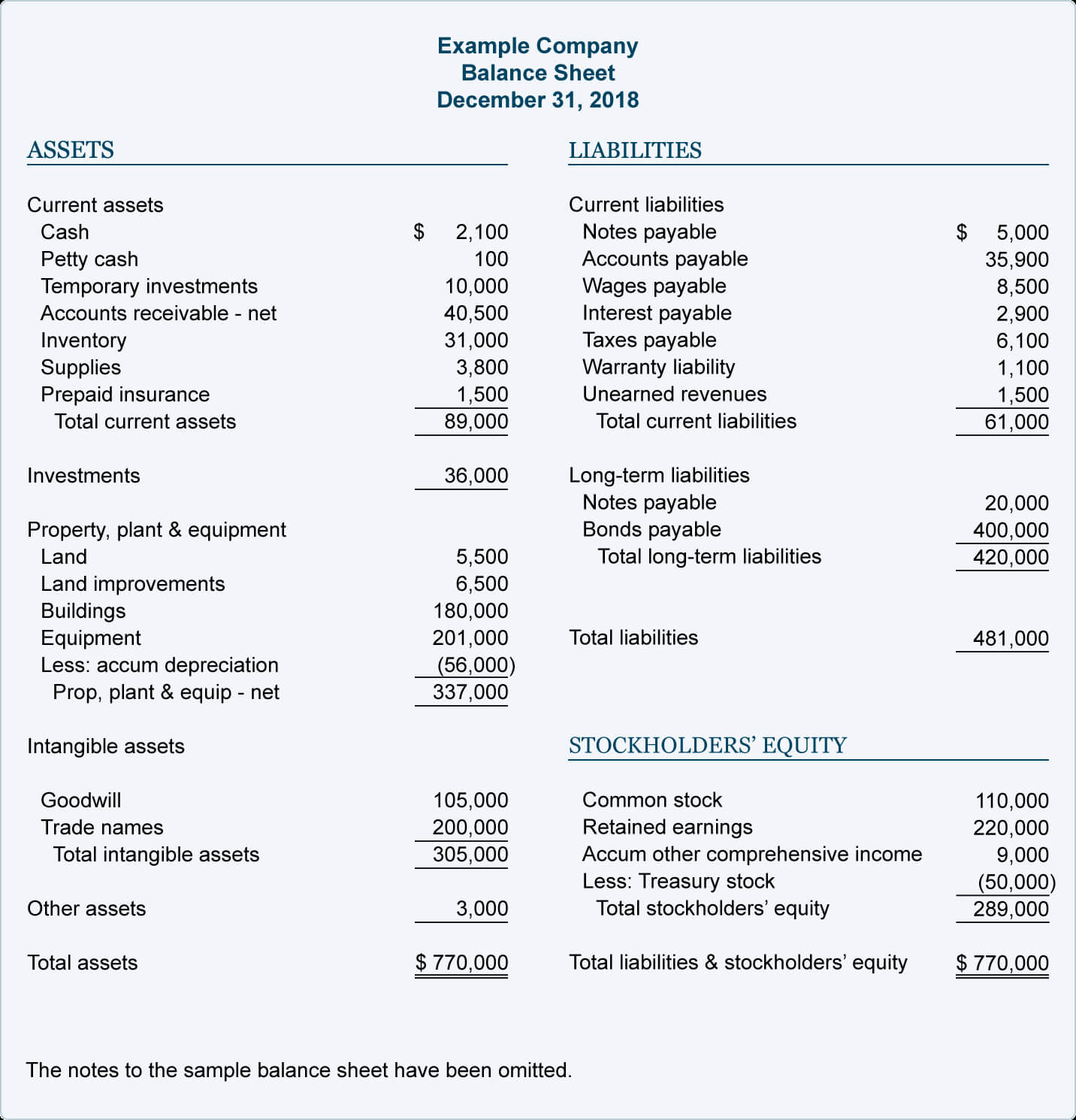

Other payable in balance sheet. These come below the headings of trade payables. Trade and other payables are liabilities (in general payable short term i.e. Other payables are rarely recorded in the financial statements.

Learn what accounts payable on a balance sheet are, compare them to accounts receivable, explore different types, and review an example to learn more. Within one year) showing separately amounts payable to trade suppliers, payable to related parties, deferred income and accruals (with for example corporate income tax and social securities as separate reporting lines based on local gaap or reporting habits). When a company purchases goods or services, it receives an invoice from the vendor.

