Breathtaking Tips About Relationship Between Income Statement And Balance Sheet Analyse The

A balance sheet lists assets and liabilities of the organiz.

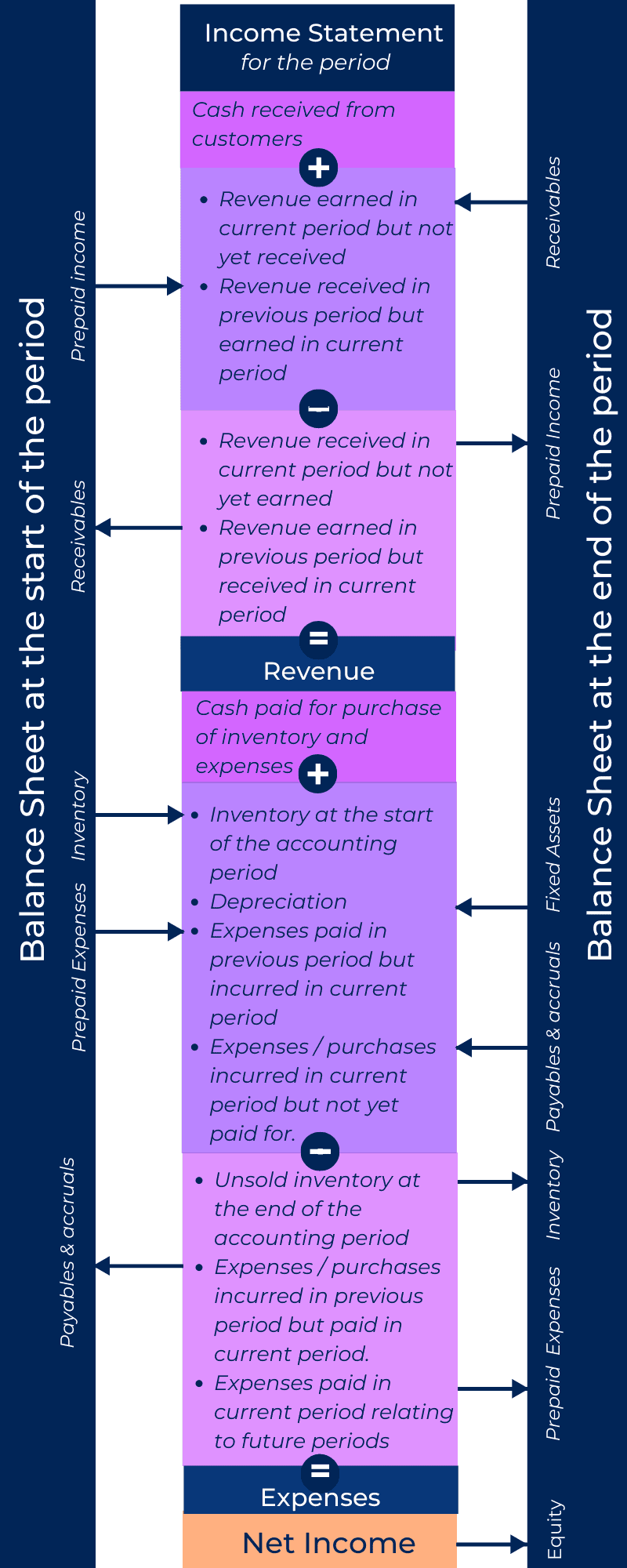

Relationship between income statement and balance sheet. Connection between the balance sheet and income statement. Each of the financial statements provides important financial information for both internal and external stakeholders of a company. Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the company’s financial.

