Nice Tips About T Accounts And Trial Balance Key Accounting Ratios

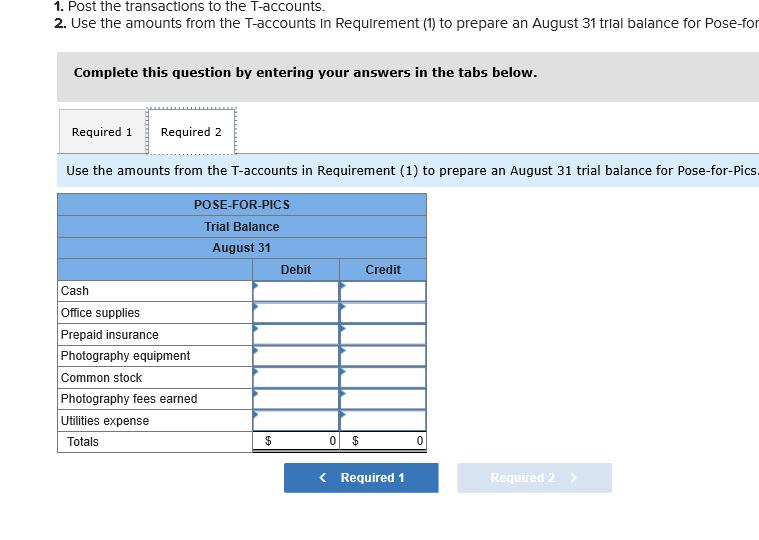

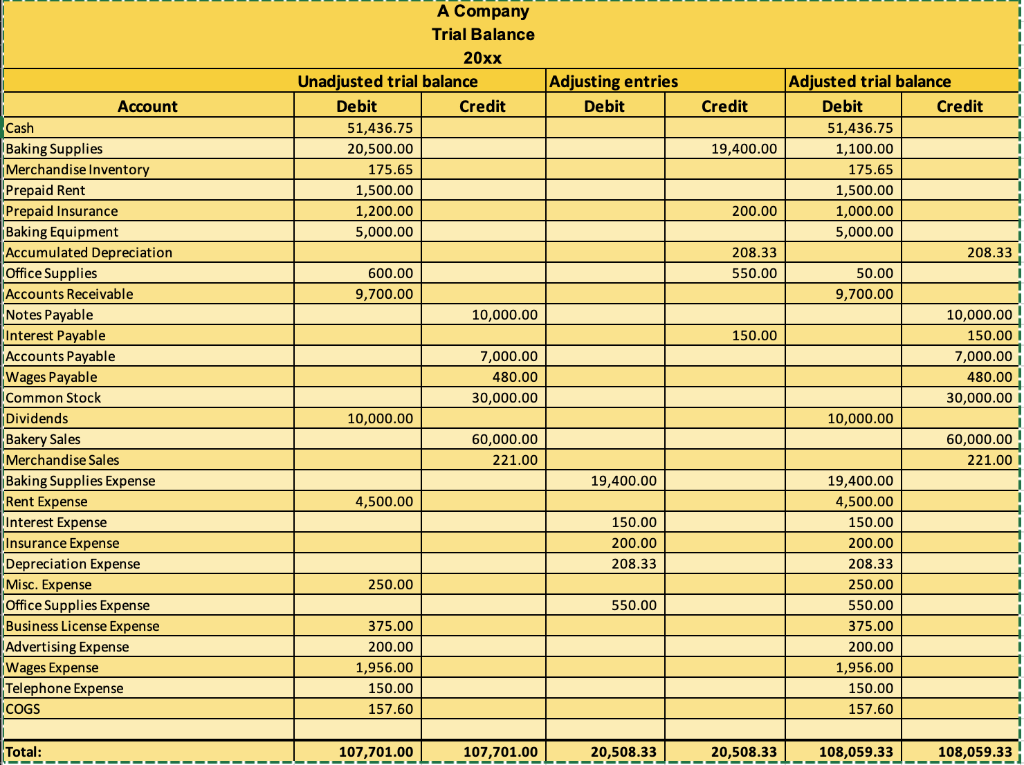

