Outrageous Tips About Balance Sheet In Agriculture Internal Audit Reporting Lines

There is no right or wrong time of the year to prepare one.

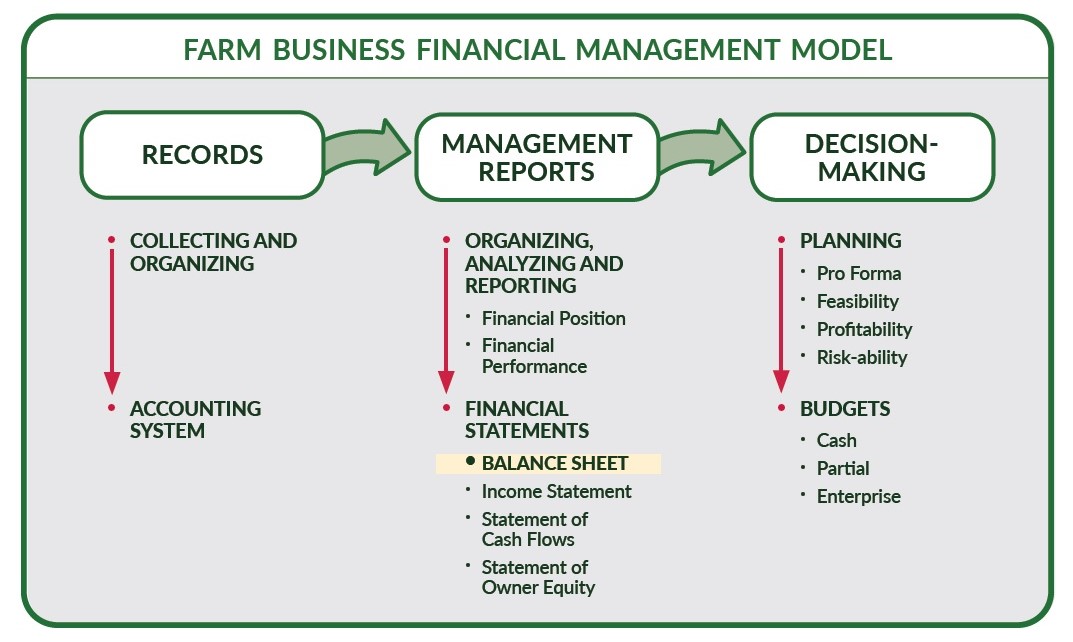

