Fantastic Info About Other Expenses In Balance Sheet What Are Year End Financial Statements

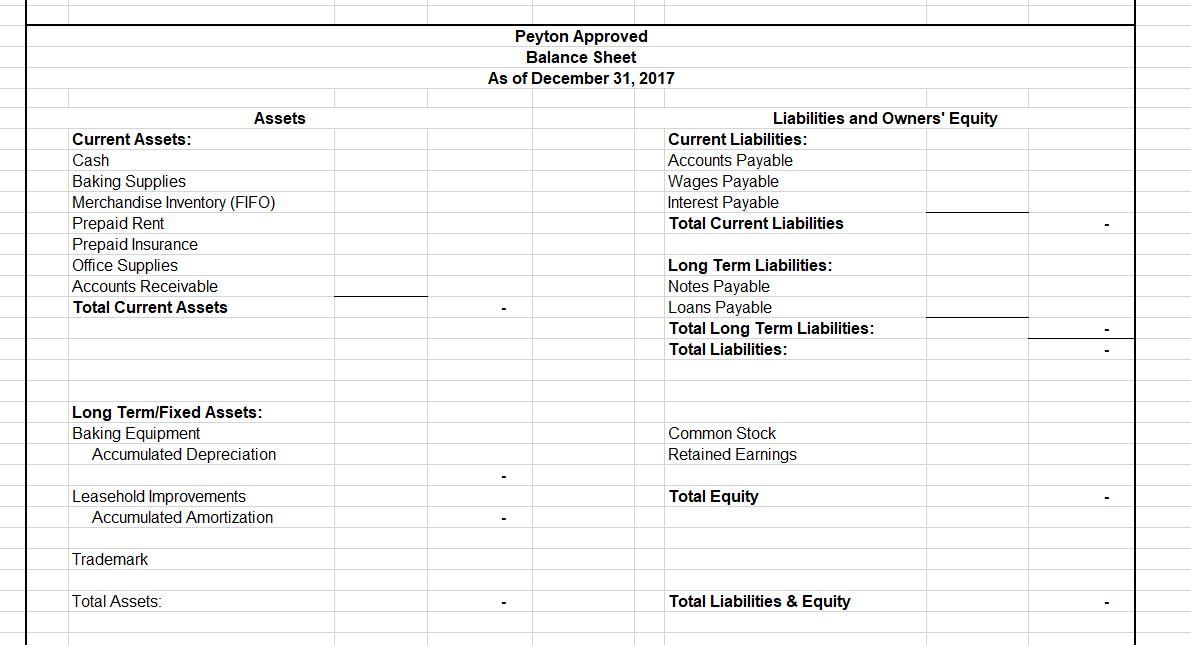

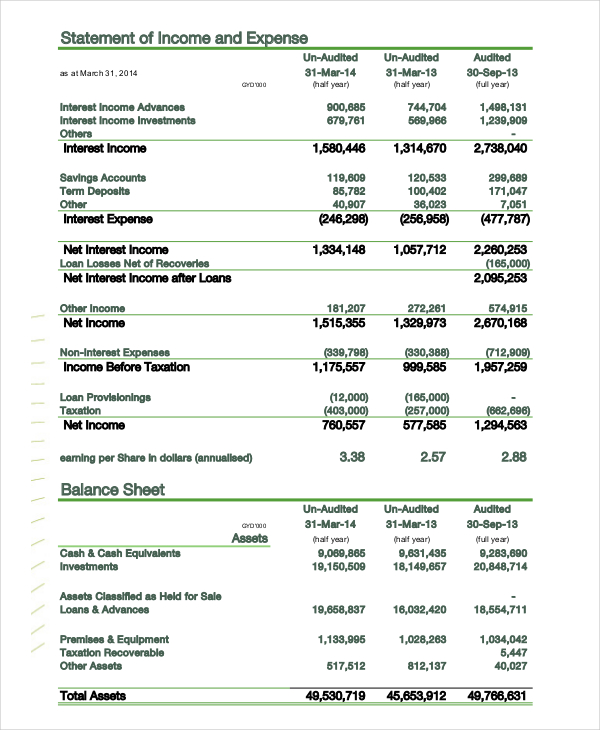

However, the incurrence of an expense also impacts the balance sheet, which is where the ending balances of all classes of assets, liabilities, and equity are reported.

