Here’s A Quick Way To Solve A Tips About Ifrs 1 To 17 Balance Sheet And Profit Loss Account Of A Company

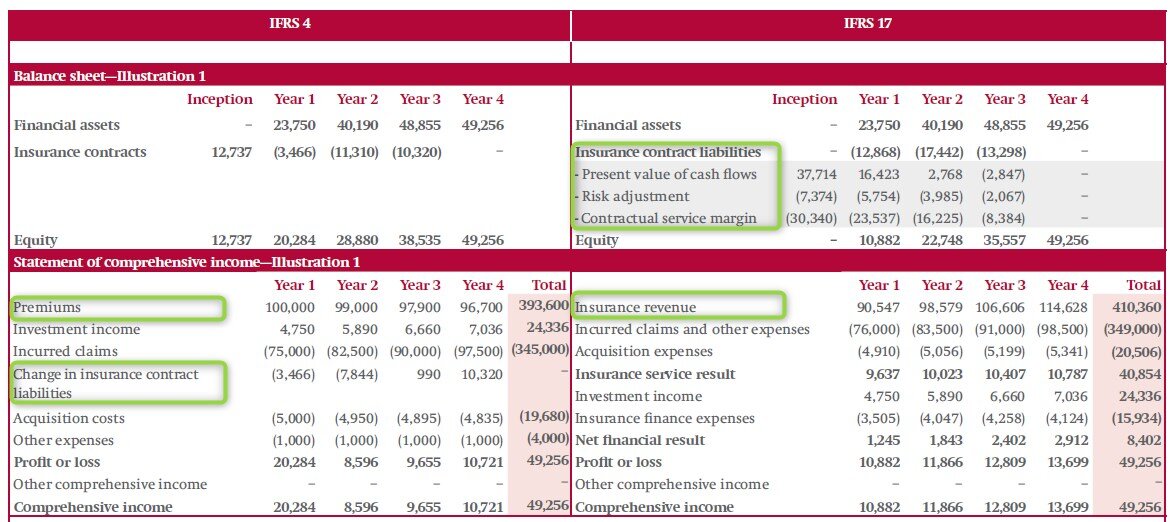

Ifrs 17 supersedes ifrs 4 insurance contracts and related interpretations and is effective for periods beginning on or after 1 january 2021, with earlier adoption permitted if both.

Ifrs 1 to 17. This is a list of the international financial reporting standards (ifrss) and official interpretations, as set out by the ifrs foundation. What do we see? Despite ongoing elevated mortality levels, especially in the us and the uk, s&p global ratings project further improvement in 2024, with earnings expected to reach $1.5b.

