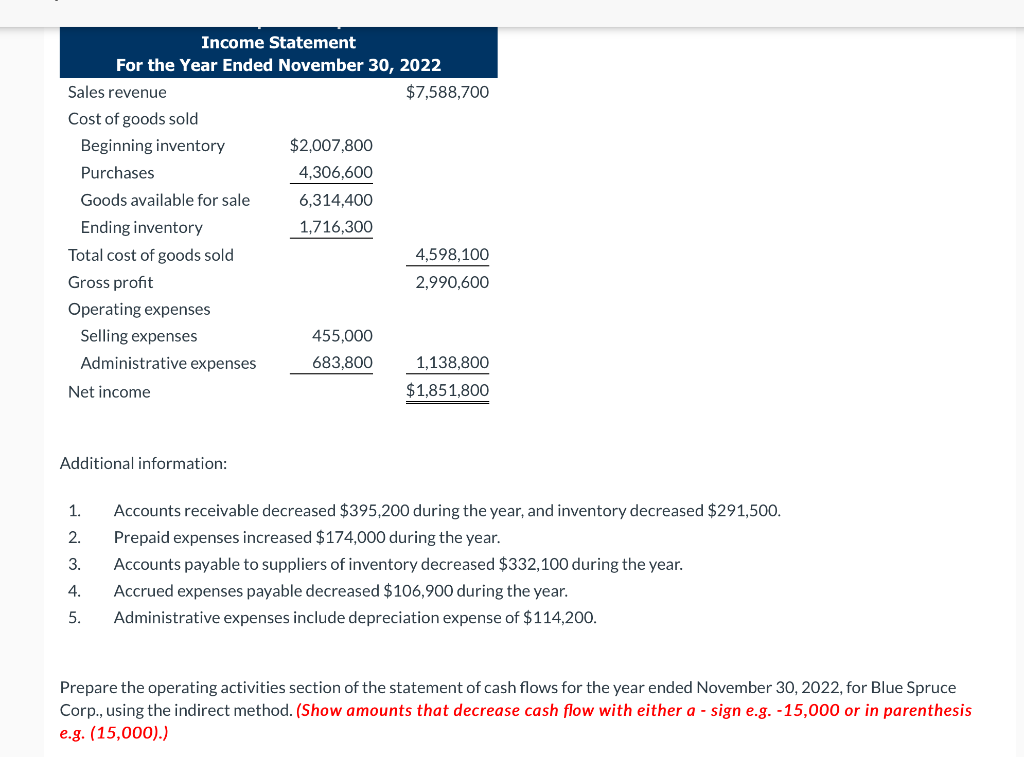

Nice Info About Provision For Bad Debts Is Calculated On How Balance Sheet Decides The Financial Statement

In addition to the $354.9 million.

Provision for bad debts is calculated on. 'provision for bad debts' in oxford reference ». The ban on applying for loans from banks registered or chartered in new york could severely restrict trump's ability to raise cash. A provision for a bad debt account holds an amount, in addition to the actual written off bad debts during a year, that will be known to be due and payable in.

