Wonderful Info About Pension Income Statement Template P&l Excel

The amount of this expense.

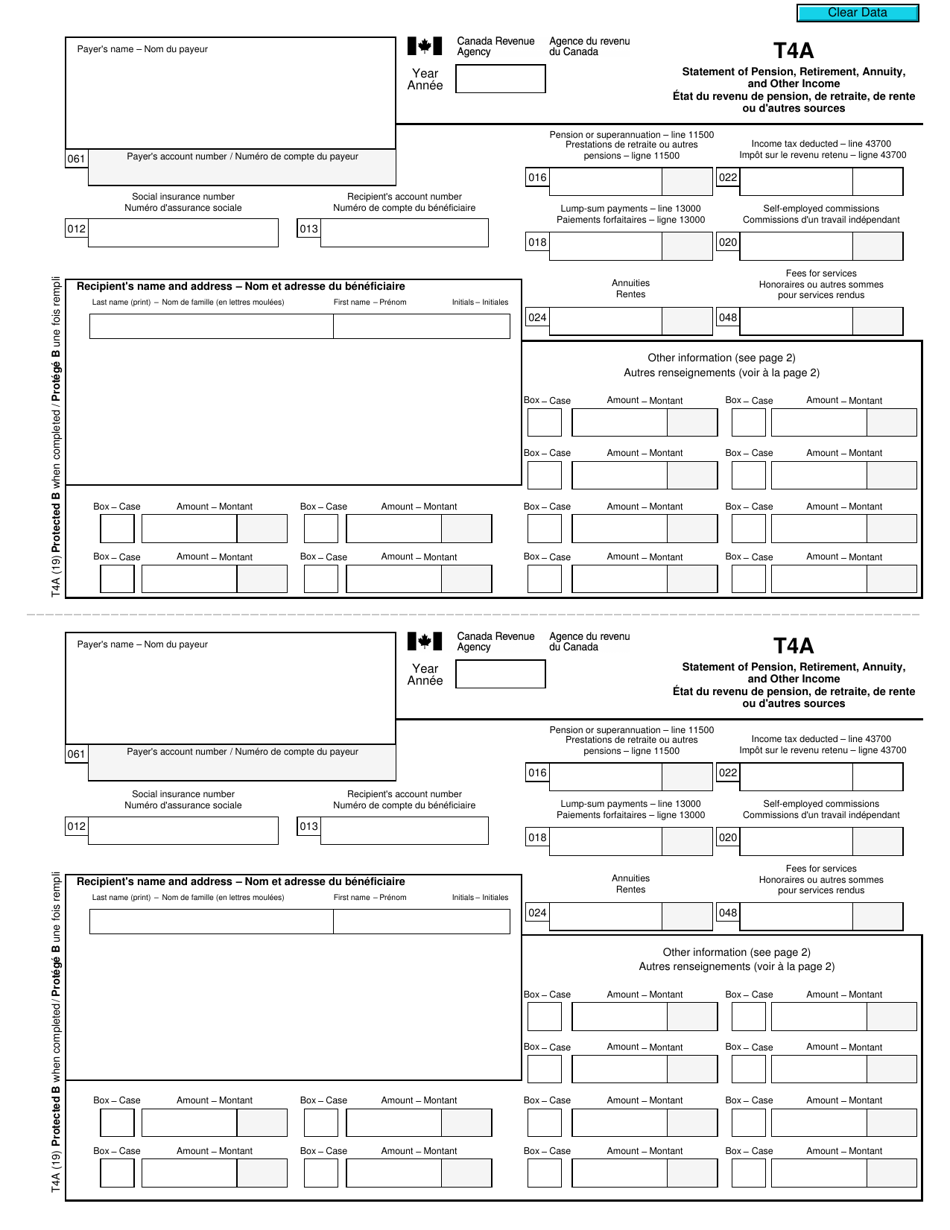

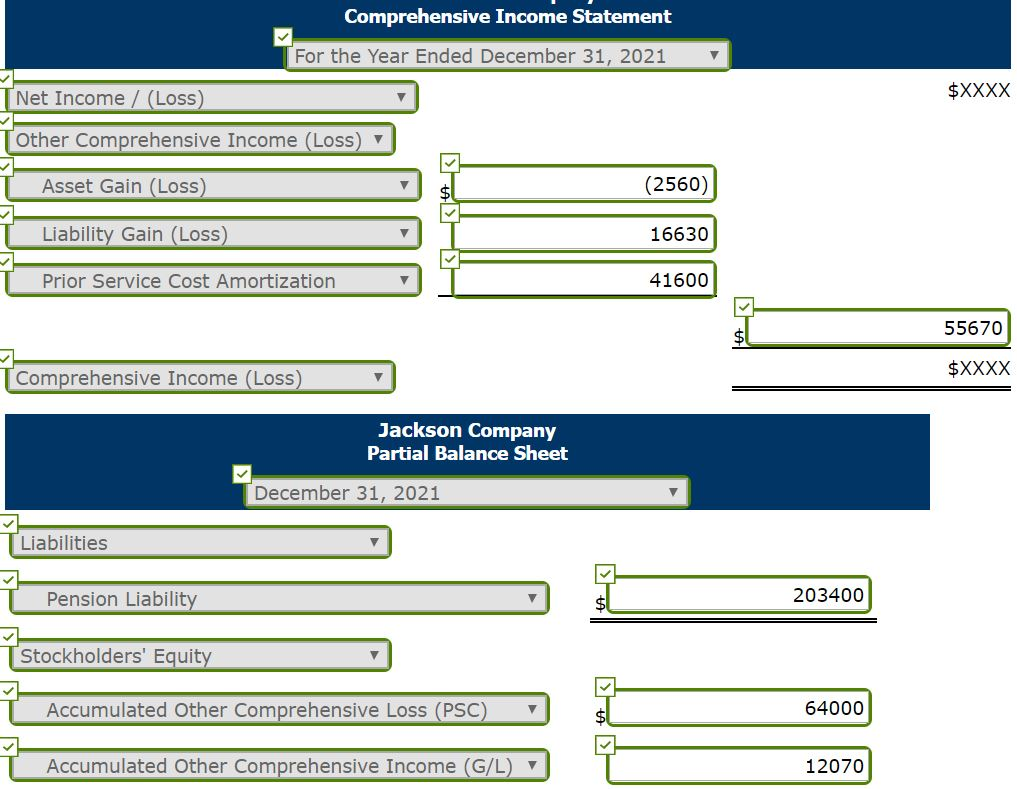

Pension income statement. Components of pension expenses that are reported in an income statement? His decision to allow a vote on a labour. In the income statement, pension and opeb costs are included in net periodic pension cost.