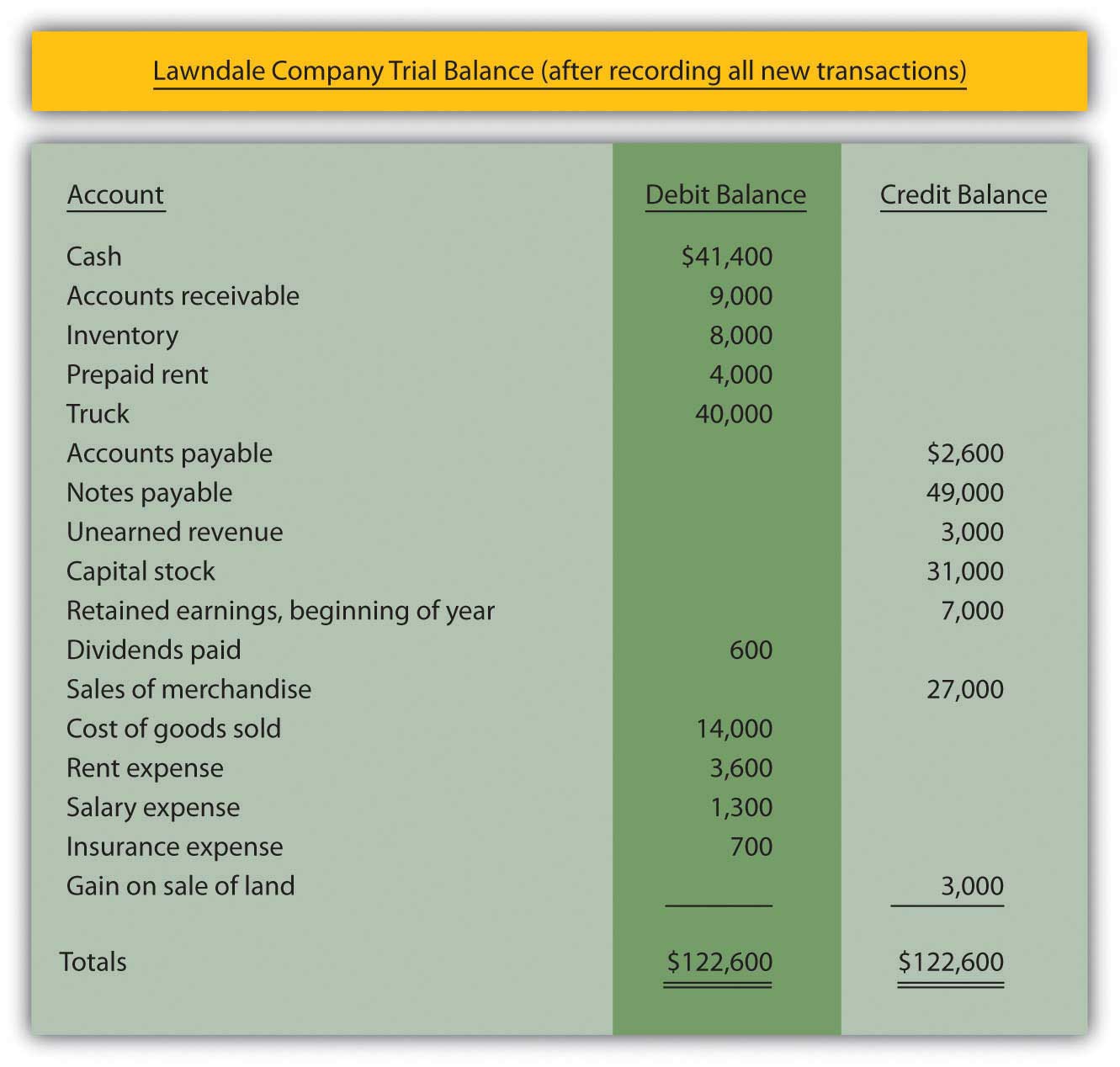

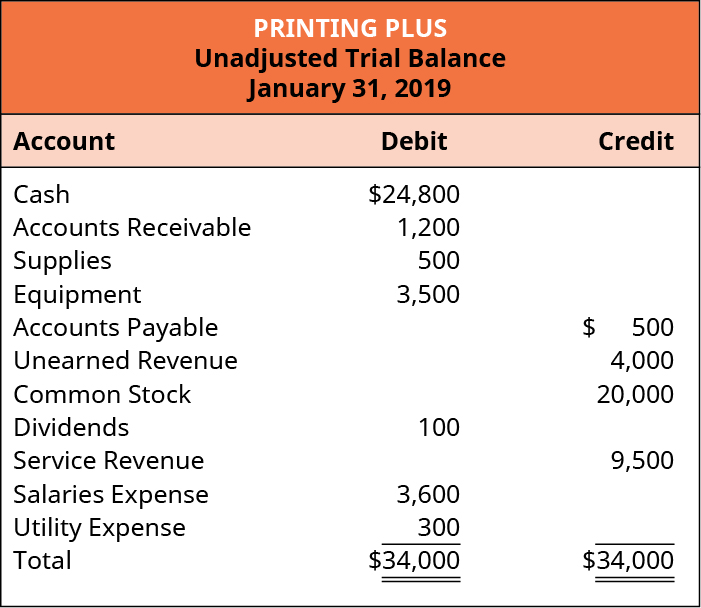

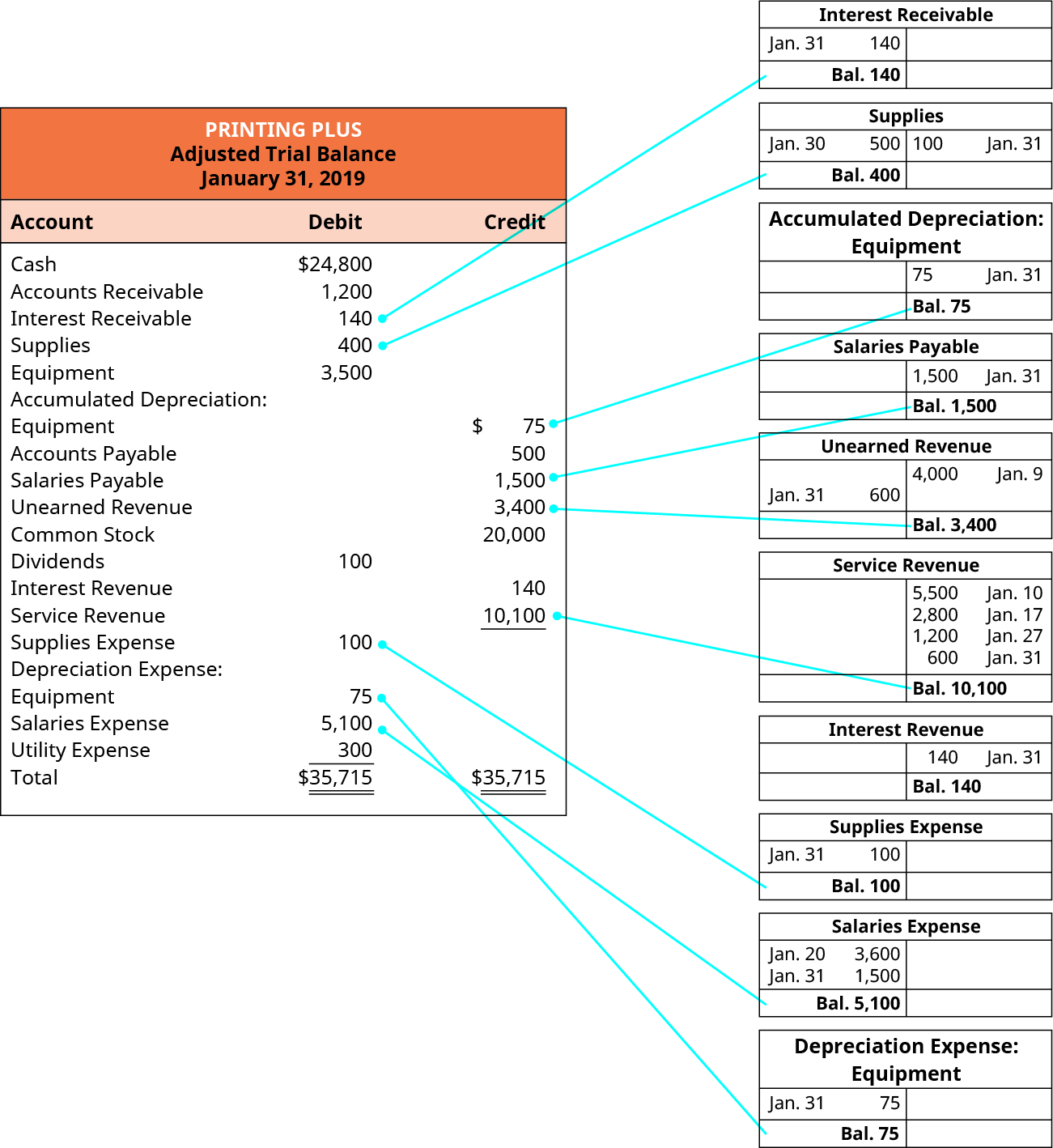

