Fine Beautiful Tips About Valuation Balance Sheet Meaning Royal Mail Financial Statements

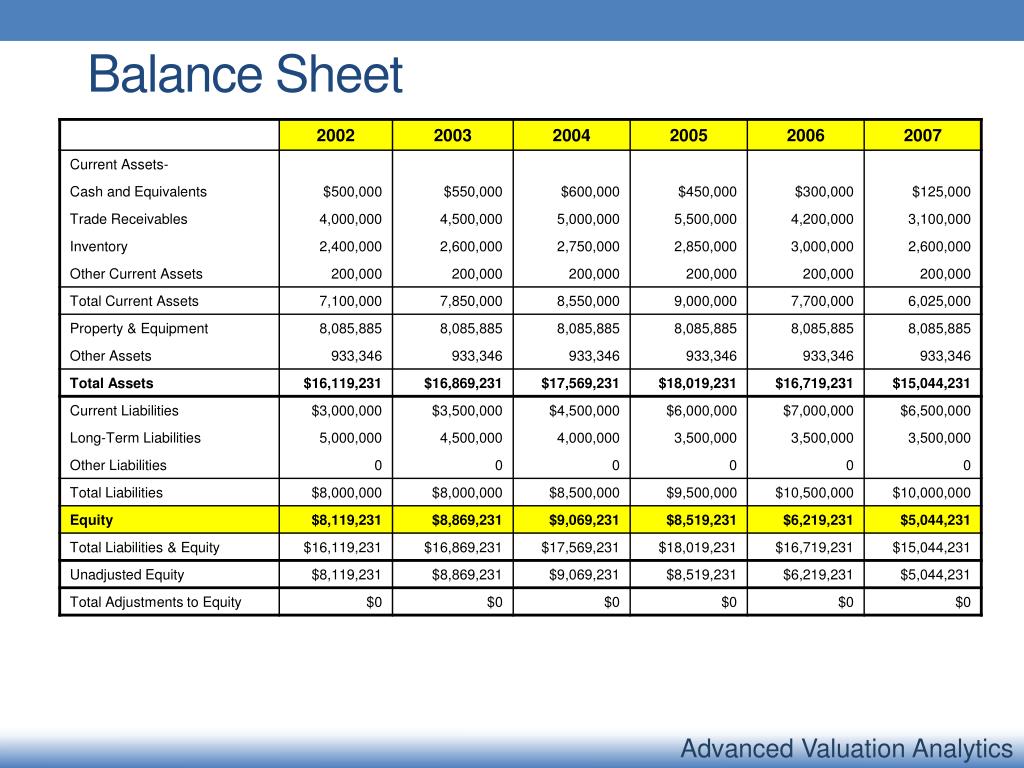

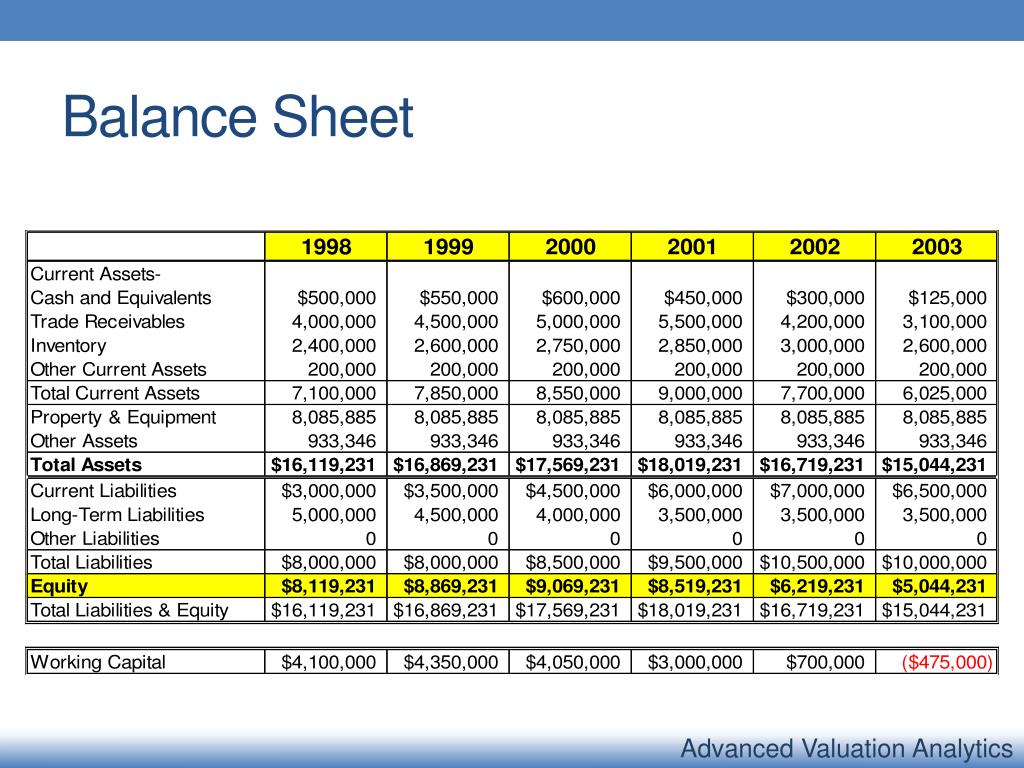

The balance sheet is often overlooked as a material component of the enterprise value (ev) and the equity value.