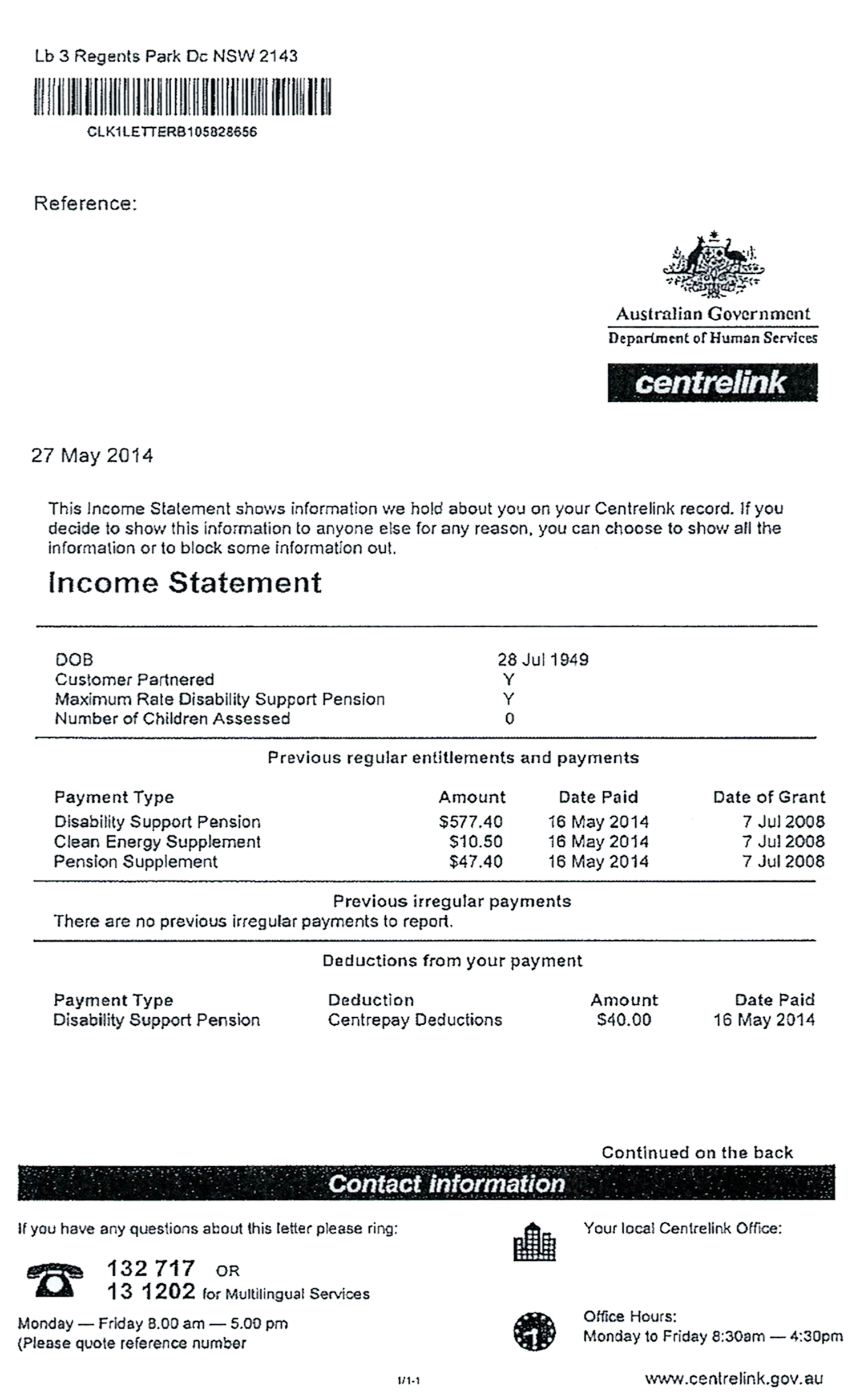

At the end of 2015, the fair value of the assets and liabilities in the pension amounted to $6 million. With regard to the question posed in the paper’s title, solid reasons have been given to highlight the importance of the pension system’s income statement and the need for. You can find your income statement in ato online services through mygov or the ato app.

