Formidable Tips About Sba Balance Sheet Financial Position Report

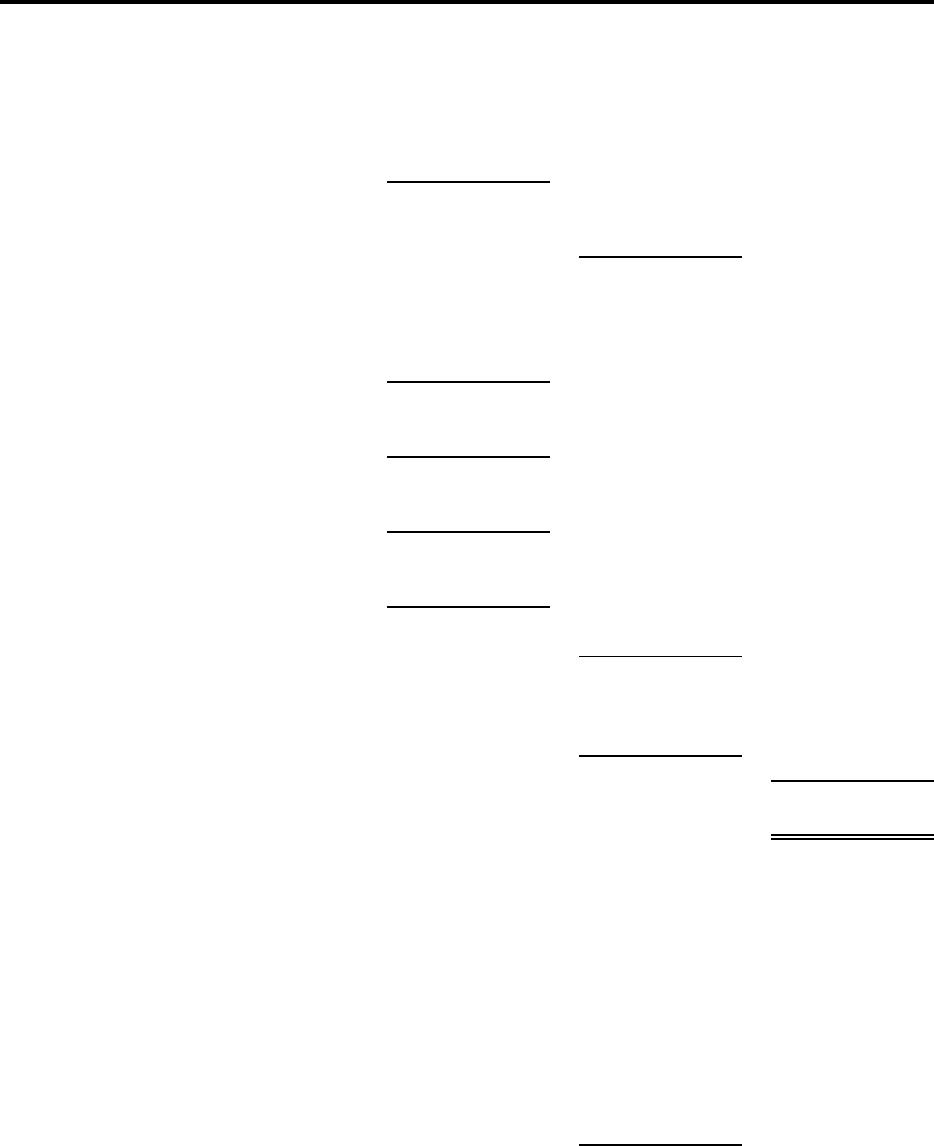

