Can’t-Miss Takeaways Of Info About Commission Expense On Income Statement Owners Equity Equals

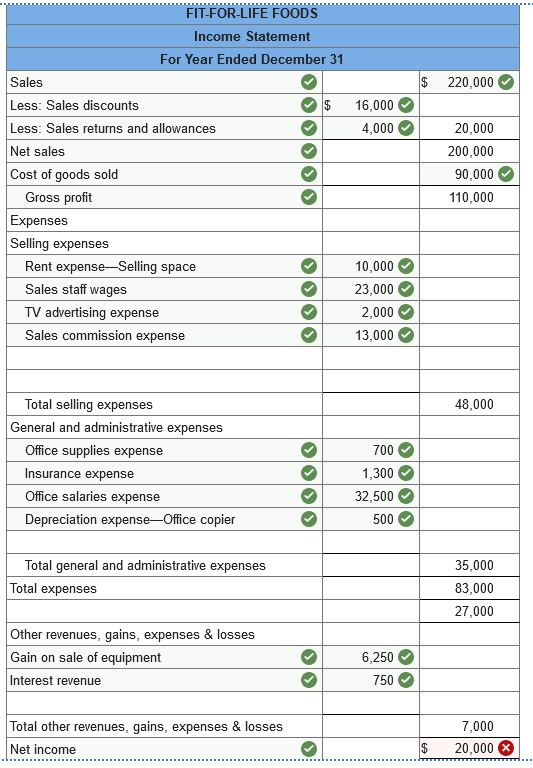

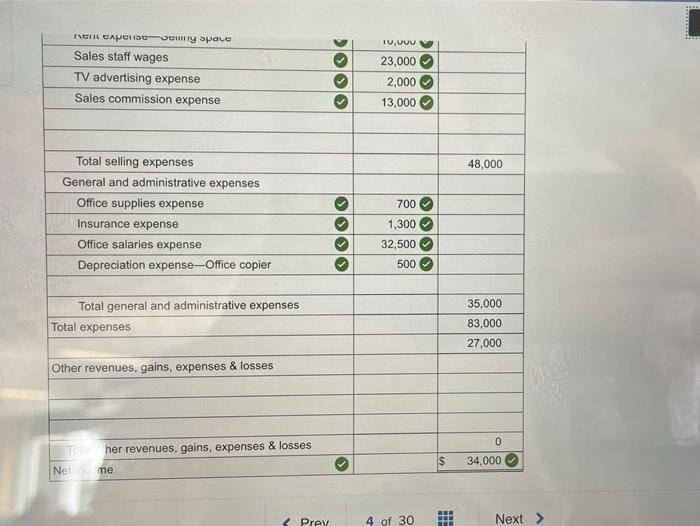

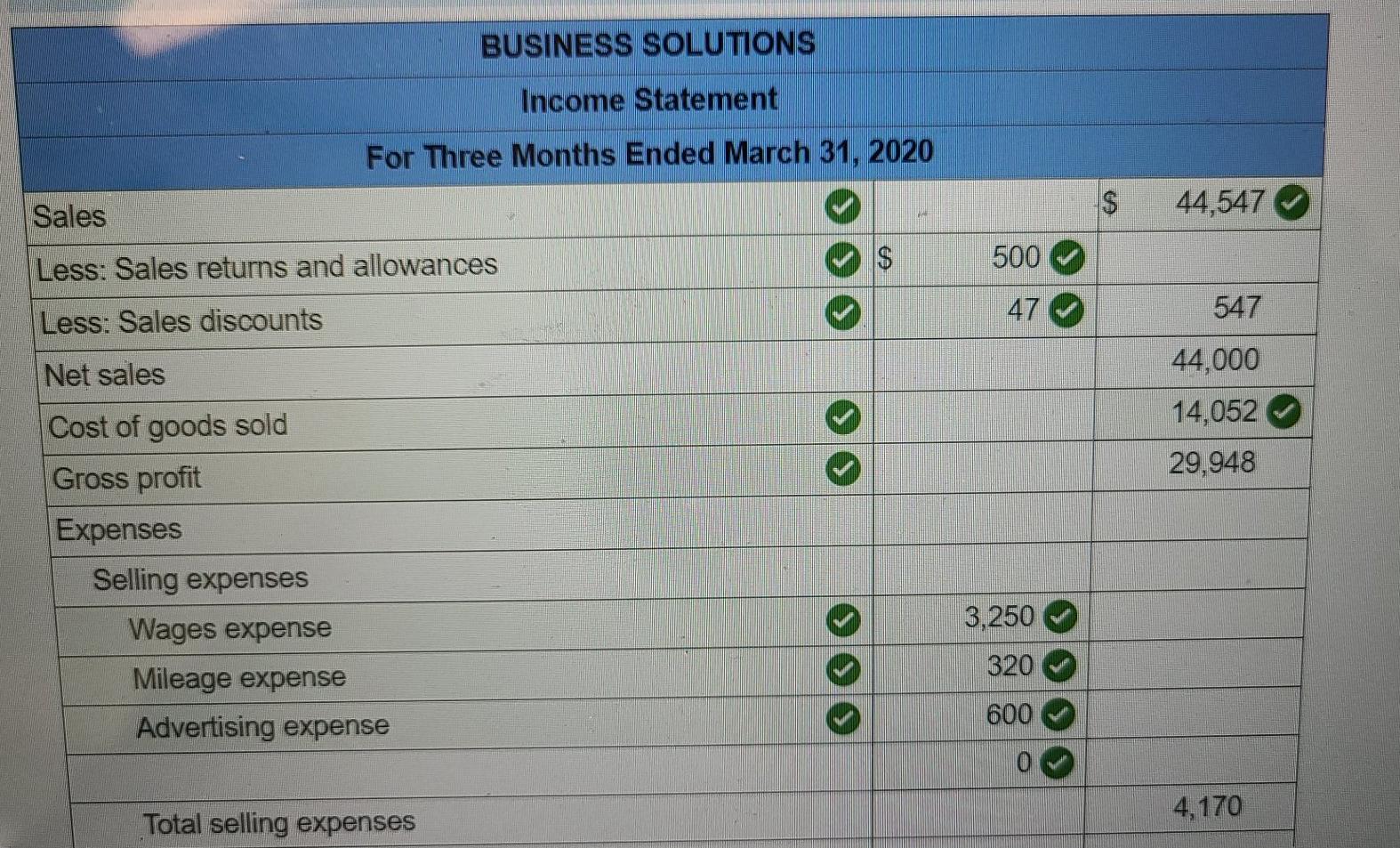