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

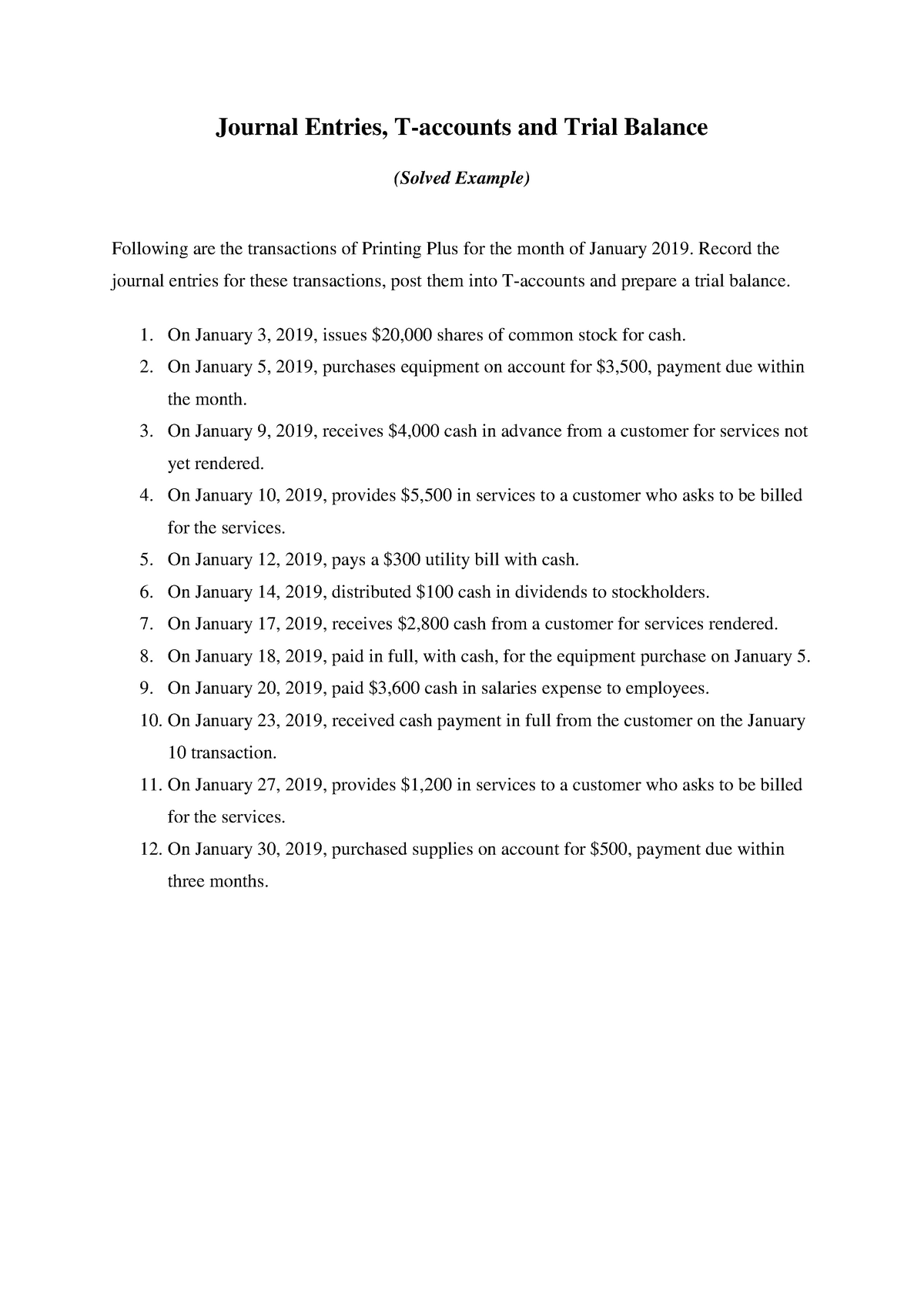

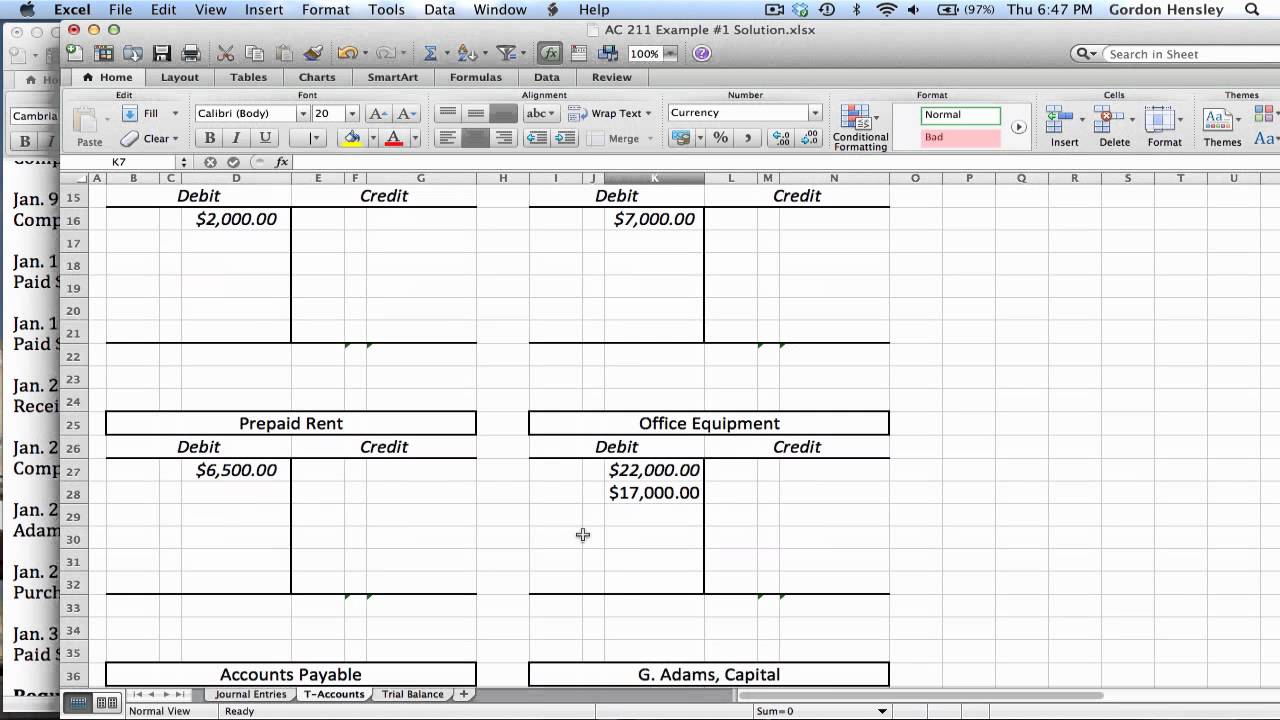

T accounts and trial balance. X took a shop on rent on which he is doing the business from mr. For tests and exams it's really important to not only answer questions correctly but do so at the right. This t format graphically depicts the debits on the left side.