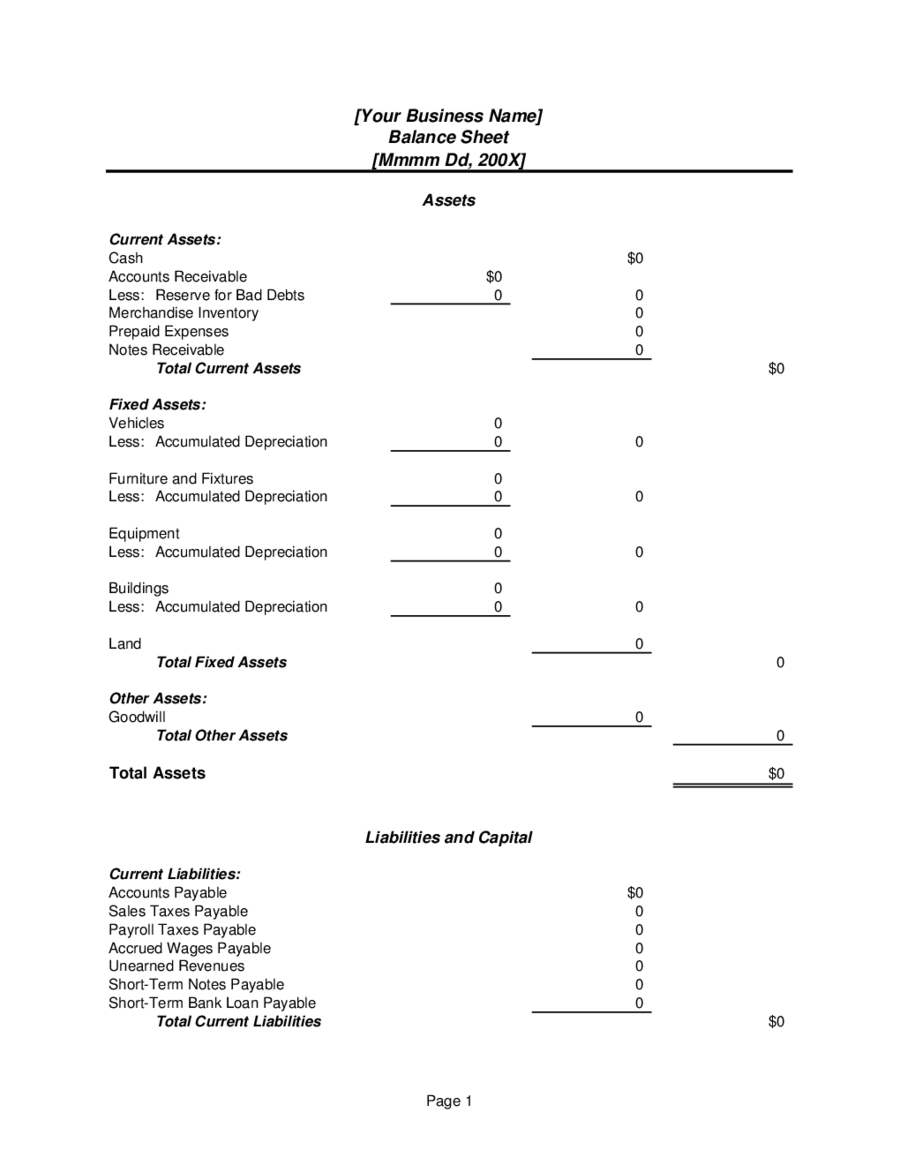

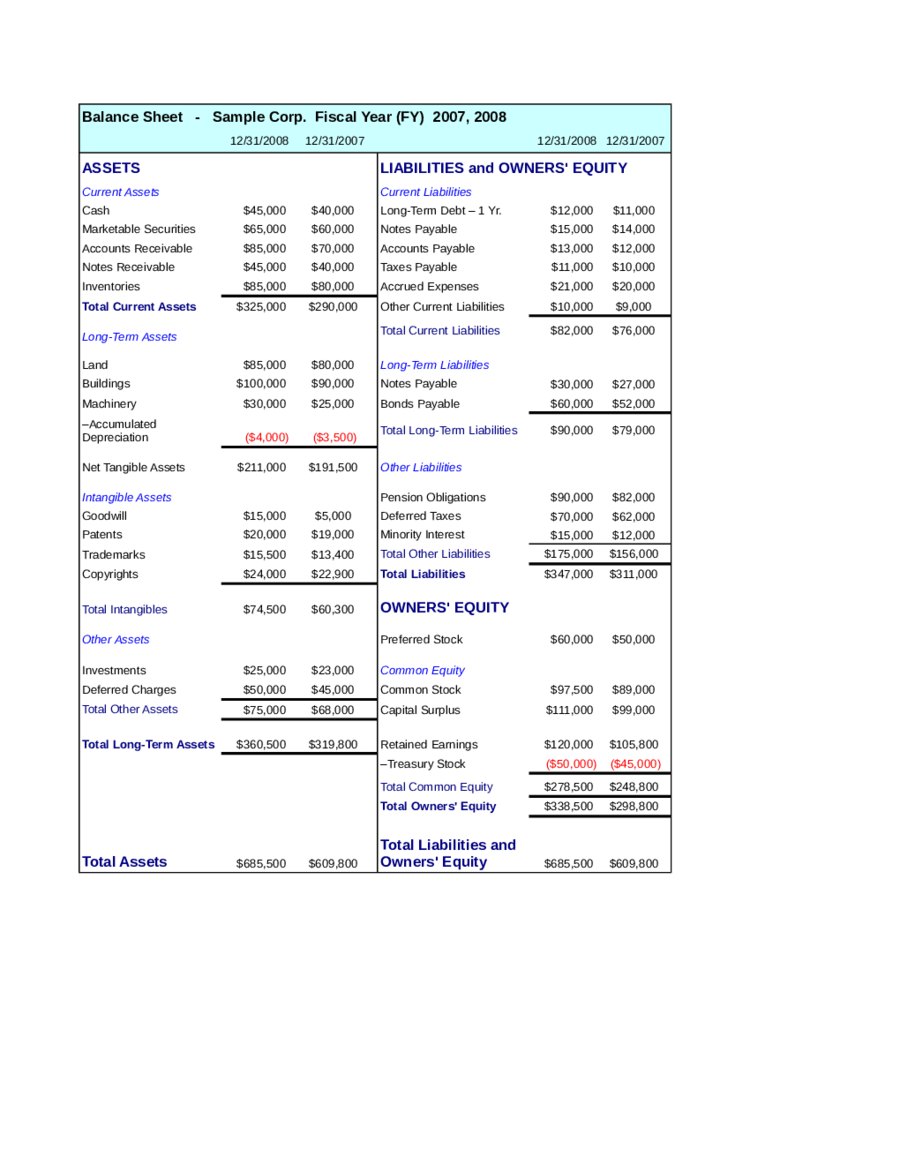

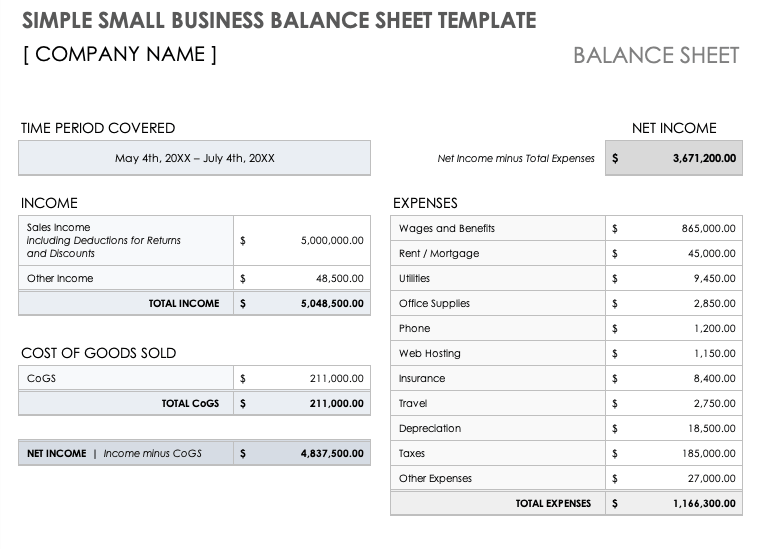

A statement that shows your company’s assets, liabilities and owners’ equity to indicate financial health at a specific point in time.