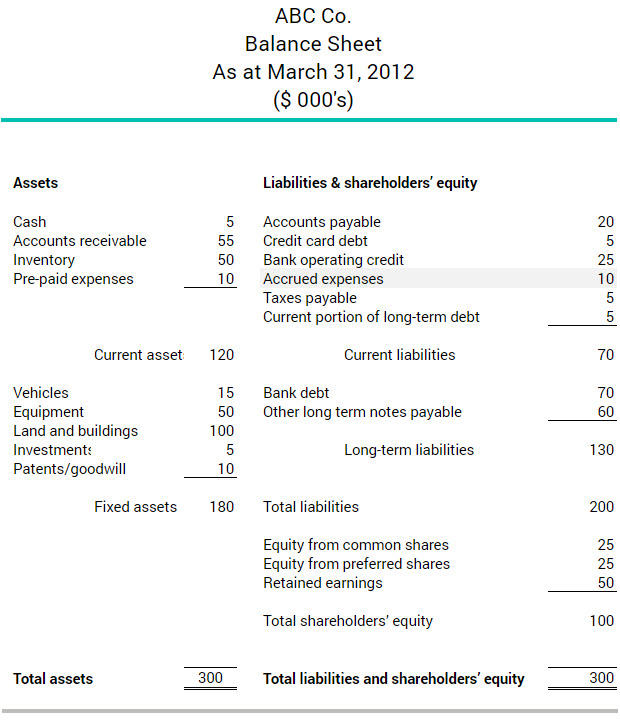

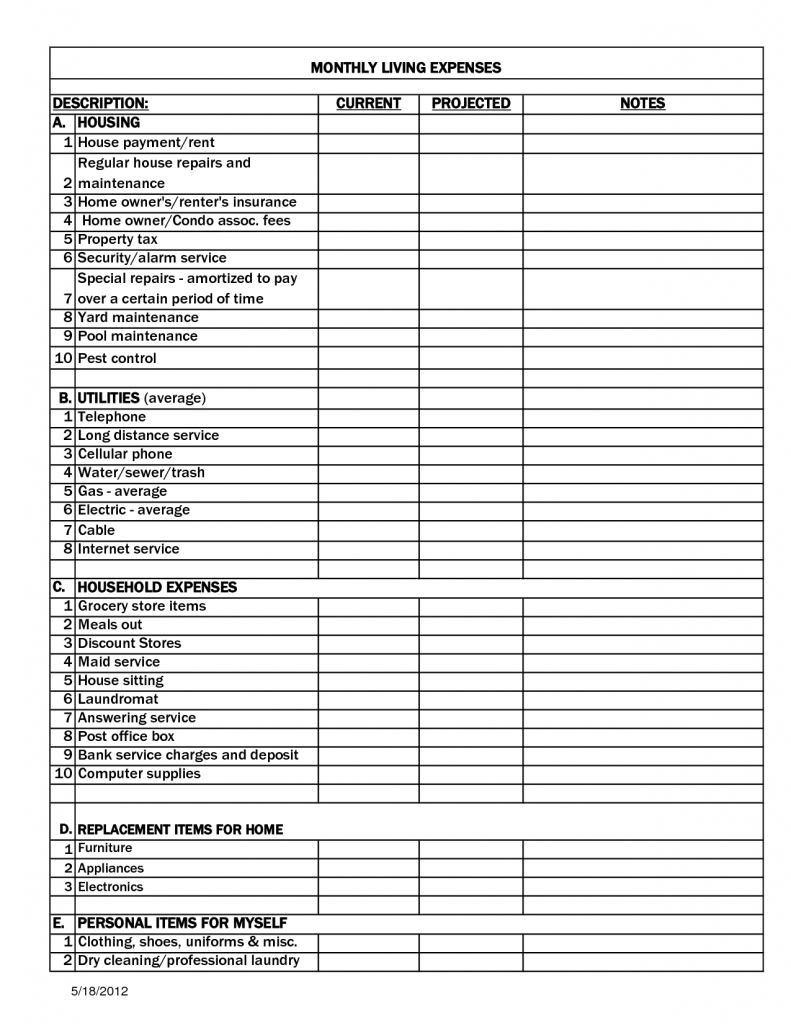

Other expenses in balance sheet. When a business incurs an expense, this reduces the amount of profit reported on the income statement. List of other expenses. Assets = liabilities + shareholders’ equity.