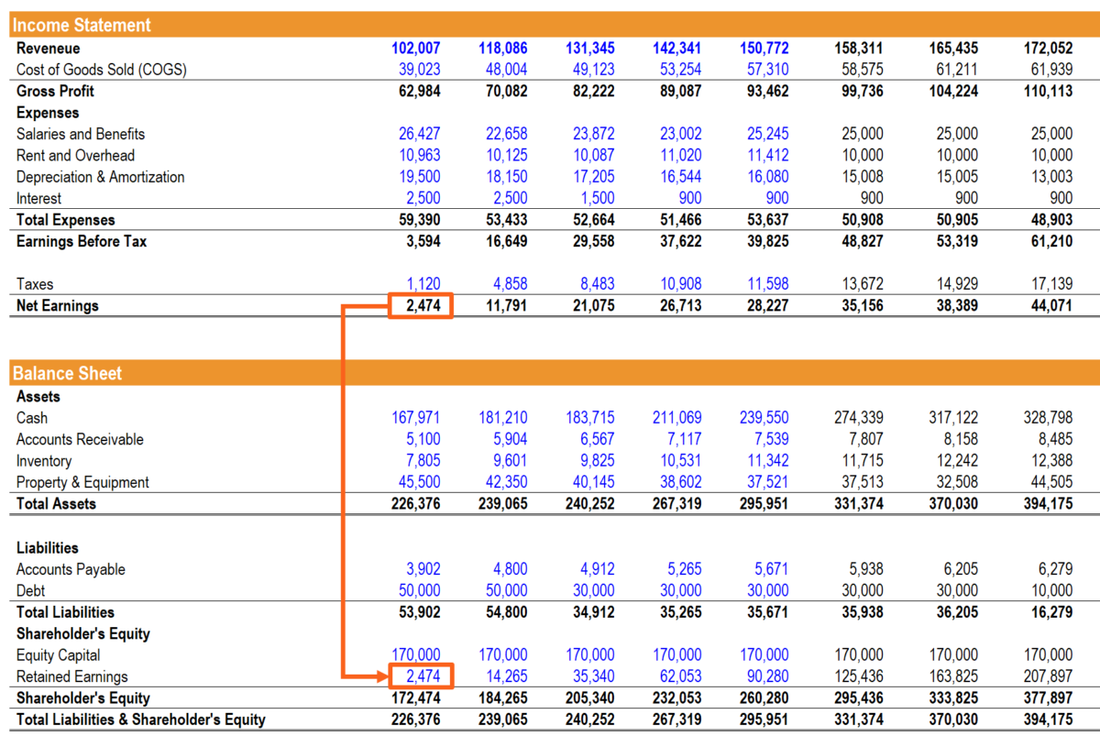

Net income & retained earnings. In business, the relationship between the balance sheet and income statement is critical to understand. The accounting equation assets = liabilities + owner's equity