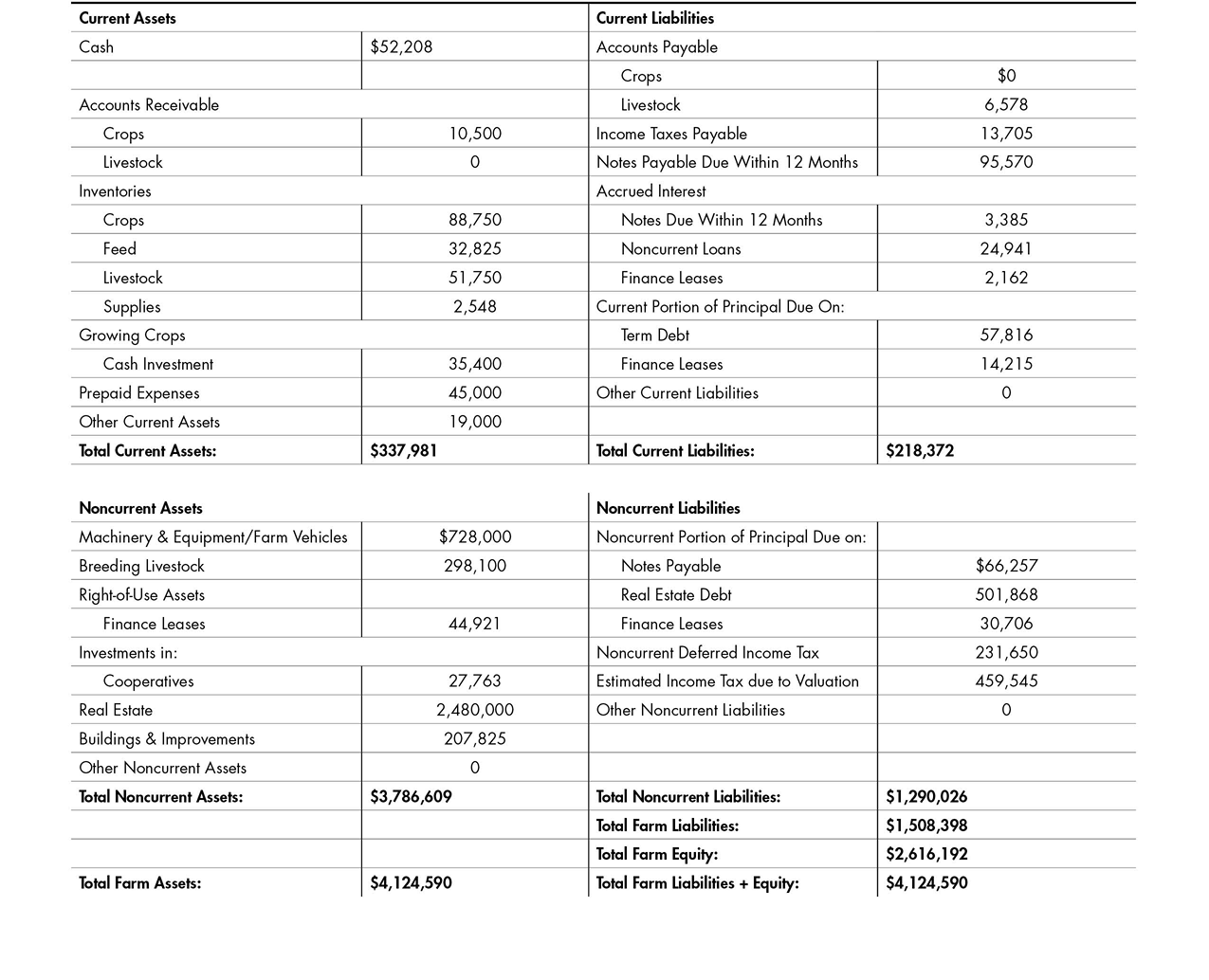

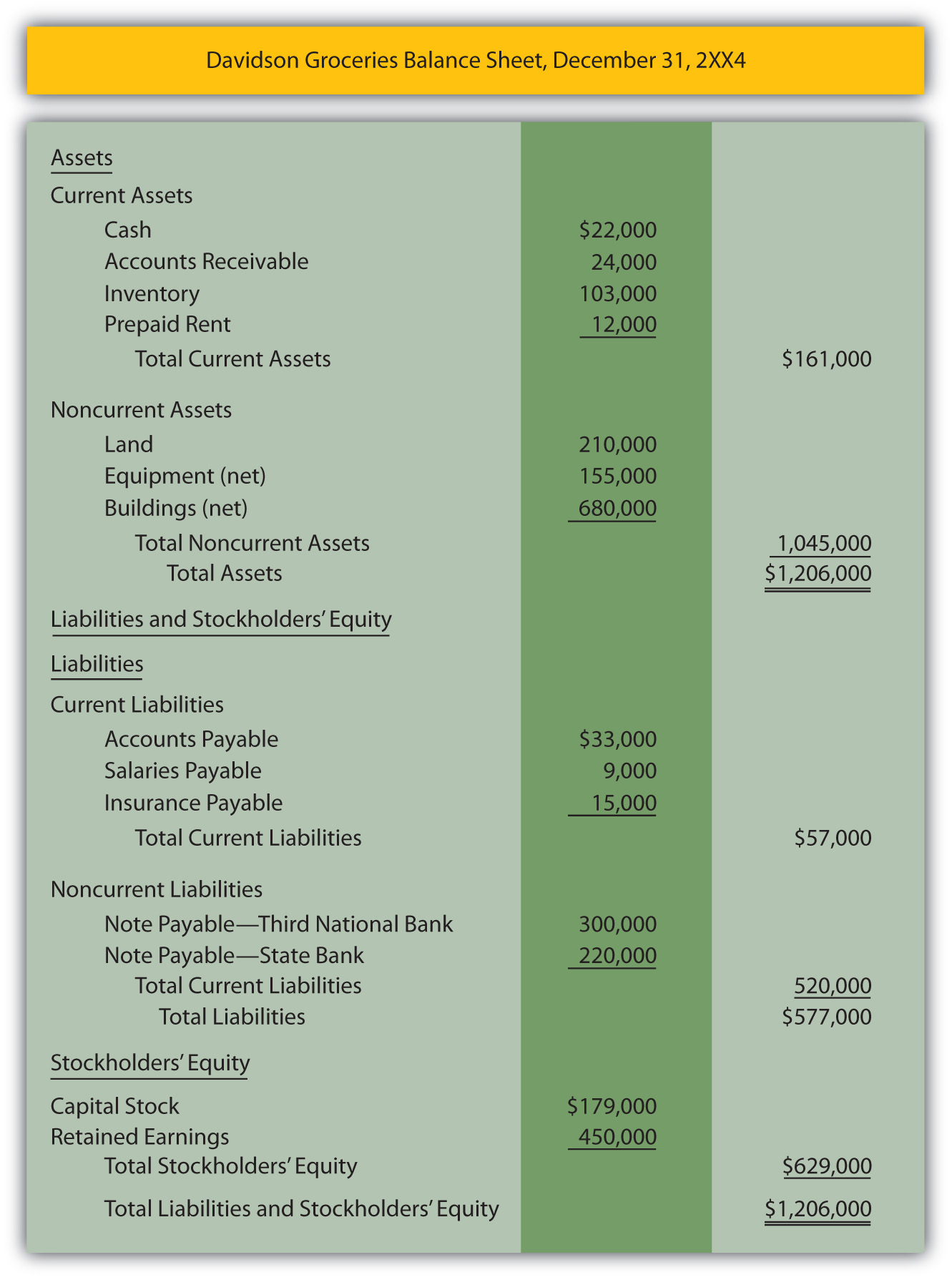

Balance sheet in agriculture. Many farmers and ranchers choose to complete a balance sheet annually. The balance sheet consists of three main parts: The balance sheet is a report of the farm business’s financial position at a given moment in time.