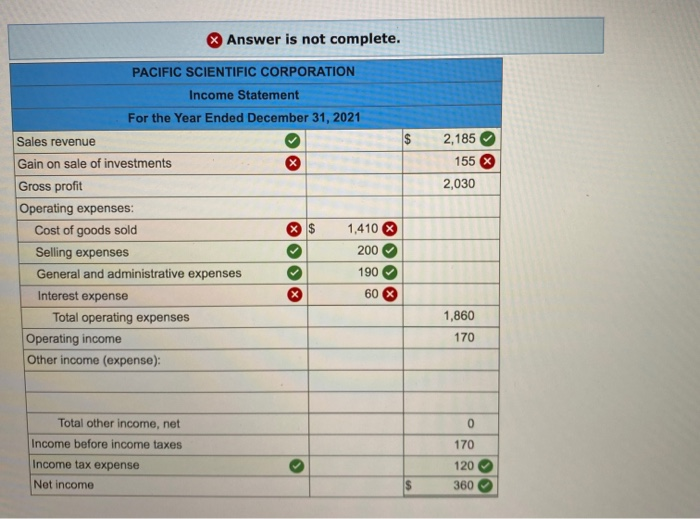

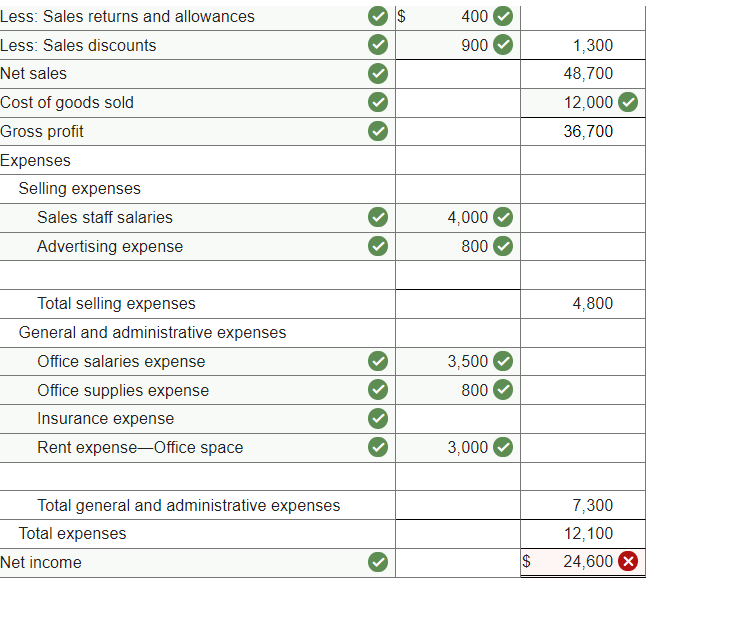

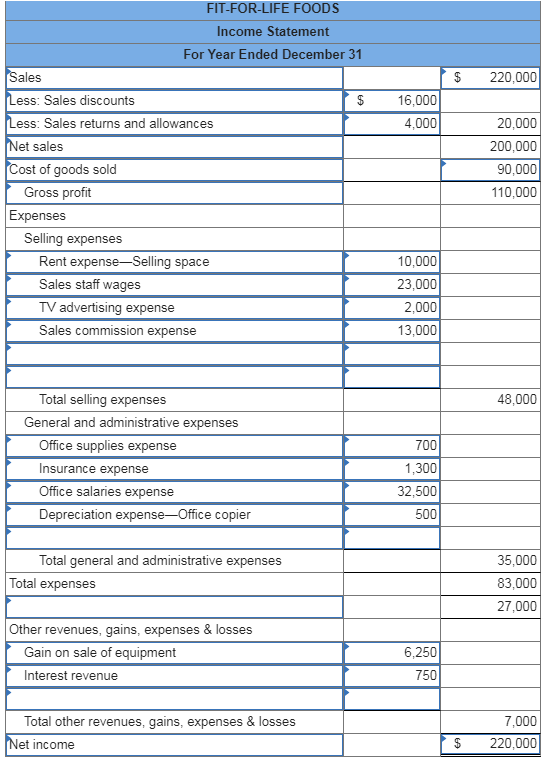

Sales commissions appear on the income statement, typically listed as an operating expense.

Commission expense on income statement. In the income statement, expenses are costs incurred by a business to generate revenue. Combines a guaranteed income with variable earnings for performance. What is commission income affiliate.