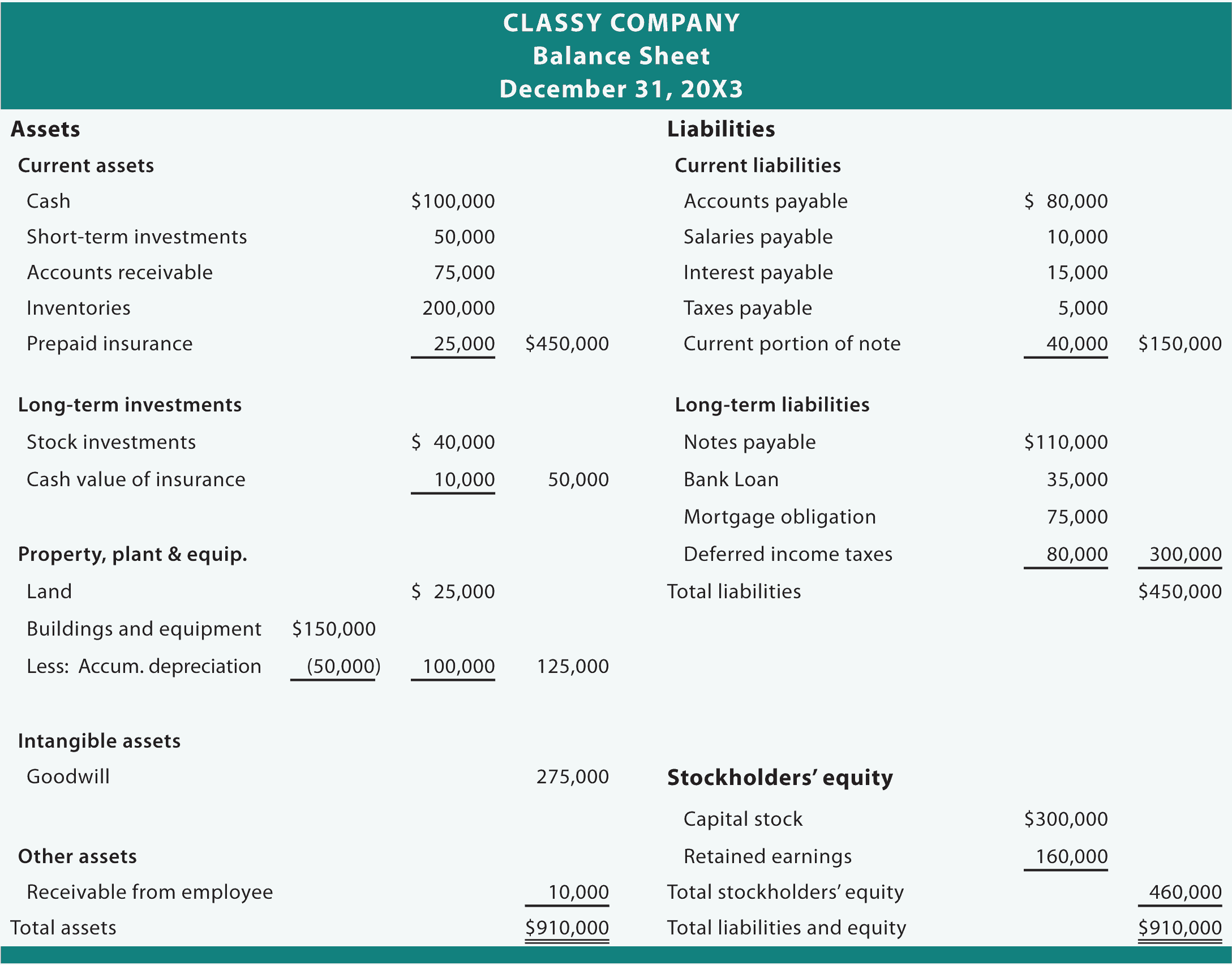

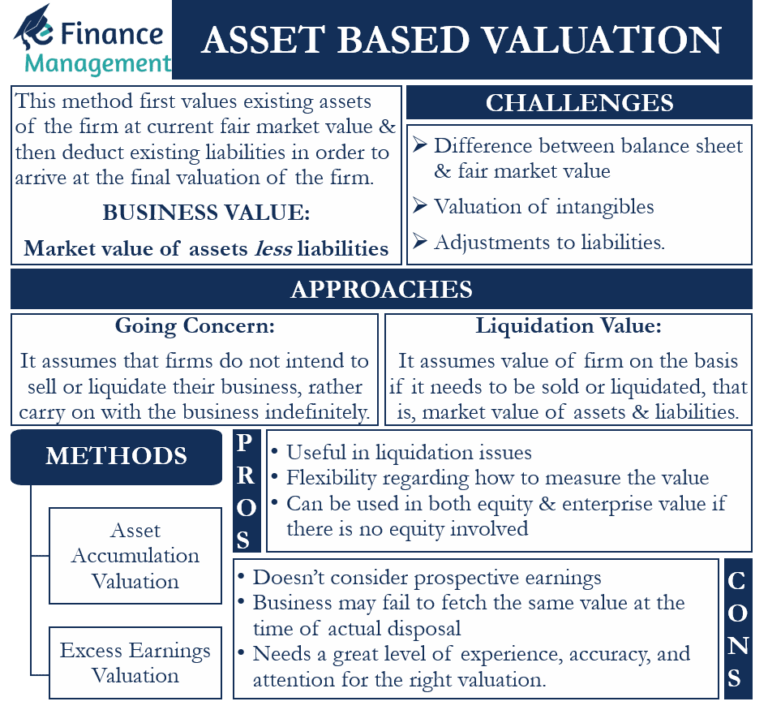

Valuation balance sheet meaning. It is the value that a business is. Asset valuation often consists of both subjective and objective measurements. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

In accounting, a valuation account is usually a balance sheet account that is used in combination with another balance sheet account in order to report the. Asset valuation simply pertains to the process to determine the value of a specific property, including stocks, options, bonds, buildings, machinery, or land, that is conducted usually. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure.

In short, the balance sheet is a. Sample 1 based on 1. It involves determining the likelihood of realizing these assets, and if necessary,.

P/b~ratio=\frac {price}{book~value~per~share}=\frac {market~value~of~equity}{balance~sheet~value~of~equity} the p/b ratio helps us. Book value is often different than a company's market. It is an economic concept that reflects the value of a business.

A firm’s value, also known as firm value (fv), enterprise value (ev). Book value is the net value of a firm's assets found on its balance sheet, and it is roughly equal to the total amount all shareholders would get if they liquidated the. A valuation allowance is an important concept in accounting that pertains to deferred tax assets.

The book value meaning in share market, more commonly known as net book value or carrying value, is a financial metric that represents the value of an asset on a. Valuation balance sheet means the audited consolidated balance sheet of the company, dated october 31, 2000, included in the financial statements. Asset valuation is the process of determining the fair market value of an asset.

A company's book value is the sum of all the line items in the shareholders' equity section of a balance sheet. Net worth is the value of a person or company and can be computed by deducting the total liabilities from the total assets that are owned by the individual/company. It is also a misconception that it is irrelevant.