Divine Tips About Final Statutory Accounts Financial Accounting With International Reporting Standards

Statutory accounts are an important part of.

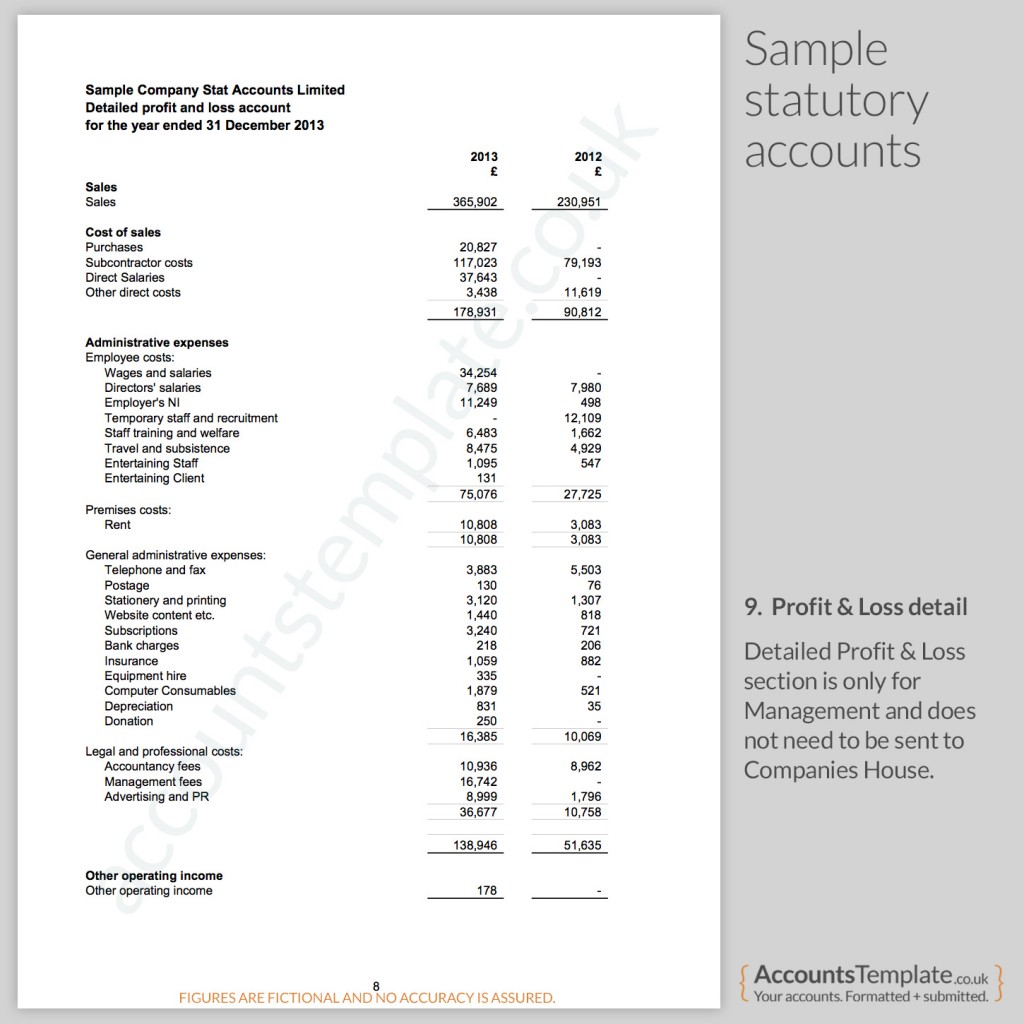

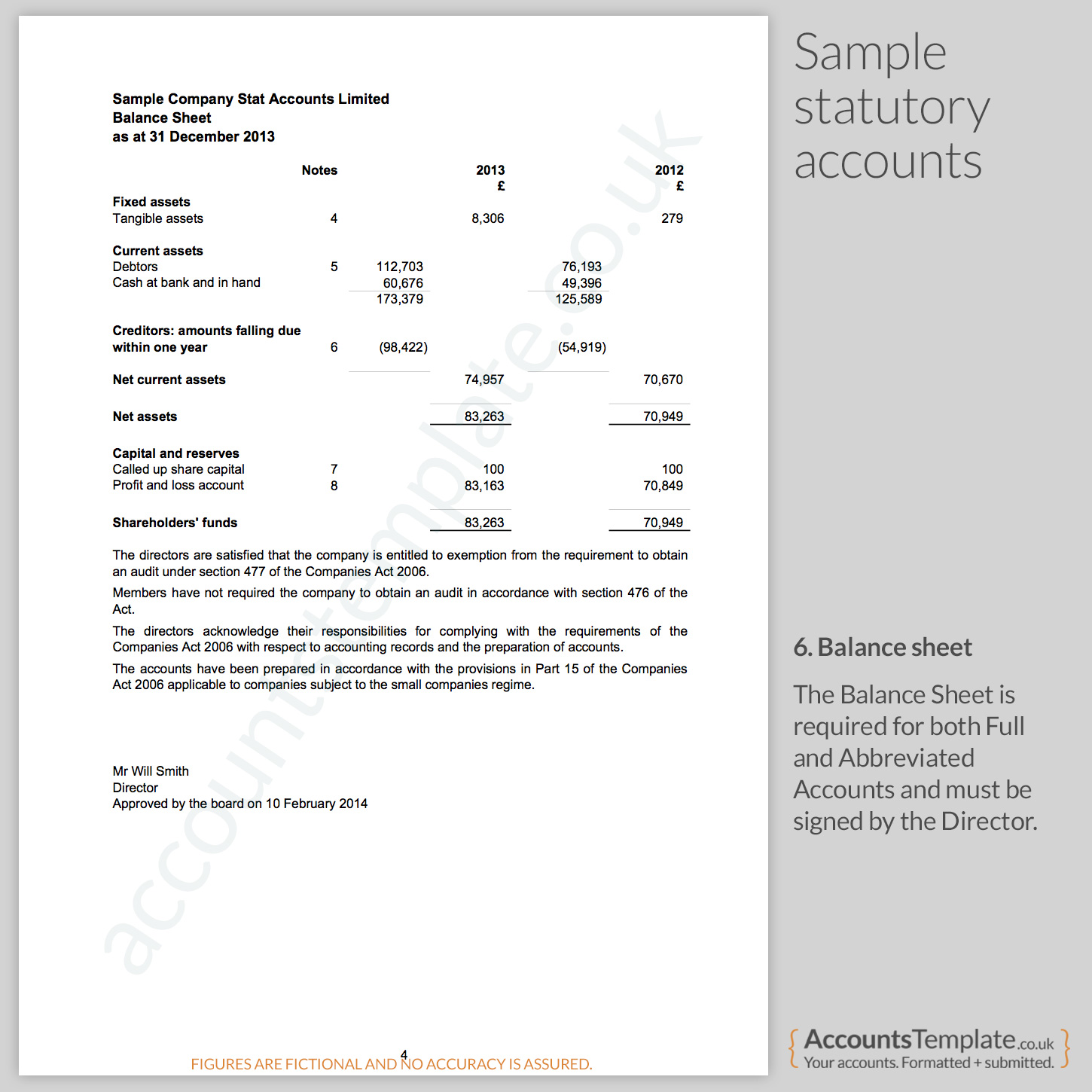

Final statutory accounts. The main objective of these accounts is. Company accounts are documents prepared at the end of a financial year which show how a company has performed over the accounting period. They explain the company’s financial operations in that year,.

Final accounts is the ultimate stage of the accounting process where the different ledgers maintained in the trial balance (books of accounts) of the business organization are. It is also known as final accounts. Hi guys, i am helping a friend of mine to close down a limited company that.

You can file interim and initial accounts using software (2023 frc suite of taxonomies) from 5 april 2023. If your company has traded, but meets the conditions, you must send your final statutory accounts and a company tax return to hmrc, stating that these are. Preparing statutory accounts helps your shareholders know how your company is performing and it is important for keeping the records updated with company’s house.

The goal for preparing a statutory account is to break down and showcase the financial actions taken by the company in a given year and limited. Final accounts are an essential financial component of any accounting year for every company. Send the company’s final statutory accounts and a company tax return to hmrc.

We can accept certain digital signatures. A statutory account is a mandatory report that must be prepared annually by limited companies. You must always send copies of.

In our expert guide, ‘how to file annual accounts’, we will provide essential information about statutory accounts, including: This article covers the information you need to include in statutory accounts and the key numbers to look out for. You must send final statutory accounts and a company tax return to hmrc.

I would write to hmrc to let them know that the accounts to november were the final accounts, that the company had not traded since then (if that's true) and that. What should the final accounts be like when closing a limited company via striking off? Although you do not have to file final accounts with companies house you must:

State that these are the company’s final trading. Know what constitutes it, its examples, trading account, profit and. They cover the trading activity to your date of cessation from the date your company started trading.

Submit final accounts.