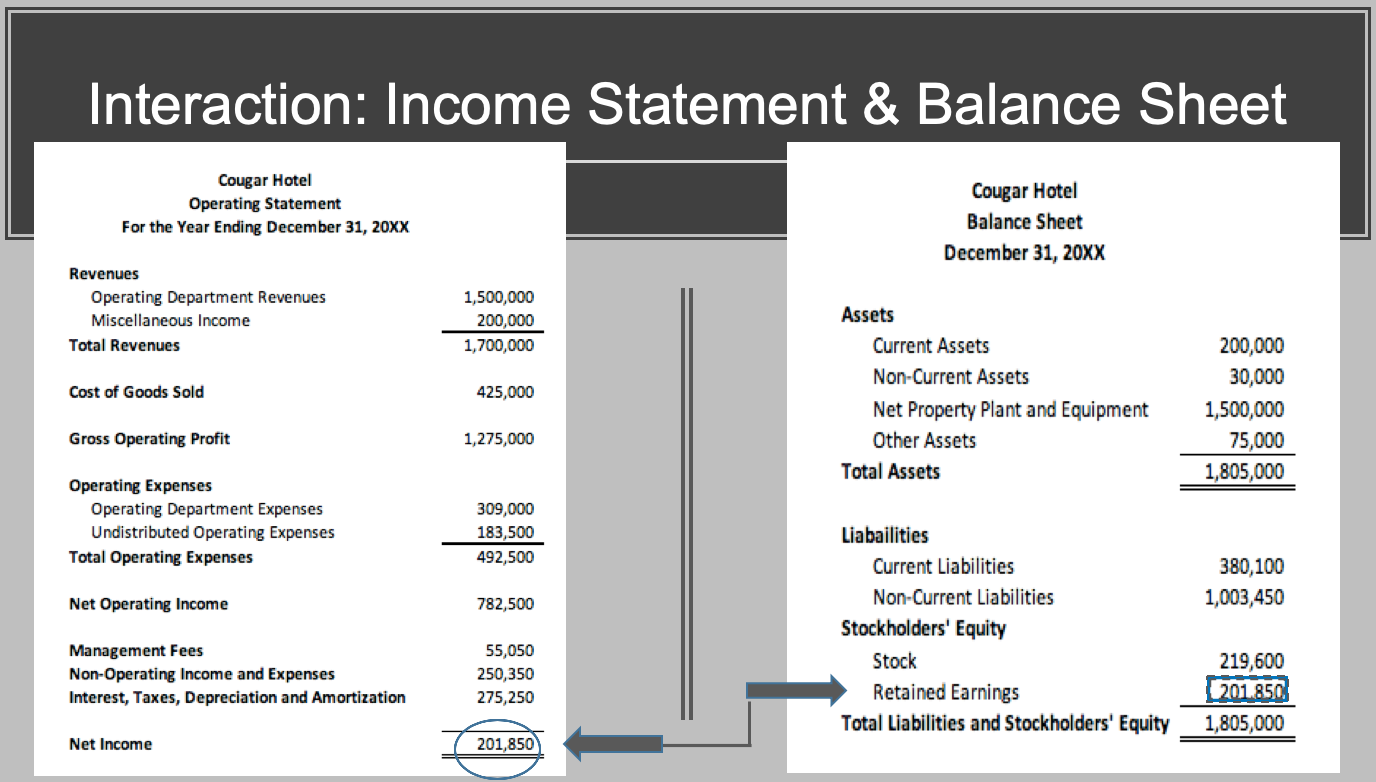

As mentioned earlier, the financial statements are linked by certain elements and thus must be prepared in a certain order. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. The balance sheet is a snapshot of a company’s assets, liabilities, and equity at a given moment in time, while the income statement reflects the company’s performance over a given period.

The income statement and balance sheet follow the same accounting cycle, with the balance sheet created right after the income statement. Focus balance sheets focus on what the business owns, what it owes, and what the shareholder’s investments look like. Although the balance sheet and the p&l statement contain some of the same financial information—including revenues, expenses and profits—there are important differences between them.