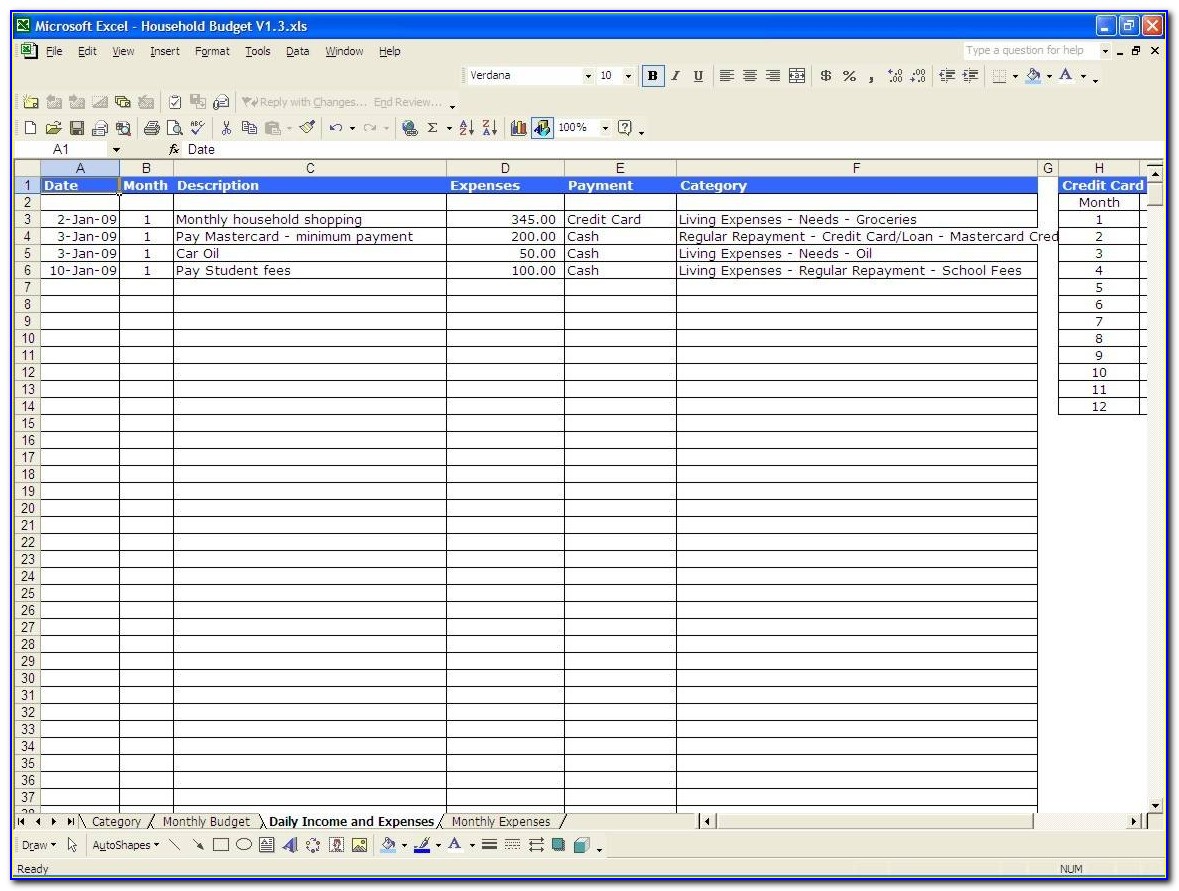

How to record sales commissions in accounting? The company or party that pays the commissions will have commissions expense. If the sales are related to the company's main activities, the commissions are reported on the company's income statement as commission expense, or as part of the.

The historical cost principle means that most. Adr annual stock financials by marketwatch. The cost of goods sold and sales commission expense should be reported in the same period as the related sales are reported.

You would normally report selling. Accrued commission expense journal entry. Sales commissions paid out are classified as a selling expense, and so are reported on the income statement within the operating expenses section.

