Stunning Tips About Bad Debt Recovery Income Statement Quarterly Statements

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)

Bad debt negatively affects accounts receivable (see figure 9.2 ).

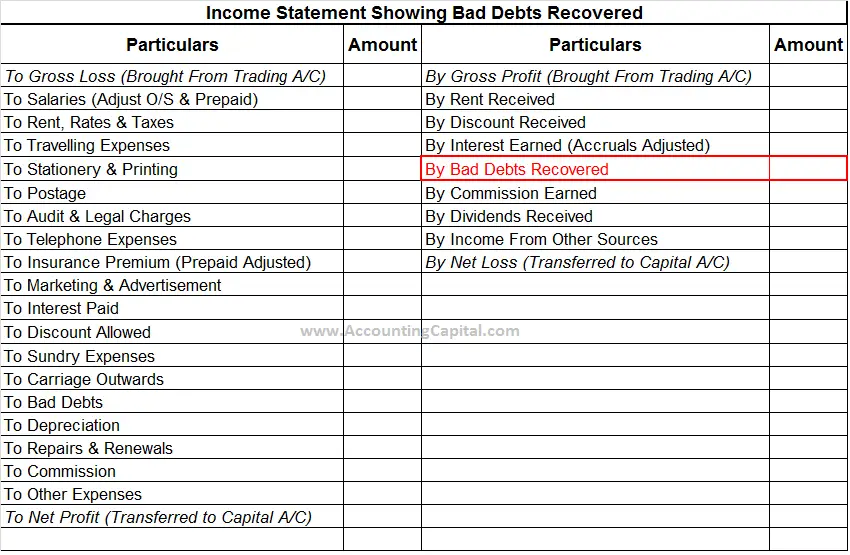

Bad debt recovery income statement. When the amount that is earlier written as bad debts, is now recovered, it is called bad debts recovered. The bad debts expense account might be referred to as a ‘receivables expense’, ‘irrecoverable debt expense’ or similar: Yes, bad debts are recorded in the income statement.

To claim a bad debt deduction in an income year for an amount included in your assessable income that has not been recovered, you must do all of the following:. Incurring bad debt is part of. How does bad debt recovery work?

Bad debts are uncollectible amounts from customer accounts. The income statement shows the aggregate financial position of a business during a specified period by displaying the. Irrecoverable debts recovered sometimes, a.

Bad debts recovered means the amount that has been received from debtors who were written off as bad earlier in the books of account. It is the amount that the company collected or recovered from. When future collection of receivables cannot be.

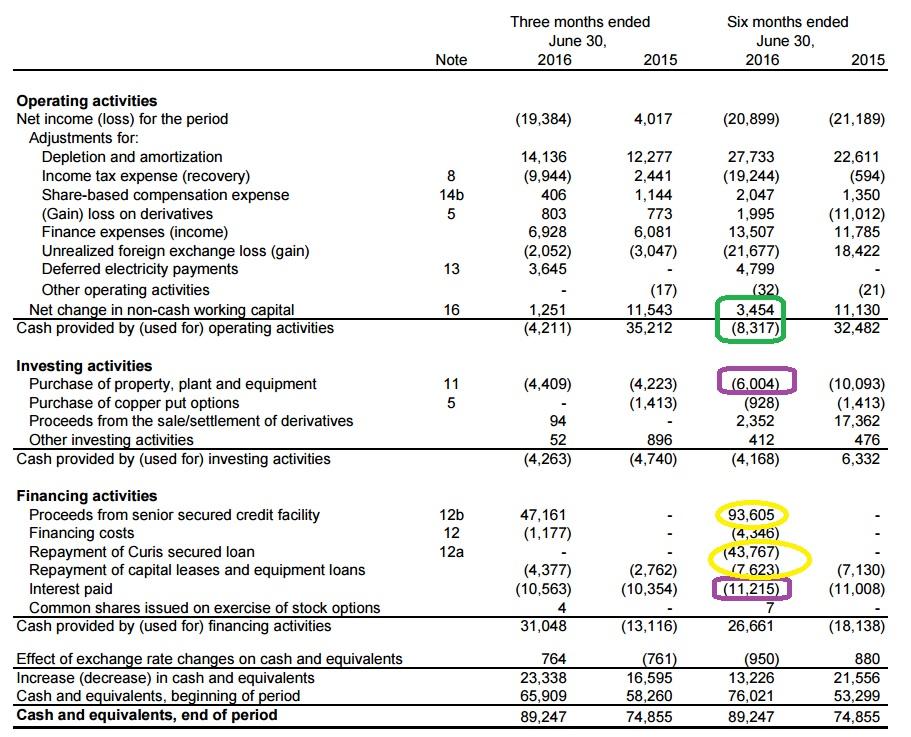

(dr.) cash $5,000 (cr.) accounts receivable $5,000 using. Let's assume that company xyz sells $1,000,000 worth of goods to 10 different customers. If the actual bad debt was greater than the provision, the bad debt expense must be tracked on the income statement for the same accounting period during which.

When bad debts are recovered, the bad debts recovery account is other income in the income statement. Key takeaways bad debt refers to loans or outstanding balances owed that are no longer deemed recoverable and must be written off. Recognizing bad debts leads to.

( dr.) accounts receivable $5,000 (cr.) bad debts recovered $5,000 next, the journal entry to record the cash receipt is as follows: Enter the name of the debtor and bad debt statement attached in column (a). Bad debt expenses are classified as operating costs, and you can usually find them on your business’ income statement under selling, general & administrative costs (sg&a).

Though part of an entry for bad debt expense resides on the balance sheet, bad debt expense is posted to the income statement.