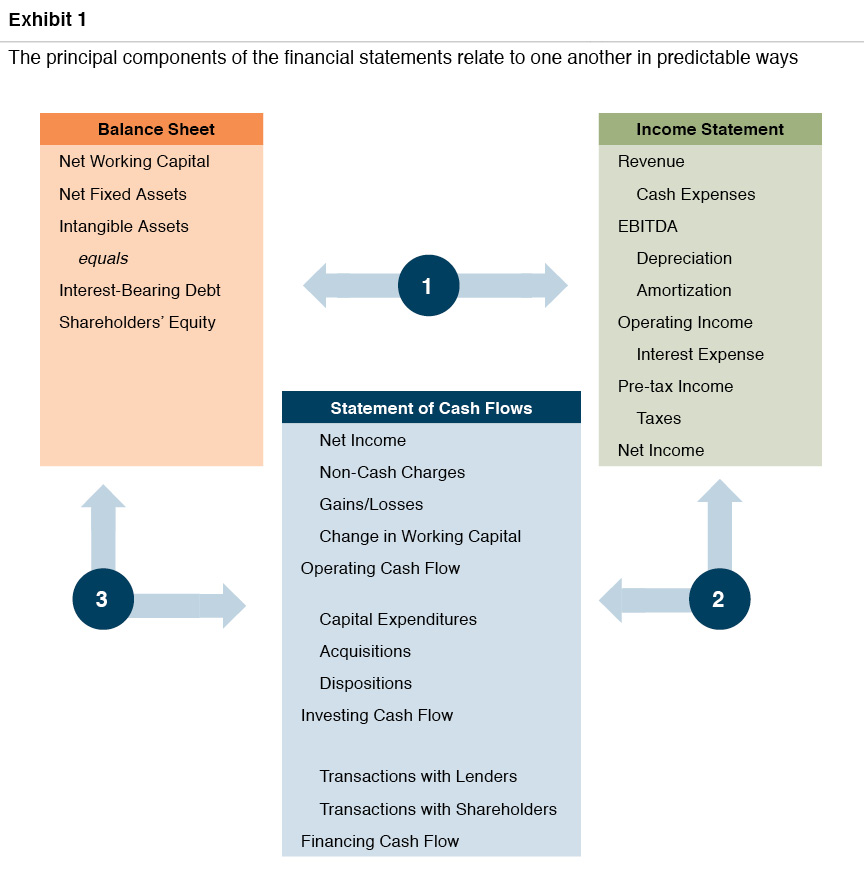

But these relationships aren’t easy to see. What's the difference between balance sheet and income statement? The income statement, balance sheet, and cash flow statement.

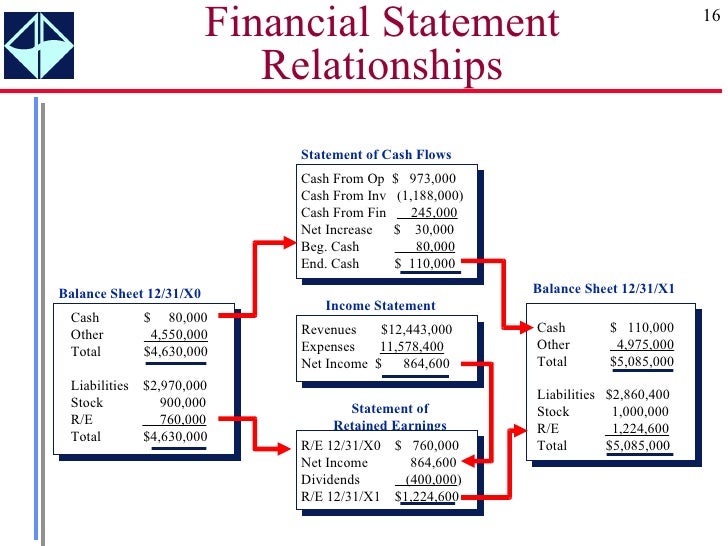

The cash flow statement shows you how to tie the changes in balance sheet together to the income statement for a particular period. In the following guide, we’ll explore the role of these financial statements to show how useful they can be to your business. While balance sheets and income statements are both financial records that give you insight into how your business is performing, they are very different in terms of scope.

The relationship between balance sheet and income statement is a strong one because any item which affects the income statement in the current year is bound to affect the balance sheet of the current year and any change in balance sheet item will have an impact on the income statement of the next year. The three financial statements are: As mentioned earlier, the financial statements are linked by certain elements and thus must be prepared in a certain order.

In financial accounting, the balance sheet and income statement are the two most important types of financial statements (others being cash flow statement, and the statement of retained earnings). Start free written by jeff schmidt reviewed by scott powell what are the three financial statements? The balance sheet shows a company’s total value while the income statement shows whether a company is generating a profit or a loss.