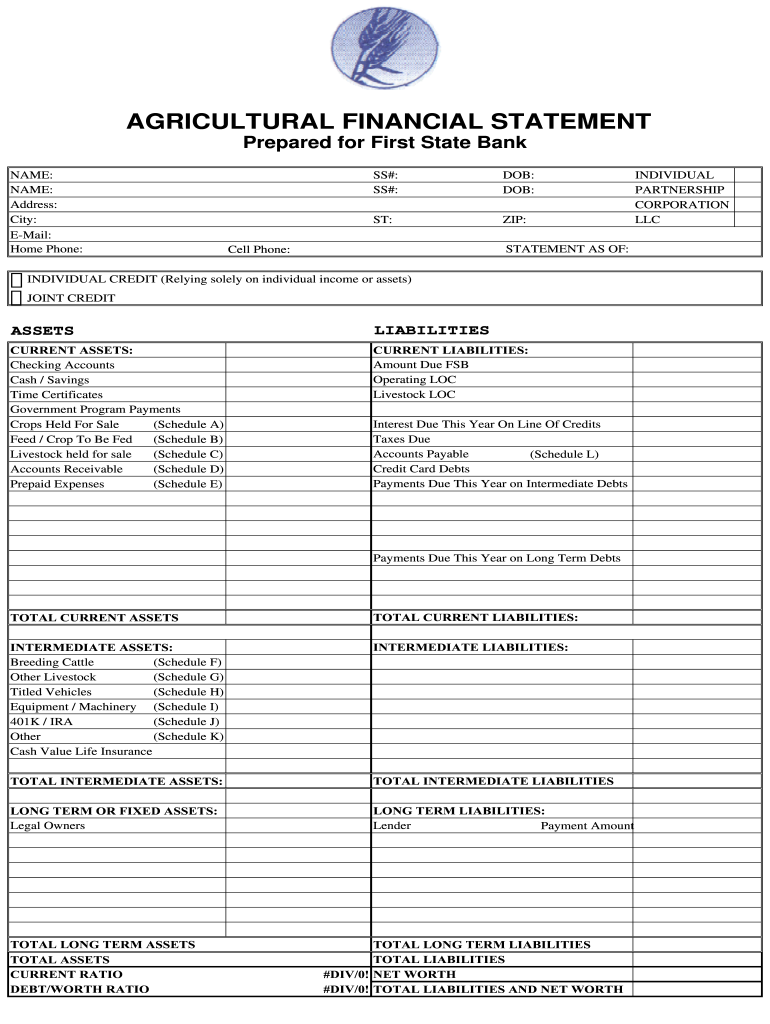

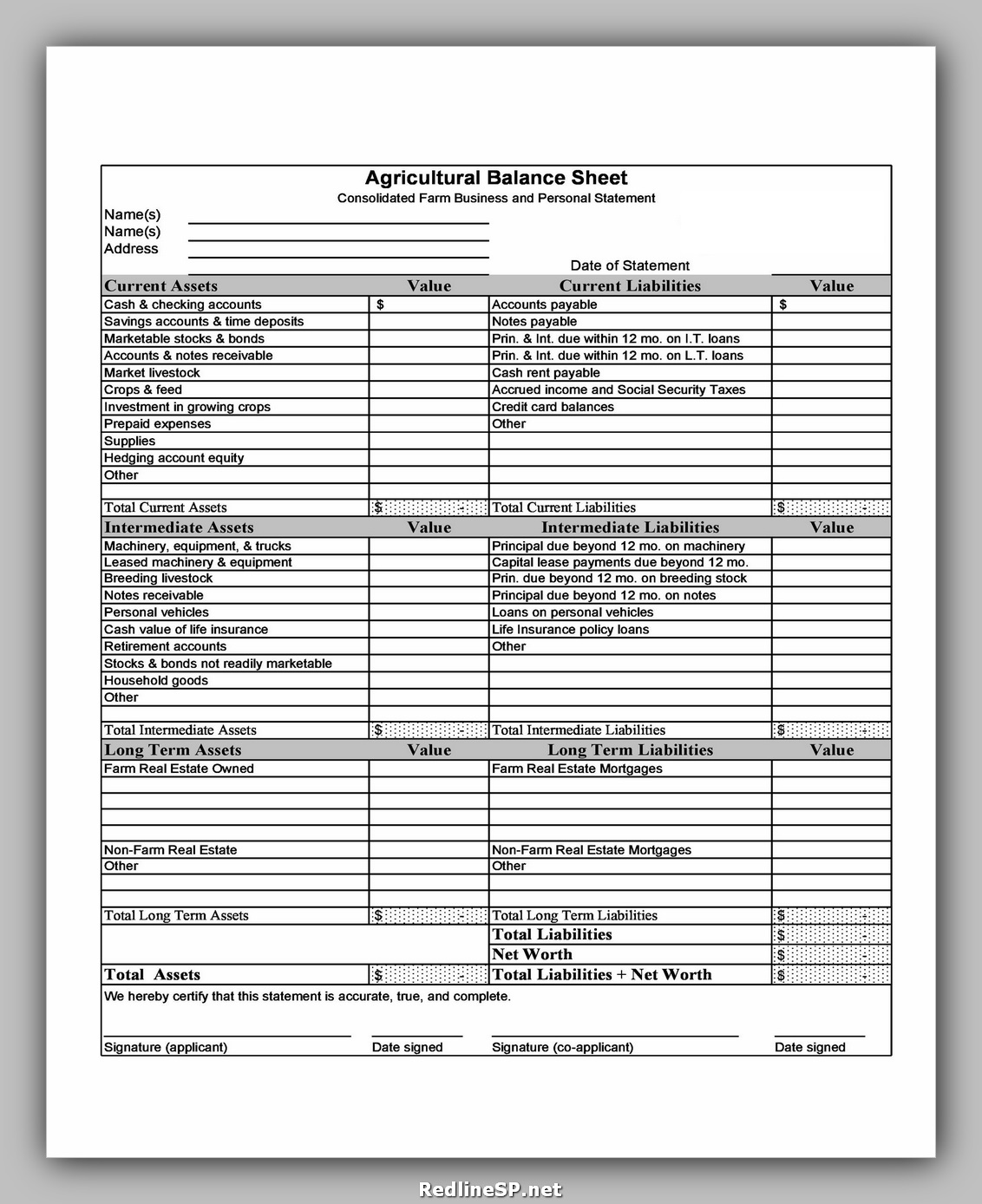

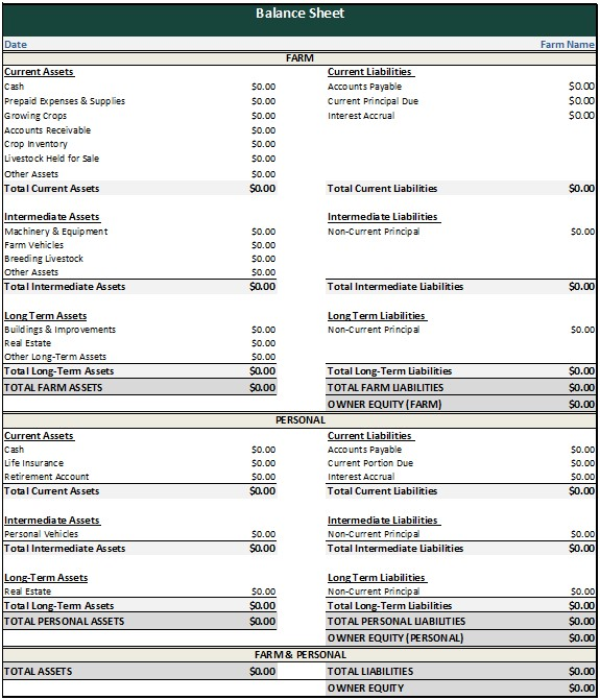

The farm balance sheet is one of three financial statements that provide critical information about a farm business. An agricultural balance sheet is the leading indicator lenders review to assess your debt ratio—total liabilities divided by total assets. The balance sheet is a report of the farm business’ financial position at a point in time.

It develops the idea of the ecological balance sheet (ebs) to enable application of familiar methods of managing built and financial capital to management of ecological assets (ecosystems that. I) steps or stages of farm business analysis a) proper recording of accounts and activities. Many farmers ask why they need a business balance sheet, as they are not selling any land.

The reality is that the balance sheet is the only record that indicates the growth in wealth of the business over time, and hence indicates a farming business’s performance and ability to manage risk. An agricultural balance sheet is a financial statement that provides a snapshot of a farmer, rancher or agribusiness’ financial position at a specific point in time. It shows how much money you could keep if the farm were sold.