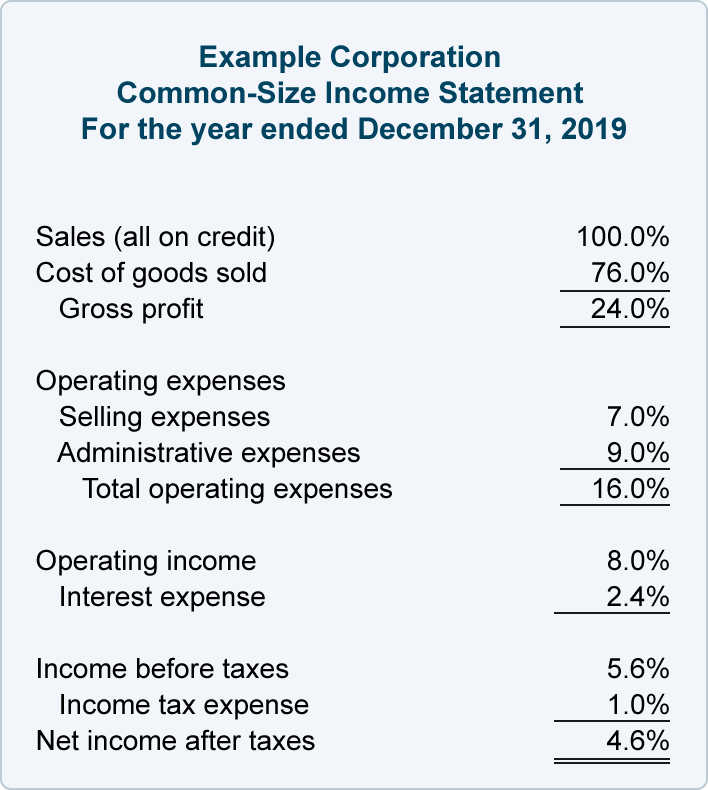

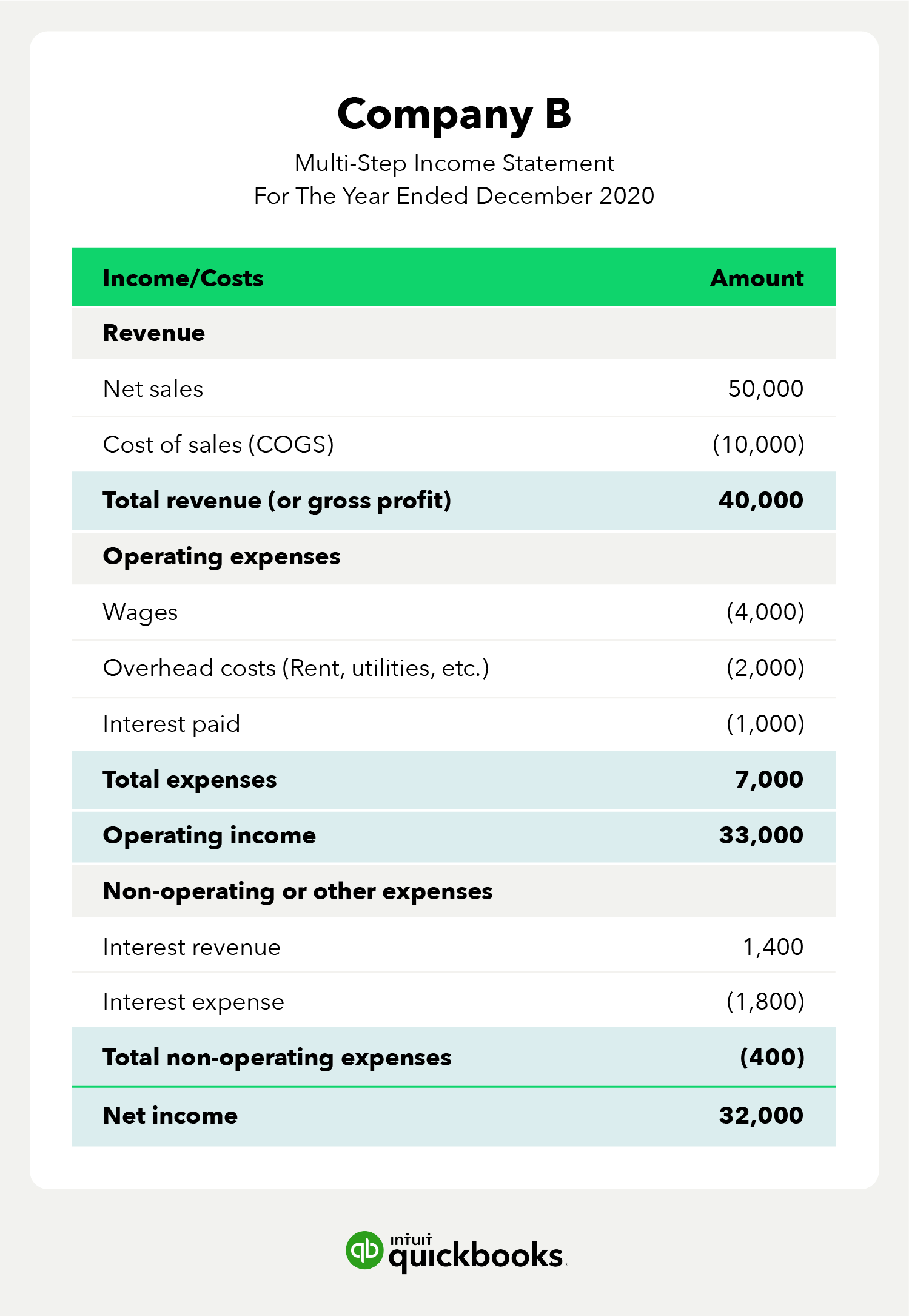

Sales commissions are an important aspect of a company’s income statement. Commission income is an amount earned in exchange for transacting a sale of a product or providing a service. The income statement focuses on four key items:

Sales commissions are typically reported as an operating expense on the income statement. It shows how much was slated to be. Under the accrual basis of accounting this income statement account reports the amount of commissions expense that pertains to the.

