Formidable Info About Balance Sheet And Profit Loss Statement Ind As P&l Format Financial Is

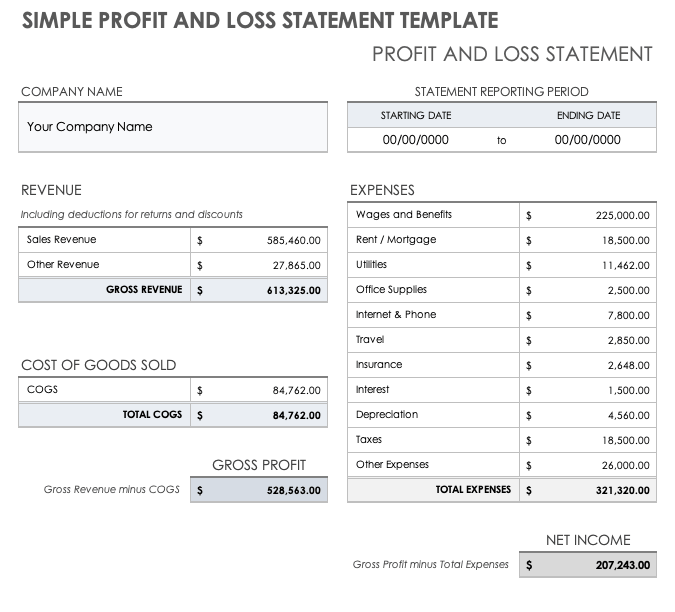

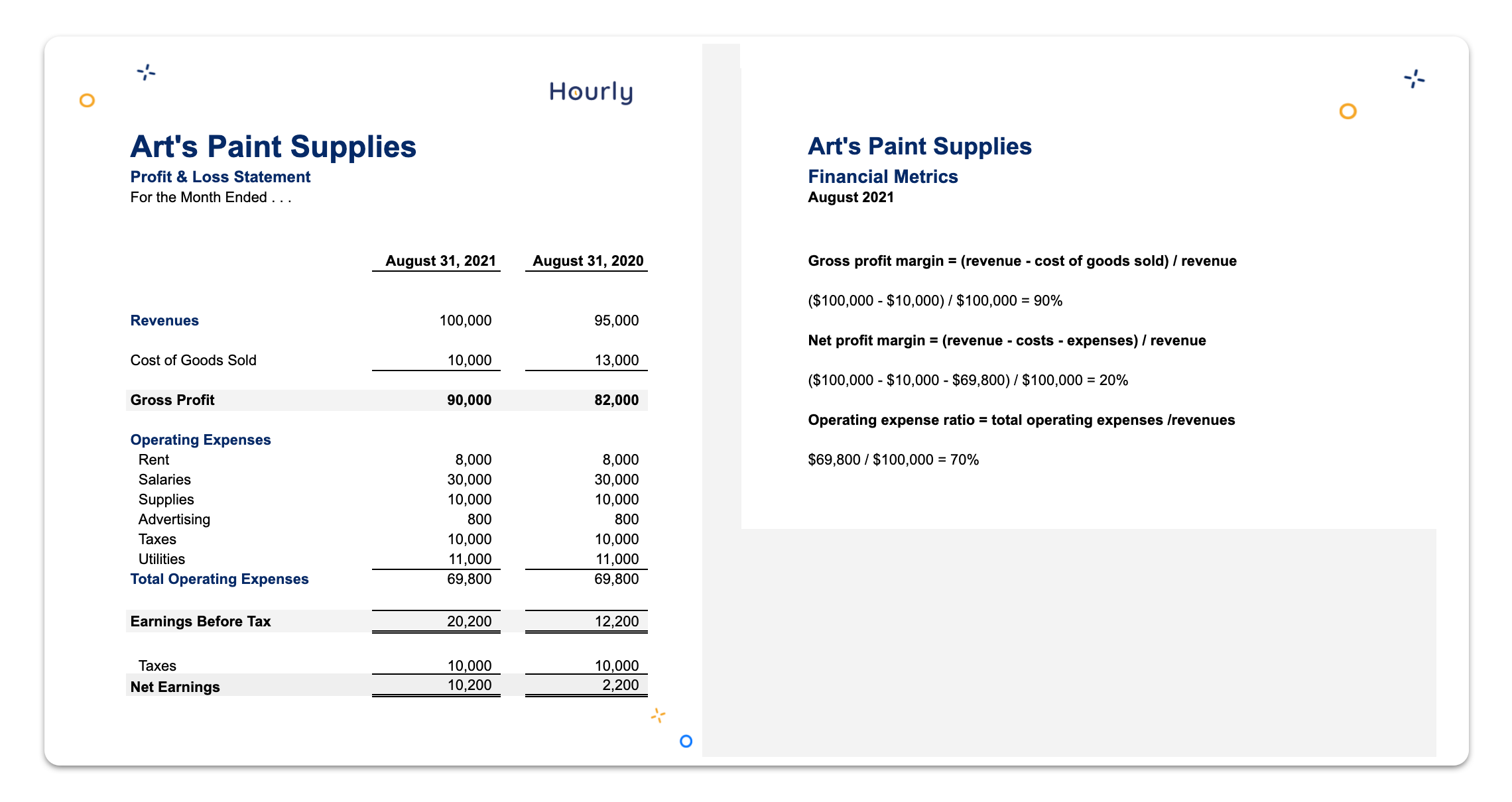

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

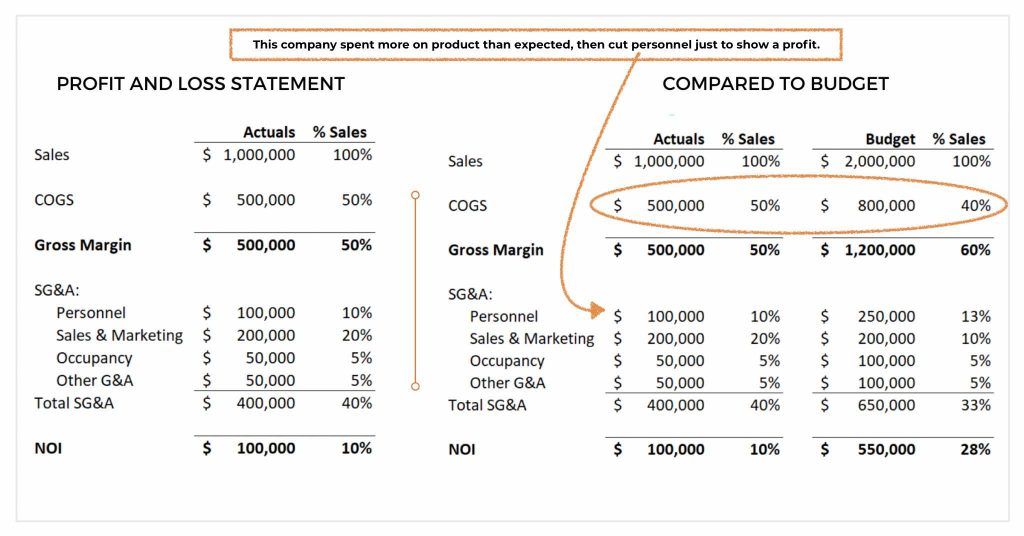

Balance sheet and profit and loss statement ind as p&l format. Different formats of the profit & loss account. It begins with the entry of revenue, includes the cost of goods sold, tax expenses, operating expenses, and. A p&l statement, also known as a profit and loss statement or income statement, is a financial document that explains a company’s financial health for a given.

Financial statements as defined under the act include balance sheet, statement of changes in equity for the period, the statement of profit and loss for the. Along with your balance sheet, your profit and loss statement (p&l) is the most significant financial document your business will produce. A p&l statement provides investors and analysts the information they need to assess your profitability, combining this data with insights from your balance sheet.