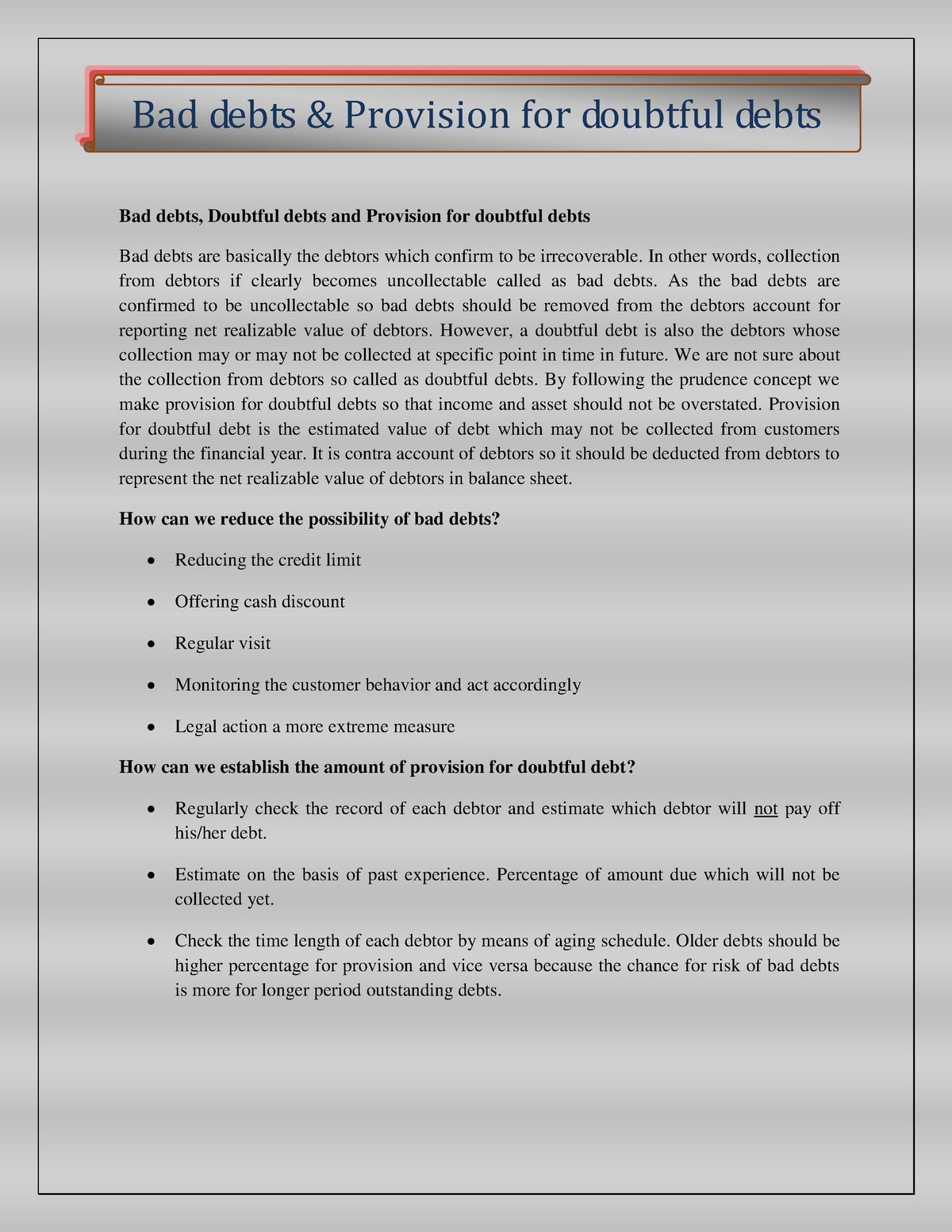

It decides to create a provision for doubtful debts that will be 1% of the total receivables balance. The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for. In the balance sheet, the amount of provision may be shown by the.