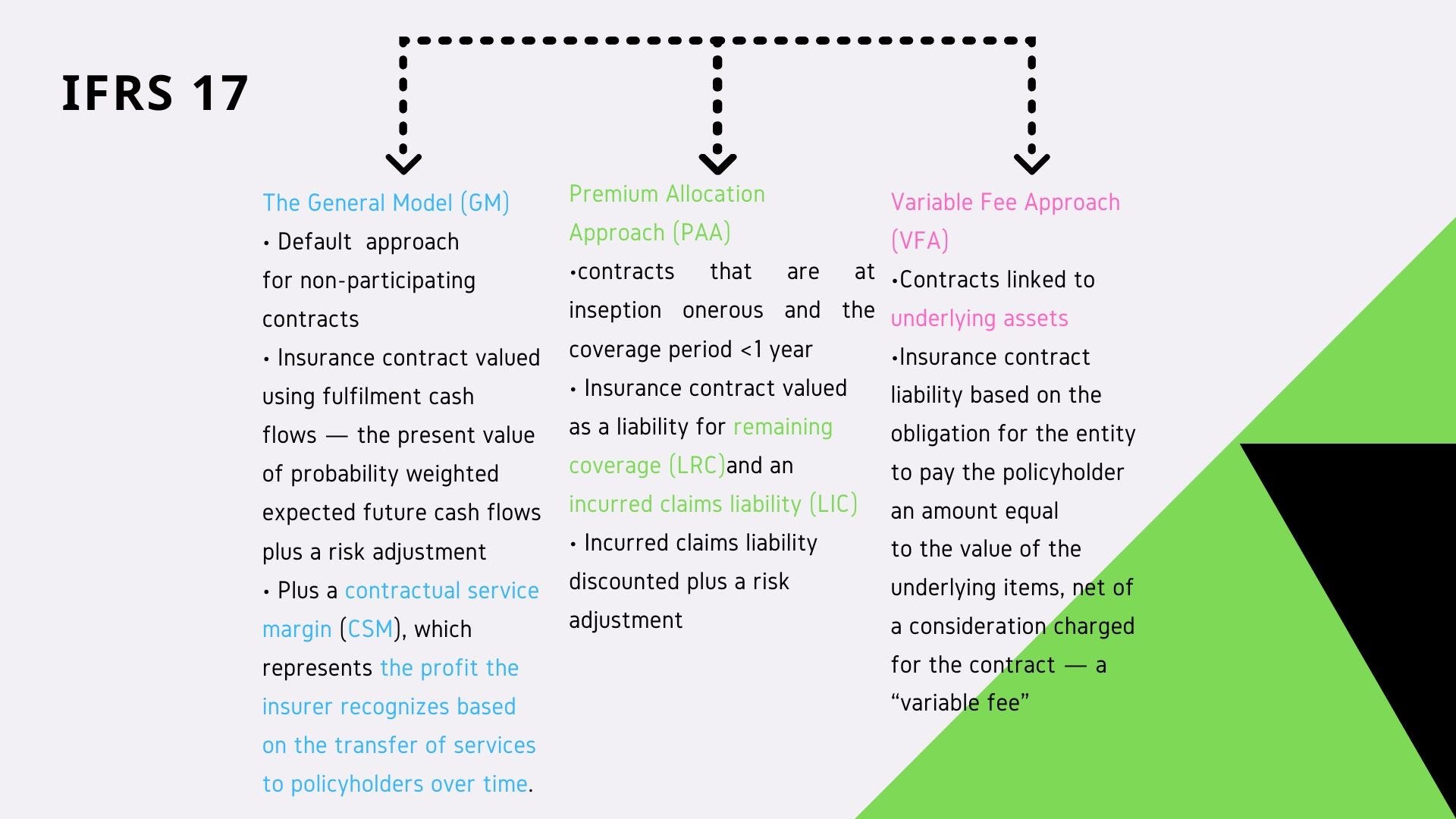

On initial recognition, an entity shall measure a group of insurance contracts at the total of: Ifrs 17 replaces ifrs 4 and sets out principles for the recognition, measurement, presentation and disclosure of insurance contracts within the. 18 rows international financial reporting standards this page contains.

With the ifrs 17 requirements set to come into effect on 1 january 2023, companies need to convert their general ledger from an ifrs 4 to the new ifrs 17 basis. [ifrs 17:32] (a) the fulfilment cash flows (“fcf”), which comprise: Global ifrs institute | insurance many insurers and analysts have hailed ifrs 17 insurance contracts as a positive accounting change, offering better.

Gearing for ifrs 17 implementation. [1] [2] it will replace ifrs 4 on. Standard news about ifrs 17 is effective for annual reporting periods beginning on or after 1 january 2023 with earlier application permitted as long as ifrs 9 is also applied.

In preparation for the adoption of ind as 117, the equivalent to ifrs 17 'insurance contracts', the insurance regulatory and development authority of india. Ifrs 17 insurance contracts. Introduction ig1 ias 10 events after the reporting period ig2.

Ifrs 17 is an international financial reporting standard that was issued by the international accounting standards board in may 2017. Starting 1 january 2025, all insurance companies will be required to report under international financial reporting standard 17. Most recently, ifrs 1 was amended by ifrs 17 insurance contracts (issued may 2017), which added an exception to the retrospective application of ifrs 17 to require that first.