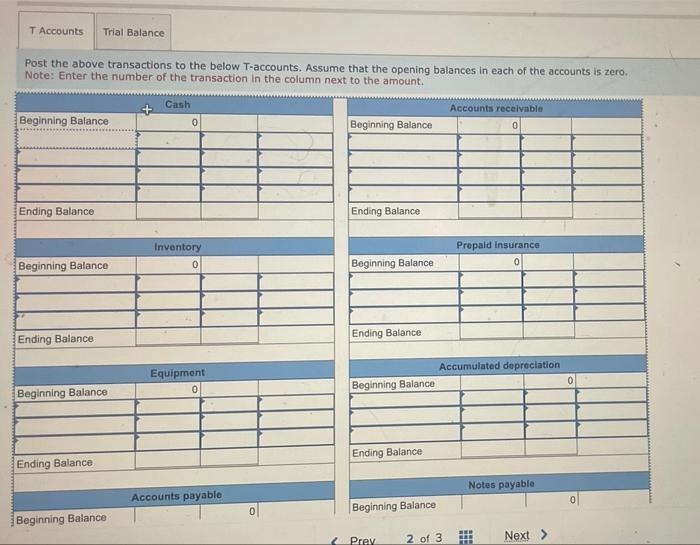

In week 4 you will learn. The debit balance of 170 can now be entered in the trial balance as part of the accounting cycle. Quickly look over the account to find the side which has the bigger total.

It should be fairly apparent in this example that the debit side is the. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; For example, utility expenses during a period.

Step 1 step 2 step 3 understanding t accounts in accounting (particularly the double entry system ), all financial transactions affect at least two of a company’s. Or get this problem started. So in order for us to begin this problem.

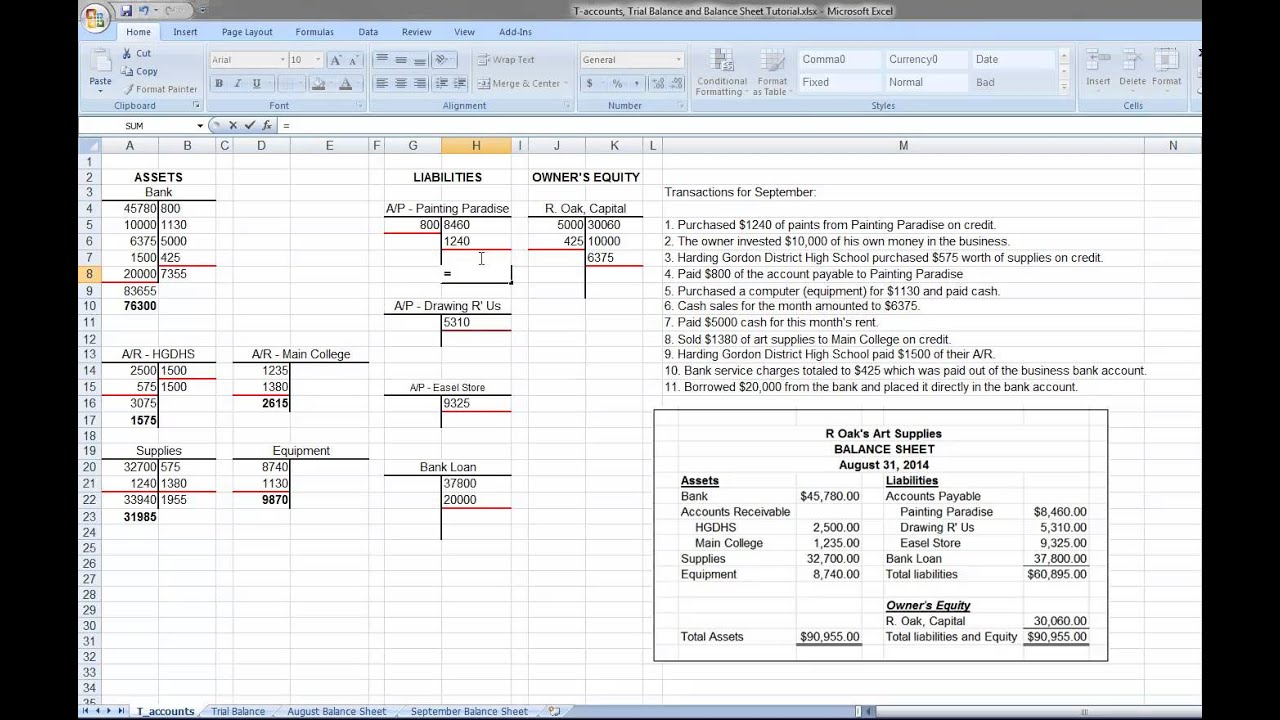

A trial balance is a listing of all accounts and their balances at a specific point in time. It lists the titles of all the accounts in a business’ general ledger in a column on the left,. T accounts, trial balance and balance sheet tutorial.

In this course, the accounting equation of assets = liabilities + shareholder equity is expanded upon to understand how debits and credits are used to stay in balance.