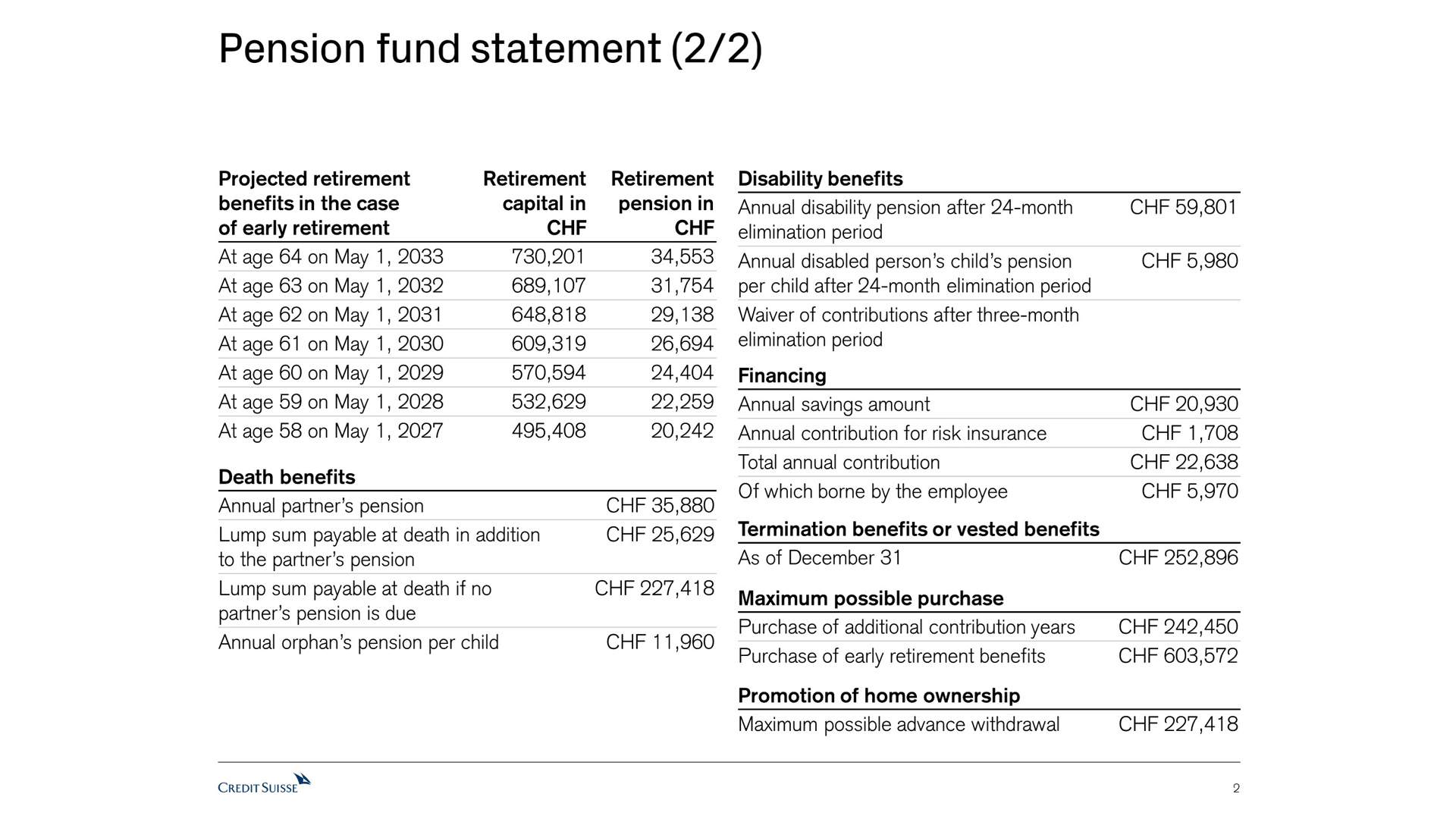

Discover data on pension fund: Pension expense (both gaap & ifrs) for the income statement pension expense = increase in the dbo/pbo during the accounting period. The pension expenses reported in an income statement include service cost, the interest.

How much you could get and when. Some regular payments you get as a gift or allowance. When you earn more, you will end up paying more in taxes.