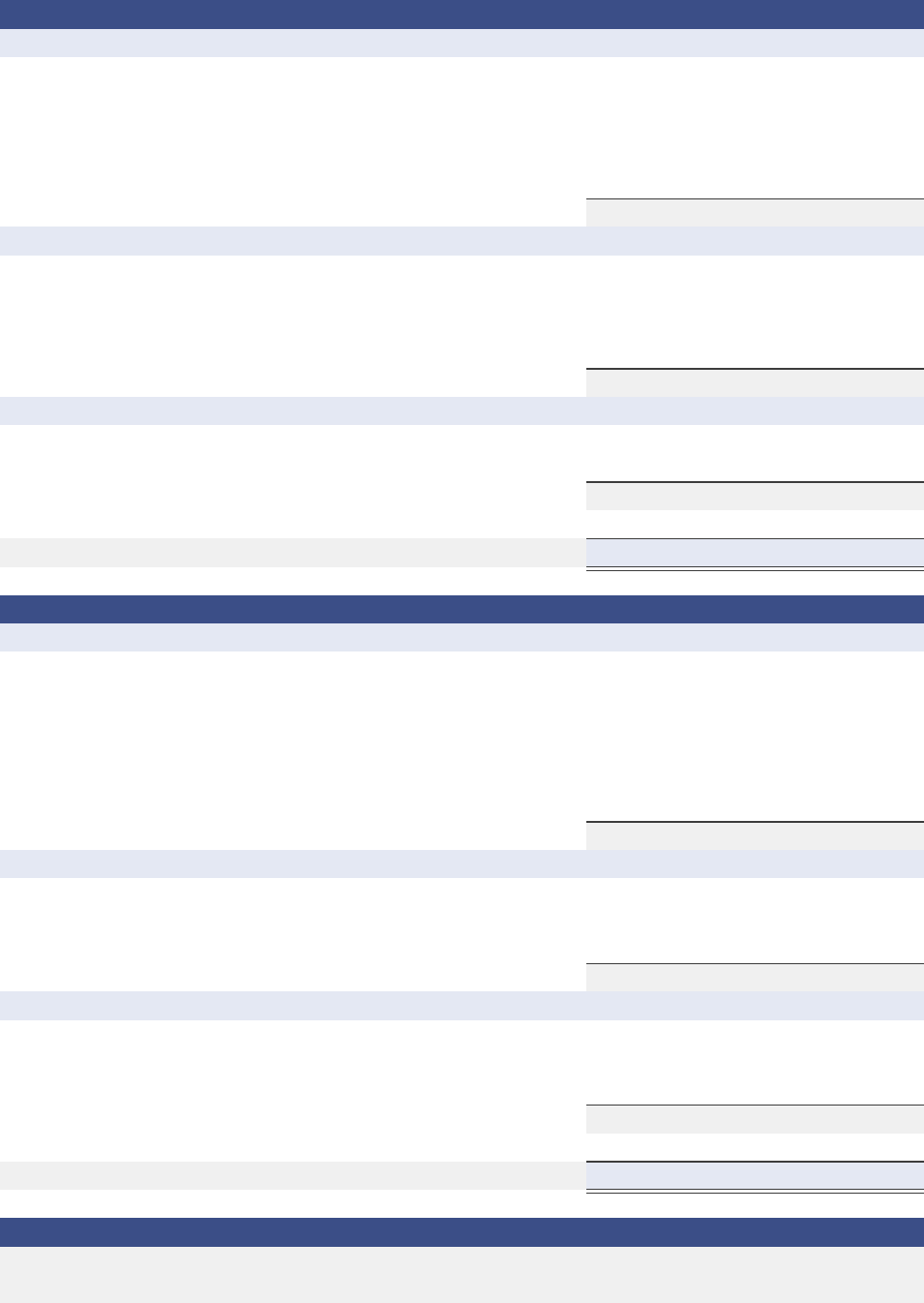

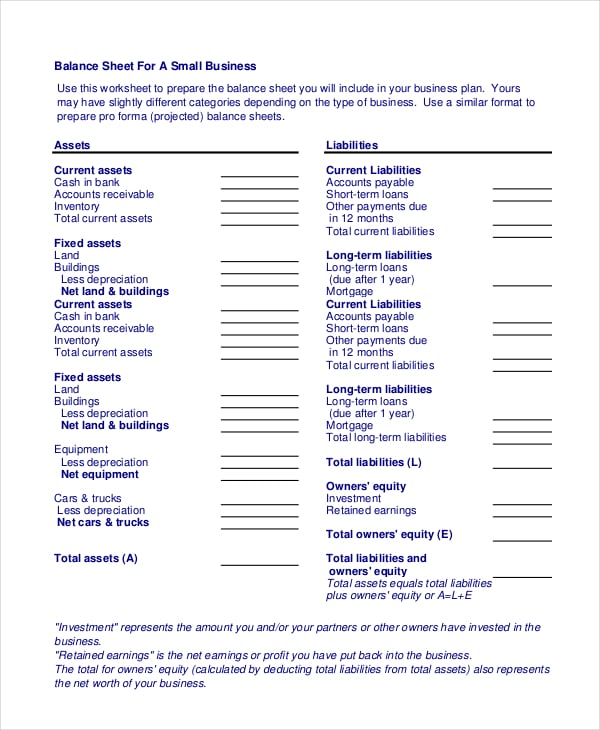

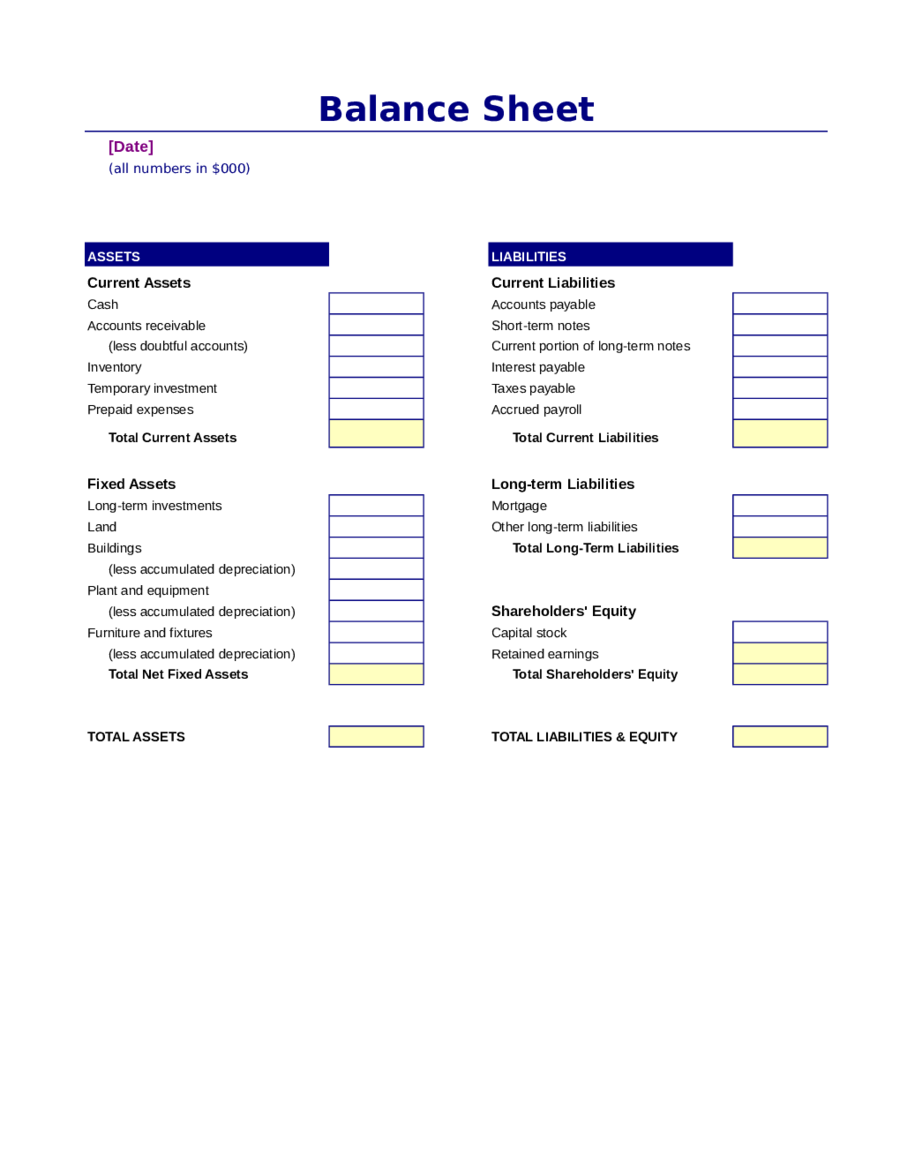

Sba balance sheet. Disclaimer any articles, templates, or information provided by smartsheet on the website are for reference only. Add total liabilities to total shareholders’ equity and compare to assets. Since a balance sheet is predicated on the notion that assets always equal the sum of your liabilities and owner’s.

A balance sheet includes a summary of a business’s assets, liabilities, and capital. This form is used to assess repayment ability and. To ensure the balance sheet is balanced, it will be necessary to.

It’s one of the most important financial documents needed in business. Sba oig contracted with the independent certified public accounting firm kpmg llp to conduct an audit of sba’s consolidated balance sheets as of september. Fundamental analysts use balance sheets to.

The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. While we strive to keep the. Because it summarizes your assets and debts, the balance sheet shows if you have personal funds and/or resources that could be used to pay back your business.

Your balance sheet provides a snapshot of your company’s financial health. Get the annual and quarterly balance sheet of sba communications corporation (sbac) including details of assets, liabilities and shareholders' equity. The goal of a balance sheet.

Sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. A statement that shows your company’s assets, liabilities and owners’ equity to indicate financial health at a specific point in time. Balance sheet (current assets − inventory) / current liabilities.

The balance sheet is one of the three most important financial statements for business owners, and includes assets, liabilities and shareholder equity. The goal of a balance sheet. The goal of a balance sheet is to make sure that your company’s assets are equal to the combination of your liabilities and owners’ equity, i.e., assets = liabilities + equity (net.

Learn what a balance sheet should include and how to create your own. Typically, a balance sheet is prepared at the end of set periods (e.g., every quarter; A balance sheet is a statement of a business’s assets, liabilities, and owner’s equity as of any given date.