Fantastic Info About Definition Of Owners Equity In Accounting What Is Examples

The statement of owner's equity portrays changes in the capital balance of a business over a reporting period.

Definition of owners equity in accounting. One of the fundamental tenets of accounting is that this relationship between assets, liabilities, and owners’ equity must always be in balance (hence the. Statement of owner’s equity definition: Generally, equity begins with the original contribution to the organisation by way of assets such as cash or assets used within the business.

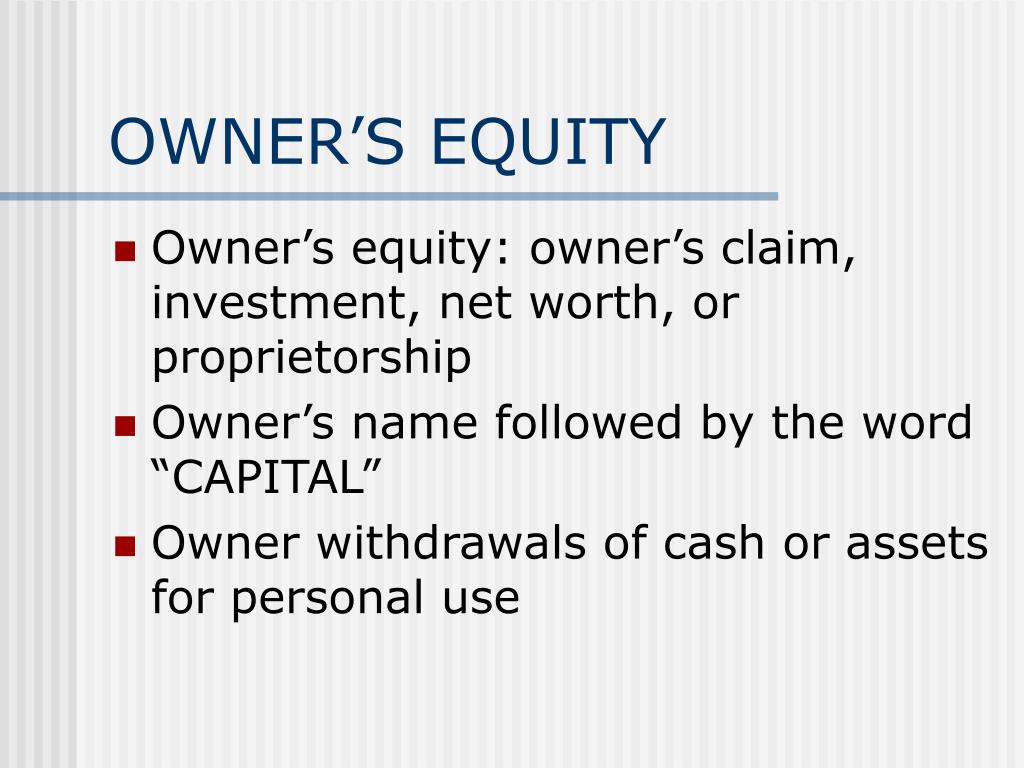

Owner’s equity, often called net assets, is the owners’ claim to company assets after all of the liabilities have been paid off. Equity in accounting is the remaining value of an owner’s interest in a company after subtracting all liabilities from total assets. It can help you determine what you actually own and what your net value.