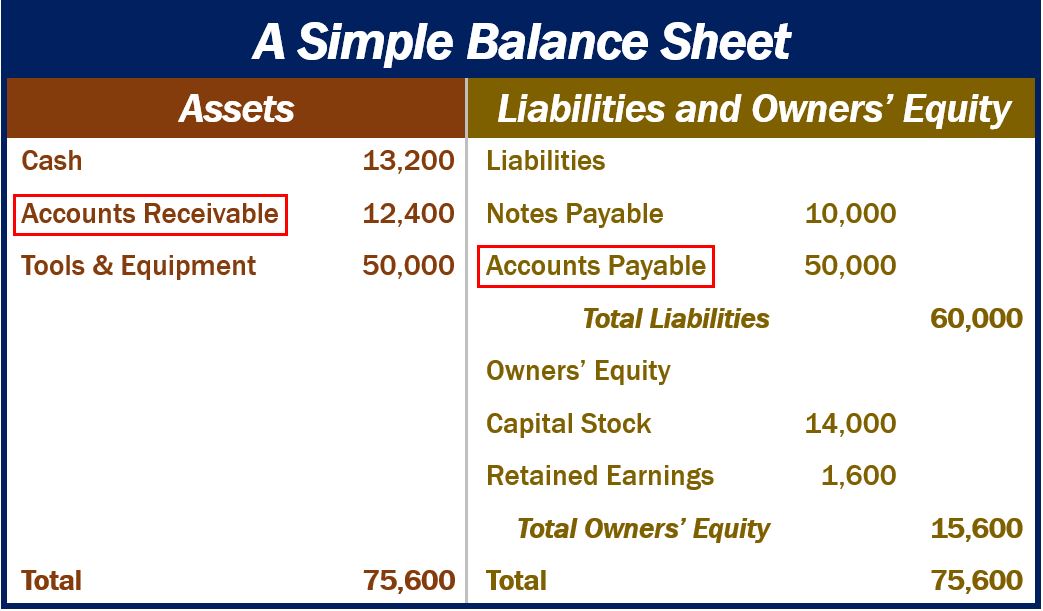

Here are some key strategies to help you manage your accounts payable effectively. Accounts payable is listed on a company's balance sheet. This account includes the payments due to investment suppliers as well as other payments that the company is due, such as payment to employees that have been awarded but are only due in the future.

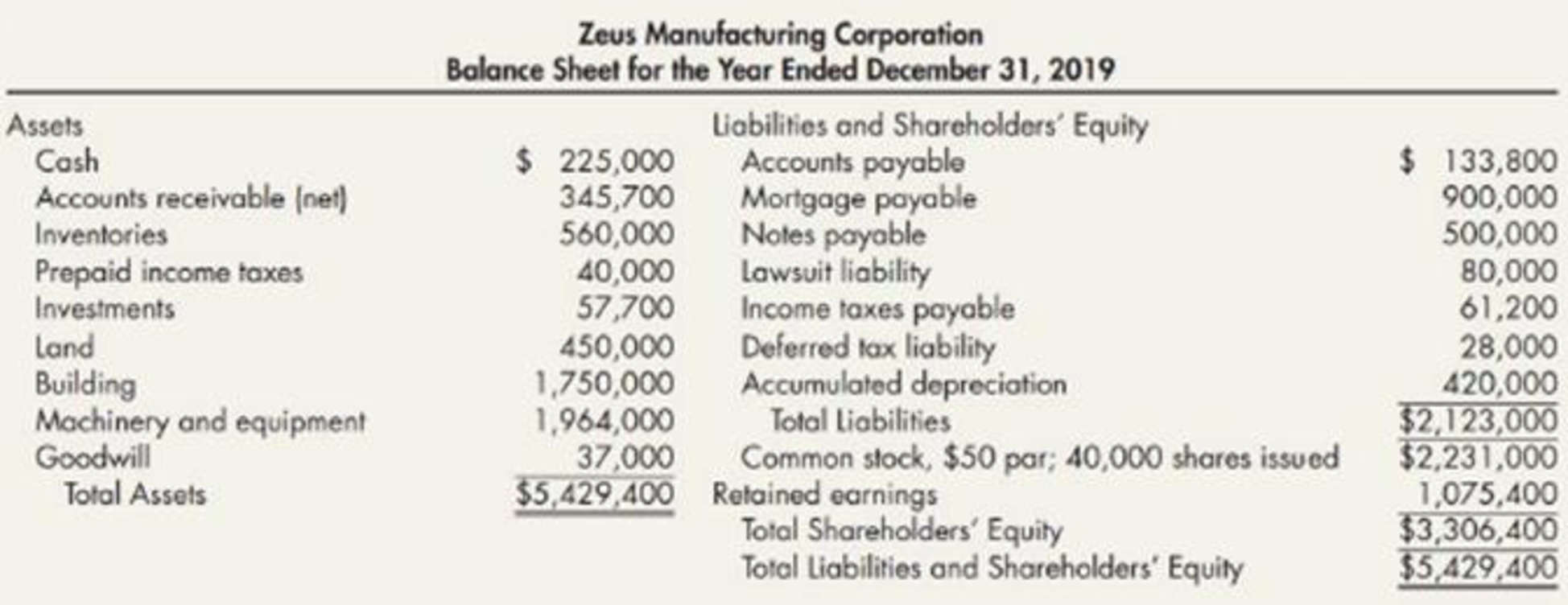

Accounts payable on a balance sheet are part of a company’s liabilities, or, in simple terms, what your company owes. The balance sheet is based on the fundamental equation: If a business has accounts payable (a/p), they have received goods or services from other companies that they need to pay off in the near the future.

In other words, the total amount outstanding that you owe to your suppliers or vendors comes under accounts payable. What is the definition of accounts payable? On the december 31, 2022 balance sheet, the corporation's $120,000 of debt is reported as follows:

To improve accounts payable in a balance sheet, businesses are turning to ap automation. Notice how notes payable can be. Payments made to suppliers for the year:

Accounts payable (a/p) is defined as the total unpaid bills owed to suppliers and vendors for products/services already received but were paid for on credit as opposed to cash payment. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. As a result, in practice, most preparers present a liability on the balance sheet equal to only the amount of outstanding checks in excess of available cash and disclose that such liability is a reinstatement of liabilities cleared in the bookkeeping process.

Subsequently, the closing amount for accounts payable will be mentioned in the balance sheet as a current liability. Other payables are characterized as uncommon or insignificant. Since no interest is payable on december 31, 2022, this balance sheet will not report a liability for.

In this article, we go into a bit more detail describing each type of balance sheet item. The balance sheet is one of the three core financial statements that are used to. ($200,000) accounts payable (closing balance):

Its role in improving the accounts payable balance on the balance sheet is multifaceted: Tracking and paying your liabilities is an important part of keeping your business running at peak efficiency. Accounts payable, on the other hand, are current liabilities that will be paid in the near future.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)