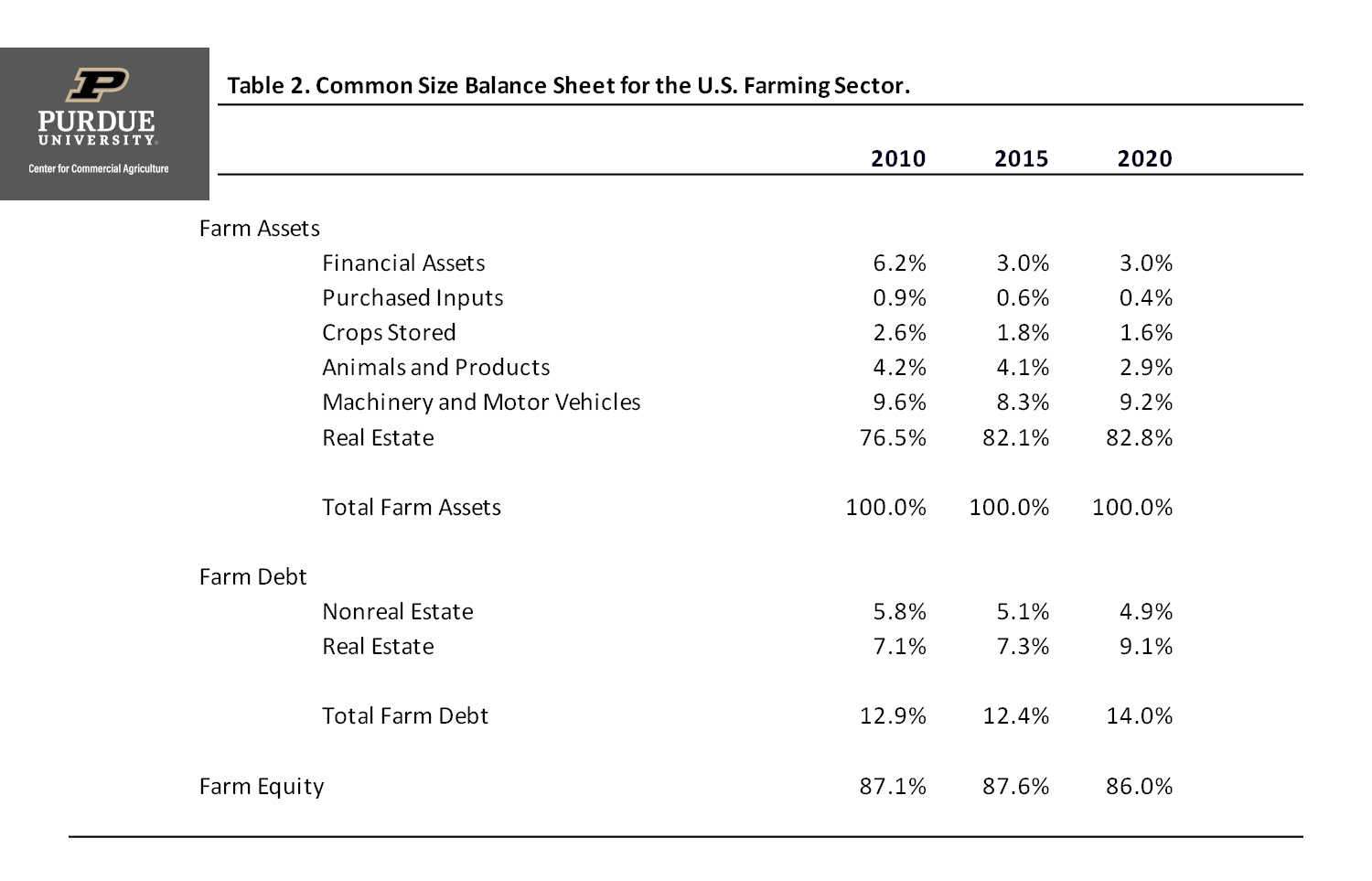

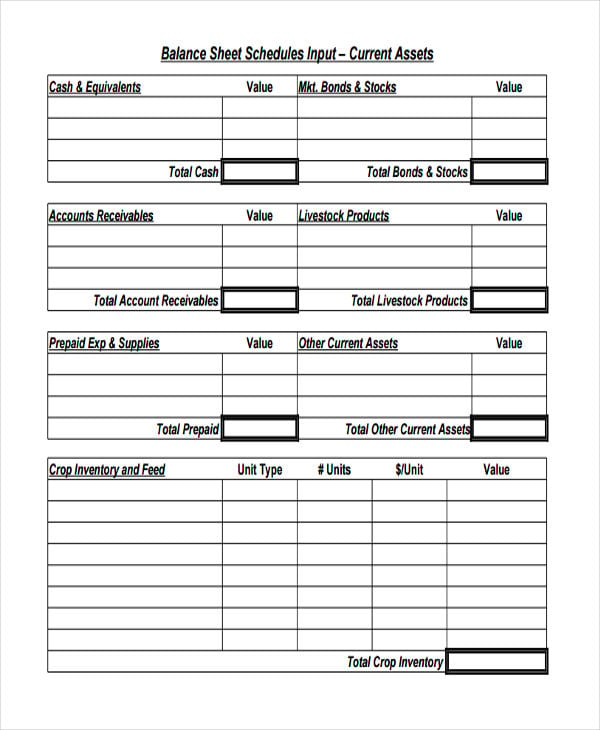

0.45 means you own 45% of farm. Often, the balance sheet is prepared after farm production has been sold or when the inventory is the lowest, allowing for less uncertainty regarding the value of calves, grain or hay. The balance sheet of the agricultural sector provides estimates of the value of the physical and financial assets in the u.s.

It consists of three main sections: It lists what you own (assets) and what you owe (liabilities) with the difference between them indicating how much the farm business is. The balance sheet objectively measures farm business growth, liquidity, solvency, and risk capacity.

Explanation the balance sheet is referred as such because it adheres to the universal accounting equation: These agricultural balance sheet ratios are an important piece of ensuring the borrower isn’t overleveraged and protect them against being put in a difficult financial situation. B) analysis of the data.

Equity to asset ratio. Iv) to prepare financial documents like balance sheet and income statement so as to acquire credit, design farm policies and prepare tax statement. Overview accounting balance sheet as it pertains to agricultural operations how to read a balance sheet methods used to prepare a balance sheet depreciation methods balance sheet systematic listing of everything owned and owed by a business/individual gives statement of owner equity at a point in time