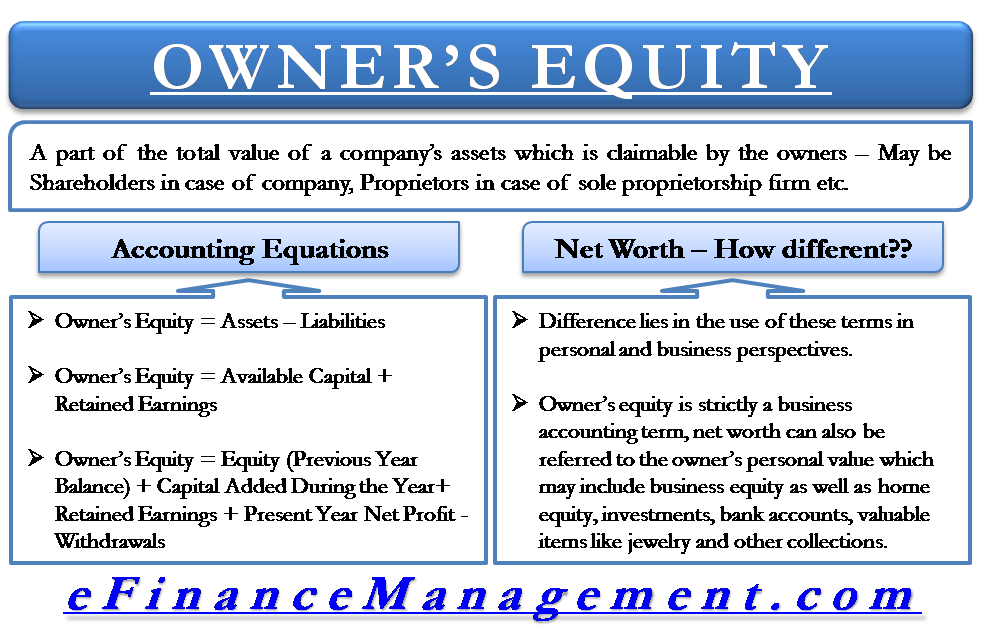

Owner's equity is one of the three main sections of a sole proprietorship's balance sheet and one of the components of the accounting equation:. Owner’s equity is defined as the proportion of the total value of a company’s assets that can be claimed by its owners (sole proprietorship or partnership) and by its shareholders. Said another way, it’s the.

The book value of equity is calculated as the difference between assets and liabilities on the company’s balance sheet, while the market value of equity is based on the current share. In accounting, the statement of owner’s equity shows all components of a company’s funding outside its liabilities and how they change. Owners' equity is the total assets of an entity, minus its liabilities.

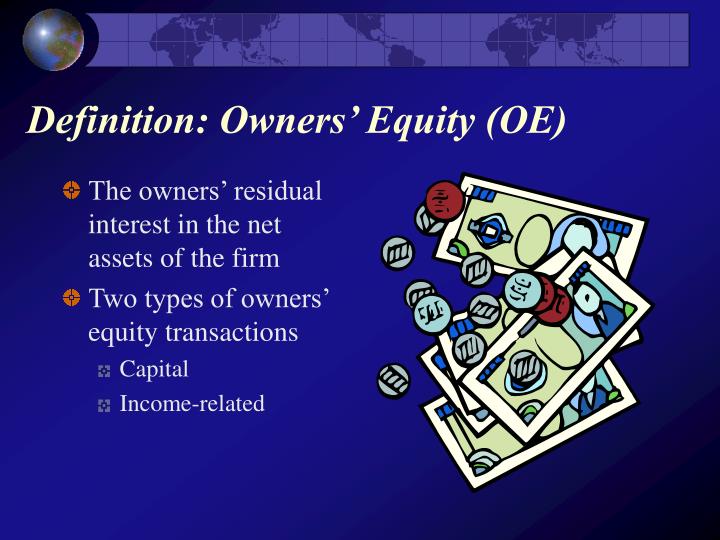

Also known as shareholder equity or stockholder equity, owner’s equity is a company’s residual interest in the entity’s assets after deducting liabilities. The concept is usually applied to a sole. Owner’s equity represents the claims by the owners and stockholders of a business to the capital available for distribution to the shareholders and is sometimes referred to as.

Owner’s equity represents the owner’s investment in the business minus the owner’s draws or withdrawals from the business plus the net income (or minus the net. In other words, if the business. Most businesses use at least some debt to finance their operations,.

2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate; Definition of owner's equity. It is also known as net worth, net assets, or shareholders' funds.

Owner’s equity is also known as net assets, net worth, shareholder’s equity, and owner’s capital. In simple terms, the definition of owner’s equity can be stated as “a part of the total value of a company’s assets which is claimable by the owners (in case of sole.

:max_bytes(150000):strip_icc()/equityaccounting_definition_final_0929-d661a957ff764ef098318df380dede24.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/_equity_final-a71099b17173432f813b15202e64459d.png)

:max_bytes(150000):strip_icc()/ShareholderEquitySE_V1-def750af6b7d42b78c60369d49f6e68f.jpg)