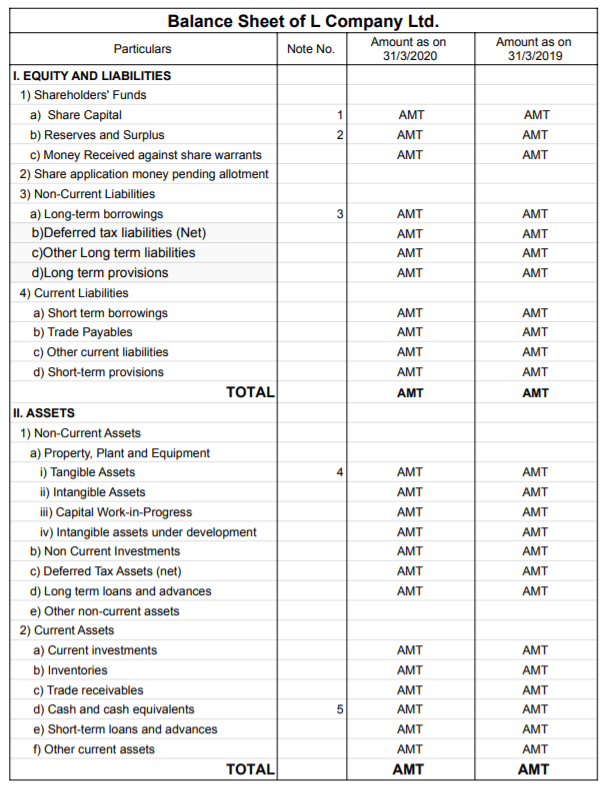

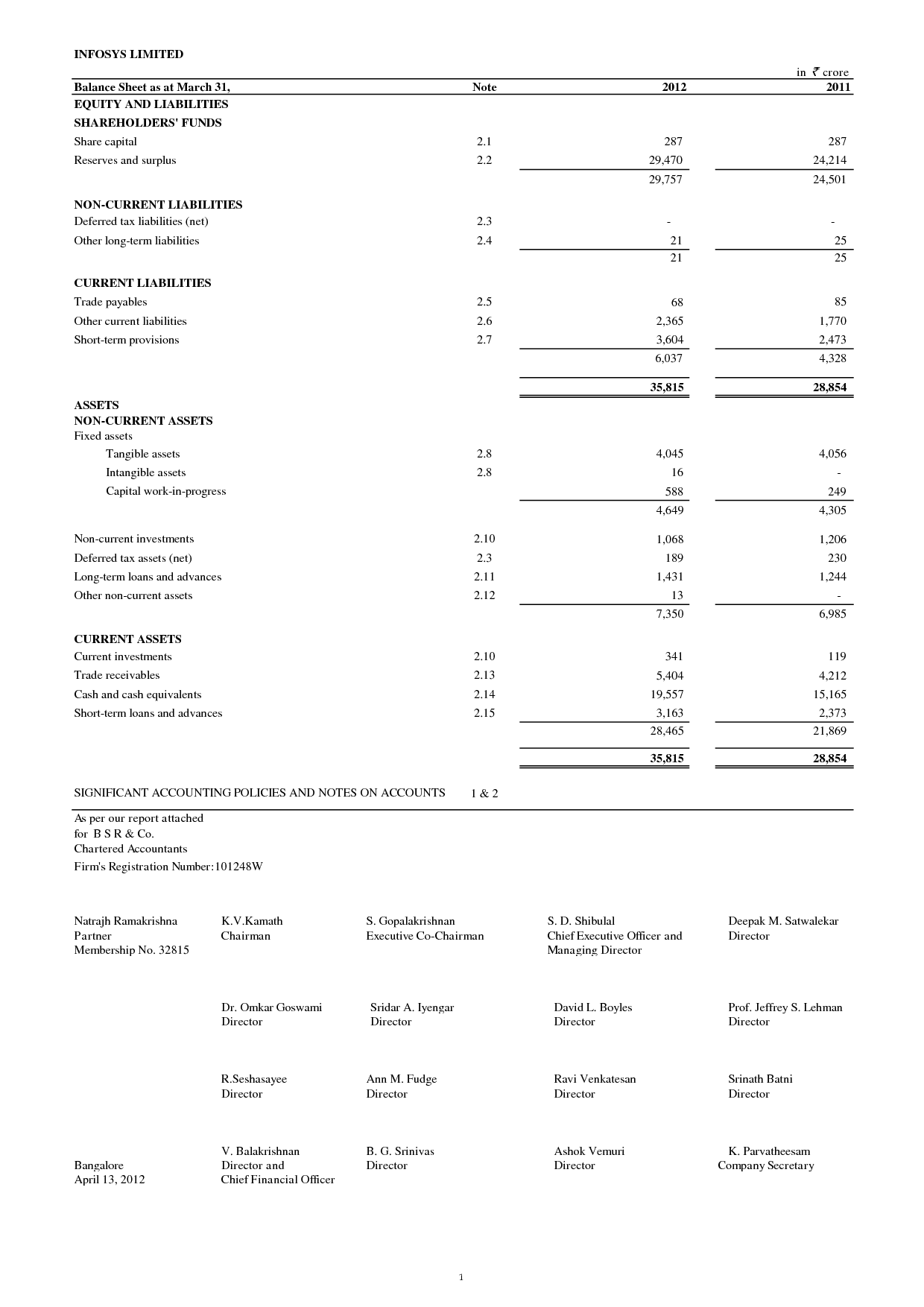

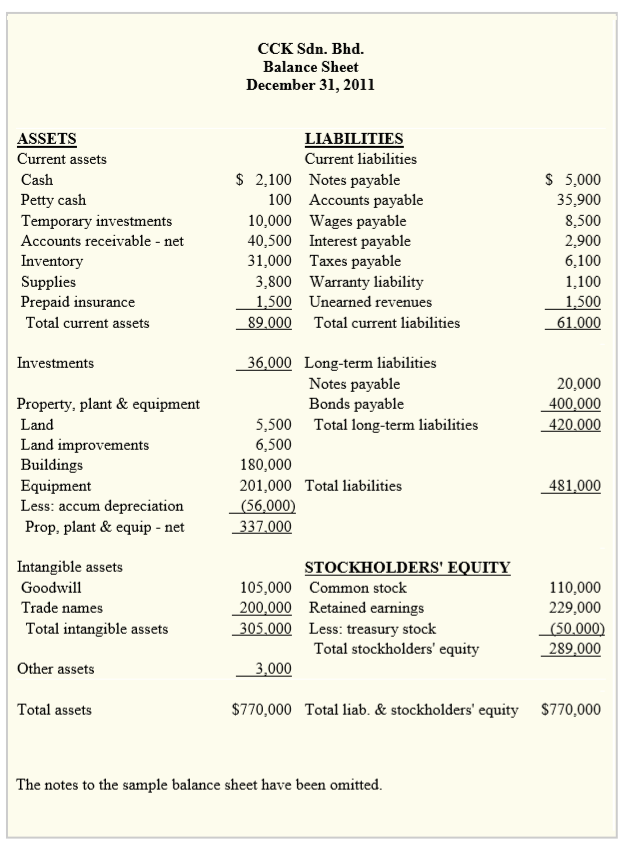

The income statement or p&l statement follows a general format. Complete set of financial statements balance sheet statement of profit and loss statement of changes in equity other comprehensive profit or loss section income. The main difference between a balance sheet and a profit and loss statement is that a balance sheet shows a company's assets, liabilities, and owner's equity at a specific.

Ind as 1 as well as the act defines a “complete set of financial statements” as follows: The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income. Profit and loss (p&l) statement template.

(a) a balance sheet as at the end of the period (including statement of changes in equity which is presented as a part of the. It’s sometimes referred to as. Profit and loss statement (p&l) vs balance sheet explained september 6, 2023 12:17 am no comments profit and loss statement (p&l) vs balance sheet.

A profit and loss (p&l) statement and a balance sheet serve distinct purposes in financial reporting. Yes, generally, the profit and loss statement is prepared first to culminate in the net income figure, which then feeds into the retained earnings in the shareholders’ equity. Format for sole traders & partnership.

July 13, 2022 when looking at your financial statements, there are three main types that you will issue on a regular basis: Profit and loss (p&l) statements are one of the three financial statements used to assess a company’s performance and financial. The balance sheet, the profit and loss (p&l).

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The p&l statement provides a summary of a company’s. This profit and loss (p&l) statement template summarizes a company’s income and expenses for a period of time to arrive at.