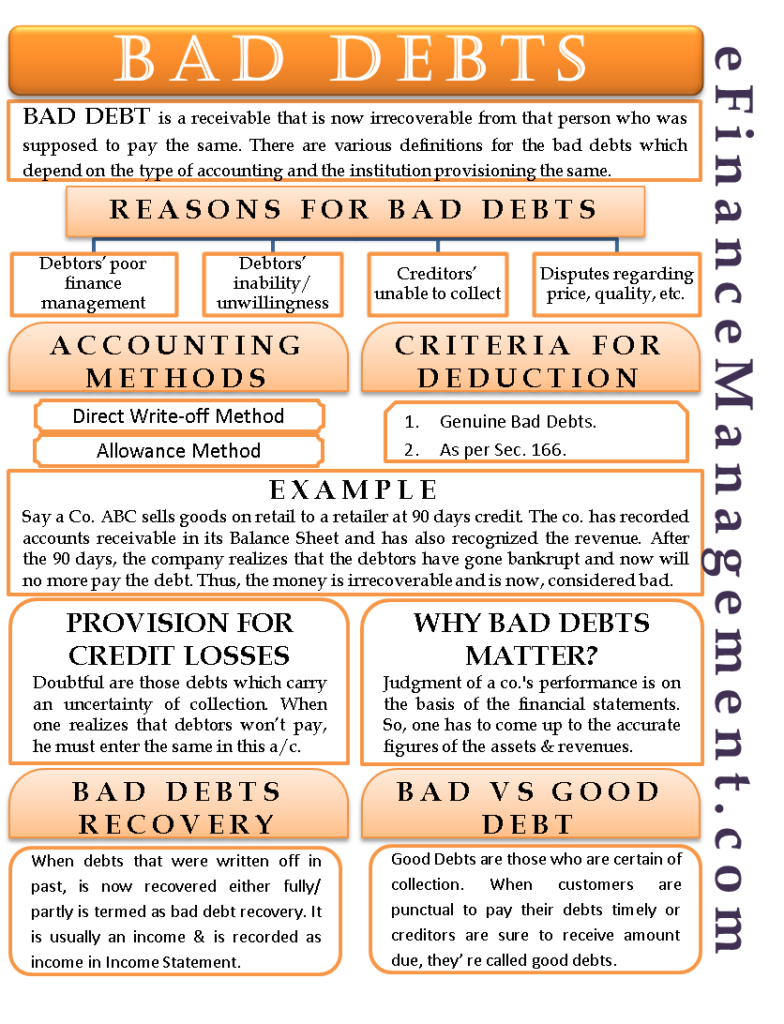

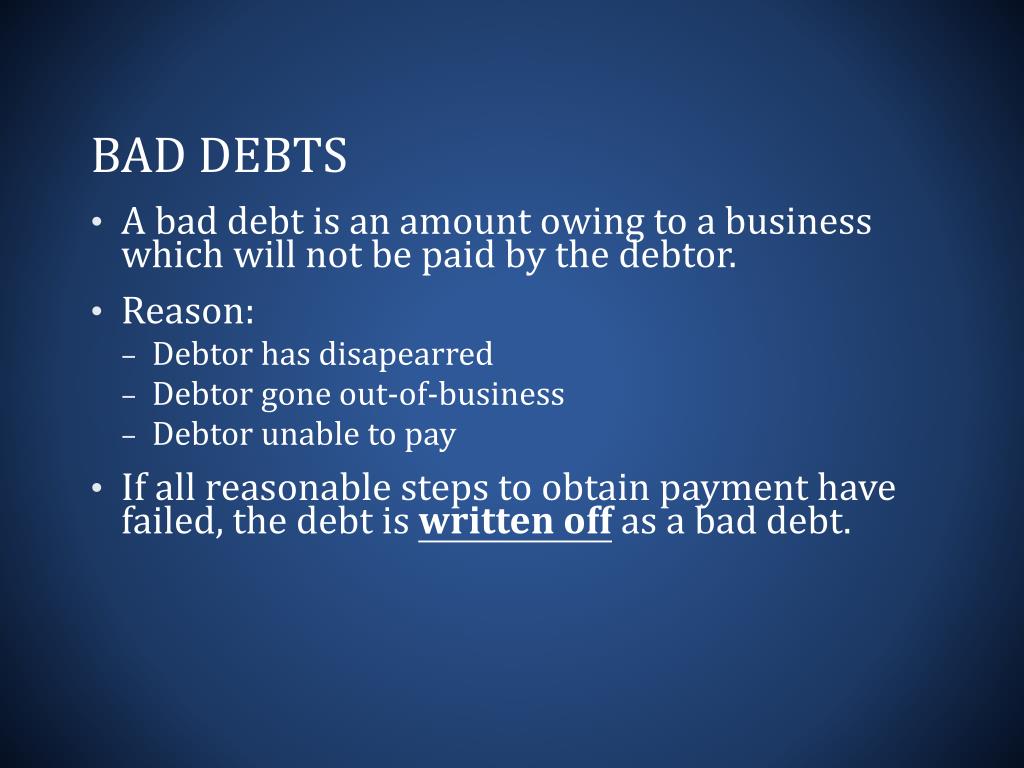

For instance, if your business has issues. Bad debt expense is an expense recorded in financial statements when amount receivable from debtors are not recoverable due to inability of debtors to meet their financial. What is provision for bad debt?

The provision for bad debts is a reserve against the future recognition of an amount of money that cannot be collected. There are several ways to make the. The process of strategically estimating the bad debt accounts that need to be written off in the future is known as the bad debt provision.

The journal entry to create provision is shown below: The process of strategically estimating bad debt that needs to be written off in the future is called bad debt provision. Bad debt provision refers to an amount of money set aside by lenders, such as banks or financial institutions, to cover potential.

You then calculate the provision for bad debts as follows: General approach in general approach, there are 3 stages of a financial asset and you should recognize the impairment loss depending on the stage of a financial asset. The percentage sales method and the accounts receivable aging method.

Company a decides to create a provision for doubtful debts that will be 2% of the total. In fact, there are 2 approaches for doing so: This was based mainly on the management estimates rather than any established and tested methodology.

Ifrs 9 requires you to recognize the impairment of financial assets in the amount of expected credit loss. Imagine company a has a total of £100,000 account receivables at the end of the year. Solution verified by toppr correct option is d) provisions are created by debiting the profit and loss account.

This estimate is referred to as a provision because it is an expense that would occur in the future at an uncertain time. Add new bad debts (posted from adjustment) 1,000: The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected.

November 08, 2023 what is a bad debt provision? A provision calculated to cover the debts during an accounting period that are not expected to be. Company a decides to create a provision for doubtful debts that will be 2% of the total.