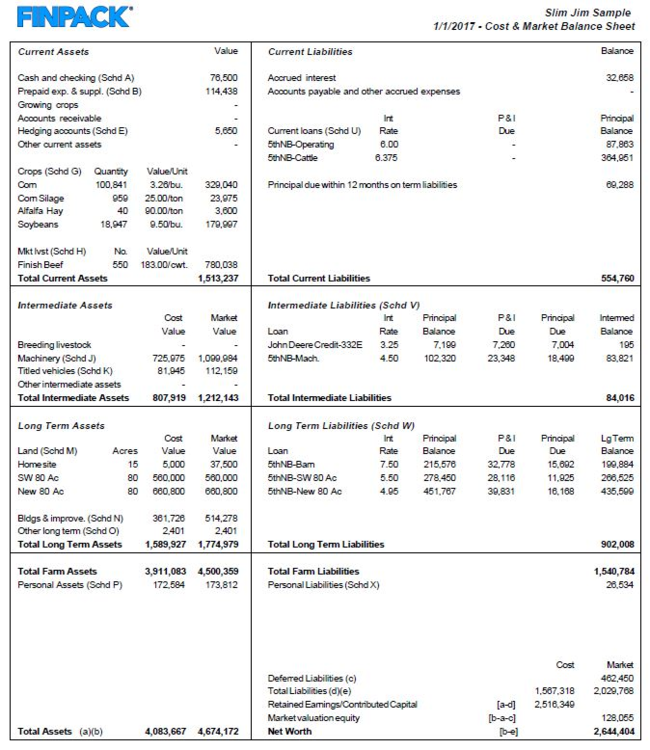

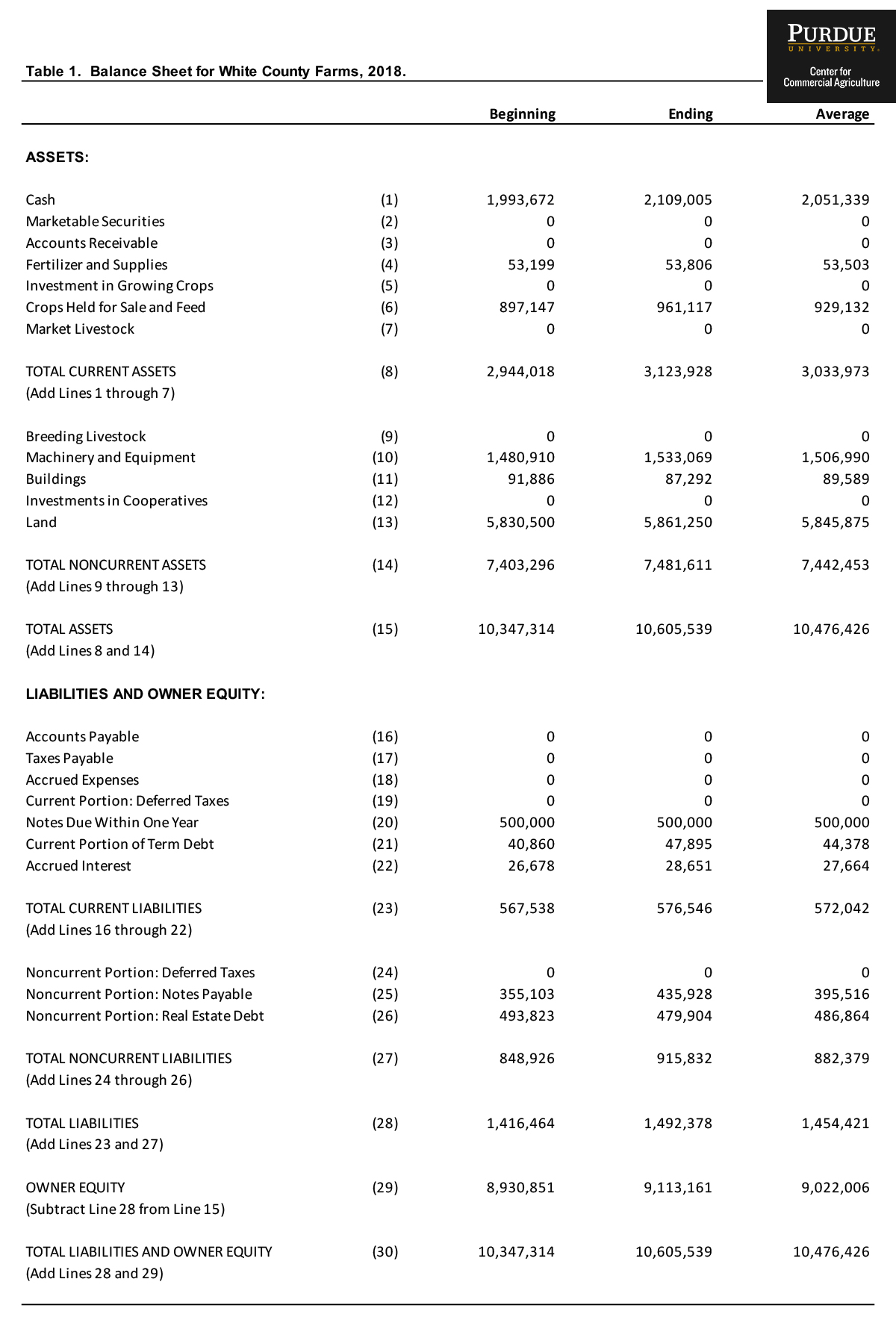

An example balance sheet from finpack shows assets on the left, liabilities on the. The balance sheet is also known as the net worth statement. Current farm sector debt is 36.1% higher than the value in 2012 and 10.0% higher than the value in 2017.

Southern region how secure is your farm business? Equity/asset = total equity/total assets. It lists assets, liabilities, and net worth (owner’s equity), and represents a snapshot of the farm business as of a certain date.