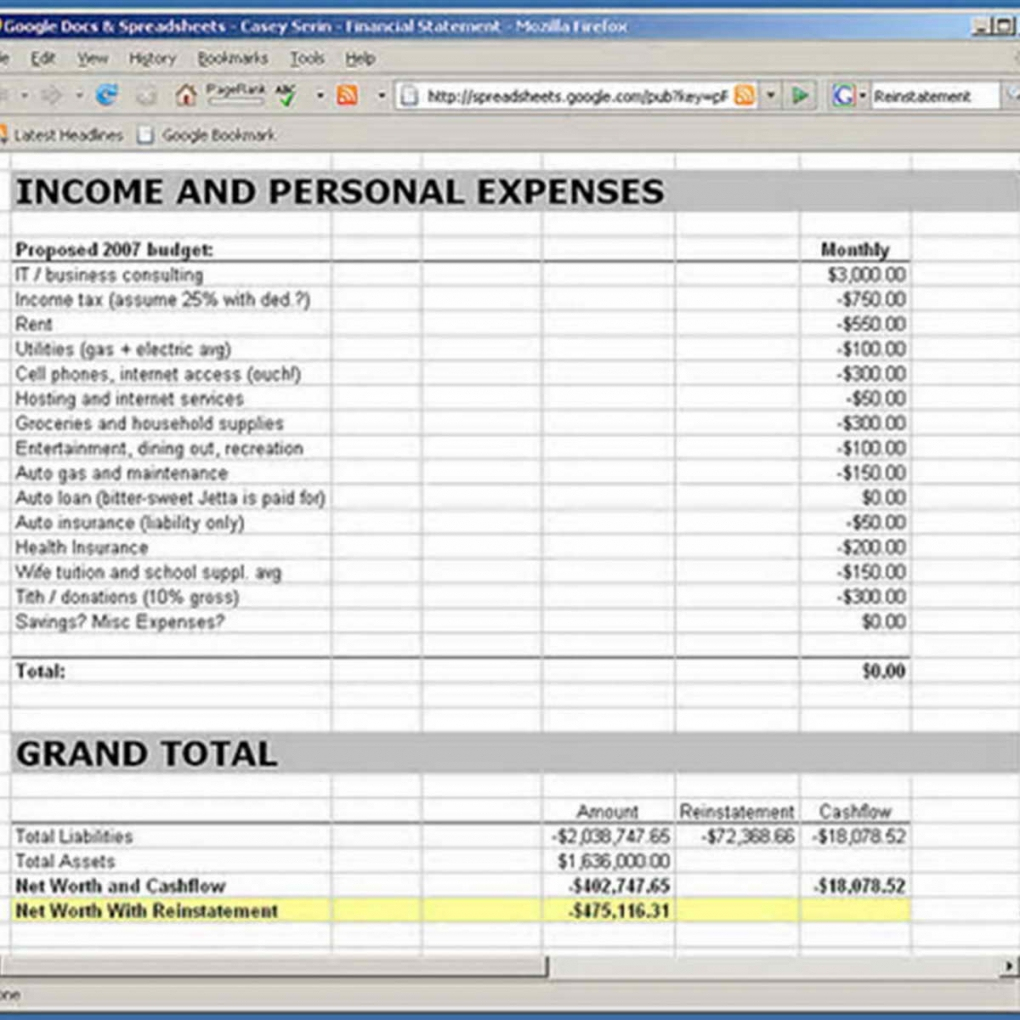

The values for assets and the costs reported in a balance sheet can be a source of confusion for both business managers and investors, who tend to put all dollar amounts on the same value basis. Here are other equations you may encounter: The expense is recorded in the.

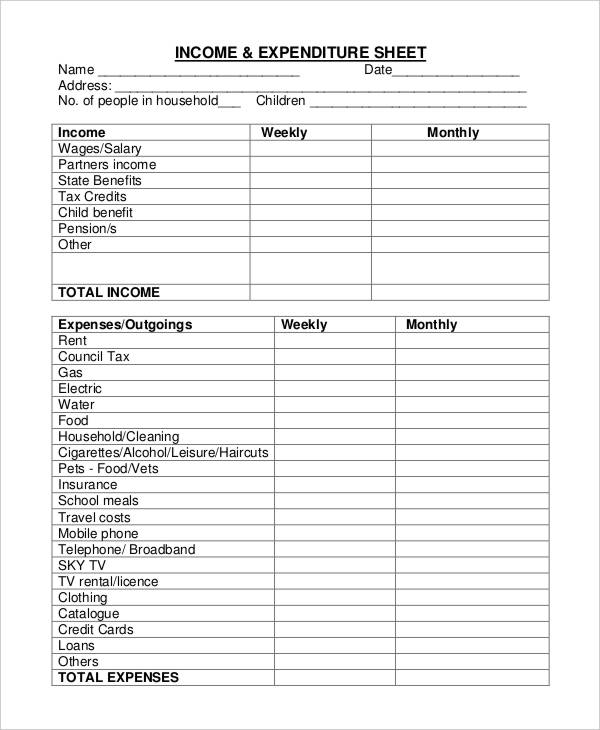

Other expenses only hit the balance sheet as payables, after which point they are paid as cash. The total is recorded on line 27. These three financial statements are intricately linked to one another.

Assets must always equal liabilities plus owners’ equity. What qualifies as other expenses on schedule c? The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and shareholders’ equity.