There are three financial statements that work together to create a complete picture of your business’s finances: All the different lines on the balance sheet simply tell you what the company decided to do with the money it kept. The connection between the balance sheet and the income statement results from:

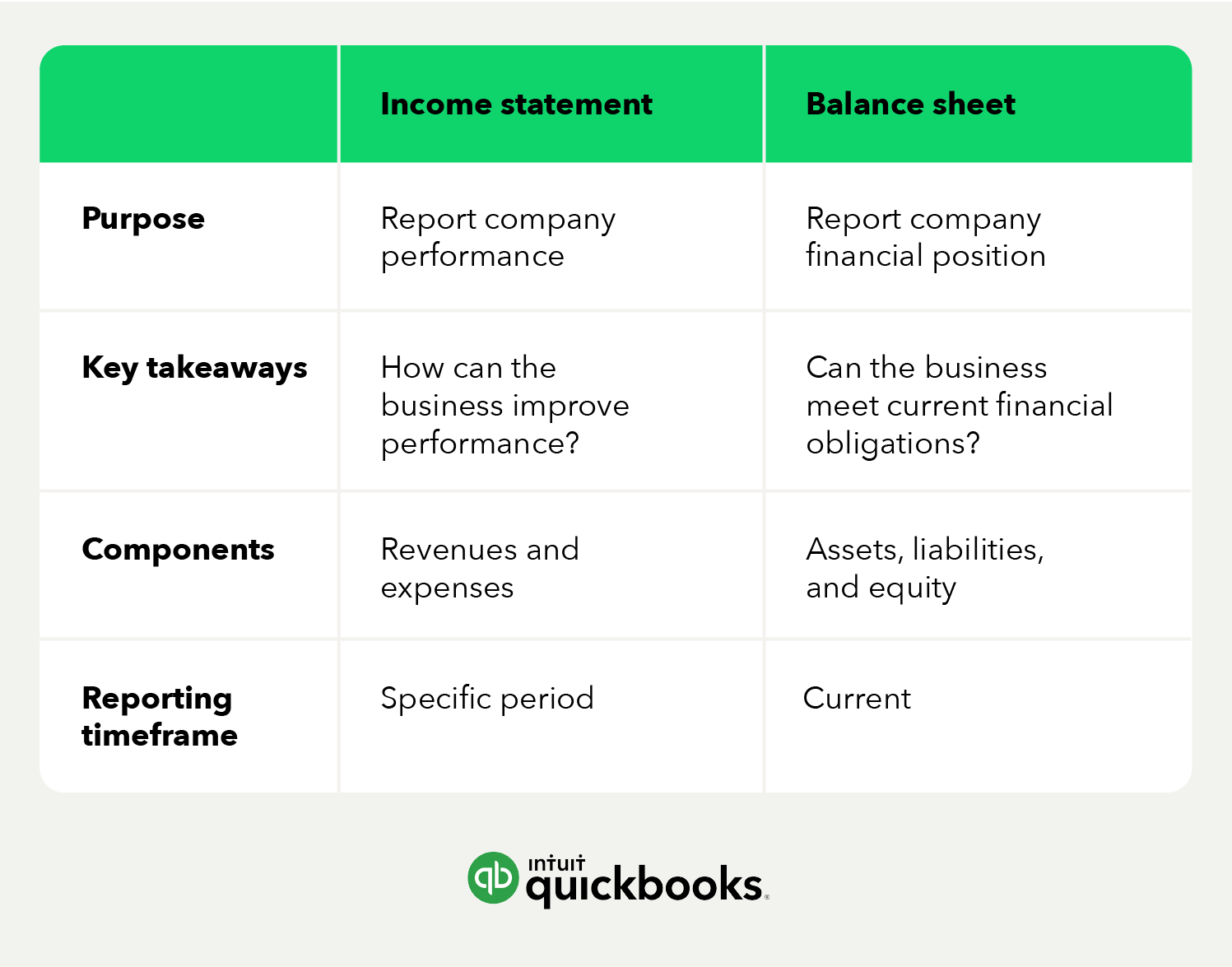

Provides a picture of a. The table below outlines some key differences between a balance sheet and income statement (also known as a profit and loss statement). The balance sheet shows the company assets and liabilities (what it owns and what it owes) at a specific period.