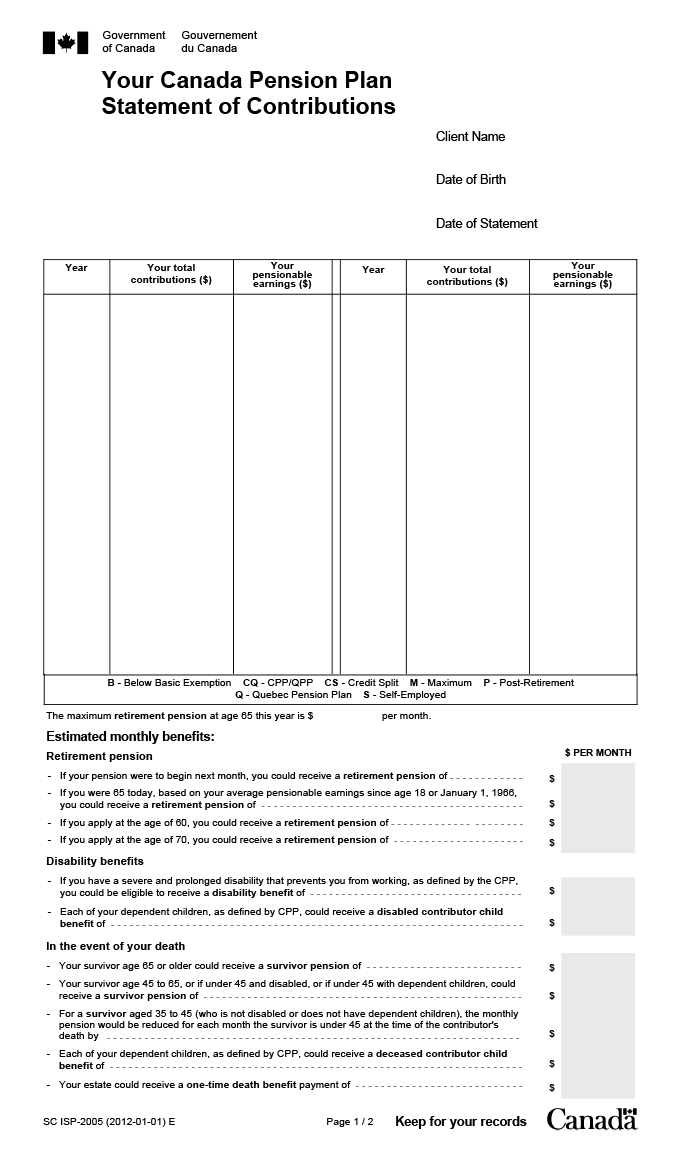

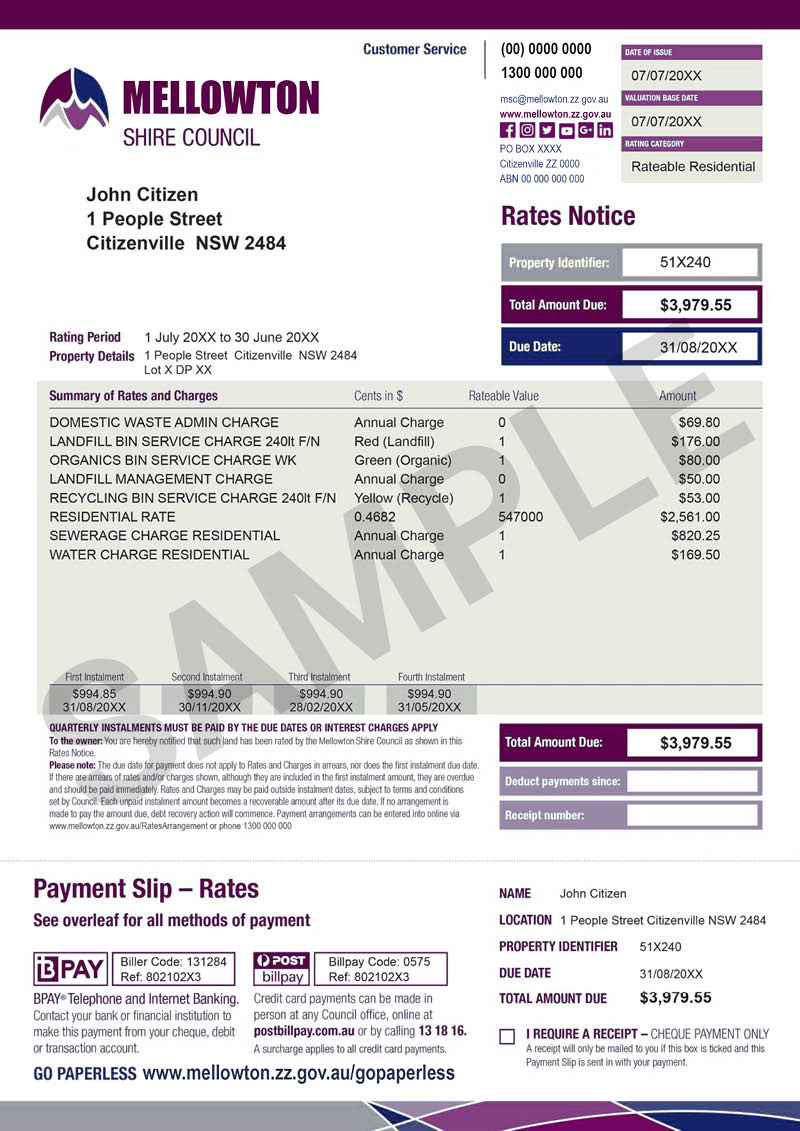

A pension statement is an annual summary of your pension pot. The netherlands is top of the class when it comes to comparing pension systems around the world, according to a recent global pensions report from the mercer. A pension is a retirement plan that provides a monthly income in retirement.

Check your state pension age. Delay (defer) your state pension. Explore expert forecasts and historical data on economic indicators across 195+ countries.

An amount you earn, derive or receive for your own use or benefit. Check your state pension forecast. Under asc 715 , net periodic benefit cost comprises:

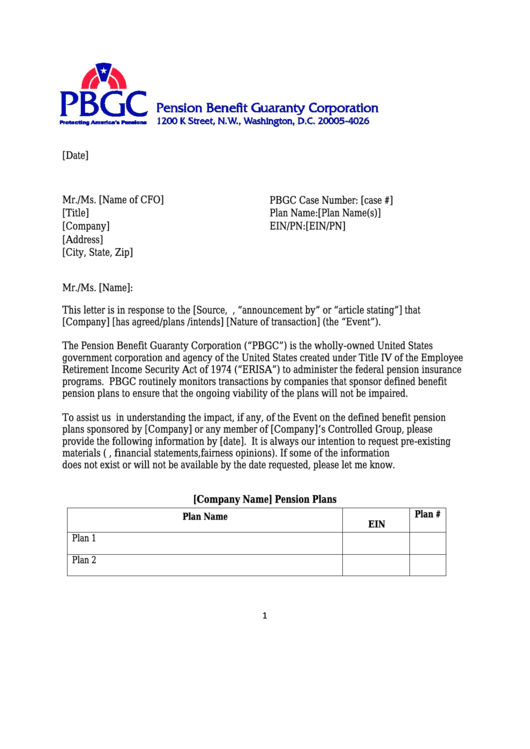

December 04, 2023 how to account for a pension the accounting for pensions can be quite complex, especially in regard to defined benefit plans. It can be in the. Unlike a 401 (k), the employer bears all of the risk and responsibility for funding the plan.

The financial accounting standards board (fasb) governs pension accounting under generally accepted. | expenses by chron contributor updated september 21, 2020 pension expense signals an employer's annual cost for maintaining an employee's pension plan. Pension expense (both gaap & ifrs) for the income statement pension expense = increase in the dbo/pbo during the accounting period.

Commons speaker sir lindsay hoyle is under pressure this morning over his handling of the snp's motion for a ceasefire in gaza. A pension statement is an annual summary sent to you by your pension provider. In this type of plan, the.

:max_bytes(150000):strip_icc()/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)