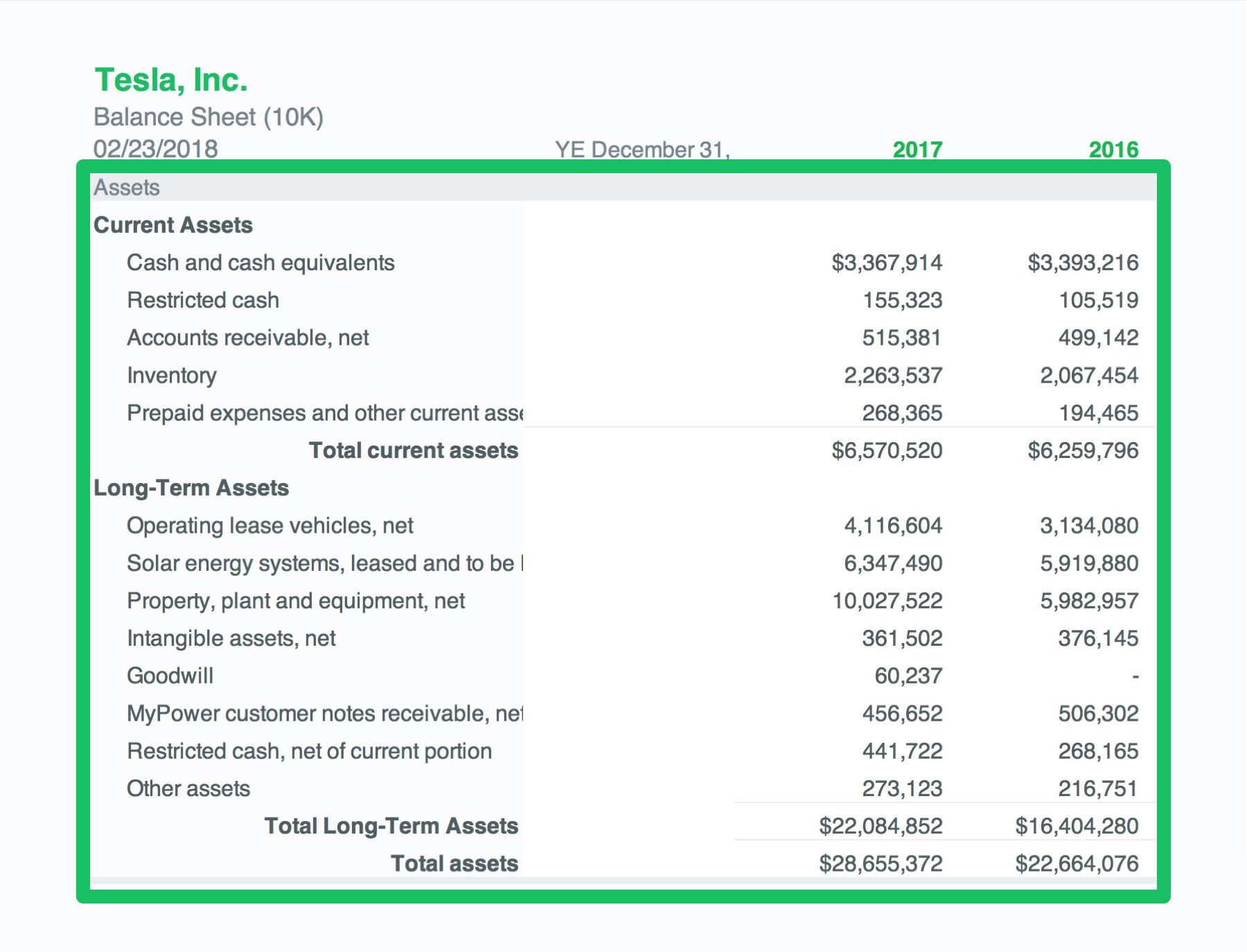

Loss from disposal of an asset or equipment. I also have drawn the balance sheet at the end of month one and the balance sheet at the end of month two. Total costs or expenses were $12.39 billion.

An expense appears more indirectly in the balance sheet, where the retained earnings line item within the equity section of the balance sheet will always decline by the same amount as the expense. Analyzing these three financial statements is one of the key steps when creating a financial model. What is a balance sheet?

Fundamental balance sheet equation. Selling, general, and administrative costs are the other expenditures not directly involved in production. In 2018, other expenses exceeded other income, so the value was negative.

Once incurred, they’re booked as an expense. Understanding these examples helps stakeholders analyze the financial health, profitability, and overall performance of a company. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

A balance sheet should always balance. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Penney, sg&a was $3.4 billion.

Expenses in accounting are the money spent or costs incurred by a business in an effort to generate revenue. Instead, they list a gain of sale of businesses as standalone other income. The income statement shows the financial results of a business for a designated period of time.