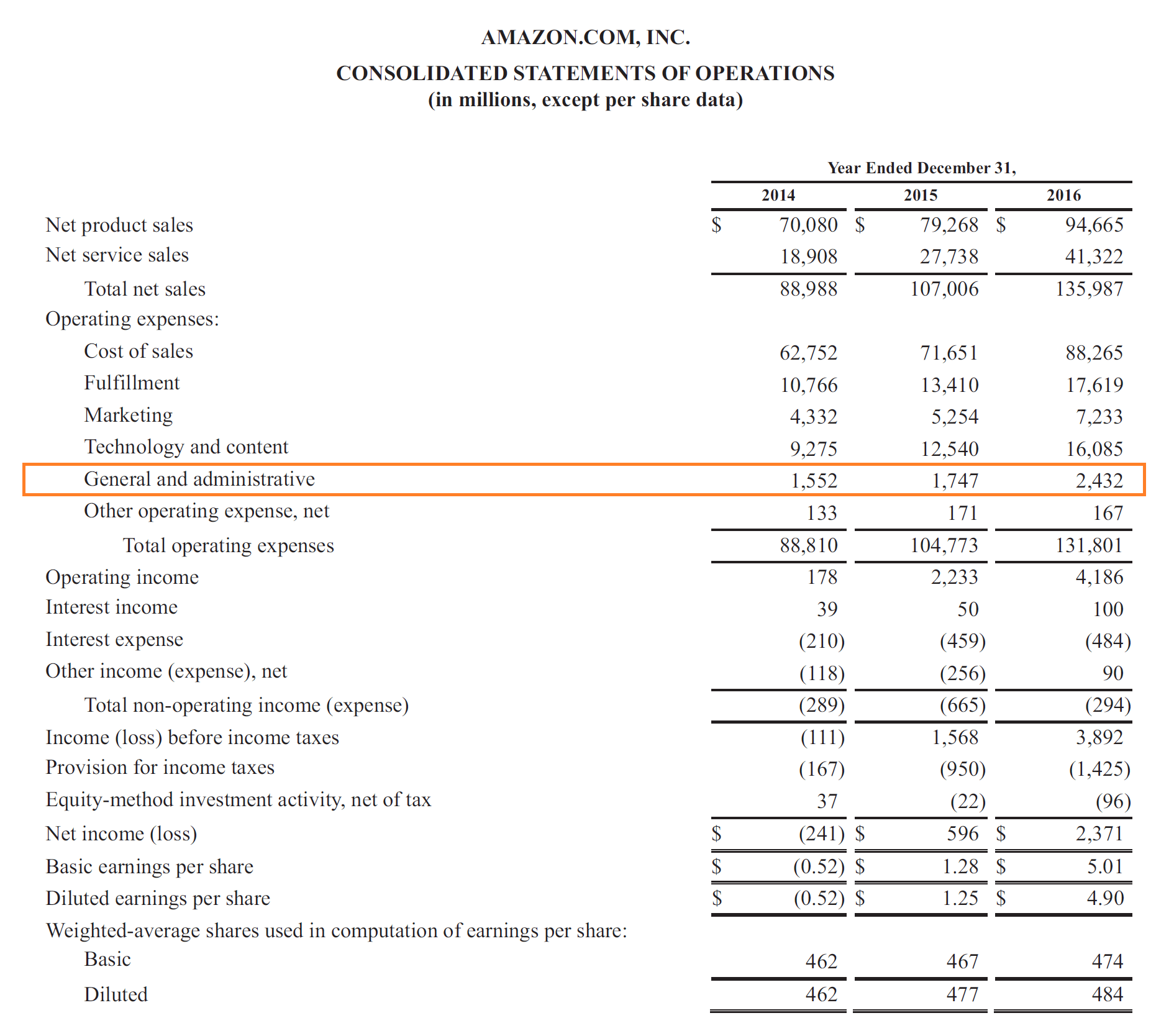

The commissions expense is an account on an income statement generated with the accrual method of accounting. Some of the common expenses recorded in the income. Sales commissions are considered to be operating expenses and are presented on the income statement as sg&a expenses.

Sales commissions expense definition. These commissions are reported as expenses, reducing the total profit. Accounting for commissions revenues under the accrual basis of accounting ,.

You can classify the commission expense as part of the cost of goods sold, since it directly relates to the sale of goods or services. View the latest jtchy financial statements, income statements and financial ratios. Commission expense is an operating expense that businesses incur when paying a fee or commission to an individual,.

(sg&a is the acronym for selling, general and. How to record sales commissions as an expense? This means that commissions are situated after the cost of goods sold.