Breathtaking Info About Features Of Common Size Statement Trial Balance Proforma

How to common size an income statement.

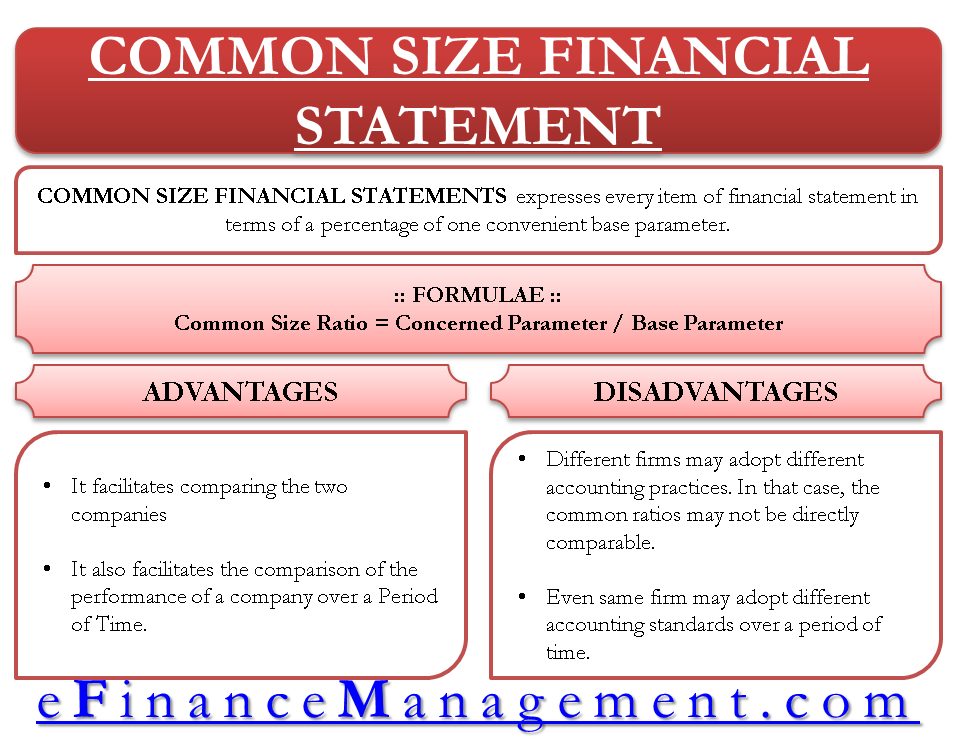

Features of common size statement. A common size financial statement displays items as a percentage of a common base figure, total sales revenue, for. The state ag’s office said that when factoring in pre. It presents financial information in a standardized format to better understand the relative.

What is a common size analysis? An important feature of common size income statements is that by using ratios rather than dollar figures, it’s possible to compare companies of very different. Judge fines donald trump more than $350 million, bars him from running businesses in n.y.

This differs compared to traditional financial statements that would use. Common size analysis is used to visualize a company's financial performance. Use industry comparisons to assess organizational performance.

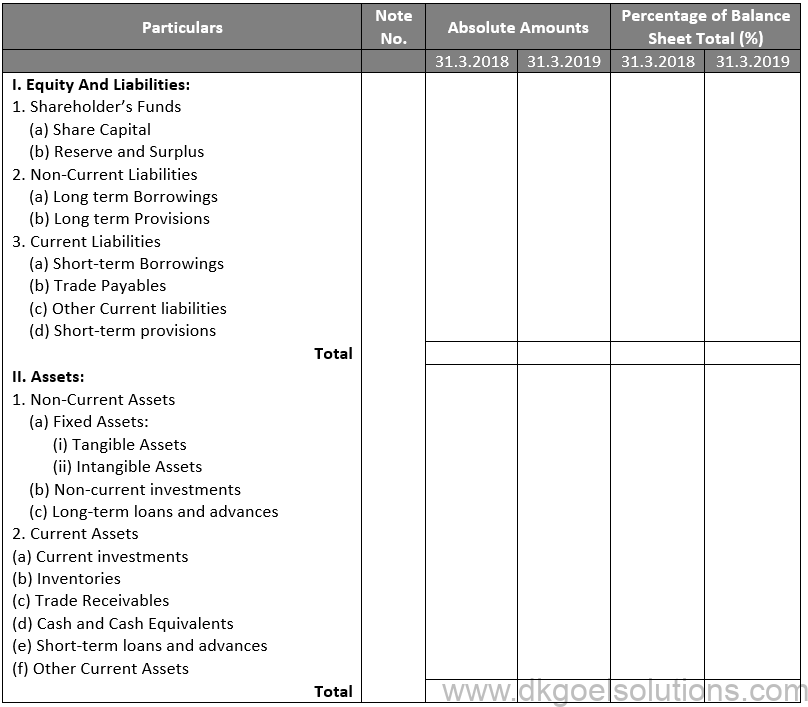

Common size balance sheet is a statement in which every item of assets, equity and liabilities is expressed as a. The process of creating a. Financial statements are redrafted to be expressed in terms of common base (total assets or liabilities in case of balance sheet and net sales in case of income statement).

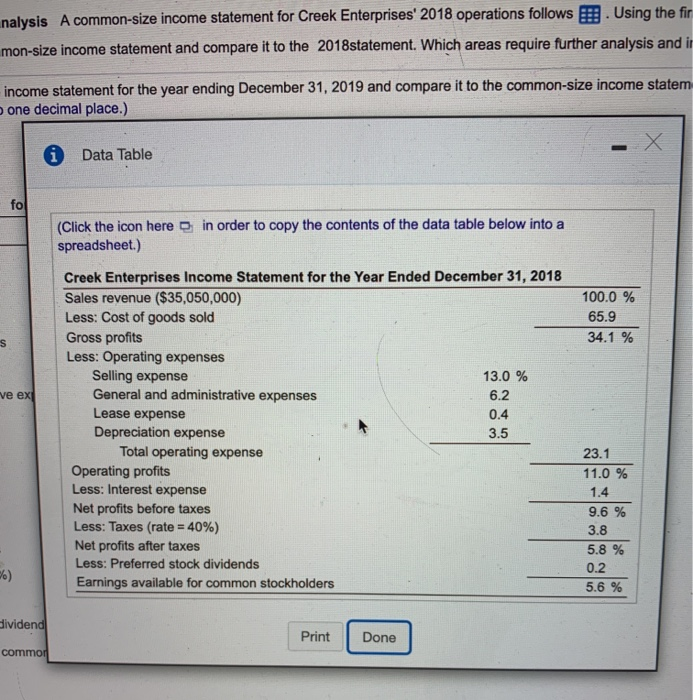

To common size an income statement, analysts divide each line item (e.g. Common size analysis is a technique that is used to analyze and interpret the financial statements. Gross profit, operating income, marketing.

Common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing. All patients used dopaminergic medications; A common size analysis is a tool financial managers use to learn more about a company's finances over certain periods.

What is a common size financial statement? This technique is also termed as vertical analysis. A common size financial statement lists any entries as a percentage of a base figure.

.jpg?w=620&is-pending-load=1#038;ssl=1)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/CommonSizeIncomeStatement_v1-6d2a9c4def2449168cbd16525632bbd1.jpg)